Uganda-based Independent Sugar Corporation (Madhvani Group) completed the acquisition of debt-ridden Hindustan National Glass & Industries (HNGIL) via the Insolvency and Bankruptcy Code.

The ₹2,250 crore resolution plan was approved by NCLT on August 14, 2025, and cleared by RBI and CCI.

A 45-day transition phase was conducted; the monitoring committee has stepped down, and a new board nominated by INSCO has taken charge.

The acquisition ends one of India’s longest insolvency cases after seven years of litigation and a CIRP launched in October 2021.

Independent Sugar Corporation, an Uganda-based Madhvani Group firm, has announced the completion of its acquisition of debt-ridden glass manufacturer Hindustan National Glass & Industries through the Insolvency and Bankruptcy Code process.

On Friday, in a duly convened meeting of Hindustan National Glass & Industries Limited's (HNGIL) newly constituted board, the company formally recorded the conclusion of this transition, clearing the way for Independent Sugar Corporation Limited (INSCO) to assume full control.

The acquisition is led by industrialists Kamlesh Madhvani and Shrai Madhvani, with financial support from Cerberus Capital Management and the International Finance Corporation (IFC), INSCO, in a statement, said.

The ₹2,250 crore resolution plan was approved by the National Company Law Tribunal (NCLT) on August 14, 2025, and has received approvals from the Reserve Bank of India (RBI) and the Competition Commission of India (CCI), it added.

Following the NCLT's approval, the formal acquisition process began, and a 45-day Monitoring (Transition) Phase was carried out to oversee all transitional matters and ensure a smooth handover, it noted.

The monitoring committee has stepped down, and a new Board nominated by INSCO and the Madhvani Group has taken charge, marking the start of a new chapter in HNGIL's history, according to the statement.

This transaction concludes one of India's most high-profile insolvency cases after seven years of litigation and a Corporate Insolvency Resolution Process (CIRP) that began in October 2021, it added.

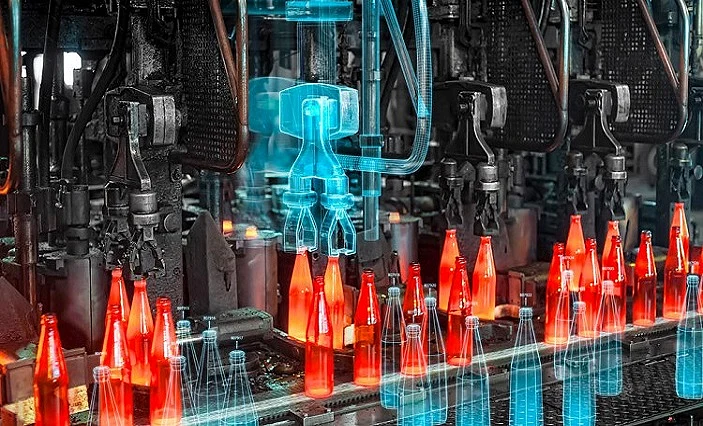

With its expertise in the global container glass industry, INSCO is fully committed to the successful turnaround of HNGIL, bringing world-class operational practices and a long-term growth vision to India's container glass market.

Shrai Madhvani, chairman of HNG's newly constituted board, said, "We firmly believe that employees and workers are the foundation of any successful turnaround. In the coming days, we will engage directly with employees and workers across all locations to understand their ideas and concerns and incorporate their insights into our turnaround blueprint".

He further said, "Our vision is not only to restore HNGIL to its former glory but also to align our efforts with the 'Viksit Bharat' vision of Prime Minister Narendra Modi, contributing to India's growth ambitions as a global industrial powerhouse".

With the transition completed and new leadership in place, INSCO is set to implement its revival blueprint, including modernisation of furnaces and equipment, fresh investments in operations, expansion of product lines, and strengthening the company's competitive edge in domestic and export markets, the statement said.