* EV adoption grows rapidly in India but insurance must match evolving technology risks.

* Standard policies cover vehicle shell only, leaving batteries, chargers and electronics exposed.

* EV-specific add-ons provide essential protection, ensuring buyers mitigate costly component failures effectively.

Over 69 lakh electric vehicles (EVs) are registered in India and adoption is accelerating, driven by lower running costs, government incentives and growing awareness. Yet, as with any new technology, EVs bring their own complexities. These are not flaws but the realities of machines that are more advanced, digitally connected and energy-dependent than conventional vehicles.

This is why it is important to look at EV insurance differently. Traditional motor insurance was designed for the age of gears, engines and exhaust systems. EVs, in contrast, run on batteries, sensors, chargers and software, assets that behave very differently from mechanical parts. Protecting them requires interventions that are just as forward-looking as the technology itself. EV insurance therefore needs a reset.

Hidden Costs Hit Hard

The single most expensive component of an EV is the battery which can cost anywhere between ₹5 lakh and ₹15 lakh depending on the model. Chargers for homes or fleet depots add another ₹50,000 to ₹2 lakh. Add electronic control systems and the software that runs them and the exposure multiplies.

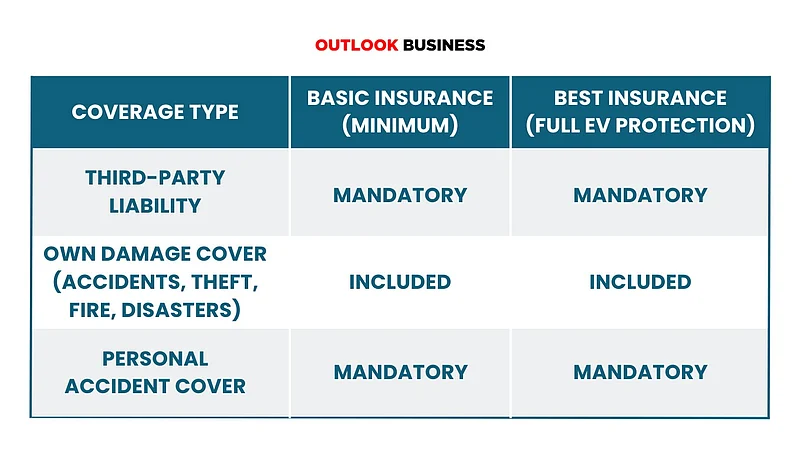

Now imagine a short circuit triggered by monsoon waterlogging or a surge in your housing society’s power grid. A conventional comprehensive policy will not cover the damage. This is where most buyers find themselves blindsided. Walk into a showroom and you will likely walk out with three standard covers: third-party insurance (mandatory by law), comprehensive insurance (covering damage, theft and disasters) and personal accident cover (mandatory for drivers). On paper it looks robust. The word comprehensive itself suggests complete protection.

In the EV world that promise is misleading. The policy may cover the car’s outer body but leave out its most crucial parts such as battery packs, home chargers and electronic control systems, components central to an EV’s performance. In effect, many EV owners are driving around with insurance that safeguards the shell of the vehicle but not its foundation.

It is like buying health insurance that pays for a broken arm but excludes heart surgery. The risks are real, the costs significant and the gaps are rarely explained clearly at the point of sale. By the time owners discover the fine print, the financial hit can be steep enough to erase years of savings on fuel and maintenance, the very calculation that made EVs appealing in the first place.

To understand how this plays out, take a mid-range EV priced around ₹17 lakh. A standard comprehensive plan costs about ₹40,000 annually and typically covers third-party liability and accidental damage from fire, floods, earthquakes, riots or even rodent attacks. However, it excludes battery-specific risks such as waterlogging damage, short circuits or electronic failures. Adding a dedicated battery protection cover costs an additional ₹3,500–₹4,000 per year, an important safeguard given the high expense of repairing or replacing a battery pack.

Similarly, damage to a home charging station is not covered under a regular plan but can be insured through an add-on costing around ₹2,500. A relatively small increase of about 15% in annual premium can provide peace of mind by covering some of the most critical and costly EV components.

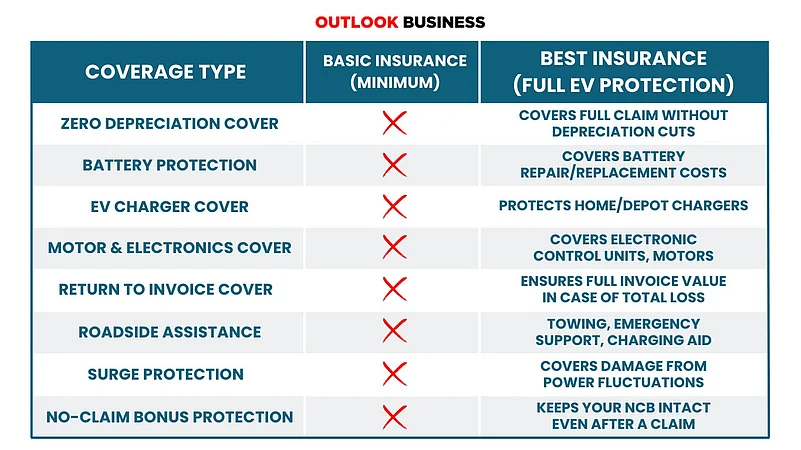

These gaps make one thing clear. Having insurance does not automatically mean you are fully protected. That is where EV-specific add-ons come in from battery and charger protection to roadside assistance and electronic surge coverage. The goal is not to take every possible add-on but to choose carefully and select the ones that cover the most essential risks.

With growing awareness among dealerships and the wider availability of such offerings from insurance providers, consumers are now being informed about these add-ons and their benefits. The choice ultimately lies with the buyer but the direction is evident. As EVs become mainstream, insurance must evolve to match their risks.

The table below breaks down the difference between a basic EV insurance package and a comprehensive, well-protected policy:

Add-ons