It was a bold move that Kolkata-based Emami Group made in June 2005. The conglomerate, known for its brands such as BoroPlus antiseptic cream and Navratna hair oil, decided to venture into a category that was almost was non-existent in India – fairness cream for men – with Fair and Handsome.

“We had identified the potential of the men’s grooming space around 2004, when a study (conducted by situations advertising and market research firm AC Nielsen) revealed that 30% of fairness cream consumers were men. When we delved deeper, we uncovered a latent desire among men to look good. But, there were no offerings designed specifically for men’s skin, and they ended up using women’s products. So we launched Fair and Handsome in Andhra Pradesh in June (It was rolled out pan India in October),” says Mohan Goenka, director, Emami.

Goenka’s observation was validated when, in the very first year, sales of Fair and Handsome crossed about Rs.500 million. Buoyed by its success, the brand roped in Shah Rukh Khan as its brand ambassador in 2007, which led to sales touching Rs.1 billion by FY09. Today, the brand has emerged as one of the power brands of Emami and enjoys a 63.7% market share in the category. Fair and Handsome contributed 9% of Emami’s total FY18 revenue of Rs.25.40 billion, which is about Rs.2.30 billion.

Goenka adds that the strong start on Fair and Handsome led them to explore the men’s grooming space further. “We saw newer gaps opening up in face washes and deodorants, and the emergence of a consumer segment purchasing online,” he adds.

Fair and Handsome’s success signaled a huge, untapped market for male-grooming products and companies, both homegrown and multinational, began investing in it. From Marico and HUL to Godrej Consumer Products (GCPL), legacy companies started innovating and introducing products across a wide range of categories. The segment also saw the entry of start-ups including The Man Company, Bombay Shaving Company and Beardo, who, with their nimble approach and digital skill-set, aimed to disrupt the market.

The industry segment has seen a healthy growth of 10% per annum which is close to Rs.100 billion, according to Nihir Parikh, chief business officer, Nykaa. For Nykaa, one of the biggest online beauty stores in India, 20% of customers are men surfing in the grooming category. “It prompted us to launch NykaaMan.com, India’s first multi-brand beauty e-commerce store dedicated to men’s grooming,” adds Parikh.

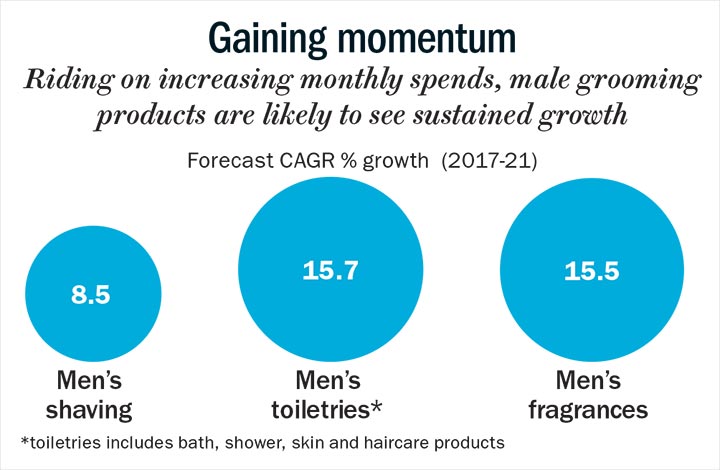

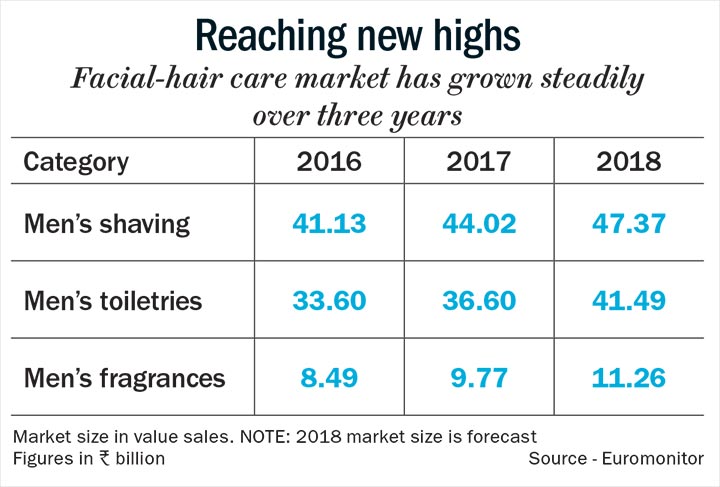

Retail experts are bullish about its growth prospects (see: Reaching new highs). “Increasing awareness of various skin types, hair types, fragrances and beard styles coupled with brands being present across platforms (online and offline) will only continue to boost sale in each of the sub-categories in this segment,” believes Harsha Razdan, partner and head, Consumer Markets, KPMG in India.

Male grooming was initially limited to the basics such as — haircuts, and fragrance. “In the past five years, owing to digital penetration, the rise of hairstyle trends by Bollywood stars and cricketers and the rise of unisex salons, the male grooming category has expanded,” says a spokesperson at Marico.

A 2017 Assocham study finds that shaving products are the highest contributors to the men’s grooming market followed by deodorants and antiperspirants. Bath and shower, and skin care and hair care products are relatively smaller categories.

Catalysts of Change

For a long time, the male grooming segment had a ‘functional’ positioning to it, states Ankur Bisen, senior vice president of the retail and consumer products division at Technopak. “This has now changed to a more ‘aspirational’ tone,” points out Bisen.

Case in point is start-ups such as Gurugram-based The Man Company, which has focused on introducing premium ingredients such as argan, almond and lavender oils in their products. Founded in 2015 by Hitesh Dhingra, they sell grooming products ranging from hair gel and shampoo to face wash and beard oil. “When we started, asking friends and family, the consistent feedback was men have been ignored. So we knew that we have a good opportunity to launch quality products,” says Dhingra. They also introduced what he calls “Instagram friendly” packaging. “This was to build virality in this category. Women are known to share what they buy with friends. Men don’t do that. That could be changed only through good-looking products,” he says.

Their Instagram handle has close to 90,000 followers. Apart from posting content, the handle is also tagged frequently by male users, sharing pictures of themselves unboxing, reviewing or posing with the products. The start-up, which closed FY19 at Rs.400 million (up from Rs.130 million in FY18), is confident of touching revenues of Rs.700 million by FY20.

Start-ups such as Happily Unmarried’s Ustraa and Bombay Shaving Company have adopted quirk as an integral part of their product strategy. From ‘Mooch Wax’ and ‘Beard Softener’ to ‘Helmet Spray’, the hatke names, innovative products and cool packaging are meant to hook millennials.

In addition, Pinakiranjan Mishra, partner and national leader, retail and consumer products, EY, says, “Social media and pop culture influencers such as actors and cricketers have helped this segment gain traction. The biggest change is the attitude of the man. A person who spends time on his grooming is not looked down upon. Today it has become acceptable.”

While the start-ups are mushrooming, the incumbents aren’t far behind. Marico, for instance, reinvented the Set Wet range of products that it acquired in 2012. “In this category, Marico caters to young, aspirational male consumers. With the ‘Jal Nahi, Gel’ campaign and the Rs.10 pack, we want young Indians in Tier-I and Tier-II cities to adopt hair-styling as part of their daily grooming,” says the spokesperson. For metros and mini-metros, they have launched Set Wet Studio X – a premium range.

GCPL has launched a new product line, including face wash and beard shampoos, for its Rs.7.5 billion personal care brand Cinthol. Similarly, HUL joined hands with retail giant Amazon to launch an exclusive line of male grooming products under the Brylcreem brand. “The feedback was that male grooming as a category was witnessing high levels of demand, especially in specialised sub-segments such as beard grooming and hair,” said Dheeraj Arora, vice president, modern trade and e-commerce, HUL, in an interview to Outlook Business earlier this year.

Biggies have stepped in and everyone has to talk a new language to the buyer. “Brands such as Cinthol, Old Spice and other shaving brands from the 1980s and 1990s never offered a new story to millennial generation. In contrast, women’s grooming brands constantly refreshed their campaigns. As a result, the men’s brands came to be perceived as ‘daddy’s brands’ and did not resonate well with the millennial consumer,” he explains.

That, happily, is no longer the case. Be it with Brylcreem from HUL or Marico’s Set Wet or even deodorant brands such as Axe and Fogg. They have moved away from the clichéd objectifying of women to portraying the man as a well-groomed groomed person or the ‘caring’ man. Think Tiger Shroff’s ad for Garnier Men face wash or Sidharth Malhotra’s #BoysManUp campaign for Brylcreem.

“Earlier, the messaging centred around him getting attention from female colleagues or friends. This has changed to portray men to be more confident and more masculine after using these products,” says Anul Sareen, senior research analyst at Euromonitor International.

Going a step beyond conventional marketing, The Man Company offers curated content for men on their social media pages, including tips around grooming, how to tie a knot, what kind of shoes to wear with different types of blazers and where to go on first date. The players also capitalise on social media trends such as ‘Movember’ or ‘No shave November’.

Grooming Growth

The newbies have opened up new channels of communication and are zeroing in on smaller categories, aggressively building it up. For example, in March 2016, The Man Company launched three soap bars with charcoal, black pepper and argon as key ingredients. “We found that sales for charcoal soap was 90% of the category. So we researched and launched face wash, scrub, shampoo and body wash with charcoal as a key ingredient,” he adds. With 65 unique SKU’s, the start-up has products ranging from Rs.250 to Rs.2,200. Dhingra says that the inflection point for the brand was launching beard-grooming products in 2016.

Beard care, as is evident, is among the most popular category in male grooming. Sareen points out that the taboo around facial hair at offices is fading away, and more and more men are now opting to keep a beard or stubble. Start-ups such as Gujarat-based Beardo, founded in 2015 by Ashutosh Valani and Priyank Shah are cashing in. ‘Anybody can grow a beard but not everybody can be a Beardo’, proclaims the start-up’s website, whose product range is an eclectic mix of growth oil, gels and wax for the beard. It has also ventured into fragrances and skincare. The Bombay Shaving Company is another start-up in this space with a similar mix of products, which was founded in October 2015 by Shantanu Deshpande, Raunak Munot, Deepu Panicker, and Rohit Jaiswal.

Despite the new categories, the largest demand is still for men’s deodorants and skin creams, says Goenka. According to AC Nielsen, men’s skincare market is pegged at Rs.5.75 billion and it has grown at 20% over 10 years.

In Perfect Sync

The nimble approach of start-ups has attracted the interest of fast-moving consumer goods (FMCG) giants, creating a symbiotic partnership. For instance, Marico invested an undisclosed amount in November 2017 to pick up 43% stake in Beardo. The start-up clocks annual sales of about Rs.500 million to Rs.700 million, of which 75% comes through the online channel. Its offline presence is in about 2,000 retail touchpoints such as salons and spas, which could be increased to 5,000 with Marico’s investment. Marico plans to make it a 100% owned subsidiary by March 2020.

Similarly, Colgate-Palmolive Asia Pacific made its first investment in India with Bombay Shaving Company, of Rs.180 million or $2.6 million, which the start-up will use to expand offline with 500 outlets in addition to its current 700 brick-and-mortar touchpoints. The company, which started with six products in 2016, today has about 32 product stock keeping units (SKUs). With its unique subscription-based model, similar to the US-based start-up Dollar Shave Club, the start-up clocked revenue of about Rs.160 million in the quarter ended June 2018. It had estimated revenues to touch Rs.200 million by close of FY19.

Emami too invested close to $3 million in The Man Company in 2017 and followed it up with a second tranche of funding in February this year, taking its stake to about 30%. “This strategic stake investment is in line with the company’s future growth map of leveraging online opportunities. It will also help us to be present in the premium end of growing male grooming segment,” explains Goenka.

While older companies are leveraging these tie-ups for an online push, start-ups are expanding offline with the fund infusion but through premium stores and salons. Dhingra says, “Emami’s investment (which pushed sales offline) helped us get 3x growth this year.” The Man Company currently has one store at Delhi airport and three pop-up stores across Delhi, Ludhiana and Chandigarh. They plan to launch 20 more in this calendar year.

For larger FMCG companies, these tie-ups are a quicker way to adapt to a changing market. “Instead of creating a brand, it is easier to hit the ground running by acquiring established brand,” says Bisen. He adds that the out-of-the-box, agile and innovative approach of the start-ups are perfectly complemented by the marketing and distribution prowess of larger companies.

These David-Goliath partnerships can help both the companies expand into far corners. At present, sales for most of these start-ups are coming from metros and cities. “Companies need to work on distribution and communication in smaller towns,” says Mishra. Bisen agrees and adds that growth in the male-grooming category itself dips beyond a few cities. He says brands need to experiment with smaller SKU sizes, value pricing and trade channels as they build the market.

Overcoming Hiccups

Uniqueness is indeed crucial in a fast-growing but nascent category. “The commercial battleground is no longer just price. Given India’s diverse range of consumers, it is important for retailers to invest in understanding the cultural behaviors and purchase motivations to create differentiated and unique products and services,” says Razdan.

For instance, Singh Styled is a start-up that uniquely identifies the needs of Sikh men and tries to address it with unique products such as the Ultra Beard Hold. With a 71% repeat rate in its 30,000 customer base, the start-up sends curated gift boxes comprising beard oils, hair brushes and accessories (turbans) to customers every month.

Mishra of EY adds that for women, repeat behaviour on grooming products is a given. It is not the same with men. “How habit forming is it? That psychology is something which companies need to study,” he cautions. Sareen adds that while men are now adapting to grooming, they still do not like to spend too much money or time on it.There is also LetsShave, founded in 2015 by Sidharth Oberoi, which offers sells razors, spare blades, shaving brushes, shaving foam, body scrubs, and travel bags. In partnership with California-based razor manufacturer Dorco, LetsShave claims to have introduced the world’s first six-blade razor.

Brands are taking feedback from their consumers to ensure their stickiness. For example, Marico’s launch of smaller pack sizes in its Set Wet range, as also the launch of Set Wet Blast in an affordable pocket spray priced at Rs.49 received a good response from trade and consumers across all the launch markets. Emami too has experimented with pricing to tap into the value-conscious consumer in Tier-II and Tier-III markets.

And as the market evolves, it may take several permutations and combinations of products, pricing and distribution before anyone can proclaim to have got it right. But one thing is sure – the ‘unkempt’ man is quickly making way for the ‘suave’ gentleman.

Just one email a week

Just one email a week