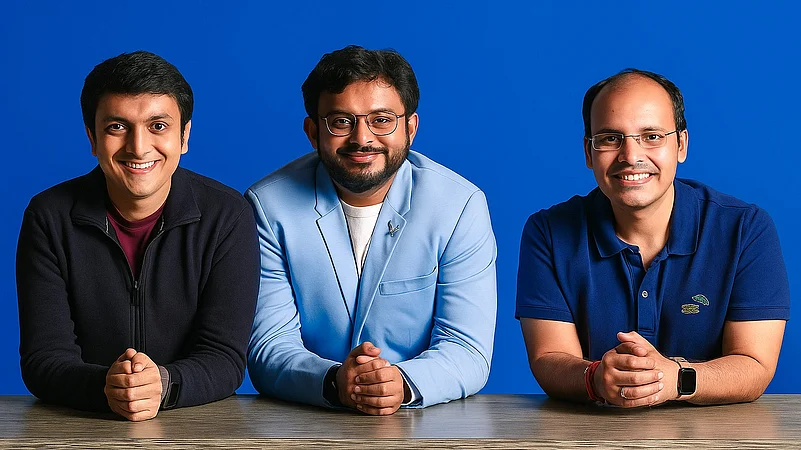

Dharmil Sheth, Dhaval Shah and Hardik Dedhia, founders of the digital pharmacy PharmEasy, have launched All Home, an architectural and interior-design firm based in Mumbai, Economic Times reported.

The company secured funding from Bessemer Venture Partners at a post-money valuation of $ 120 million (₹ 1,041 crore), though the exact amount remains undisclosed. According to insiders, the deal totalled approximately $ 20 million in equity and debt.

Bessemer Venture Partners was also an early investor in PharmEasy. Several angel investors participated, including PharmEasy founder and CEO Siddharth Shah; B Capital founding general partner Kabir Narang; Motilal Oswal Financial Services group CFO Shalibhadra Shah; and Motilal Oswal Asset Management chief investment officer Niket Shah.

All Home will collaborate with interior-design businesses, offering technical support, internet-based manufacturing and distribution, and market analytics. The company will also partner with industry brands by investing in them and providing expertise in technical assistance, internet-based manufacturing and distribution and market data.

Sheth will oversee operations; Shah will manage brand development, finance, legal, compliance and human resources; and Dedhia will handle technical functions.

In January 2025, Sheth, Shah and Dedhia stepped down from their operational roles at PharmEasy, remaining on the board of directors or as observers with reduced involvement in daily management, according to a company statement. Their exit coincided with PharmEasy reviving plans for a public offering, two years after withdrawing its initial IPO attempt.

PharmEasy Fundraise

PharmEasy recently raised $ 216 million (₹ 1,804 crore) in a round led by investors including Ranjan Pai’s Manipal Education and Medical Group (MEMG), Entrackr reported.

The start-up raised funds at a 90 % valuation cut to $ 710 million. It was last valued at ₹ 560 crore in 2021, Moneycontrol reported.

A special resolution was passed by API Holdings Pvt Ltd (owner of PharmEasy) to allot 18.6 crore cumulative convertible preference shares issued at ₹ 96.8 each. Pai’s family office led the round with ₹ 800 crore; Prosus, Temasek and 360 One Portfolios invested ₹ 231 crore, ₹ 184 crore and ₹ 200 crore respectively, Moneycontrol reported. Other investors included CDPQ Private Equity, WSSS Investments, Evolution Debt Capital and Goldman Sachs.