In life, you are free to choose the path you want but there will always be trade-offs. While we grew by acquiring and shaking hands with multinational companies, we could not capitalise on “generics”. It didn’t make sense competing with the companies we were partners with. We chose to grow our business through contract manufacturing instead, keeping the trust with global companies intact. Those days, there was a lot of mistrust so we didn’t want to end up as competitors. We did decide to grow the research wing though, but didn’t have much breakthrough. Nearly 15 years of research didn’t work out. We had to write it off. Not everything works out, but you should be clear what you want. If you do, eventually, the bet will pay off.

I had gone to Abbott’s headquarters in Chicago to meet chairman Miles White. This was to get them on board for a contract manufacturing deal. When he came to India, we met for dinner. Before I could warn him, he had bitten into a whole red chilli. He was red! Once he had recovered, we spent the rest of the evening discussing pharma companies in India. He wanted to know which one would be worth buying. I was happy to oblige, not knowing then what he had in mind. A few months down the line, when Olivier Bohuon and team came, I invited them to see our plants. I showed them the whole business operation, thinking they were serious about our contract. I was so naive. I only knew of their true intentions when they called to say they wanted to buy us!

I was least interested. The thought had never crossed my mind. I didn’t react. Nor did I act. Then, one day, I just thought about it and said why not? There was no provocation really. But I wanted to see what lay here. So I called up a few bankers and they valued the company at some $2 billion-$2.5 billion. It left me unimpressed. We were not desperate to sell, they were the ones chasing us.

Miles White, Olivier, Nandini and I met in Dubai. I consulted Nitin about the value – he was convinced we should ask our price. I had a three-page note summarising our business, our growth rates, profitability, distribution and quality standards. I made my case for a $4 billion valuation. They agreed with every single point! There was nothing that could be disputed anyway, because it was all factual. We had slotted half a day for that meeting, it got over in less than two hours. They called a few times asking me to explain the valuation. I did. I never pushed them, just stated my price. There was no negotiation from my side because I wasn’t keen to sell anyway. They started with a $3 billion valuation, then came back with $3.5 billion, then $3.8 billion. I could have pushed but I agreed to close. My solicitors were getting scared... the deal was agreed on the phone.

Even at the last minute though – just two days prior to signing the deal, some Abbott officials were making a fuss about petty liabilities – some Rs.100 crore or so. Again, the solicitors were worried. They kept pushing me to accept the demands for fear of losing the deal. I found it rather funny. I told them their chairman would be here in a couple of days to sign the deal. Could those officials afford to call off a nearly $4-billion deal for a $20 million issue?

Of course, the deal went through. That’s my greatest learning from Bhagavad Gita — if you are dispassionate, you’ll win. Till date, Abbott has not sacked any of our people. Several of the systems we followed continue, which gives me great satisfaction. The deal was a win-win, not just for shareholders. We made a killing! How could we not share it with the employees? I asked the board to give away about Rs.100 crore as one-time bonus to employees, those who stayed with us and those who were to go to Abbott.

***

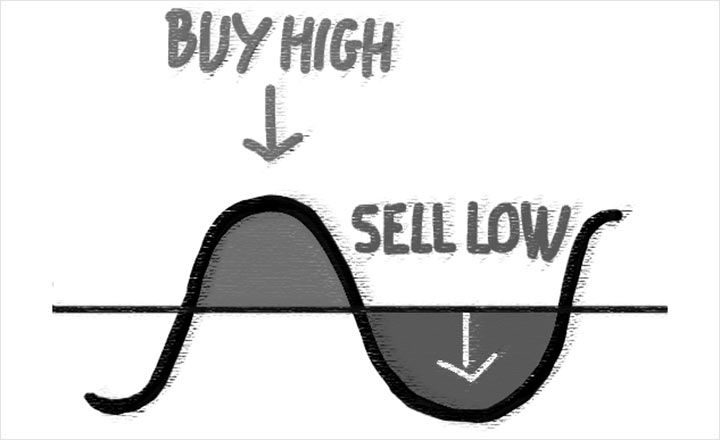

There’s a simple logic to good investments: buy low and sell high. It’s not rocket science. Most acquisitions fail because the CEO looks at it as a way of pulling off something remarkable. Bankers push a deal only for money, to go up the league table, earn a bonus. After all, no one gets paid for rejecting a bad deal. The key is to go against the tide and not get swayed by popular fancy.

In the early days, when we were hunting for acquisitions, I faced more than my share of criticism. Analysts didn’t believe in our story. There were voices of dissent — we had no organic growth to show, we were driven by only acquisitions, that’s not a good strategy and so on. But it worked and worked beautifully. In the history of pharmaceutical deals, we got the highest multiples ever. When I bought these companies, I bought them at a third of their sales value. But when we sold them, we sold at nearly 10x sales. That itself gave us a 30x return!

It’s all about recognising the risk correctly. There is so much criticism around our investment in real estate. Lending to developers is risky; the banks have to provision additional capital as risk weight. But for us, it is almost risk-free. You have the project as a security. If you lend with a safe margin and the developer does not execute, you can take over the project at half the value, complete it and make your money. It’s one business where you get to take over the assets without any baggage like labour or other costs. A bank can’t take over a project and recover its money, but we can. We have the execution capabilities.

What has always helped us in the journey is the relationships and trust we built. If the Vodafone deal came to us, that too at a higher rate of return, it was because of the trust factor. The management believed we would sell out to them without any fuss when the time came. They did a deal with another large business house to hold the shares till the regulations changed, paying 12% per annum. But they came to us with a significantly better rate of return. We nearly doubled our money in two years. The Rs.5,000 crore we invested in 2012 nearly became Rs.9,000 crore in 2014.

***

More than money though I have been drawn to people who sought value. Narayanan Vaghul’s brilliance and vision in shaping ICICI caught my eye. When he retired as the full-time chairman of ICICI, I invited him to join our board. He had, still has, an innate knack of identifying the right people. It was he who introduced me to Aditya Natraj. After some great work at Pratham, Aditya would create an excellent programme around headmaster training.

Vaghul’s simplicity was unmatched – imagine a man of his stature, living in a two-bedroom apartment without a single staff or servant! It was probably this facet of his that appealed to me, maybe because Dad also lived that way. I remember opening his cupboard after he died – he had exactly seven pairs of clothes. He used to spend just Rs.1,500 a month on everything including his outings, clothes, and the modest indulgence of a peg of whisky once in a while!

Somewhere, his lifestyle shaped my thinking and steered me towards philanthropy. Let’s face it, some of us end up spending more in a day than what people earn in a year. Being privileged, we can’t be blind to the needs of society. The biggest learning in this area came from Vaghul. He opened my eyes to three things: first, the problems in India can’t be solved with the solutions that already exist, we need to innovate; second, we need to scale up to make a difference to the millions of people in the country; third, to achieve that scale, we need to partner with the government.

That’s what drives me today. When my grandfather saw some success in business, he started a school in Rajasthan that gave admission to Harijans, something that was unheard of then. He also started the first girl’s school. That’s the legacy I want to carry forward — of being a change-maker in the true sense.