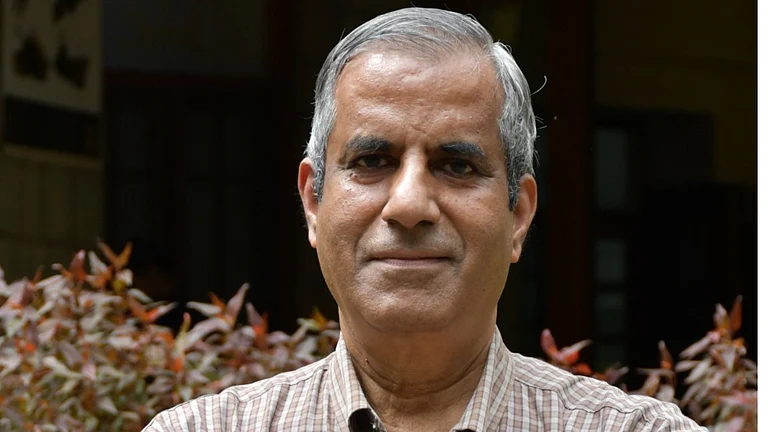

Waaree Energies has posted a striking 93% jump in net profit for the first quarter of FY26, underpinned by strong order inflows, a sharp rise in solar module production, and steady progress on its manufacturing capacity. In an interview with Outlook Business, Dr Amit Paithankar, CEO, Waaree Energies, attributes the surge to disciplined execution across sales, production, and project delivery—and lays out an ambitious roadmap to transform Waaree into a full-spectrum energy transition company, spanning solar, storage, green hydrogen, and beyond.

In the first quarter of FY26, Waaree Energies reported a striking 93% year-on-year increase in net profit. What factors underpinned this performance?

Our growth rests on three core pillars: sales, production, and project execution. The results reflect our sustained focus on these fundamentals.

Let’s start with sales. Our current order book stands at ₹49,000 crore—roughly 25 gigawatts—which is a significant validation of demand across markets. In Q1 alone, we secured 2.23 gigawatts in fresh orders from the US, reinforcing both market momentum and our execution capabilities. We are also tracking a robust pipeline of approximately 100 gigawatts, which positions us well for continued growth.

Production, too, has delivered. We achieved a 64% increase in output year-on-year, reaching 2.3 gigawatts this quarter. Importantly, this was done with only marginal infrastructure additions—mainly in the US. The improvement is largely a function of enhanced operational efficiency and asset utilisation, supported by our emphasis on safety, quality, and lean practices.

Finally, on the project side, we’re executing several large-scale manufacturing expansions. A 10-gigawatt solar cell facility is under development in Gujarat, while another 10-gigawatt ingot and wafer plant is being constructed in Bhutiburi, Maharashtra. Additionally, a 6-gigawatt module manufacturing unit is underway in Samakhiali, near Bhuj. These investments are critical to sustaining our order pipeline and long-term delivery commitments.

You’ve mentioned solar cell production ramp-up. When will it begin to match your module capacity?

Our 5.4-gigawatt facility is already operational and scaling up in phases. We expect it to be fully ramped up by the next quarter. In parallel, the 10-gigawatt solar cell facility in Una is scheduled for commissioning in FY27. At that point, our solar cell capacity will reach 16 gigawatts. Our module manufacturing will scale up to approximately 25–26 gigawatts over the same period. So we’re steadily working toward a balanced internal ecosystem—25–26 GW in modules, 16 GW in cells, and 10 GW in ingots and wafers.

Waaree has maintained its EBITDA guidance of ₹5,500–6,000 crore for FY26. What supports this confidence?

It again comes down to the fundamentals—sales, production, and projects. On the sales front, we already have a substantial order book in hand. Execution is now the focus.

Operationally, we’ve ramped up production without disruption, and our teams are delivering at scale. Meanwhile, our project rollout continues as planned. Within the next six months, our module capacity will expand to 23–24 gigawatts. This expansion, combined with the momentum from our order book and operational track record, gives us the conviction to maintain our EBITDA guidance.

The board has cleared a ₹2,754 crore CAPEX plan to boost cell and ingot-wafer production. What strategic objective does this serve?

This investment supports our commitment to sustaining an order book in the ₹45,000–50,000 crore range. To execute consistently at that scale, we must build sufficient manufacturing capacity. The ₹2,754 crore outlay will directly enhance our ability to meet this demand reliably.

Why the pivot from Odisha to Gujarat and Maharashtra for manufacturing? Is it a matter of logistics or policy?

The single biggest factor is speed to market. Wherever we can roll out the first cell, module, or wafer the fastest, that becomes the preferred site. The sooner we produce, the sooner we deliver value—both to customers and shareholders. That said, Odisha remains strategically important for us, and we continue to explore other opportunities in the state. This is reflected in our broader growth strategy.

Waaree is expanding into battery storage, green hydrogen, and water production. What’s the thinking behind this diversification?

Our long-term ambition is to become a global energy transition player. While solar remains our foundation, we’re building out the adjacencies that a low-carbon economy demands.

Battery storage is a natural extension. As renewable penetration deepens, grid stability becomes paramount, and storage is central to solving that challenge. Green hydrogen is another key frontier—especially for industrial decarbonisation and sectors like transport. The market is still evolving, but the potential is significant.

Inverters are yet another critical piece of the clean energy puzzle, and we are stepping into that as well. Our strategy is to become a comprehensive clean energy platform over the next two to three years, with integrated capabilities across solar, storage, hydrogen, and beyond.

You already have a manufacturing footprint in North America. Is the Middle East on your radar?

Certainly. We’re actively evaluating markets where the Indian government is building deeper bilateral ties—whether through FTAs, strategic investments, or trade initiatives. The Middle East and Africa are of particular interest for our EPC business.

We’re open to expanding in any geography where the fundamentals align and market conditions support scale.

Your thoughts on the UK Free Trade Agreement (UKFTA)? Is it a gateway for future expansion?

We are currently analysing the UKFTA in detail, so it’s too early to draw conclusions. However, we view any government-to-government trade agreement as a strategic signal. We will evaluate each on its merits to identify potential commercial opportunities.

What further support would you like from the Indian government to help scale domestic solar manufacturing?

The government has already extended critical support—starting with the imposition of Basic Customs Duties (BCD) on imported modules and later on solar cells. Policies like the Approved List of Models and Manufacturers (ALMM), first for modules and now for cells, have added much-needed structure and direction.

What the sector now needs is policy consistency. Once a direction is set, continuity becomes vital. Abrupt policy changes introduce uncertainty, deter investment, and can derail planning cycles. Stability is the single most important enabler for long-term manufacturing growth.