Juniper Green Energy on Monday said it has raised ₹2,039 crore in debt financing from marquee global and national financial institutions such as NaBFID, HSBC, DBS, Barclays and Aseem Infrastructure.

In addition, Juniper Green Energy has expanded its non-fund-based limits with Federal Bank and Axis Bank, a company statement said.

According to the statement, Juniper Green Energy Ltd on Tuesday announced it has successfully secured ₹2,039 crore in debt financing from marquee global and national financial institutions such as NaBFID, HSBC, DBS, Barclays and Aseem Infrastructure for growth and development of upcoming renewable projects of Juniper Green Energy and its subsidiaries.

This round of financing follows Juniper Green Energy’s successful ₹1,739 crores debt raise in August 2025 from the Indian Renewable Energy Development Agency Ltd (IREDA).

The National Bank for Financing Infrastructure and Development (NaBFID) has provided debt financing of ₹566 crore for the company’s under-construction 90 MW Juniper Green Kite Wind Power Project in Gujarat.

With this financing, Juniper further extends its relationship with a major infrastructure development financial institution, NaBFID, complementing its strong existing relationships with PFC and IREDA.

HSBC Bank has extended debt financing of ₹408 crore for the company’s under-construction 75 MW Juniper Green Beam Eight Solar-Wind Hybrid Power Project in Maharashtra, representing HSBC’s first greenfield project financing to Juniper Green Energy.

HSBC Bank has also extended non-fund-based and green loan facilities in the past. DBS Bank India and Barclays Bank have sanctioned ₹300 crore and ₹250 crore, respectively, in medium-term debt (three-year tenor) to support the capital expenditure requirements of various under-construction renewable energy projects.

Aseem Infrastructure Finance Ltd (AIFL) has also extended long-term debt of ₹515 crore for the Group’s under-construction 75 MW Juniper Green ETA Five Solar-Wind Hybrid Power Project in Maharashtra.

This is AIFL’s second project financing for Juniper Green Energy.

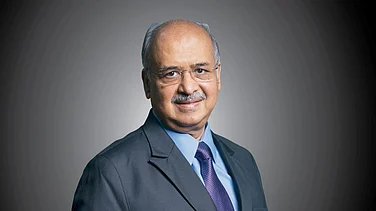

Parag Agrawal, Chief Financial Officer, Juniper Green Energy, said, “This financing is a testament to strong lender confidence in the quality of our asset base, project pipeline and execution track record… We remain focused on scaling responsibly while contributing meaningfully to India’s clean energy transition.”