Investigations into the Andaman and Nicobar State Cooperative Bank Ltd (ANSCBL) scam revealed loans over ₹80 crore were sanctioned against properties mortgaged via power of attorney (PoA), despite a 2020 bank circular banning such loans.

PoA allows a person to manage another’s property, but in this case, loans were taken without actual owners’ knowledge, leading to disputes.

Investigations into the Andaman and Nicobar State Cooperative Bank Ltd (ANSCBL) scam involving former Congress MP Kuldeep Rai Sharma have revealed that the majority of loans were sanctioned against property mortgaged through the ‘power of attorney’ for land, officials said on Monday.

A senior police officer said, "We have found gross irregularities on behalf of the bank in disbursing loans amounting to more than ₹80 crore to a section of businessmen, based on mortgages of property which were ‘power of attorney (PoA) for land’ in nature." He added, "It is surprising that the top management of the bank disbursed loans on such mortgages, even though in 2020 the bank itself had issued a circular banning loans against PoA, citing legal disputes." Explaining PoA for land, the officer said, "It is a legal, notarised document where the actual landowner appoints another person to look after the property, including selling, buying, or leasing. This is common in cases where the landowner is abroad, unwell, or elderly." "In this case, those who were given PoA by landowners availed huge loans from ANSCBL, often without the knowledge of the real owners. This led to disputes after objections were raised by the actual owners," he added.

Probe revealed that on November 23, 2020, the ANSCBL issued a notification (StCB/MD's Secretariat/2020-21/30) which read, "It has been observed by the undersigned that many loan applications are being received by the bank by way of mortgage of landed property through power of attorney (notarized and registered). Of late, it has been observed that many legal disputes arise due to mortgage of property, which are power of attorney in nature." "Accordingly, it has been decided by the bank that no loan shall be issued on the basis of mortgage of landed property by way of power of attorney with immediate effect. Any deviation from the above will be viewed seriously," the notification added.

On May 15, the Andaman and Nicobar Police lodged an FIR against Ex-Congress MP Kuldeep Rai Sharma in connection with the ANSCBL loan scam.

Apart from Sharma, others named in the FIR include the cooperative bank’s former chairman, board members and directors/officials of the bank and several beneficiaries.

On July 18, the CID arrested the ex-Congress MP in connection with the case.

Sharma, who formerly served as the chairman of ANSCBL, was arrested from a private hospital in Port Blair, where he was admitted due to health issues.

The arrest was made following a complaint from the deputy registrar of cooperative societies (HQ), which alleged gross irregularities in sanctioning loans to various people by the lender.

Since June 25, eight people have been arrested in connection with the scam, including ANSCBL managing director K. Murugan, bank employee Kalaivanan, Bablu Halder (director of Andaman Mormon Infrastructure Private Limited), Tarun Mondal (director Blair Enterprises Private Limited), Ajay Minz (director Andaman Treepie Adventure Private Limited respectively), K. Subramanian (ANSCBL director) and M. Sajid (Owner of M/s Andaman Escapades).

Meanwhile, the Enforcement Directorate (ED) has also started a parallel investigation.

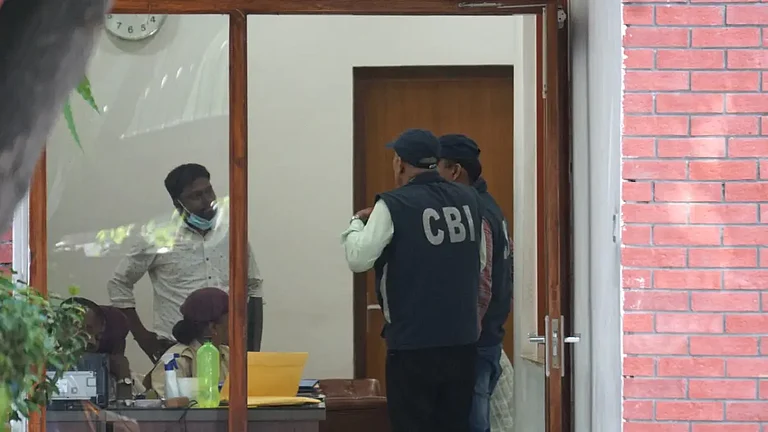

On July 31, the agency carried out its first-ever search operation in the islands, and has since summoned 10 people to Kolkata for questioning.

During the searches, the ED collected evidence suggesting that over ₹500 crore in loans were fraudulently obtained through more than 100 loan accounts.