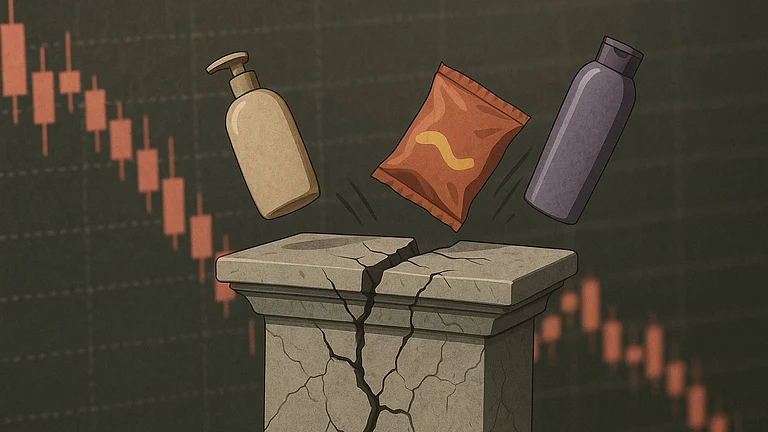

Global brokerage firm Jefferies has picked out Asian Paints, Hindustan Unilever (HUL), and Varun Beverages as its top 'contra ideas' for the year ahead, stating that the recent underperformance in these consumer-facing stocks may offer attractive entry points for long-term investors.

In its latest note, Jefferies, while took stock of several large-cap consumer firms that have struggled in recent quarters, weighed down by challenges in growth, competition, and profit margins. These growth pressures have also reflected in their share prices, with Asian Paints down 27%, Varun Beverages off 33%, and HUL trading 21% lower from their respective 52-week highs.

Factoring the downside, the brokerage argued that much of the bad news was now priced in, and any improvement in fundamentals could offer meaningful upside, while downside risks appear limited.

Investors also responded positively to Jefferies' contra bets, lifting shares of Asian Paints, Hindustan Unilever (HUL), and Varun Beverages over 1% higher in opening trade on July 9.

Double-Upgrade on Asian Paints

Among the three, Jefferies sees the strongest scope for a rebound for Asian Paints, upgrading the stock to ‘buy’ from the previous ‘underperform’ call. Side-by-side, Jefferies also sharply raised its price target for the stock to ₹2,830 from ₹2,000, reflecting a potential 12.6% upside from the last closing price.

While the brokerage did acknowledge competitive pressures for Asian Paints, particularly from new entrant Birla Opus, it still believes that the initial impact has largely played out. Jefferies now anticipates a gradual recovery in earnings from FY26, driven by stabilising margins and continued brand strength.

Steady Outlook for HUL

For Hindustan Unilever, Jefferies maintained its existing price target, citing a cautious but constructive outlook. The brokerage pointed out that the company’s stock performance has been largely stagnant in recent years amid concerns over volume growth and pricing pressures.

However, it applauded the company’s recent strategic shift towards prioritising growth over margins, combined with the renewed focus on India from its global parent, Unilever. These changes, according to Jefferies could help set the stage for a more sustainable recovery in performance.

Trimmed Target, But Positive on Varun Beverages

While Varun Beverages also features among Jefferies’ contra picks, the brokerage has revised its stock price expectations downward in light of a weaker-than-expected summer season. It cut its EPS estimates by 9–10% and lowered its price target to ₹560, down from ₹650 previously. Despite this, the ‘buy’ rating remains intact, with Jefferies citing attractive valuations as the key reason for the optimism.

Valuations Not Cheap, But Opportunities Remain

Jefferies also accepted that valuations for these stocks are not particularly cheap by traditional valuation measures. However, it believes the current market pricing already reflects caution, and that the potential for a cyclical improvement in fundamentals could reward investors willing to take a contrarian view. “In case our thesis does not play out, we think downside is limited from current levels,” the brokerage added.