In May 2014, the Narendra Modi-led Bharatiya Janata Party (BJP) became the first since 1984 to win the national elections with absolute majority. Apart from an anti-incumbency wave, one of the biggest contributing factors to the resounding victory was the relentless advertisement campaigns. As BJP poured money into Brand Modi, the then-ruling Congress party spent millions defending its record against corruption charges.

As reported to the Election Commission, the BJP spent Rs.7.14 billion on the 2014 campaign, while the Congress spent Rs.5.16 billion. Even a regional party like Sharad Pawar’s NCP spent Rs.510 million. The battle is all set to begin again in 2019, and news media stocks that have largely underperformed this year could get a big boost in earnings, over the next quarters.

“The role of political TV advertisements were not big before the 2014 elections, but this election changed everything. Ad campaigns started around two to three quarters before the polls. Similarly, this time around too, ad revenues could spike,” says Bhupendra Tiwary, research analyst at ICICI Securities.

Tiwary’s optimism is shared by other analysts as well — the consensus is that this is the right time to buy news media stocks, and the following companies seem particularly promising.

Zee Media Corporation

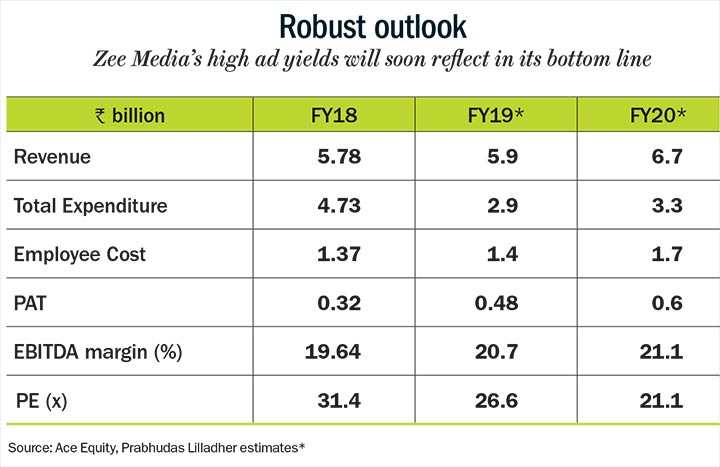

With 327 million viewers and 14 news channels in eight different languages, Zee Media is one of the biggest news broadcasters in India. The company’s broad portfolio puts it in pole position to take advantage of the spike in election spending, according to analysts. Following its lacklustre performance in previous quarters, the company reported robust numbers in Q1FY19 — net profit surged a whopping 604%, from Rs.51.1 million in Q4FY18 to Rs.366 million in the latest quarter.

Improvement in Zee News’ ratings, the company’s flagship channel, along with strong performance from newly-launched regional channels helped the company’s top line. “Over the past year, Zee News has drastically revamped its content. This has led to improvement in effective ad rate, translating into higher revenue,” says Jinesh Joshi, media analyst at Prabhudas Lilladher. With an ultra high-yielding property like the Lok Sabha elections just around the corner and continuous improvement in channel rankings, Joshi expects sales and net profit to grow at CAGR of 14.8% and 22.5% respectively, over the next two financial years (see: Robust outlook).While its regional and Hindi news channels have turned into revenue generators, English news channel WION is yet to break even and could be a drag on the balance sheet. “They were expecting WION to break even within three to four quarters after launching it in FY17. It got some good deals and was able to pre-sell airtime, which gave some visibility in terms of cash flow. However, the channel is not performing as per their expectations,” says Joshi.

Exiting its loss-making e-commerce business bodes well for Zee Media. In FY18, the e-commerce arm reported revenue and pre-tax loss of Rs.50 million and Rs.280 million, respectively. According to analysts, the pre-tax loss from Zee’s e-commerce business ate up 57% of the consolidated pre-tax profit, dragging down overall profitability for FY18.

After touching a high of Rs.50 in January, Zee Media is currently trading at Rs.29 — 40% lower than its peak, and at an estimated FY19 P/E of 26x.

TV Today

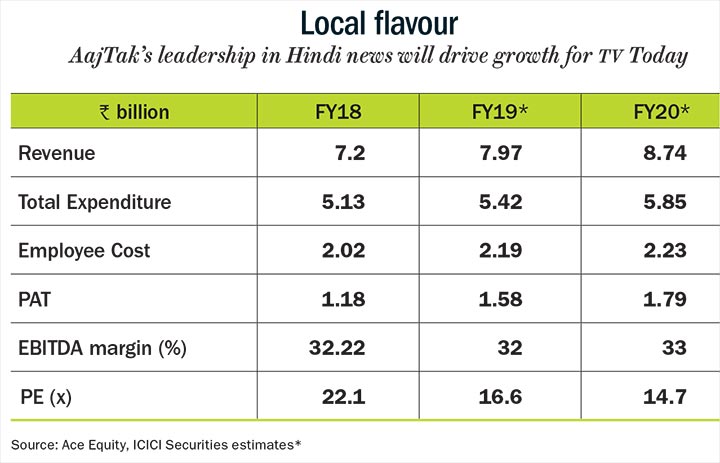

TV Today’s flagship channel, AajTak, dominates the Hindi news segment. This makes it a massive draw for the upcoming 2019 elections. The management stated that following TV Today’s decision to make AajTak a free-to-air channel in FY15, the company’s ad revenue grew by 18.7% in FY16. The double digit growth in ad revenue could be attributed to a spike in ad yield in wake of state elections and AajTak’s dominant position in Hindi news genre. Currently, AajTak charges advertisers an average of Rs.5,500 per 10 seconds, and is expected to levy a premium on this rate during the elections.

Analysts believe, political ad spending this year could further increase AajTak’s ad rate. “AajTak is about yield play and has the potential to garner healthy, double-digit yield growth. As the political parties fight for airtime, the yields will rise in upcoming quarters,” says Tiwary.

The company’s stock price has doubled over the past year on the back of decent growth. After hitting a high of Rs.521 in March, AajTak’s stock price has corrected to about Rs.437. In FY18, the company reported year-on-year growth in revenue and profit of 10% and 18%, respectively. In Q1FY19, TV Today’s topline grew 10.5% year-on-year to Rs.1.81 billion. The company’s upward trajectory is likely to continue, as analysts expect TV Today’s ad revenue to grow from 8.9% in FY18 to 13.6% in FY19, thanks to political spending (see: Local flavour).

Apart from decent revenue growth and profitability, a major positive for the company has been healthy margins. In Q1FY19, TV Today’s Ebitda margin stood at 34%, up 590 basis points. While exiting the radio business could further boost margin, analysts are sceptical about whether TV Today will be able to sustain its current margin. “The expenses of the company reduced this quarter. Expenses for Gujarat or Punjab elections were also not significant, but they won’t be able to sustain that in an election year,” says Tiwary. That said, he still expects TV Today to maintain Ebitda margin of 32% this financial year.

While AajTak continues to lead in the Hindi TV news segment in terms of viewership, TV Today’s English news channel India Today is ranked third, behind Republic TV and Times Now. However, with its flagship channel enjoying greater reach than any English news channel in India, TV Today will be banking on AajTak to improve its topline in the current year to Rs.7.97 billion. “The yield of Hindi news channels will go up as viewership rating of an average Hindi news channel would be higher than that of a leading English news segment during the elections,” says Tiwary.

TV Today might not have a diversified regional portfolio like its counterparts Zee Media and TV18 Network, but with four news channels, the company holds a dominant position in the TV news broadcasting segment. Analysts expect its revenue to grow at 13% CAGR to Rs.8.74 billion over the next two years, aided largely by the national elections tailwind. With the stock trading at one-year forward P/E of 16x, it could be a decent addition to the portfolio.

NDTV

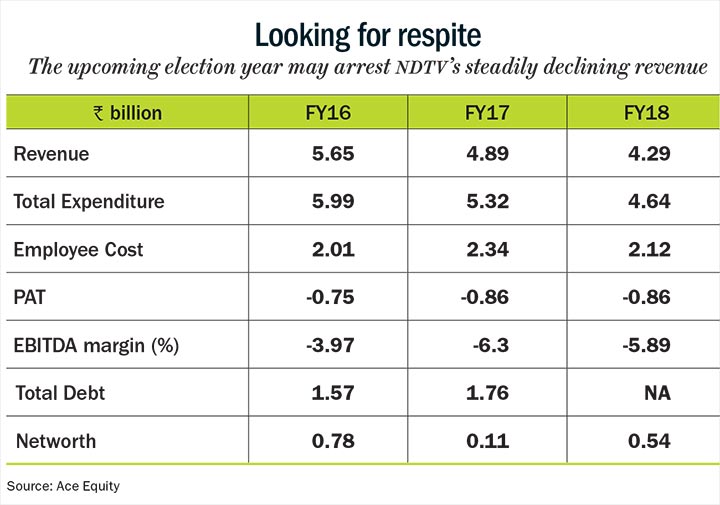

Although NDTV does not command a dominant position in the market any more, the news broadcaster is still seen as a credible brand, with market cap and net worth of Rs.2.5 billion and Rs.540 million, respectively.

In its FY17 annual report, NDTV claimed that it gets a higher advertising rate per viewer in comparison to other channels in India because of its balanced, credible news coverage, but there aren’t enough figures supporting the claim. Citing turbulence in business, NDTV’s management said that in order to buffer against volatility, the company has put in place a cost rationalisation programme and also taken steps to liquidate its stake in key non-performing assets. The company had proposed sale of IndianRoots.com, and its controlling stake in NDTV Good Times.However, NDTV’s revenue has dropped over the last three financial years, falling from Rs.5.65 billion in FY16 to Rs.4.29 billion in FY18. The consolidated Ebitda has been negative for the past three years, despite reduction in operating expense from Rs.5.99 billion in FY16 to Rs.4.64 billion in FY18. (see: Looking for respite)

In July, NDTV’s stock surprisingly surged 74% on prospect of selling at Rs.214 in an open offer. Since then, the stock has corrected sharply, with euphoria around the open offer dying down. NDTV, too, like other news broadcasters in India, will gain from the increase in political ad spend in 2019, but due to its weak financial performance and high debt, only investors wanting to play contrarian might look at it.

TV18 Broadcast

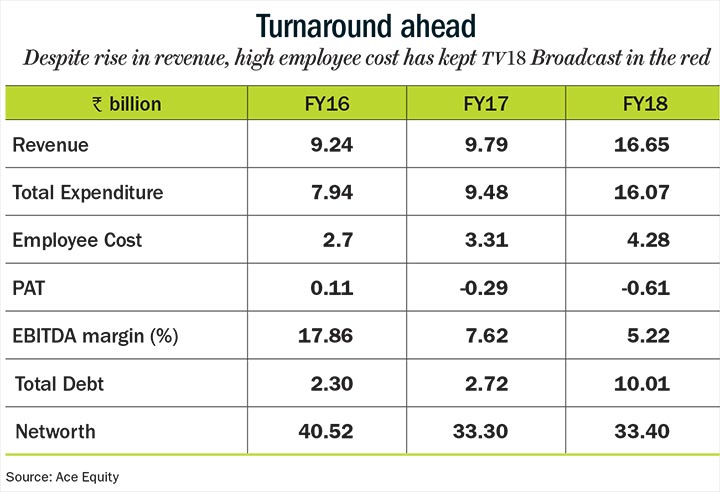

This Mukesh Ambani-controlled broadcaster has a diverse portfolio that includes entertainment, digital and film content. The company’s broadcast division, Network18, has four business news channels, a general news channel and 14 regional news channels. FY18 wasn’t a good year for the company with its consolidated net loss widening to Rs.610 million in the last financial year, up from Rs.290 million in FY17.

In Q1FY19, the company’s net loss expanded to Rs.120 million, from Rs.110 million in June 2017. Rahul Joshi, managing director of TV18 Broadcast and Network18, admitted after Q1FY19 results that the past two years have not been great for the news broadcast industry. However, he asserted that things look more positive of late, and the state and general elections would create some excitement this year (see: Turnaround ahead).

The management’s bullishness might not be misplaced as the revenue from business and general news segments grew 14% year-on-year in Q1FY19 to Rs.1.73 billion, driving overall growth. Revenue from regional news and infotainment also increased 24% year-on-year, thereby reducing operating loss to Rs.220 million, as against Rs.370 million in Q1FY18.

Analysts have stopped coverage on TV18, stating that the company doesn’t share enough financial metrics. Investor confidence is also waning, and the stock has fallen 39% from its high of Rs.70 in April, due to poor Q1FY19 results. However, the worse seems to be over at least for the upcoming quarters, as political ad spends look set to provide a timely boost.

DB Corp

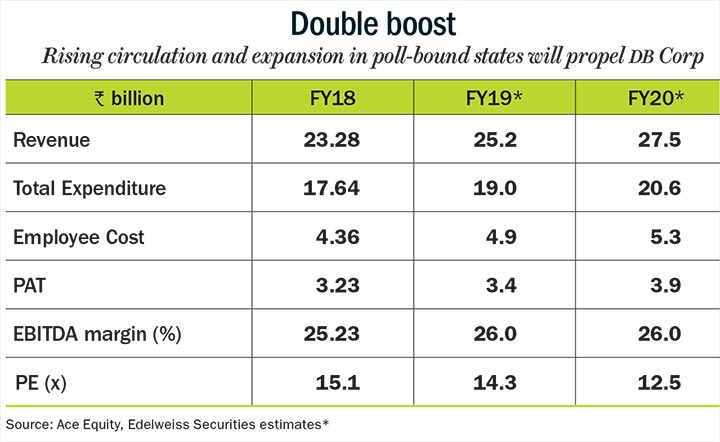

Like TV networks, listed print businesses are also expected to shrug off their slow growth this year due to a spike in political advertising. With 65 editions in four languages and presence in 13 states, Dainik Bhaskar will be in a strong position to bag a major chunk of political advertising. During the Q1FY19 result conference call, the management highlighted that government advertising has picked up due to elections, which will aid revenue.

The elections could not have come at a better time for the company. In an election year, DB Corp has managed to successfully implement its expansion drive in Bihar, Rajasthan, Madhya Pradesh and Gujarat. Circulation revenue jumped 10% year-on-year, up to Rs.13.45 billion in Q1FY19 from Rs.12.2 billion in Q1FY18. The management claimed that it sold 5.8 million copies in this quarter, as compared to 5.1 million copies in the same quarter last year.

The rise in circulation would help the company charge higher ad rates to political parties. “DB Corp’s readership base is increasing, meaning they can even charge higher ad rates to corporates,” says Abneesh Roy, senior vice president, institutional equities, Edelweiss Securities. Pointing to the government’s rural push in the election year and stabilisation of the economy, he expects corporates to invest more in advertising.

However, high newsprint cost is a cause of concern. Analysts expect newsprint cost to jump from 6.5% in FY18 to 10.5% in this financial year. In Q1FY19, the Ebitda margin dropped 479 basis points to 27% (see: Double boost) due to increase in raw material cost driven by newsprint inflation and expansion in Bihar. “The rupee has sharply depreciated, which will affect newsprint cost and this huge risk will continue to loom. It will be tough for margin expansion, and whether margins begin to shrink remains to be seen,” says Roy.

He adds that while print media companies are not among his top picks, DB Corp could be a good play on election ad spending. The stock currently trades at Rs.249.50, at 14.3x FY19 estimated earnings.

Jagran Prakashan

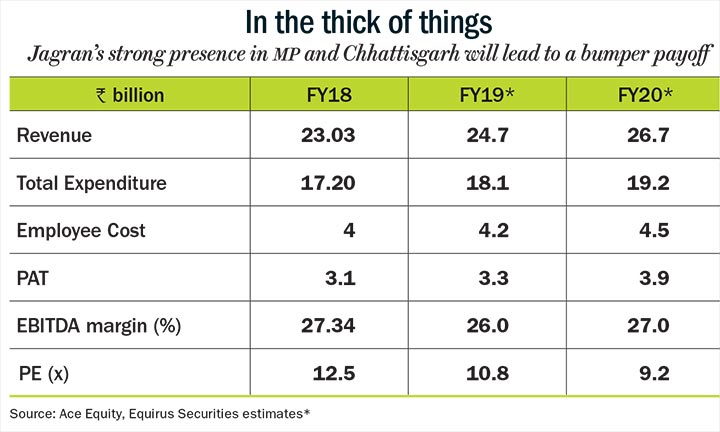

With Jagran Prakashan’s stock currently trading near its 52-week low, increase in political ad spending could bring much-needed respite. While the company has interests spanning across FM radio, OOH and digital media, the key contributor is its print business, which has slowed down over the past few quarters. After registering weak standalone print advertising and circulation revenue growth over the past financial year, the company seems to have arrested the decline. Print advertising revenue was flat year-on-year in the latest quarter, after two consecutive quarters of negative growth. However, Jagran Prakashan’s radio advertising and digital revenue grew 8% and 25% year-on-year respectively, in Q1FY19.

The management is confident of increasing revenue in the next years (see: In the thick of things), buoyed by higher advertisement incomes, and the newspaper’s strong presence in states where assembly elections are due this year. “They have very good presence in Madhya Pradesh and Chhattisgarh, and elections are scheduled to be held in these states in FY19. Jagran will benefit from a revival in ad revenue due to these elections,” says Depesh Kashyap, analyst, Equirus Securities. Additionally, revival in FMCG, e-commerce and auto sectors is expected to aid advertisement revenue in the upcoming quarters.

To brace against the impact of rising newsprint cost, the company has hiked its cover price, but has not reduced its pagination to protect margins. “They have reduced the number of copies by 4-5% as the industry has been grappling with rising newsprint cost, but the company maintains that they have not lost market share as competition has also seen fall in circulation,” says Kashyap.

With the stock dropping around 40% from its high of Rs.189 in January 2018, analysts now rate it as highly promising. “Expected ad recovery in the second half of the financial year, increase in cover price and drop in number of copies may neutralise the impact of newsprint inflation,” says Kashyap. Jagran Prakashan is currently trading at a P/E of 10.5x FY19 earnings.

HT Media

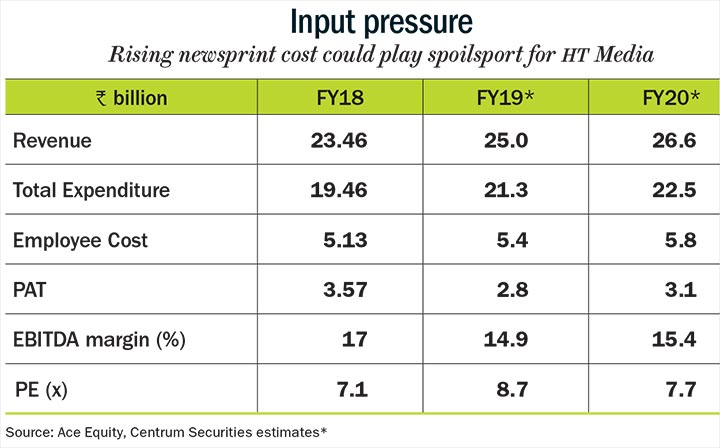

Relief is also around the corner for HT Media, which has been grappling with hard times. After eight straight quarters of decline, the company is looking at high upcoming political spends to bring a spell of respite. Its stock recently touched a nine-year low, after a disappointing June quarter. HT Media’s consolidated revenue fell 7% year-on-year to Rs.5.4 billion, with print ad revenue dropping to Rs.3.9 billion. Further adding to its woes, circulation revenue also declined 3% year-on-year to Rs.700 million in the latest quarter.

Analysts believe, HT Media can deliver relatively better numbers based on revival of corporate and political ad spending. “We have predicted high single-digit ad growth in Hindi dailies for FY19 on the back of low base, and sectors such as auto and real estate bouncing back. The rise of political ad spending on account of national elections would also impact growth,” says Ankit Kedia, research analyst, Centrum Broking. He also predicts margin expansion in the radio business, and probable lower losses in the digital business.

The concern of higher newsprint cost looms large for HT Media as well. Kedia says that the rise in cost of newsprint over the last two months can impact margins (see: Input pressure), despite management increasing cover price by Rs.0.50 per copy. In Q1FY19, raw material and services cost spiked by 13% (year-on-year), rising from Rs.710 million to Rs.810 million.

The company’s Hindi print business, Hindustan Media Ventures (HMV), is better poised to take advantage of political ad spending in comparison with its parent company. HMV has a strong presence in the Hindi heartland with 20 editions, and holds the number two spot in Uttar Pradesh.

In fact, HMV is expected to grow at CAGR of 11% between FY13 and FY19, as compared to 6% CAGR for its parent company in the same period. With HT Media holding 74% stake in HMV, any growth in the Hindi print business will be beneficial for the parent company, too. With HMV also being listed separately, investors have the option to opt for a pure Hindi media play. The stock currently trades at 9x FY19 estimated earnings.

With the parent trading at 6.5x FY19 estimated earnings, it seems less expensive in comparison to its peers. Given the other options available to investors, it remains to be seen whether the near-term spike in advertisement revenue brings back investor confidence.