Ceat shares experienced a sharp rise, hitting a 4-month-high of Rs 3,298.10 on the National Stock Exchange. The tyre company reported healthy Q4 figures with sales soaring to Rs 3,414 crore, a year-on-year (YoY) uptick of 14.6%. Revenue from operations figure stood at Rs 3,413 crore price level, up by more than 14% during the quarter under review.

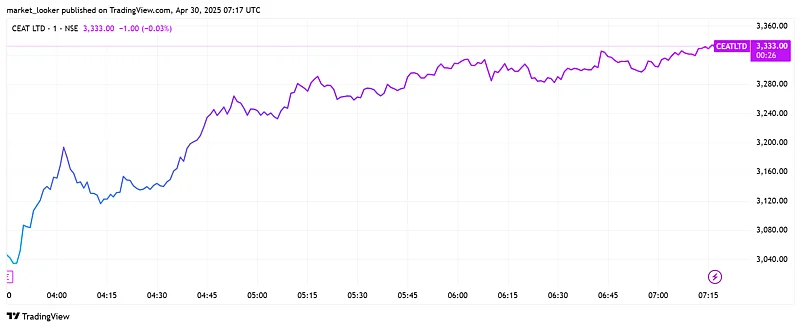

At 12:10 the Ceat shares were trading at Rs 3,301, up by 7.86% on the National Stock Exchange.

However, net profit plummeted over 8.4% to Rs 99.5 crore, as against Rs 108.6 crore recorded in the corresponding quarter of the previous fiscal. Gross margins improved by 65 basis points (65 bps) to 37.5% owing to favourable revenue mix. The management stated that operating margins reported a healthy uptick of over 120 bps due to strong cost controls across the value chain.

The management indicated that it is expecting double-digit growth in the standalone business for FY26. Regarding the premium segment, while volumes remain limited, the company is witnessing significant growth, Managing Director and CEO Arnab Banerjee told CNBC-TV18. For the upcoming quarter (Q1FY26), the raw material basket is likely to remain largely in line with levels seen in Q4FY25.

Ceat Shares today

The shares of the tyre company have surged over 18.3% in the last 6 months. In the last month alone, Ceat stock has gained more than 15% on the NSE. The shares of the company are just 7% down from its 52-week-high of Rs 3,578.80 price level.

At 12:45 am, the shares of Apollo tyres surged over 4.13%, trading around Rs 474 price level on NSE.

Other tyre stocks, including JK tyre and Apollo tyres witnessed a similar uptick. A few weeks back, CLSA pointed out that the Indian tyre industry is experiencing a structural shift, driven by improved profitability and better capital efficiency.

According to the investment firm, this transformation is being fueled by three key factors: greater pricing discipline among companies, improvement in product quality and a strategic shift toward a more profitable product mix.