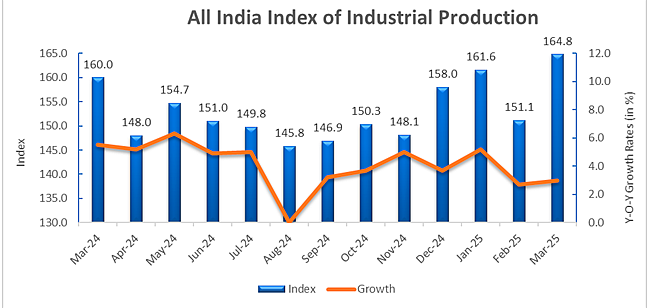

The central government continues to recover the Index of Industrial Production (IIP), which grew by 3% year-on-year in March 2025, according to data released by the Ministry of Statistics and Programmer Implementation. The number showed a recovery from the six-month low of 2.9% recorded in February. In March, the IIP was at 164.8, up from 160.0 a year earlier.

The ministry also highlighted the IIP growth of various sectors like manufacturing, electricity, infrastructure, and more. Manufacturing sector has the largest weight in IIP as it increased 3%, slightly higher from 2.9% in February. And within this sector, 13 of the 23 industry groups reported positive growth. The electricity generation grew 6.3% as compared to 3.6% in the previous month.

While mining output reported growth at 0.4% compared to 1.6% in February, Infrastructure and construction goods witnessed 8.8% growth. Besides this, the consumer durables increased 6.6%, and the consumer non-durables decreased 4.7% during the month, the data showed.

In the financial year 2024-25, cumulative IIP growth moderated to 4%, compared to 5.9% in the preceding year.

What Do Economists Say?

Economists stated that the latest data reflects “weak growth” in this fiscal year. So, the recovery process requires more consumption in both rural and urban areas.

“As we advance, sustaining a broad-based industrial recovery will require stronger consumption pickup in both urban and rural markets, a continued push from government capex, and a revival in private capex, even as there is a risk of plateauing government capex as fiscal consolidation gains priority,” said Sankar Chakraborti, MD & CEO, Acuité Ratings & Research Limited.

It is possible that the lower response rate associated with the preponing of the data release has dampened the estimated growth rate, which may subsequently undergo a relatively larger revision as compared to that seen in the past, according to Aditi Nayar, Chief Economist, Head – Research & Outreach at ICRA.

“The improvement in YoY growth of electricity and mild uptick in that of manufacturing was offset to a large extent by the dip in the growth of mining. Looking ahead, while there is some evidence as well as commentary around frontloading in exports to the US, we need to see whether this is driven by redirection away from other geographies or a bump up in output in the ongoing month,” she added.