As India’s IT giants roll out their quarterly results, one of the most anticipated updates is when these companies will offer salary hikes to their employees. The sector, which employs over 5.8 million people in India, has so far sent mixed signals on annual increments.

Infosys, on April 18, announced that it had already rolled out its FY26 hikes starting in January, with some increments implemented earlier this month. However, Tata Consultancy Services (TCS) has deferred its hikes for now, citing “uncertainty” caused by U.S. tariffs and continued cuts in discretionary spending. Wipro appears to be following a similar path, with its CHRO stating that a decision on pay hikes will be made closer to its appraisal cycle in September.

Comments from all three companies suggest that tariffs proposed by US President Donald Trump could weigh heavily on their business outlook—even though the reciprocal hikes have been temporarily paused for 90 days.

Could these mixed signals from India’s largest private-sector employer be an early indicator of broader corporate increment trends? We asked experts to explain what the US tariff situation could mean for Indian private-sector employers and how it might impact workers' wages.

Will Trump’s Tariffs Impact 2025 Increments?

According to experts who spoke to Outlook Business, since most companies had already locked in employee performance reviews and budgeted for salary increases by March 31, the newly announced 10% universal tariffs and variable reciprocal tariffs on April 2 are unlikely to significantly affect FY26 increments.

Neeti Sharma, CEO of staffing firm TeamLease Digital, said that IT services are “directly impacted” by these tariffs because “they don’t know how things will play out.” That uncertainty is why companies are adopting a cautious approach.

“But if you look at Global Capability Centres (GCCs), they’ll continue to offer higher increments—likely in double digits, not single digits,” Sharma added.

She also noted that other sectors aren’t likely to defer or reduce salary hikes due to tariff risks—at least not yet. “The real impact will come later, once the actual tariff implications are clearer,” she said.

“It’s still a little too early to talk about this in detail,” added Rishi Shah, Partner and Economic Advisory Services Leader at Grant Thornton Bharat. He explained that while tariff impacts will vary by company depending on their U.S. exposure, the current uncertainty doesn’t change the performance metrics already logged for FY25.

Hike Expectations Already Low

Even before the recent tariff concerns, macroeconomic headwinds and a broader slowdown had already dampened salary hike expectations across many sectors.

Sharma said industries like e-commerce, retail, BFSI, and small-to-mid tech and manufacturing (SMTG) will typically offer hikes in the 8–10% range.

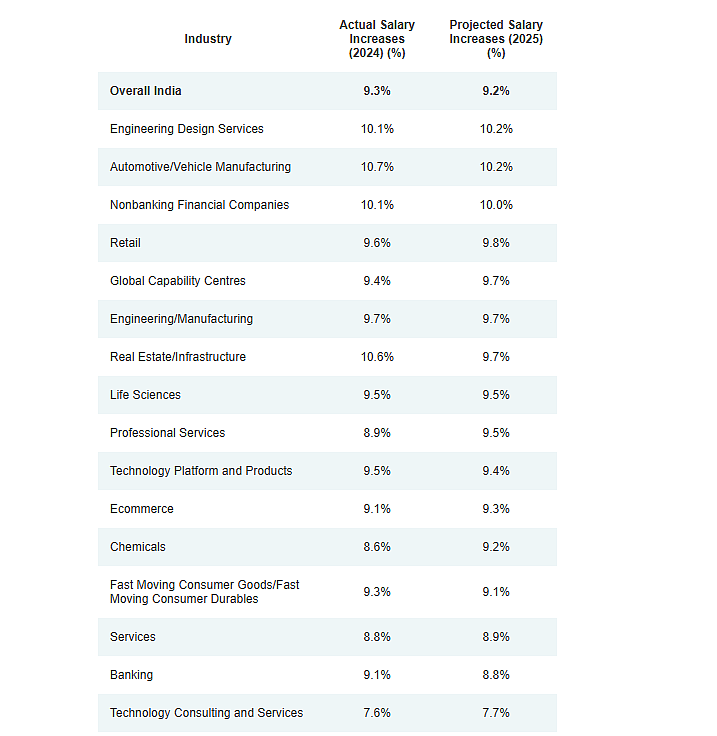

According to a February report by professional services firm Aon, salaries in India are projected to rise by 9.2% in 2025—slightly lower than last year.

“The slight dip seen across sectors factored in various geopolitical risks, including ongoing wars and the potential impact of U.S. elections on trade policies. Given that, we don’t expect any additional negative impact on India Inc, especially since growth projections and economic fundamentals remain strong,” said Roopank Chaudhary, Partner, Human Capital Solutions, India, at Aon.

Aon’s report shows that engineering design services and automotive/vehicle manufacturing firms are projected to lead with the highest hikes at 10.2%. They are followed by non-banking financial companies (10.0%), retail (9.8%), and GCCs (9.7%).

Life sciences, professional services, and tech platform/product firms are expected to offer increases in the 9.4%–9.5% range. Meanwhile, chemicals, FMCG/FMCD, and services sectors are projecting slightly more modest hikes between 8.9% and 9.2%. Banking is expected to see just 8.8%, and technology consulting and services could be the most conservative at only 7.7%.

The April 19 report also noted a downward trend in salary increases since 2022, when companies had offered 10.6% hikes due to “The Great Resignation.”

What TCS, Infosys, Wipro Have Signaled

“Because of the uncertain business environment, we will decide on the wage hike during the year,” said TCS Executive Vice President and CHRO Milind Lakkad during the company’s Q4 FY25 results press conference earlier this month.TCS typically announces its pay hikes in the first quarter of the financial year.

The IT giant reported muted Q4 results, with revenue declining 0.8% sequentially, although it was up 2.5% year-on-year. Profit margins also slipped, with EBIT margin at 24.2%. Management said client spending delays beginning in late February impacted revenues.

Meanwhile, Wipro’s CHRO Saurabh Govil said, “We are still quite far from the next cycle. In this uncertain environment, we will decide on wage hikes closer to the date.”

His comments followed the company’s quarterly earnings, which included weak guidance for Q1 FY26. The Bengaluru-based company forecasted a sequential revenue decline of 1.5% to 3.5% in constant currency terms.