Starbucks CEO Brian Niccol reportedly visited India after Tata Consumer Products halted new investments.

Tatas have pushed back against Starbucks’ high-cost format, pausing funding until a more profitable approach is agreed.

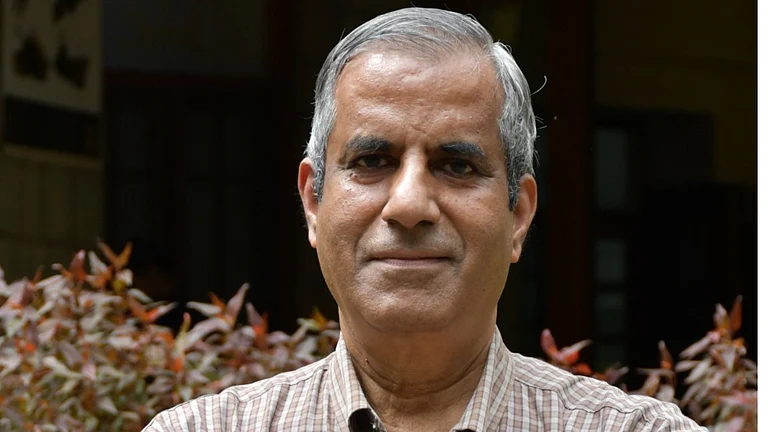

The reset discussions led Niccol and senior leaders to meet Tata Sons chairman N Chandrasekaran at Bombay House last week.

Starbucks Corporation CEO Brian Niccol was reportedly compelled to visit India last week after joint-venture partner Tata Consumer Products slowed fresh investments. The FMCG arm of the Tata Group wants to rationalise the Tata Starbucks operating model.

According to The Economic Times, the Tatas have taken a firm stance against the chain’s high-cost approach, holding back new investment until a profitable model is established. This push for a reset prompted Niccol and senior executives to meet Tata Sons chairman N Chandrasekaran at Bombay House last week.

Tata Consumer Products has argued that Starbucks’ global template — large 3,000 sq ft stores, equipment built for 700 cups a day and premium pricing of around ₹400 per cup — does not suit India’s competitive out-of-home coffee market, value-conscious consumers or high rentals.

This has triggered a business overhaul, with Starbucks expected to shift towards smaller, more efficient, India-specific stores to improve unit economics.

A TCP spokesperson told ET, “During our last review, we worked on the store ambience and aesthetics, especially in tier II cities. The macro indicators and demographics of the country make it especially attractive, and the QSR category overall has tailwinds spurring its growth.”

However, this growth has brought more competition, especially in the coffee beverages segment. Tata Starbucks now competes not only with global players such as Tim Hortons, Pret A Manger and Barista but also with homegrown chains like Third Wave and Blue Tokai.

Meanwhile, Starbucks India reported a loss of ₹135.7 crore in FY25, with losses widening even as revenue rose 5% to ₹1,277 crore. Since opening its first outlet in 2012, the chain has expanded to 500 stores.

The report says Starbucks and Tata Consumer Products have informally agreed to rebuild the business around a leaner, India-specific model. Until this is finalised, the venture has paused its earlier target of reaching 1,000 stores by 2028.

Globally, Starbucks recorded a 1% drop in comparable store sales in FY25, which ended on 30 October, with declines across the US and China. Consolidated revenue grew 3% to $37.2 billion, while operating margins fell sharply due to restructuring costs, higher labour spending and inflation.