Tesla and Elon Musk face a securities fraud class action in Austin, Texas.

The shareholders’ lawsuit accuses them of downplaying public safety risks linked to the new robotaxi programme.

Tesla shares fell for two consecutive days, dropping as much as 6%, and are down over 18% so far this year.

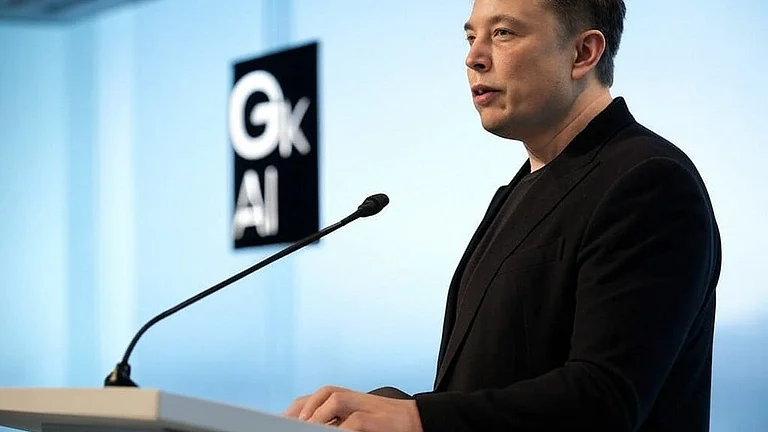

Elon Musk and his electric vehicle company Tesla have been hit with a securities fraud lawsuit from shareholders, alleging that the company downplayed or concealed public safety risks associated with its newly launched robotaxi programme.

The class action suit was filed by shareholder Denise Morand in a federal court in Austin, Texas. Following the news, Tesla’s shares fell for two consecutive days, dropping as much as 6%. Tesla’s shares have fallen over 18% so far this year.

The lawsuit claims that Musk and Tesla repeatedly overstated the effectiveness and prospects of their autonomous driving technology, inflating the company’s financial outlook and stock price, according to Reuters.

It cites Musk’s assurance during an April conference call that Tesla was “laser-focused on bringing robotaxi to Austin in June,” alongside the company’s statement the same day that its approach to autonomous driving would deliver “scalable and safe deployment across diverse geographies and use cases.” Tesla’s current CFO Vaibhav Taneja and former CFO Zachary Kirkhorn are named as co-defendants.

Tesla began public tests of its robotaxis in late June in Austin. Since then, reports suggest the vehicles have experienced issues including speeding, sudden braking, driving over curbs, entering the wrong lane, and dropping passengers in the middle of multilane roads.

The lawsuit covers individuals who held Tesla shares between 19 April 2023 and 22 June 2025. It seeks damages, alleging that investors were misled about regulatory hurdles and technical limitations. The case cites Tesla’s public statements and Musk’s social media posts as evidence of misrepresentation that allegedly violated federal securities laws.

In a 24 July note, analysts at US brokerage Wedbush observed that Tesla continues to face a challenging EV demand environment, with autonomy now a key driver of the company’s momentum.

“We believe that the upcoming quarters will be critical for Tesla on the autonomous front as Musk & Co. aim to have autonomous ride-hailing in half the US population by the end of 2025, including Unsupervised FSD for personal use in some US cities by late 2025. Plans are in place to expand robotaxis across Florida, Arizona, California, Nevada and more, as Tesla targets significant robotaxi scaling in FY26,” the brokerage report said.

Hype Claims Not New for Tesla

Securities fraud lawsuits are not new for Tesla and Elon Musk, both of whom have been accused of exaggerating the potential of the company’s autonomous technologies.

Earlier this year, a federal jury in Florida found Tesla partially responsible for a 2019 fatal crash involving its Autopilot system. The company was ordered to pay $243 million in damages for the death of Naibel Benavides Leon and injuries to her boyfriend. Tesla blamed the driver and has said it will appeal.

In 2024, the National Highway Traffic Safety Administration (NHTSA) identified critical flaws in Tesla’s Autopilot, linking it to 467 crashes, 13 of which were fatal.

In 2023, Musk and Tesla were found not liable in a separate securities fraud class action. That case involved Musk’s 2018 tweets about taking Tesla private.

In August 2018, Musk tweeted that he had “funding secured” to take Tesla private at $420 a share and that investor support was “confirmed,” halting trading and causing weeks of volatility. Musk later admitted he relied on a verbal commitment from Saudi Arabia’s sovereign wealth fund and would have sold SpaceX shares to finance the deal, but it never materialised. A San Francisco jury deliberated for less than two hours in early 2023 before clearing Musk and Tesla of liability.

Over the same tweets, the US Securities and Exchange Commission (SEC) filed a civil securities fraud action against Musk, calling his claims misleading. The case was settled in September 2018 with Musk and Tesla each paying $20 million. Musk also agreed to step down as chairman for three years and to have key tweets pre‑approved.