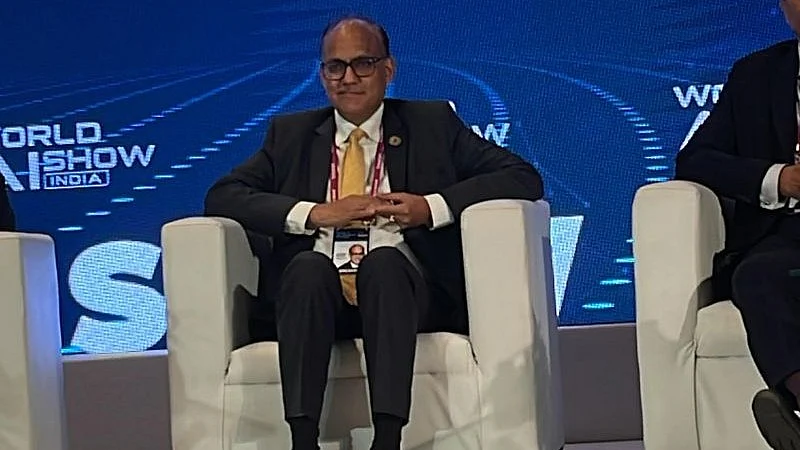

SBI managing director Ashwini Kumar Tewari on Wednesday at IFTA 2025 expressed concerns over Account Aggregator's mechanism of obtaining a single consent from customers for all financial services products.

Speaking at an event here, Tiwari argued that most customers do not read the fine print and often sign up without understanding the details.

An Account Aggregator (AA) is a Reserve Bank of India (RBI) regulated entity that acts as a consent-based data intermediary.

The Account Aggregator framework was introduced by the Reserve Bank of India (RBI) to enable the easy sharing of data between financial institutions for quicker decision-making. There are as many as 225 million users on AA at present.

A single consent from the customer is used across all financial services products, including giving loans, signing up for wealth management or account openings, Tewari said at an event here.

Customer consent is obtained only once; customers do not read the fine print before authorising and end up signing up without understanding, Tewari said. "I am a little worried about this... Nobody understands the fine print. And they give a single consent for everything. Is that ok? Probably not," Tewari said.

Tewari said "we are in an era where privacy has become very important with laws like Europe's General Data Protection Regulation (GDPR), and wondered how "we operate with such a set-up in India where customers may be lacking understanding." The senior official from the country's largest lender also further noted that the self-regulatory organisations (SROs) for the fintech sector have not achieved any success in getting the right solution to the problem, he said.

He urged the industry to come together and solve it by themselves by building the right safeguards, warning that otherwise the regulatory apparatus may come in with a ban as it did with real money gaming.