If nobody will lend you money, Rana Kapoor certainly will. Many an industrialist has lived for a good part of the last decade or more with this unshakeable belief.

Five years ago, the promoter of a mid-size shipping company was staring down a barrel of debt. A large private sector bank was after him for repayment and time was running out. The money involved was around Rs.3.5 billion and every bank he turned to was reluctant to help. That was understandable since talk of his company’s liquidation was already doing the rounds. A well-wisher told him that Kapoor, who was the big boss at Yes Bank, would be the person to reach out to. The businessman could not reach the banker despite making many calls but, a couple of days later, Kapoor’s office reached out to him. They wanted a meeting over dinner and the venue was to be the banker’s home at Samudra Mahal, Worli.

Kapoor was known to be a generous host, especially to his corporate guests. In fact, in late 2014, he acquired a building on Altamount Road, one of Mumbai’s best residential addresses, because his apartment seemed too tiny for these meetings. Situated right next to Mukesh Ambani’s Antilia, the banker paid Rs.1.28 billion for an apartment block that sat on third of an acre. The plan was to demolish the structure and build a bungalow.

As that evening with the shipping-company promoter progressed, there was conversation but none about business. It was a couple of hours before Kapoor brought it up with, “You need Rs.3.5 billion, to be repaid over five years”. The businessman would find it hard to believe the offer Kapoor was about to make — he could borrow Rs.5 billion over 12 years. When no banker was willing to touch him with a bargepole, here was generosity that was hard to understand. He protested gently saying he did not need that kind of money but that was shot down. With no option left, he quietly agreed.

Like most things in life, it came with a caveat. He had to pay Rs.500 million or 10% of the amount sanctioned as an upfront fee. This was not conventional banking but, given his desperation, he said ‘yes’. Kapoor would use the fee income to make his profit and loss account look better. It was tack he had repeatedly used and it was at work again. The evening and dinner were both done and, in a couple of days, the money landed in the promoter’s account. Not surprisingly, he was pleased.

Aggressively ambitious

Rana Kapoor is a bit of an oddball in banking circles. In a business often marked by some level of conservatism, he brought in an aggression that was unprecedented. Private sector banks, barring the occasional binge, choose to tread on the right side of caution. Of course, lending to sectors such as power came a cropper when coal licenses were cancelled and that landed many of them in a soup. Bruised, they slowly limped back to normalcy.

By contrast, here was a man more than happy to entertain people at home with drinks and dinner or take them to Mumbai’s racecourse or sponsor golf tournaments. He liked the limelight and could never seem to have enough of it. His rivals in the banking industry wickedly call him the ‘lender of the last resort’. That title is not entirely misplaced. In fact, it has sadly done him in. Friends are distancing themselves and Yes Bank, the institution Kapoor co-founded, is out of his grasp. Not only has he lost his job but the shares he holds in the entity are no more than 0.8% of the bank’s equity.

Those who have known him say the real Rana Kapoor is aggressive (abusive as well, they add gently), hyperactive and will do anything to get a deal. Equally, he knows how to get his pound of flesh and it is said very few can match his ability to get back the money he has lent. Be it folks as dodgy as Deccan Chronicle Holdings or the Vijay Mallya-promoted Kingfisher Airlines, every rupee lent came back. It left many a lender, which included large public sector banks, an embarrassed lot, as the fate of their money remained unknown. Besides, it gave Kapoor the confidence to lend larger sums to borrowers and that lack of judgment cost him dearly. Clearly, aggression worked only when the going was good.

Kapoor fancied himself as an ace corporate banker and his pedigree was the reason for that. After stints at Bank of America and ANZ Grindlays, where he was involved in loan syndication and later investment banking, he joined hands with Ashok Kapur and Harkirat Singh (from ABN Amro and Deutsche Bank, respectively) to create Rabo India Finance in 1998, which was an NBFC. The three individuals would hold 25% of the equity, with the other 75% with the Netherlands-headquartered Rabobank. In 2003, Kapoor, Kapur and Singh sold their stake, with their sights on setting up a bank.

The same year, they got the licence and, in 2004, Yes Bank was off the ground. Singh had decided to move on and it was now left to Kapoor and Kapur, who were already related since their wives were sisters. A private sector banker who knew the two says that it was Kapur’s moderate approach to banking which convinced the RBI to grant them the licence. “He was a highly respected man and known to be from the old school. Rana was brash and the complete antithesis of Ashok,” says the banker.

Responsibilities were clearly divided with Kapur being the chairman and Kapoor, its CEO, with the job of running the bank on a day to day basis. The two men, as different as chalk and cheese, managed the relationship well, until disaster struck in 2008. Kapur was killed in the Mumbai terrorist attack that year, and from then on Yes Bank became Kapoor’s fiefdom. A veteran investment banker recalls meeting him during that period and describes Kapoor as being “too sure of himself”. A proposal to work with a strategic partner from within Asia was presented and Kapoor was not too impressed. “There is nothing we can learn from them,” he said dismissively. According to the banker, Kapoor, whose Yes Bank was barely four to five years old, believed that he was next only to HDFC Bank. “It was the only bank he admired for the quality of people and was convinced that Yes Bank was not too far away. It was quite ambitious for someone who was still new,” he recalls.

During that meeting, Kapoor had made it clear that the bank was on track and it was time now to look at insurance, through a different entity outside of Yes Bank. “Rana is a good professional banker with a lot of passion. It’s just that he wanted to do too much too quickly,” adds the banker.

Rise before the fall

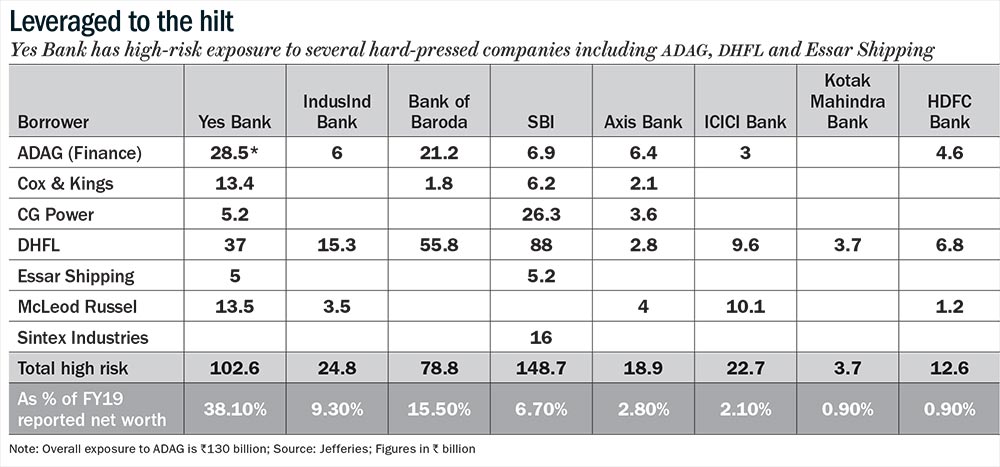

Never letting go of a borrower was Kapoor’s way of doing business. But most on that list have defaulted at will, leading to Yes Bank’s current position (See: Leveraged to the hilt). Even the relatively good borrowers express a sense of surprise on how easy it was for them to get money.

One large infrastructure group needed Rs.20 billion for a project expansion. It had fallen on bad times with its traditional lenders turning tight-fisted. Not only was the loan sanctioned in just two to three meetings, there was no talk of wanting to see the project in the current form. A senior official at the group remembers Kapoor as being the “most unconventional banker”, who had no interest in prolonged discussion. The rate of interest was higher at 15-16% compared to the 13% others charged, apart from the now well-established upfront fee of 2-3%.

A standard joke in banking circles is about how Kapoor would never compromise on fee income, Yes Bank’s mainstay for at least six years. If there was pressure on that building up towards the end of each quarter, a call would go out to a borrower informing him that an additional loan has been sanctioned. In most cases, the businessman would not need the loan but a sanction letter would be sent anyway, and he would have to send it back signed. “The fee did come but one never knew if the loan ever went out,” quips the private sector banker quoted earlier. Consequently, fee income upwards of Rs.3 billion was reported every quarter.

This was Kapoor’s bank and he would run it the way he wanted to. Former Yes Bank officials say there were no power centres, since it was him deciding everything. “It was very normal for Rana to fire a relationship manager by sending him a text message,” says one person in the know. While disbursing a loan, it was Kapoor who would sit with the businessman and thrash out the smallest detail. “It was a power trip for him to deal with the promoters directly. The team only had to disburse the amount,” says the source, adding that it was odd that he would involve himself even in smaller deals. This approach works when you are a small organisation. With size, the lender needs to evolve and change. Yes Bank didn’t.

He ruled over the board with an iron fist and that came to light when a bitter battle ensued between the Kapur and Kapoor families. This was after Kapur passed away and his wife wanted to nominate her daughter Shagun on the board of Yes Bank. This was not going through and the Kapur family alleged that Kapoor had absolute control over the board. This turned out to be a long battle ending only early this year, when Shagun was finally accommodated.

While all this was going on, the Reserve Bank of India (RBI) was starting to look at the books of banks a lot more closely. The worry was that non-performing assets (NPAs) were difficult to monitor, since banks always had a way to beat the system. The method was simple and banks would quietly move around NPAs between themselves when they realised that a loan was close to the danger zone. This is essentially Bank A selling a bad loan (an asset) to Bank B, and promising to buy it back at the same price later. It adds no value but makes the books look good, giving investors and regulators a false assurance. The absence of technology to monitor this was fully exploited by these banks and the result was that NPAs were always under reported.

Yes Bank had said it was producing less than 1% of bad loans, when its corporate exposure was a high 65%. In an interview with CNBC-TV 18in April 2016, Kapoor, who was then at his peak, was asked how he managed to do this, when rivals were well in the double digits. To this, he grandly said the solution was in building, what he termed, a three-eyed principle — with relationship managers, product managers and risk managers, all looking at a relationship from all angles. “That makes sure that when you have a problem, the red flag surfaces early enough,” stated Kapoor.

Red flags had begun to go up at the central bank, which had started to tighten the loophole by storing details in its central database, called Central Repository of Information on Large Credits (CRILC). This was in 2016. Banks now needed to submit quarterly reports on all its borrowers with an exposure of Rs.50 million or more (fund-based and non-fund based). This was apart from having to segregate borrowers as special mention accounts (SMAs) to determine if they could go delinquent.

This kind of scrutiny is what led to the risk assessment report (RAR), which was more stringent than the conventional asset quality review. A former Yes Bank official says that reports on industrial groups and their high debt levels were now out. “Suddenly, there was more information available to the RBI. Historically, the regulator was good in laying down the rules but did not impress on execution. The current scenario allowed for a higher level of probing,” he says.

All that resulted in getting to the core of loan divergences or the difference between what the RBI thought was bad compared to what the banks had been reporting. In the case of Yes Bank for FY16, the non-performing loans or gross NPAs were now assessed at Rs.49.25 billion, while the official number reported was a much smaller Rs.7.49 billion or a divergence of Rs.41.76 billion! For the following fiscal, the divergence was a whopping Rs.63.55 billion. Suddenly, the whole claim of having less than 1% as bad loans began to fall apart. Kapoor’s game was now up and he was sent packing.

The jury is still out on whether the decision was based only on the divergence issue. Ex-Yes Bank officials maintain the regulator had already been keeping a close watch on Yes, along with Dewan Housing Finance Corporation (DHFL) and Indiabulls Housing, for a while. “The bank was making money and reclaiming its loans but the fee model was making a lot of people uncomfortable,” one of them claims. Besides, the return of the incumbent government at the Centre is said to have complicated things just a little for Kapoor. It now transpires that its list of borrowers, such as DHFL, were quite close to the previous regime and that link is said to have gone down badly.

Earlier this year, following the elections, the government was starting to look closely at their books as well as those of Indiabulls, and Kapoor was asked for specific details on the nature of Yes Bank’s dealings with them.

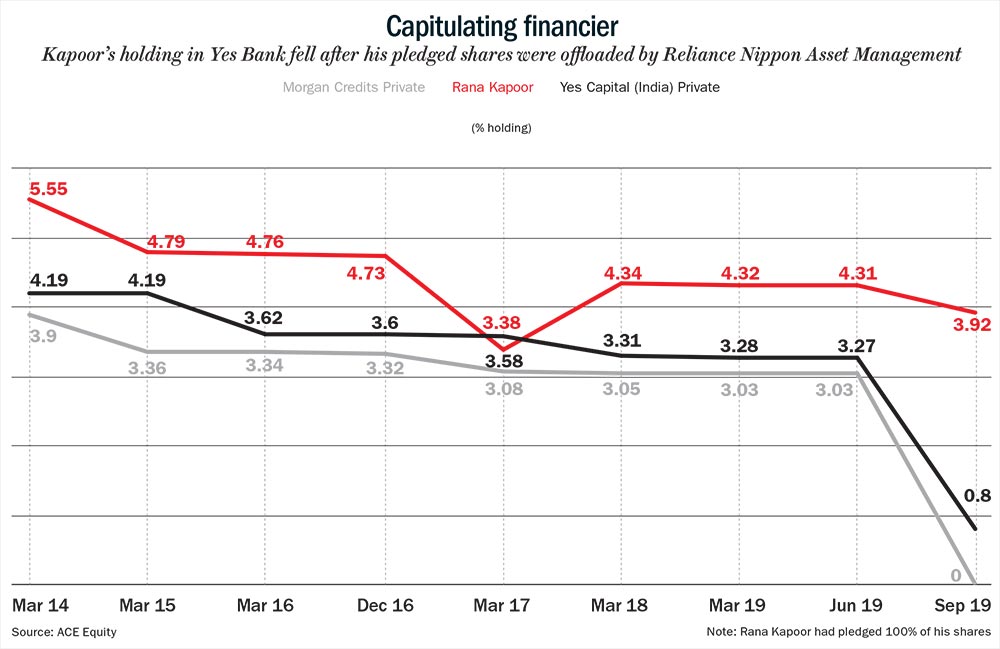

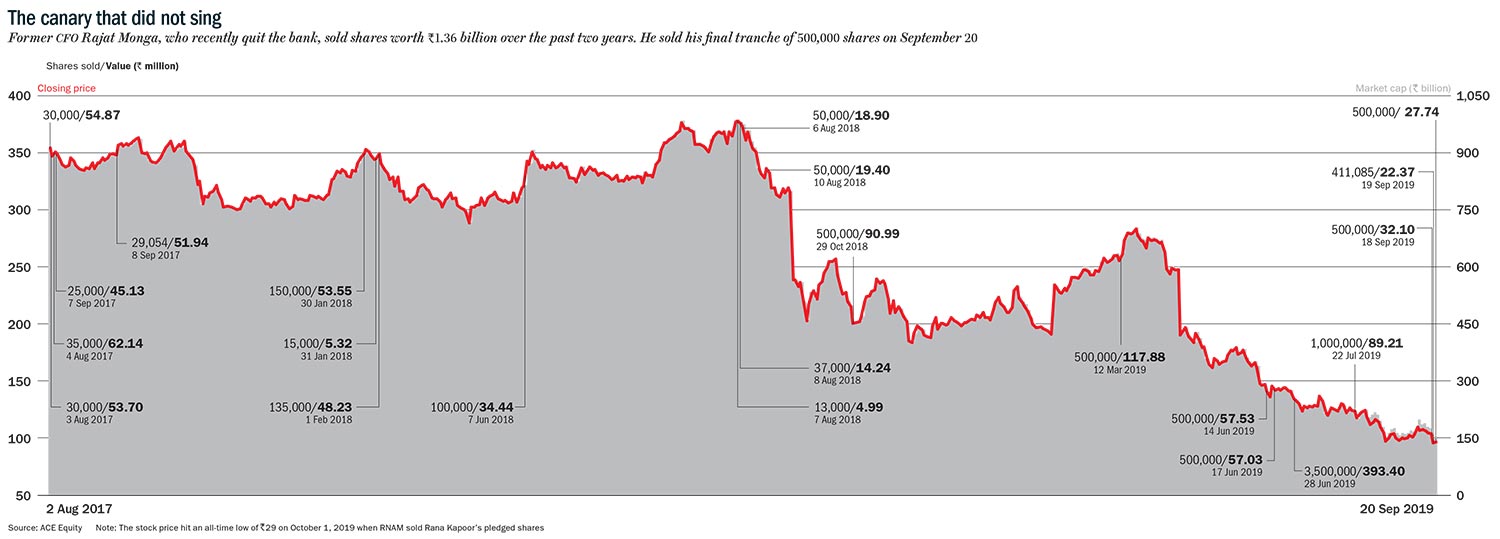

Nothing came out of that, but the regulator seems to have taken note of another transaction, where Kapoor, through promoter entities— Morgan Credit Private and Yes Capital India — borrowed Rs.6.3 billion via unsecured NCDs from RNAM. They were eventually secured by the AMC recently and Kapoor’s pledged shares were sold off pushing the stock price to an all-time low (See: Capitulating financier). While there was time till next March to repay, the plummeting stock price might have forced the AMC’s hand. Not that the transaction was kosher to begin with — a listed AMC lending to the promoter of a bank, which in turn was the AMC’s parent’s biggest lender. The other puzzle is that the bank’s ex-CFO Rajat Monga has managed to extricate himself out of Yes Bank amidst the mayhem (See: The canary that did not sing).

His continuous selling suggests that Monga realised that Kapoor was losing favour with the powers that be. “Rana is well-networked professionally but does not have too many friends. A lot of banks too were quite upset when he managed to get back the money from Deccan Chronicle and Kingfisher before they did,” says the former Yes Bank official.

One incident in particular landed Kapoor in a spot. A sum of approximately Rs.1.5 billion was lent to Gautam Thapar, Avantha Group’s chairman and the collateral was his bungalow in South Delhi. The default on the loan meant that it went on the block and was picked up by Interglobe Aviation’s co-founder, Rahul Bhatia, at a price significantly more than what was quoted. Kapoor managed to quietly scuttle that sale and bought it for himself. A livid Bhatia wrote to the government complaining about the inappropriateness of the process and a government already uncomfortable with the running of Yes Bank began to push for Kapoor’s removal. The official line was still the NPA divergence.

As the heat built up mid-last year, Kapoor was informally speaking to other banks for a potential deal. A conversation with one such entity broke down at the very first meeting. When this bank was keen on knowing the list of top 25 borrowers, Kapoor coolly produced it from his drawer. The banker is said to have been horrified at the quality of borrowers and made a hasty exit.

What spooked the banker was captured in a recent report by Jefferies, on stress exposure across major accounts. In the list of high risk borrowers, ICICI Bank and HDFC Bank have an exposure of Rs.22.7 billion and Rs.12 billion, respectively, with Axis Bank at Rs.18.9 billion. Here, Kotak Mahindra Bank is the most conservative with Rs.3.7 billion. By contrast, Yes Bank’s exposure is at over Rs.102.6 billion, only second to SBI’s just under Rs.150 billion. Within this, Yes Bank’s lending to Anil Ambani’s finance businesses stands at Rs.28.5 billion, with Axis Bank, among its peers, having the largest exposure at Rs.6.4 billion, with ICICI Bank and HDFC Bank together at Rs.7.6 billion. The total exposure of Yes Bank to ADAG across its businesses is a stupefying Rs.130 billion. Yes Bank’s exposure to Cox & Kings, again a high-risk borrower in Jefferies’ report, is Rs.13.4 billion, with only Axis Bank among its peers having lent any money (Rs.2.1 billion). SBI from the state-owned segment has an exposure of Rs.6.2 billion to this entity, which is less than half of Yes Bank’s.

Kapoor responded to our long list of detailed queries with precious little. “Since I am no longer associated with Yes Bank, having been its founder, MD & CEO since inception in 2004 until January 2019, it is best you direct these questions to the current MD & CEO, Ravneet Gill and the communications team at Yes Bank,” he wrote.

Say yes

Ravneet Gill has an unenviable task, having joined in March this year. In hindsight, his move from Deutsche Bank, where the parent itself was going through a rough patch, to Yes Bank, may seem like a jump from the frying pan into the fire. His illustrious career seems to have come full circle as he started out with BCCI, which itself came under international regulatory glare and was liquidated. The Indian arm of BCCI was taken over by SBI.

A Deutsche Bank veteran of almost three decades, heading its India operations till last December, Gill has his job cut out. Right on top of his priority list is to get in about $1.2 billion in fresh capital. In August, the bank took the QIP route to raise $285 million at Rs.83.55 per share. At the current price of Rs.50, that still leaves a lot of distance to be covered, both for the new QIP investors and potential new investors.

According to Gill, the bank’s asset quality has stabilised. This, despite significant exposure to ADAG, Essel Group and DHFL. “For the names mentioned, resolutions are underway. While the process has taken longer than may have been anticipated, our prognosis for long-term debt has not changed materially,” he says.

Gill is doing everything possible to regain investor confidence, but the end game is a little unclear for Yes Bank. As fixing its bad loans could be long drawn out, rather than another bank, it could appeal more to a strategic investor. What Yes Bank has got going for itself is an established network of 1,200 branches, its Rs.400 billion retail book and well-entrenched corporate relationship. Yes Bank has more than stood by its corporate borrowers and it is only fair to assume that that goodwill kicks back once the bank is recapitalised. Given that a banking licence still commands a premium in India, the list of suitors could range from newbie Indian bankers to sovereign funds to private equity. During his heydays, Kapoor said ‘Yes’ to a lot of corporate borrowers. Gill is now waiting for potential investors to say, ‘Yes’ to his recapitalisation plan. Kapoor’s “diamonds” may just about find a new deposit vault soon.

Also read: How Rana Kapoor Allegedly Made Rs.20 Billion From Loans Worth Rs.60 Billion