When Steve Jobs introduced the iPhone to the world in 2007, Vijay Shekhar Sharma instantly knew that consumers would shift to smartphones. His company One97 Communications, a mobile VAS company which offered cricket scores, horoscopes, jokes and movie songs was going to be toast. It was a feature-phone-led business and feature phones were on their way out. He needed to quickly figure out a game plan to survive. One thing was certain — mobile commerce had to happen and there was no payment system in place. So he decided his company would enable people to pay through mobile. That’s how Paytm got its name. In 2014, Paytm launched its mobile wallet after getting the nod from RBI. Now you could load money in the wallet and spend them at merchants who accepted digital payments. In about a year, it was the first Indian app to hit 100 million downloads. But one event that really changed its fortunes was when the government decided to demonetise 86% of the cash in circulation in November 2016. Overnight, everyone from your paanwala to the friend to whom you owed money was using Paytm to send and receive money, and as a result the user base increased from 122 million to 177 million by the end of 2016 and by February 2017, the user base grew to 200 million. But an open platform, high regulatory control and increasing competition has turned its core payment business into a commodity. So, Paytm decided to be everything to everyone. Now it offers payments, commerce, gaming, content, financial services, business services and banking. “We don’t consider ourselves a wallet player but we like to call ourselves a payments player. We hope to process half a trillion worth of payments on our platform over the next two years and that will enable a commerce and financial services ecosystem that will drive our revenue and profit,” says Sharma, founder, Paytm. A plan that is easier said than done. There are perils of being everything to everyone – you are juggling too many things at the same time and spreading yourself a little too thin. While the mantra for Paytm has always been ‘Go big or go home’, can it beat the odds, this time around?

During the initial years of its journey, Paytm spent a lot of effort and money trying to incentivise consumers to use their wallets and merchants to get on their network and accept payments from their wallets. Its first major inflection point came in 2014 when it partnered with ride-sharing unicorn, Uber to become one of its payment options. A year later, it entered into a partnership with IRCTC that allowed its users to book railway tickets online. While they acquired millions of users spurred by demonetisation, the first-mover advantage unfortunately didn’t stick for long. Just three years into launch, NPCI has been driving digital payments in the country. The open payment platform allowed players to build their payment app on top of it. Soon, everyone who wanted a piece of the payments business jumped on board and threw cash around to lure users. Within three years of its launch, PhonePe has 62 million users and 7.8 million merchants on its platform. Google Pay has about 67 million active monthly users and has processed $110 billion in transactions till date.

While Paytm did all the heavy lifting to get consumers on the digital payments platform, it only made things easier for competition to launch and scale their operations. Consumers who were now comfortable with digital payments switched between payment apps depending on the cashbacks offered. For Paytm, the plan was to get to 500 million users by 2020. Today, it claims to have 350 million users but here is the catch — it has 140 million monthly active users (MAUs). At the end of December 2016, Paytm roughly had 80 million MAUs, but with negligible rise in average spend. What happened, you ask?

NPCI-backed UPI happened. A real-time mobile payments platform, it was launched in August 2016 just before demonetisation with 21 banks live on the platform. And two months after its launch, demonetisation sucked the cash out of the system. For the now Walmart-backed PhonePe, which had just launched its services, the timing couldn’t have been perfect. “Because of demonetisation when money was short, the biggest challenge was the ability to transact; the only option left was netbanking or UPI suddenly. We launched to 10 million installs in a matter of three months and we never ever expected that. Most start-ups don’t see 10 million users in their lifetime. So, it was good timing and a bet on that really worked well,” says Sameer Nigam, founder and CEO, PhonePe. He says PhonePe decided to go with UPI since there was enough regulatory and government backing for UPI. Since there were larger players such as Paytm and MobiKwik already on the wallets side, PhonePe decided to innovate on the brand new ‘Made in India’ stack called UPI.

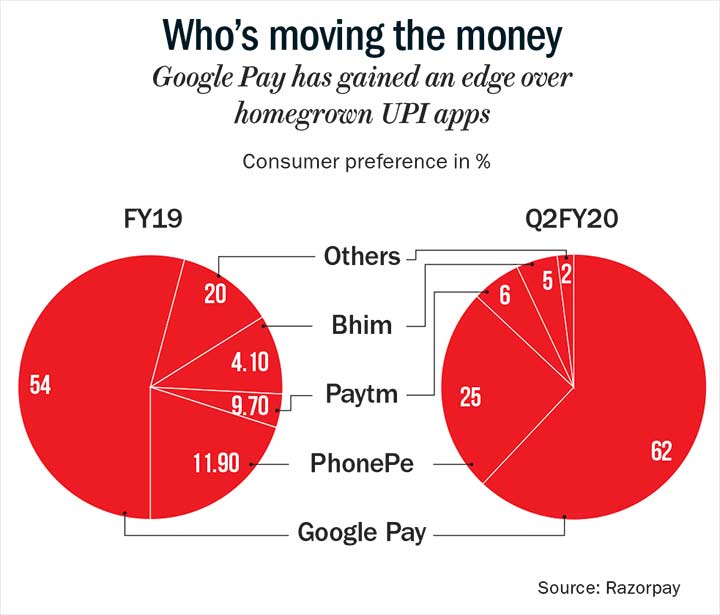

Google also threw its hat in the payments business and chose UPI. “Money is information. Cash transactions carry a lot of information. At Google, wherever we see opportunity for the end-customer, we look into it. E-payments is a huge opportunity in India, not only for business but also creating impact,” says Ambarish Kenghe, director-product management, Google Pay. At the time of their launch, UPI was clocking monthly transactions of 10 million. Cut to today, UPI crossed a billion transactions this October, a little over two years. As the transactions on UPI gathered momentum post the entry of Google Pay, Paytm couldn’t ignore UPI and it launched its UPI app in November 2017. As of September 2019, it accounts for 6% of the transactions with Google Pay on top with 62%, and PhonePe at 25% (See: Who’s moving the money). Amazon also has its own digital payment platform, Amazon Pay, and added peer-to-peer (P2P) digital payments earlier this year.

But almost 75-80% of the transactions done today are P2P transactions and there is little money on UPI for the payment service providers. MobiKwik co-founder and CEO Bipin Preet Singh breaks it down. “Non-banking apps have very little control over how UPI works; it’s just built on top of UPI. In the long term if anybody can make money through UPI, it is the banks. The underlining economics of payments through UPI is controlled by the banks.” Hence, Sharma says Paytm is moving away from incentivising P2P transactions. “We see very little economic value in P2P transactions. In fact, most of the customers are gaming the system to earn more cashbacks and that is why we are off that market. For us customers become valuable when he pays the merchants and that is the incremental market we are after,” says Sharma.

The fact remains that despite the surge in transaction volume, UPI has not really increased the user base. As Sharma points out, there are a large number of transactions that happen through the day to avail cashbacks and it is a pattern seen on a month-on-month basis. Sharma says, of the 100 million users on UPI, transactions are concentrated among 20-30 million users. It is basically users moving from one provider to another depending on where the cashback is higher. “The right question to gauge the ecosystem is, ‘Fine, I am doing 20 million transactions, but what value of the customer’s relationship am I capturing?’ Ultimately, in financial services, it’s the amount of wealth which you manage. So, if I do 10 million transactions, which may be 50% of the industry but if I am managing only 3% of the value, then it is very obvious who owns the relationship,” says Parag Rao, Country head-payments bank & marketing, HDFC Bank. The bank’s payment wallet Payzapp has over 15 million customers and 1.5 million merchants on its platform. While he agrees that tech companies will be faster and nimble going by their core competency, one needs to look deeper at what that technology is solving. “Everybody is approaching it from a perspective of how can we get that transaction on my network or app, earlier it was wallets and now apps like Google Pay. That is an interim journey. While everyone out there is saying that is my customer, you can only truly say that when you have a larger share of the customer’s financial relationship with you,” Rao adds.

But companies such as Google, Amazon and WhatsApp are not looking to make money from their payments business. For them, payments are just a means to an end where they can generate better revenue from existing products and clock higher ad revenue. The data can be used to develop new products, offer personalised content and ads, besides monitor the effectiveness of their ad campaigns. For companies such as Walmart-owned PhonePe and Amazon it helps to understand where consumers are spending. So the transaction data becomes more valuable than the transaction itself and for that the companies don’t mind offering substantial cashbacks as well. If UPI’s launch was a game changer of sorts for the payments industry, many feel the entry of WhatsApp will change the pecking order in payments yet again. “If WhatsApp can overcome the regulatory hurdles and offer payment services in India, they will win the P2P game. Everyone is comfortable using WhatsApp. Just as people moved seamlessly to WhatsApp calls, the same will happen to payments,” says a senior payments executive. The Facebook-owned mobile messaging app has more than 400 million users in India and has been beta testing its payment services on a million users. Since the app already has a payment button, the experience is even more seamless. But fortunately the payment players can breathe easy for now as the WhatsApp launch seems some time away as it tackles regulatory hurdles on data localisation and privacy concerns. But Sharma isn’t too concerned about the competition. “We are a 20-year old company and every two–three years we see a new set of competitors, and that has been the reason for our growth. Who would have thought we would have Google as one of our competitors some day. It keeps us on our toes and helps us grow,” he says.

But this time around, the new set of competitors are formidable and come with very deep pockets that allow them not only to garner market share through cashbacks but also the ability to develop the best-in-class technology. “Deep pockets alone cannot win the game. If that was the case, Microsoft should have won over Facebook, they couldn’t. Facebook should have won over WhatsApp and deep-pocket retailers should have won over Amazon, both couldn’t. “I am committing to invest $2 billion in the payments business in the next three years and I don’t think any of the deep-pocketed players will commit that kind of money for one line of business. We will be investing that money to acquire customers, merchants and in financial services,” adds Sharma.

Unlike China, where digital payments is dominated by two major players WeChat and Alipay, there will be multiple players including banks and third-party apps vying for the consumer’s wallet. At least that’s the way NPCI wants it. “The objective is to have a very healthy multi-party ecosystem with all our partners. It’s not a closed-loop system like the ones groomed in other countries. For us, it’s about interoperability. It’s about multiple banks and frontline apps where the apps could be banks or third-party apps; ultimately giving choice to the users,” says Praveena Rai, COO, NPCI. There are reports that NPCI is looking to cap a single player’s market share at 33% and players feel that restrictions so early on in the digital payments journey may prove counter-productive. “I believe that regulations are important and they keep people safe. At the same time, we need to make sure we don’t stifle innovation and we have been vocal about a more open ecosystem where players keep innovating and coming up with better products and customers have the option of choosing the best product,” says Google Pay’s Kenghe.

Multiple pivots

As banks and non-bank payment apps encroach on its territory, Paytm is trying everything in order to claim a higher share of the customer’s financial relationship. In 2016, Paytm forayed into flight & hotel bookings, movie and event tickets and digital gold. Paytm competes directly with travel and movie ticket aggregators and earns commission. In the first year of operation, it clocked about nine million flight bookings and three million movie tickets. Over the past year, Paytm has done more than 115 million flight bookings and movie tickets. While both spaces have well entrenched players such as MakeMyTrip and BookMyShow, there is more competition here as well with Amazon inking a five-year deal with BookMyShow and Cleartrip to offer flight and movie ticket bookings. Sharma says he is not looking to take on the leaders here but create a niche yet profitable business for Paytm. “These verticals are large and the business has seen strong incumbents with no significant number two player. We have managed to find a niche in these businesses. Because of our reach we have managed to add consumers from Tier-II, III and IV towns who were otherwise not on the platform,” he adds.

In 2017, it forayed into e-commerce business with Paytm Mall. But it was a little too late in the game with Amazon and Walmart-owned Flipkart dominating the market, and Paytm Mall despite its cashbacks and discount offers failed to make a dent. The platform has a little over 3% of the Indian market, compared to more than 30% each for Amazon and Flipkart. But the cashbacks and the discounts did hurt with Paytm Mall alone posting a loss of Rs.11.71 billion in FY19. However this was about 35% lower than the loss the company posted in FY18 thanks to a change in its strategy. With the B2C commerce game out of its reach, Paytm Mall changed its focus to bringing offline merchants online and increasing their discovery online. “Paytm has discovered its mojo in getting offline retailers online. So right from helping stores with customer walk-ins to managing their inventory and software required for them to sell online, they are happy to pay us for these services. So we decided to focus on these services rather than being an online retailer where you can constantly face cash crunch,” says Sharma. According to him, the losses will decline further as smart inventory management has led to significant cost savings. On a combined basis, he expects the overall commerce business (physical and digital) to post a loss of about Rs.5 billion to Rs.6 billion in FY20.

India is home to millions of mom and pop shops, which sell everything from grocery, clothes to electronics. “The offline opportunity is huge and so our promotional cashbacks have now been set aside for offline payments. It builds long-term relationship with the shopkeeper. His data then allows us to sell them a loan or an insurance package or a wealth management solution,” say Sharma. He says the merchants have the option of parking the funds in the wallet in a money market fund against which loans can be given. For the lending business, Paytm has partnered with various lenders and NBFCs who extend loans based on the merchants’ cash flow. “ Chasing a large loan book can be very risky and we are aware of the losses that can come from lending. So, we have been conservative and have gone with the DSA model where we help them get customers and earn a monthly commission for it,” says Sharma.

According to him, less than 10% of payments made by consumers to businesses are through digital means. So Paytm enables merchants to offer a whole range of options through the Paytm wallet, which accepts cash, debit cards, credit cards, UPI-linked bank accounts, and other wallets. “Our business model is now focused on increasing merchant payments and enabling them to accept more digital payments,” says Sharma.

But Paytm is not the only one wooing merchants. Walmart-owned PhonePe, Google Pay and Amazon Pay are also looking to grab a piece of the overall market. PhonePe is looking to enable direct interaction between customers and merchants. “There are a lot of lines of engagement between them, whether it is building solutions for merchants for hyper-local economies, whether it is building financial services — both for merchants and consumers. Third, enabling more commerce to happen and driving footfall of discovery of services,” says Nigam. PhonePe now has 7.8 million merchants on its platform and will play a crucial part in helping Flipkart penetrate the next 300 million users by understanding the payment patterns in its merchant network and creating affordability through payment solutions.

There are about 14 million merchants using Paytm services and they enable 800 million-900 million transactions a month. For the convenience they offer merchants, Paytm charges around 1-2% of each transaction. In FY19, Paytm clocked a gross transaction value (GTV) of over $50 billion across 5.5 billion transactions compared with $25 billion clocked in FY18 across 2.8 billion transactions. This year, the company says it will touch gross transactions worth $100 billion and commerce business both on Paytm and Paytm Mall will bring in GMV of $30 billion.

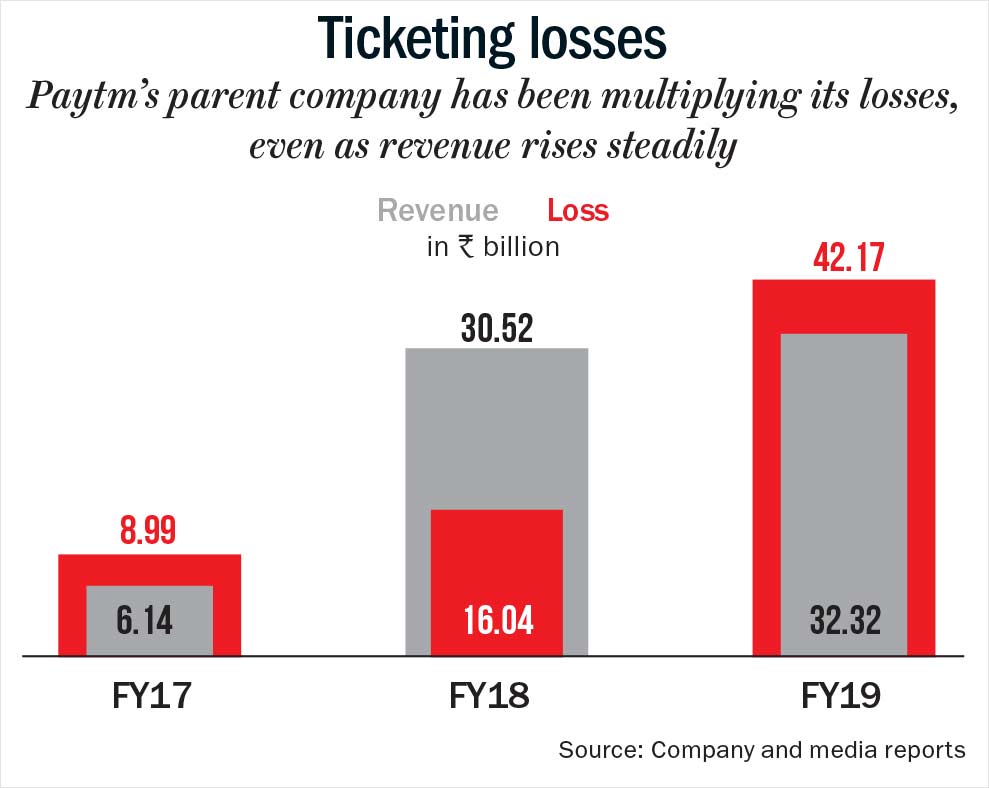

But in a business where you have to spend a lot more to earn incremental revenue, more transactions often translates to higher losses. Battling competition in almost all of its businesses has cost Paytm dearly. Its losses increased by around 2.5x from Rs.16.04 billion in FY18 to Rs.42.17 billion in FY19. Paytm’s marketing and business promotion expenses saw a 33% jump from Rs.18.94 billion in FY18 to Rs.28.32 billion, in FY19 driven by cashbacks and discounts, both in payments and e-commerce. Revenue from operations saw a modest increase from Rs.30.53 billion to Rs.32.32 billion for the same period. Sharma is hopeful that all the ducks will line up in a row over the next couple of years. “Our financial services will start to contribute to our overall revenue and profit. We will be launching insurance services and expanding our lending services and the recently launched broking services will also contribute to overall profit,” he says. According to him, the ability to process nearly half a trillion payment transactions in the next two years will give Paytm an opportunity to scale up its financial services and commerce business. He expects losses to come down to Rs.30 billion this year and Rs.15 billion in the next, and breakeven and turn profitable at the group level in 2022, after which they will consider an IPO.

Scaling up the financial services business is not going to be a walk in the park. Banks and NBFCs are jostling with each other for the same business and are not going to give up their share easily to fintech players who are already eating into their lunch. “In financial services there are deep-pocketed players but they are happy in their space, and not looking for incremental customers. If you expect the economy to be at $5 trillion in the next five to seven years, that means an additional $2 trillion opportunity waiting to be captured. Even if the incumbents take half, it is still a trillion dollar opportunity for us,” he says. While Sharma definitely has a plan on paper, the path to profit is laced with uncertainty and going by its past couple of years’ performance, a tough ask. In FY19, to earn an incremental Rs.2 billion, the company spent Rs.26.13 billion and this only means while payments still need cashbacks to sustain revenue, the new businesses aren’t firing on all cylinders either. Earlier, in FY17, the company posted a loss of Rs.8.99 billion (See: Ticketing losses).

Competition isn’t faring too well either. For instance, PhonePe saw its FY19 loss mount to Rs.19.05 billion from Rs.7.9 billion in FY18 when it logged revenue of just Rs.428 million. Similarly, Amazon Pay India saw its loss widen to Rs.11.61 billion in FY19 from Rs.3.34 billion in FY18. If one were to add the Rs.10.28 billion given as cashbacks by Google Pay during FY19, the four major players would have raked in more than $1 billion in losses as they scrap for market share.

No wonder then, Paytm was hoping that financial services will come to its rescue and shore up revenue and help monetise its user base, something it has been struggling with for some time now. The payments bank was to be its silver bullet that would help in getting it closer to its target of 500 million users by 2020 apart from enabling financial inclusion. But payment banks in India never really took off the way it was envisioned because of the numerous regulatory constraints of not being allowed to lend and the cap on deposits. In fact, of the 11 players granted licenses to launch payment bank services, only four are in business. And Paytm Payments Bank is one of them. Even after being the largest player in the space with 52 million accounts and about half them coming from existing wallet users, it is still a far cry from the overall target. Sharma says he is happy with the progress at the bank and that it will be the template to push their financial services business. “We have acquired customers who earlier didn’t have bank accounts and since we are a digital bank, we don’t have much need for physical infrastructure. The past two years have shown there is huge unmet need for financial services and the half a billion number is still achievable,” says Sharma. The bank has processed Rs.3.25 trillion in transactions and has around Rs.5 billion in deposits.

With payments banks still finding their feet, it was time to take a different bet. Enter Paytm Money. Beginning its journey in 2018, Paytm Money offers direct plans of equity funds and now has permission to offer brokerage services as well. The firm has about four million customers and while, all this sounds exciting you have to remember the customer base is one that comes to you for cashbacks as low as Rs.50 and which has an annual average transaction value of Rs.700. “Now, If I start with offering e-wallet and give you Rs.50 cashback on each transaction and then expect you to also take insurance policies, fixed deposits and term loans from me; that’s a little far-fetched,” says HDFC Bank’s Rao.

According to the company, about 85% of Paytm Money’s mutual fund transactions are under Rs.500 and the average SIP value is around Rs.1,000 as against the industry average of Rs.5,000-6,000. “My belief about companies offering lower entry point mutual funds is that, these are all pilots. While the thought of approaching the previously unattended customers is good, the jury is yet out on whether these are successful and sustainable schemes. Even we are watching and learning from them. Let’s wait and see”, says HDFC Bank’s Rao. Paytm has also ventured into wealth management offering gold investments in 2016 where customers can invest in digital gold certificates and redeem it at their partner stores. Sharma says in India savings and wealth management may not typically follow the patterns in the West. “In India, the largest investment is in gold. For some investors, it could be equities and mutual fund but the majority still puts their faith in gold. We have about 50 millions customers using Paytm Gold services and that is twice the number of investors in all the AMCs in the country,” he explains. That aside, the thinking at Paytm Money is that mutual funds will be the investment destination that consumers will seek out. “We contribute about 40% of SIPs in direct equity plans in the country today. The mutual fund industry has about 19 million investors and we expect the investor base to more than double to over 40 million by 2025 and Paytm Money wants to grab a significant chunk of that user base,” says CEO Pravin Jadhav. According to him, about 70% of their customers are from Tier-III and Tier-IV towns and first-time investors in mutual funds. “A lot of them are aware of mutual funds thanks to the campaigns by AMFI but had no access to a trusted platform. Distributors have been chasing big-ticket investments since those fetch them higher commissions. So, there was a gap in the market and that gap we are filling,” says Jadhav.

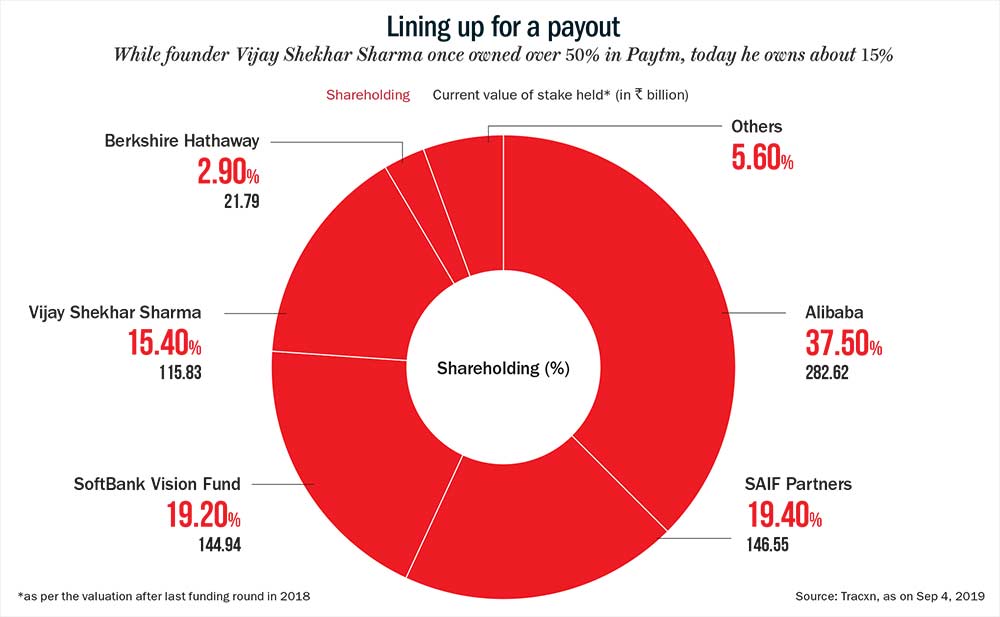

Show me the money

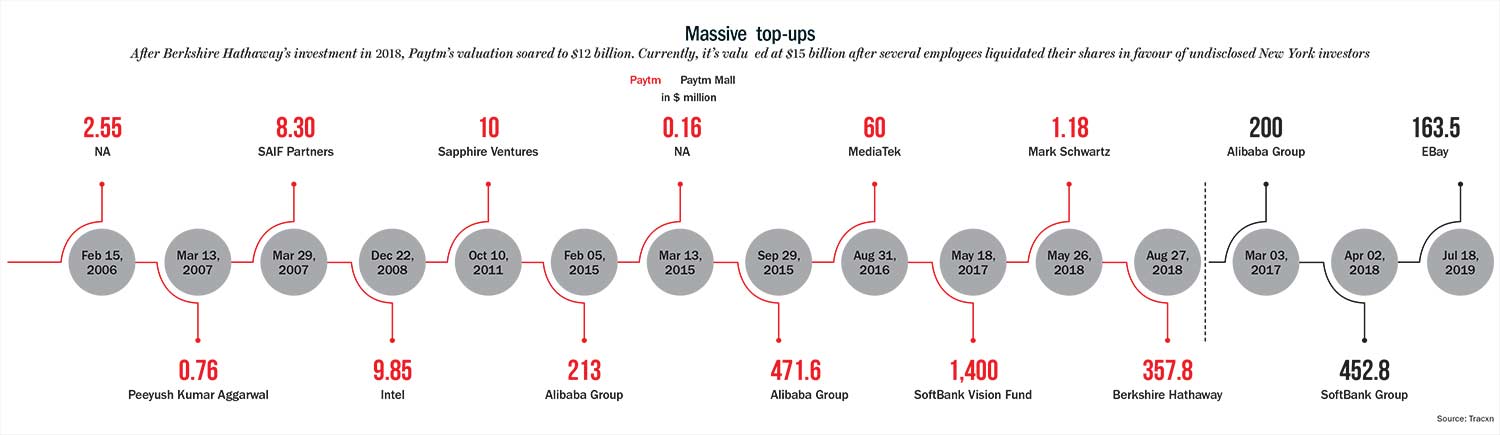

Besides ebullience, capital is the other thing that Paytm has never been short of. The float in its wallet business helps, but it also has consolidated debt of Rs.7 billion. Paytm’s parent company One97 Communications has raised $2.5 billion in funding so far from marquee set of investors including Alibaba, Softbank, Berkshire Hathaway and SAIF Partners. In more ways than one, Paytm is an Alibaba company with the Chinese e-commerce giant holding 37.5% stake (See: Lining up for a payout). But the investors are not trigger happy when it comes to writing cheques. In Paytm Mall’s last fundraise where Ebay bought 5.5% for $160 million, existing investors Alibaba, Ant Financial Softbank didn’t participate.

Paytm was last valued at $15 billion when several employees cashed out selling their shares for $150 million to New York-based investors in August this year. It was valued at about $12 billion in August 2018 when Berkshire Hathaway invested about $300 million (See: Massive top-ups). The company has been in talks with investors to raise more money. News reports indicate the firm has raised $1 billion in its last round of funding with T Rowe Price being the latest addition with an infusion of $150 million-$200 million. While the rest is being coughed up by existing investors including Alibaba, Ant Financial and Softbank, the investment is coming with its own set of riders. After Uber’s poor listing and the WeWork debacle, Softbank is no longer in a position to hand out free cash and tell start-ups to “go capture the world”. Now it is urging its portfolio companies to work towards the path of profitability rather than chasing growth for growth’s sake. Reports say Softbank signed off on the latest round of funding on the condition that Paytm would plan an IPO within five years or Softbank would be free to sell its stake to other investors. There has also been pressure from investors on Paytm to tighten its belt and find new revenue streams in the past year or so. Sharma took the hint and started with rehauling the e-commerce business first and cutting back on P2P cashbacks. It is already spewing accounting jargon investors want to hear like being ‘contribution margin positive’ during the September 2019 quarter. Simply put, on every sale, Paytm makes a tiny profit after deducting variable costs but before deducting people and establishment costs. Not to get too excited, this is still a step away from operating breakeven and a long way from generating cash profit. Cutting costs and cashbacks were the easy parts. The hard part still remains how it will scale up its user base, and more importantly, monetise it. And despite having more than half a dozen businesses at work, there is still no clear path for that one.

Regulatory haze

Apart from intense competition, the payments space also has the additional scare of tackling ad hoc regulatory changes that more often than not catches players off guard. For instance, in 2017, RBI threw another curveball at Paytm when it mandated that mobile wallets will have to go through the same KYC norms like banks, when they sign up users. So, wallet companies have been going with minimum KYC where a customer’s mobile number gets authenticated and the operator collects just one government identification number, without cross checks. “Unless the customer is opening a payment bank account, we don’t insist on KYC,” says Sharma. The company has little over 100 million KYC compliant customers out of its 350 million registered users. RBI has given the final deadline that all wallet customers should be KYC compliant by February 2020; otherwise they will be unable to use their wallets. It takes anywhere between Rs.100-150 depending on where the customer is, to do complete KYC and on a base of 250 million users, that would mean an additional cost of Rs.25 billion. To spend that much on a base that is predominantly non-active or uses wallets only for minimum recharge, it does not make economic sense. “This verification process works when the customers are in for taking loans of Rs.50,000-60,000. It doesn’t make sense for a customer using the platform for Rs.100 phone recharges. We and some other players have such huge customer base that it is impractical to do phone KYCs for each one of them. That’s why we are arguing with the regulator that there should be proportionate KYC, where customers can use the platform without KYC for some time and if they want to go beyond that level they can do KYC,” says MobiKwik’s Singh. The wallet provider has over 100 million users, of which, a million avail financial services. In all probability, wallet players would willingly let go of non-active customers. Rather than spending on KYC, Paytm wants to spend money to increase its active base to 250 million in the next one year by spending Rs.7.5 billion through offline cashbacks, gaming, content services and merchant acquisitions.

While new players have entered the fray, none of them have actually expanded the market. It is the same 100 million that is getting tossed, be it the UPI-led apps or wallet players. That has really been the problem when it comes to scaling up the active user base for Paytm.

From mutual funds to travel bookings to content and games, every new business that Paytm has set its eyes on is already highly competitive and crowded with strong incumbents. And payments right now has no moat to offer. “Reality is no matter how much you spend on branding, marketing and offers, customers can ultimately leave and go to other platforms. And there are many large platforms like WhatsApp, Paytm and Google, and all of them are burning cash in this race,” says MobiKwik’s Singh.

Paytm has even ventured overseas to Japan where it has launched payment services along with Softbank and Yahoo. ‘Masa San wanted to do something pre-Olympics, so that’s why we teamed up with them,” explains Sharma. Paytm’s team in Canada has been working with Softbank and Yahoo and has gained about 10 million users in the first 10 months. It is also looking to venture to the US in case they find a suitable local partner. It is exhausting even writing about all the things Paytm is trying to do in pursuit of growth. Investors were willing to shell out a premium valuation given its dominance in mobile payments and now that domination along with its ability to monetise its user base is definitely in question. For Paytm, not only is the path to profitability not easy, despite everything, it still isn’t very clear and therein lies its biggest challenge.