A study by Alexander Borisov, Andrew Ellul and Merih Sevilir examines the relationship between a company’s decision of going public and employment growth experienced by the company, and its overall performance. By looking at 3,654 companies that went public from 1980 to 2010 in the US, they found out that a firm with an upcoming initial public offering (IPO) hires twice more employees around its IPO than during its life as a private firm. The number of employees increases at an average annual rate of 39% during the two-year period around the IPO. By having access to debt and equity markets, the firm has much more bargaining power in terms of procuring funds directly from the markets than from banks at higher rates. The companies may then use these funds to invest in organic growth or human capital, which, in turn, increases the probability of better performance.

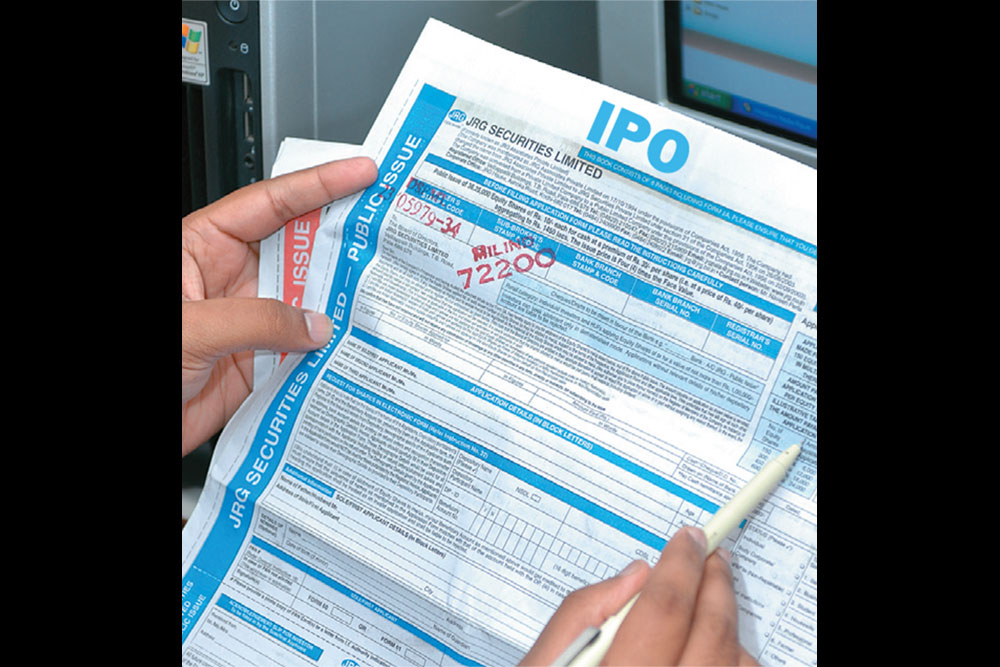

Title: IPOs and Employment;

Source: Social Science Research Network