Who could have imagined that one of the fastest-growing asset classes in the country today was conceived over a poker game? This was in the early eighties. The game was played every Friday night, the players included technologists, builders and Ivy League alumni from Silicon Valley, among them Bill Biggerstaff and Robert Medearis, and they discussed business. The group had observed the rise of start-ups and the neglect that they experienced from conventional financial services. One weekend in 1981, after a game and while cooking for their families that Saturday, Biggerstaff and Medearis pitched the idea of Silicon Valley Bank (SVB) to their poker gang and surprisingly all were in. The bank was registered in 1983, more than two decades after venture equity took off in the US. It was the formal start of venture debt financing.

Nearly three decades later, Indian start-ups started looking at debt to finance their short-term needs. And recently in July 2019, Bigbasket raised Rs.1 billion in venture debt from Trifecta Capital. What makes it even more note-worthy is that it came two months after the online grocer became a unicorn — the company had raised $150 million at a valuation of $1.2 billion.

So India’s largest online food and grocery retailer had no dearth of cash flow or investors. Then why take on debt at all, you ask? Let’s break it down — what venture debt really is and why unicorns and fledgling start-ups are warming up to the idea.

Changing the game

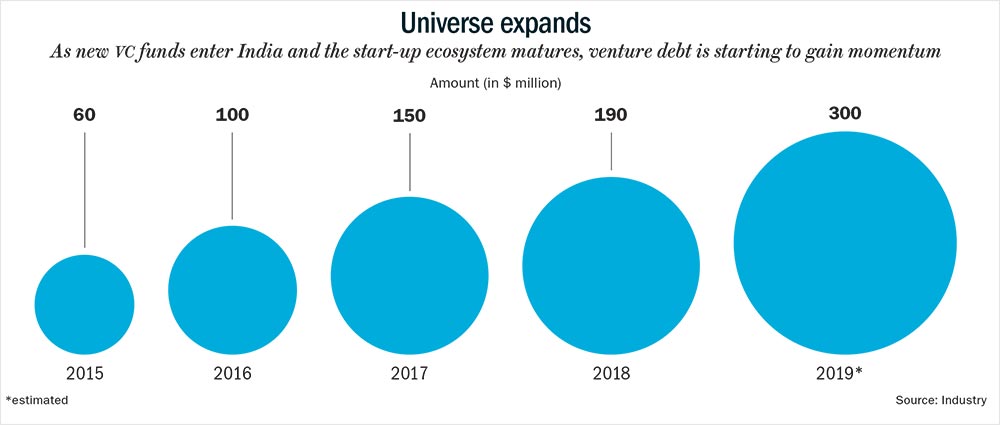

Over the past five years, venture debt funds have invested just $800 million, around 2% of the total venture equity funding in India. Undoubtedly, venture capital is the moneybags of the start-up ecosystem, investing $53.14 billion during the same period. But debt funds have been growing at 50% annually since 2015 (See: Universe expands).

The chief reason ‘startupreneurs’ are beginning to like debt funds is that they help scale up business without diluting the founder’s equity. Simply put, they don’t have to sell off a piece of ownership in the company just because they need to build a new warehouse or add to their fleet of vehicles. Venture debt not only ensures a better return on equity (RoE) but also enables companies to raise equity at higher valuation, as they scale up. Faasos, for example, raised about Rs.300 million from Alteria Capital during the last quarter of 2018. The company was able to double its revenue over the next seven to eight months, which helped significantly in bumping up its valuation when it raised $100 million in equity funding a couple of months ago.

In the case of Lendingkart, a fintech firm, it was timely access to capital from Alteria that helped them tide over the NBFC crisis. The start-up borrowed about Rs.800 million from Alteria. “Most non-banking financial companies (NBFCs) were struggling to raise money, but Lendingkart has a robust underwriting platform that helped it convert the crisis into a growth opportunity,” says Vinod Murali, managing partner, Alteria Capital. Lendingkart has disbursed loans to 55,000 customers since its inception in 2014.

Venture debt funds, apart from providing timely access to capital, also bring in financial discipline to ensure the repayment of loans. That’s the second reason why these funds are catching on. Start-ups are now looking at optimising their capital structure rather than mindlessly raising money, and VC funds could be too generous, not asking too many questions about where their money goes.

Third, traditional banks tend to stay away from start-ups, as they don’t meet many of their lending criteria such as having a profitability track record, free cash flow or the ability to provide collateral. “Our business requires quite a bit of working capital. Venture debt is our only alternative,” says Cashify’s founder Mandeep Manocha. The firm is into buying old smartphones and selling refurbished ones, and has raised about Rs.1 billion in venture capital and Rs.140 million as venture debt.

And fourth, cost of venture debt is almost half of cost of equity at 14-15%, making it an attractive proposition for many upcoming businesses. Agreed, it is still higher than traditional banking loans, but venture debt funds seek higher rates due to higher risk involved. In some cases, warrants that can be converted into equity at a later date become the collateral. Venture debt funds typically generate 17-18% return for their investors and in some deals they take an equity stake (usually 10-15% of the venture deal) that they can cash in during future fundraises.

The conversion usually happens when a start-up sees a significant increase or bump up in valuation. “While 80% of our portfolio companies generates regular return, about 10-15% of our companies go on to become unicorns and generate extraordinary return,” says Alteria’s Murali. The extraordinary return makes up for those start-ups which go belly up. Currently, about 1-3% of the loans go unpaid for venture debt funds.

Venture debt is also used as bridge capital when the start-ups get a commitment for equity funding but the paperwork takes more than a couple of months, in some cases even six months, and there is delay in the money hitting the start-up’s account

Big three

While it makes sense for start-ups to approach debt funds, why are investors taking the risk of lending to young companies? In India, the three big debt funds are InnoVen Capital (which invests across Asia and invests $100 million annually in India), Alteria Capital (Rs.9.6 billion) and Trifecta (Rs.15 billion). The space is also seeing new entrants such as newly minted billionaires Sachin and Binny Bansal who are making venture debt investments through their investment companies and as limited partners, and new funds such as BlackSoil Capital. The past few years have been good for them because start-ups are gaining scale and are beginning to generate good cash flows.

“One of the reasons for increased venture debt funding is the size of the ecosystem has expanded over the past three to four years,” says Ashish Sharma, CEO, InnoVen Capital. Thanks to the surge in global liquidity and a thriving start-up ecosystem, the past couple of years have seen healthy inflows in venture equity and there is about $3 billion-4 billion of funds raised waiting to be invested on the sidelines. If VCs have more money to punt, start-ups will feel motivated to expand and that means more business for venture debt funds.

These lenders also have the ability to recycle capital thanks to the shorter duration of their loans. Since these loans typically have a tenure of two to three years, the funds can recycle the capital during their tenure, which could be anywhere between seven and eight years. For instance, Trifecta Capital, which raised Rs.5 billion in its first fund, has actually been able to invest Rs.7.7 billion from the first fund thanks to its ability to recycle the capital. It hopes to close its second fund at Rs.10 billion, and have an investible corpus of Rs.15 billion. Similarly, Alteria Capital, which has raised Rs.9.6 billion is looking to recycle its capital and invest Rs.18 billion. The fund has already invested 70% of its capital across 30-odd deals across consumer, healthcare and technology sectors.

Also, start-ups here are discovering new use cases for these funds, and they usually go to a debt fund they are familiar with. The number of follow-on deals is therefore increasing and, as the start-up scales so does the loan amount. For InnnoVen, nearly one-third of its deals are follow-on deals. Alteria and Trifecta already have 10-12 follow-on deals from their first fund. “As start-ups raise more capital, their balance sheets have the capacity to add more venture debt. We now see companies including venture debt as part of the overall fund raising plan, rather than an after-thought,” says Trifecta Capital’s managing partner Rahul Khanna.

He believes equity should be used to fuel growth and debt is for capital expenditure or working capital needs. Since 2015, Trifecta Capital has supported over fifty companies including Bigbasket, Cashify, PaperBoat, Rivigo, UrbanClap, Box8, CarDekho, Ninjacart, SigTuple and GOQii. Its lending to Bigbasket, earlier this year, was one of the largest venture debt deals so far in the country.

Bigbasket’s CEO Hari Menon agrees with Khanna on how the funds should be utilised. “Using equity for working capital and capex requirements is not always optimal. We prefer to use equity for growth investing, for instance in marketing, customer acquisition and technology,” he says. The venture debt raised will go towards operational costs for setting up new warehouses, strengthening its cold chain and supply chain of fruits and vegetables. Bigbasket’s first tryst with venture debt began in 2017 when it raised Rs.450 million. “Since venture debt helps reduce the overall cost of capital, we decided to raise additional capital in the form of debt to meet our capex needs,” says Menon.

Universal Sportsbiz, which has partnerships with famous sports and movie personalities to co-create apparel brands, looked for venture debt when it was expanding. “In a retail driven business like ours, it helps to have some cash reserves that can come in handy for expansion and, if the business is generating enough cash to service the venture debt, then it becomes a very lucrative option for start-ups,” says Anjana Reddy, founder, Universal Sportsbiz. Their brands include WROGN inspired by Virat Kohli; Jacqueline Fernandez’s ethnic line IMARA; Kriti Sanon’s western line Ms. Taken and Aditya Roy Kapur’s fashion line for men, Single. The company, which is looking at an operating breakeven this year, is clocking revenue of Rs.4.25 billion.

While B2C businesses such as retail gravitate to venture debt, the funds themselves favour B2B businesses such as SaaS companies. They are safer bets, since they are subscription based and offer revenue predictability, compared to the cash-guzzling B2C start-ups.

Tracing the roots

Debt funds don’t want to miss out on an opportunity, but they are also not handing out money to all and sundry. Only start-ups that have raised a round of equity (typically Series A) usually find favour with them.

“Every fund raised by the start-up is a validation of the enterprise value,” says Murali. “Debt comes down to intent and capacity to repay. In the start-up ecosystem we have seen that intent is rarely the issue. So it comes down to the firm’s capacity to repay debt. Unlike traditional businesses, they don’t have free cash flow or profitability or meaningful assets but they have enterprise value, which can rise pretty fast.”

Debt funds also look at the track record of the institutional investors backing the start-up, since this often gives an indication about the firm’s ability to raise the next round of capital. “We only back companies that have raised institutional capital from seasoned investors and have achieved some level of product market fit,” says Sharma. Otherwise, InnoVen Capital is stage and sector-agnostic, with their portfolio including early stage, growth stage as well as many late stage unicorns. The Temasek-backed fund was one of the first entrants into venture debt in 2008 and has since funded over 150 companies including OYO, Swiggy, Byju’s, Bounce, Milkbasket and Rivigo among others in India. The fund has invested over $500 million in 200 companies across Asia.

The lenders trust the wisdom of players who have been financing start-ups for nearly two decades now, and that includes VC firms. “Venture debt relies on venture capital to understand what kind of business models work and who are the core investors who have been successful,” explains Murali. Infact, most founders of venture debt funds have a background in venture capital. For instance, Rahul Khanna, founder of Trifecta Capital, was the MD of Cannan Partners India. This helps the start-ups too, says Anil G, co-founder of Bounce. “They (debt fund managers who come from VC houses) understand the business models and the risks involved. So, they don’t expect businesses to be profitable from day one and the conversations are a lot easier,” he says. Bounce has raised $92 million in equity funding and Rs.400 million in venture debt, which is being used to fund its fleet expansion — from 13,000 dockless scooters to 100,000 by the end of 2020. “Funding our fleet expansion through debt will enable us to manage our capital more efficiently,” says Anil.

Alteria Capital, which was started by former InnoVen Capital members, Murali and Ajay Hattangdi, closed its maiden debt fund in July 2019 at a corpus of Rs.9.6 billion, 20% more than it had initially planned to raise. Its limited partners include domestic banks, family office and financial institutions such as IndusInd Bank, Sidbi, AzimPremji and Binny Bansal. While traditional financial institutions refrain from lending directly to start-ups, some of them invest indirectly via venture debt funds.

Watch your head

Yes, the market has been very strong over the past few years and that can sometimes lead to temptations to push the envelope. But over the long run, a disciplined investing approach would lead to better risk adjusted return, says Sharma. “In this asset class, we take lesser risk than early stage VCs and also have lesser return expectation,” he adds.

Trifecta’s Khanna says that venture debt has great scope to grow in India. It accounts for less than 2% of all start-up funding in the country, as against 15% in the US. “Many of the start-ups in India face a supply side constraint so a lot of their efforts go towards building supply side capacity, be it inventory, warehousing or transport. So it ends up drawing more capital. There is need for a larger balance sheet,” says Khanna.

According to him, start-ups are now looking for receivables and payables financing, financial solutions for vendors and finance for acquisitions as well.

“As the ecosystem evolves and the start-ups scale up, the appetite for venture debt is only bound to increase in the next couple of years. There is definitely opportunity for a lot more funds to enter the Indian market,” says Reddy. It is just the beginning and optimism is starting to build in the investor community. With caution and the guiding hand of VCs, venture debt could be a powerful fuel for the ‘startupreneurship’. After all, SVB which started over a game and dinner now manages Rs.24 billion in loans and $147 billion in deposits and investments, and has supported over 30,000 start-ups.