Standing at 8,848.86 metres as the world’s tallest mountain, Mount Everest tests a climber’s physical and mental endurance, which explains why less than 6,000 people have successfully scaled its summit.

The recent metamorphosis of Sequoia India and Southeast Asia (SEA) into Peak XV Partners—inspired by Mount Everest’s original name—symbolises the challenges that the venture capital (VC) firm will likely encounter.

On June 6, 2023, Sequoia announced that it was spinning off Sequoia Capital (US/Europe), Sequoia China and Sequoia India and SEA into independent firms with distinct brands by March 2024. Sequoia India and SEA has been rebranded as Peak XV Partners and will continue to be led by Shailendra Singh, the man synonymous with the VC firm in the region.

This can be construed to mean that Singh is setting up his own VC company, independent from Sequoia Capital. But why and how is the moot question, given Sequoia’s strong legacy.

In a mail to its limited partners (LPs), Sequoia said that the spin-off decision was taken since “it has become increasingly complex to run a decentralized global investment business. For example, each business has evolved to meet the opportunities in their markets across a wide range of sectors. This has made using centralized back-office functions more of a hindrance than an advantage. Additionally, as each entity’s portfolio has expanded to include companies that are becoming global leaders, we’ve seen growing market confusion due to the shared Sequoia brand as well as portfolio conflicts across entities.”

However, speculations are rife that the VC giant took this decision to navigate recent geopolitical issues between the US and China. TikTok parent ByteDance and apparel platform Shein, which Sequoia backs, are under growing regulatory scrutiny in the US. In a tit-for-tat gesture, the Chinese government told infrastructure operators in its country to stop buying products from the US chipmaker Micron.

Sequoia Capital hoped to steer clear of this trade war by splitting the company into three entities where Sequoia China will adopt the name HongShan in English. Founded and led by Neil Shen, who not unlike Singh, is synonymous with Sequoia’s Chinese entity, it managed about $56 billion in assets and raised $9 billion in four funds in 2022.

Both Shen and Singh have the final say in all matters related to the VC firm in their respective jurisdictions. Their larger-than-life persona in the industry proved to be a boon to their VC companies, helping them attract early-stage founders with innovative ideas as well as limited partners (LPs) who believed they could get the manifold returns investors sought.

However, it also proved to be a double-edged sword, as evidenced by the recent cases of corporate misgovernance and financial discrepancies in Peak XV’s investee companies in recent times. Singh even stepped down from the board of Singapore-based e-commerce platform Zilingo after questions were raised about its accounting practices and lack of due diligence guardrails. With Shen and Singh now spearheading HongShan and Peak XV respectively, is this tantamount to placing high onus on their infallibility?

Most global corporates shy away from letting a key management personality become bigger than the brand to avoid their actions getting intrinsically linked to the organisation’s fortunes. While having the founder or MD as brand ambassador does have its merits—investors know who the decision maker is and customers know where the buck stops—it could lead to excessive concentration of power in a single individual. Is that what will soon be played out at HongShan and Peak XV?

The Road Ahead for Peak XV

In its new avatar, Peak XV will continue its existing programmes and initiatives like Guild, Build, PitStop and Horizon. It does not plan to make any changes to its existing fund sizes or terms, investment strategy or in its operating team. In 2021, Ashish Agarwal and Harshjit Sethi were promoted as managing directors (MD) in the company’s venture team. Ishaan Mittal, Tejeshwi Sharma and Sakshi Chopra were also elevated to its growth investing team as MDs, and joined other MDs—Singh, Mohit Bhatnagar, Rajan Anandan, Ravishankar GV, Shailesh Lakhani, Abheek Anand, Piyush Gupta and Amit Jain.

Interestingly, few in the effusive start-up sector knew that a rebranding exercise was underway. Now, many are curious about Peak XV’s strategy to continue holding its pole position. Does this also signal the retreat of the global VC firm from the Indian start-up landscape, which is the third largest globally?

Sequoia would not like to put it in that light. In a press statement, Singh said, “It’s a new beginning for us as Peak XV Partners, but unlike most beginnings, this is an opportunity for us to build on top of the foundation laid over the last 17 years. Our firm will continue to be managed by the current leadership team and will continue to invest from the most recently raised set of funds focused on India and SEA.”

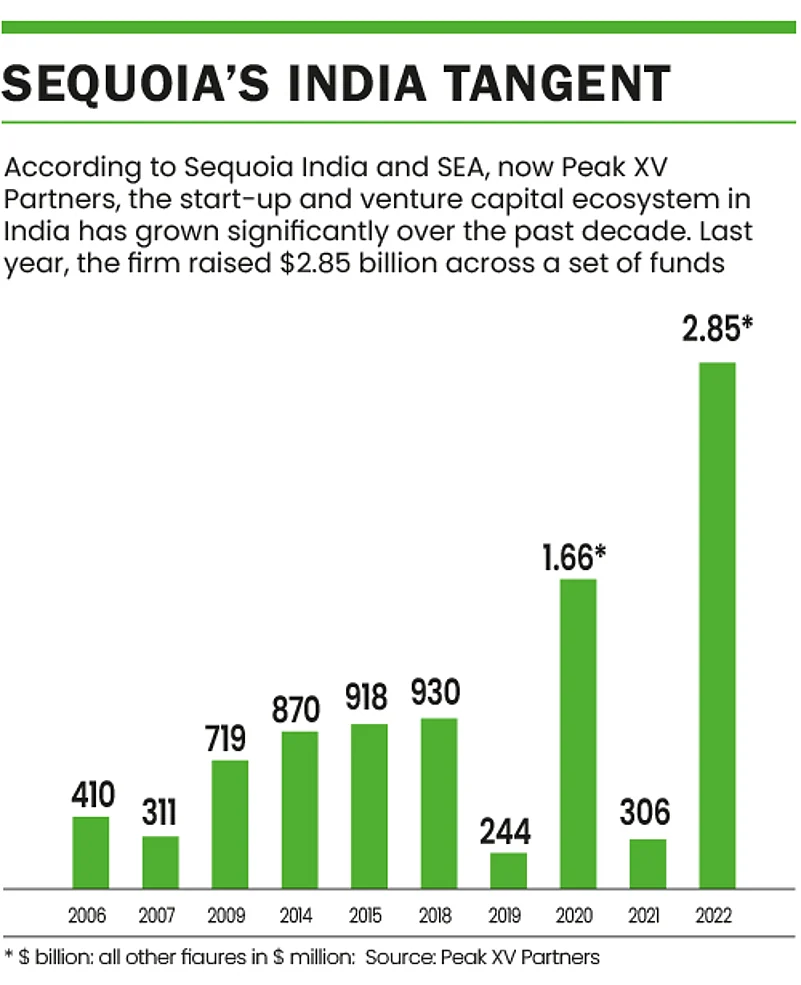

Over the last 17 years, Sequoia India and SEA claimed to have raised 13 funds and invested in over 400 start-ups, with over 50 unicorns (companies valued at $1 billion and above).

It added that its portfolio had seen multiple successful M&As resulting in $4.5 billion of realised exits and has $2.5 billion of uninvested capital. Stating that it did not publish its returns publicly or share details about its funds since it was private, Sequoia claimed to lead the industry on all exit metrics with 19 IPOs.

One reason Sequoia was able to achieve this in India since starting its fund in 2006 was because of the trust LPs reposed in the VC when it came to selecting high-growth start-ups. However, any rebranding exercise is likely to have a modicum of impact on a business where trust is the currency.

Ravi Challu, chairman of the Start-Up Hub Expert Committee at Bangalore Chamber of Industry and Commerce and co-founder at Wise Owl Consulting, notes that the spinoff could result in increased conflict between start-ups, developing competing solutions across three entities. He is also concerned that a hands-off scenario will emerge when a start-up attempts to fund its geographic expansion outside of India and SEA, unlike earlier times. In such a case, it is quite plausible that the founder might consider working with another VC firm.

Entrepreneurs, who sought Sequoia’s aegis before, might now wonder whether Peak XV can help them make inroads into global markets, acting independently from its US parent company. In an industry where deals are made on trust and credibility, Peak XV will have to work harder to build its individualistic identity, distinct from its global legacy.

According to a report by Bain & Company in association with Indian Venture and Alternate Capital Association, while macroeconomic factors have driven the funding slowdown globally, India remains attractive to investors.

The year 2022, a difficult one for private equity (PE) worldwide, saw healthy PE-VC investments in the country at $61.6 billion in 2022, according to the report. This is just a shade shy of the peak of $69.8 billion in 2021. Moreover, family offices, corporate VCs and first-time funds remained active over 2022, participating in more than 300 deals, in line with 2021.

Then why the retreat of Sequoia from Indian shores? The question begs an answer.

Dotting All The I’s

In the conventional structure at most global VC funds, a start-up deal evaluation occurs at the regional level while operations like due diligence or compliance are centralised. In most cases, when it comes to the functioning of the investment committee, smaller checks are decided regionally, while larger ones are approved by a centralised committee. According to industry experts, Sequoia too subscribed to this model, taking support from the central team for its operational activities. The recent decoupling begs the question of how much the central team contributed towards picking start-ups for the India and SEA unit’s portfolio and the major role that the investment committee played.

Ajay Jain, co-founder and managing partner of Silverneedle Ventures, believes that, following the spinoff, it is unclear if and how one fund will support LPs from another unit since cross-border investments by LPs are not unheard of. But, a Peak XV spokesperson clarified that there are no institutional Indian LPs in the US funds.

Singh had mentioned in his press statement that in the past, the shared Sequoia brand caused market confusion at times. “In many regions, founders are confused by which Sequoia entity they should engage with. In other cases, there is confusion around which Sequoia entity has partnered with a company. While we try to avoid portfolio conflicts, we are seeing companies emerge from every region with global ambitions. As a result, companies backed by different Sequoia entities will eventually compete with one another, which creates challenges for founders and their teams,” he said. Sequoia India’s SaaS companies like Druva, Clevertap, Sirion Labs and Atlan Data have faced this issue where there is a Sequoia Capital portfolio company like Cohesity, Kahuna, IronClad and Stemma that respectively competed with them. “As the India to global SaaS ecosystem grows rapidly, we expect this issue to become more difficult over time. Now with separate brands, we are able to avoid this issue,” he added.

A Capital Idea

Last year, Sequoia India and SEA launched two funds, a $2 billion early-stage venture and growth fund for India and a $850 million dedicated fund for SEA, which means Peak XV has adequate capital to deploy in the short term. However, as an independent entity now, will it successfully give its LPs robust returns without the backing from its parent company?

Jain explains that while this question might be mainly linked to the company’s current deals, Peak XV’s issue is whether it can manage things solo. “This is a critical issue in the present split—will Peak XV be able to structure the deals for its portfolio without the support of its parent fund?” he wonders. Industry watchers also wish to know if Peak XV will have to get its LPs to recommit to the $2.85 billion fund now after the rebranding, especially with the ongoing funding winter. However, a Sequoia spokesperson stated that existing legal agreements do not allow for this. The apprehensions are further compounded by the corporate misgovernance instances plaguing several of its well-known portfolio companies, be it Byju’s, Trell, GoMechanic or BharatPe.

Jain concedes that since Peak XV’s team has been groomed under the Sequoia umbrella, its management will have the DNA to get things going. Moreover, with a localised outlook, they are likely to steer clear of high-risk investments. Fortunately for them, like Challu points out, there are very few Indian LPs who have an inclination for high-risk investments.

The US Factor

The fee structure at most VCs consists of around 2% management fee and approximately 20% performance or carry fee. Operationally, Sequoia India and SEA was always separate from its US and China funds, though around 25% of the region’s fees went into the global pool.

Milan Sharma, partner at VC firm 35North Ventures, says that since the three firms will be separate legal entities without cross holdings, the carry fee will not go into the shared pool anymore. “The profit-sharing arrangement will definitely change as the Indian entity will raise separate funds from LPs without any association with the US firm,” he adds. “The US business is much bigger than the Indian one and hence, the spinoff of its India and SEA region will not make much difference to the US profits overall.” Peak XV’s spokesperson, however, maintained that there would be minimal impact on profits for any region.

According to an industry expert, the exclusion of the carry fee from the global pool can be a bonus for Peak XV since it will have more fiscal and operational independence. This, in turn, can give it additional flexibility and autonomy to run its business, which can eventually add to its performance and profitability.

On the flip side, though, fundraising will emerge as a challenge since it will now compete with its parent entity to raise funds. “Peak XV and the Chinese fund were raising significant amounts from US investors and institutions. This is a new ball game,” feels Jain.

The key question right now is whether Sequoia will allow Peak XV to use its brand. According to sources, the existing investee companies can continue to state that they are backed by Sequoia, now Peak XV, if their term sheet were signed before June 6, 2023. Also, Peak XV will not pay any royalty to its parent company for leveraging its brand name.

Nonetheless, industry watchers claim that developing an entirely new brand for Peak XV, delinked from its rich heritage, will not be an easy feat, the charisma of Singh notwithstanding. Nor will it come cheap, which will further eat into the company’s profits.

It is premature to decide who will end up holding the short end of the stick. It is also unclear whether the parent entity will have more cash to plough into the US region, since all three units are deeply involved economically, and it will take months before they decipher the impact of the spinoff on their respective cash flows.

Against the backdrop of the dollar’s strong position, Peak XV’s profits might shrink initially, though this depends on the transfer pricing, if any, among the three entities. However, Singh’s team has its work cut out for now—it will have to go back to the drawing board to understand its overall fund costs and operational structure, in addition to convincing LPs about its strategies.

More importantly, it will have to undertake spring cleaning at its portfolio companies to weed out any underlying governance issues which might blow up and impede its prospects in the region—something it can ill-afford at this point in time.

Peak XV Partners clarified that it raised $1.66 billion in 2020 and not $658 million, as it mentioned earlier.