What does your company do?” is a question that still stumps Ashish Gaikwad after all these years. Honeywell Automation India Limited (HAIL) has been in India since the mid-1980s. It is a name that rings a bell in the minds of people, with not much clarity on what it does. In reality, it is a leader in the sphere of integrated automation and software solutions, making it an industrial IT company. “I just say we are a technology company,” says the soft-spoken Gaikwad, HAIL’s managing director, with a smile, giving the impression that it’s often too complicated to explain and even harder to understand.

In India, the company has a product portfolio in areas as diverse as environmental and combustion control, apart from providing engineering services in the field of automation and control to its global clients. Globally, Honeywell has been around for well over a century with revenue of $40 billion. Through its four business areas, it manufactures, among others, products for aircraft, which aids in predicting the weather, collision avoidance systems and even the famed black box. Apart from this, it provides the technology in making various fuels out of crude oil and even manufacturing a fibre that eventually goes into bullet-proof helmets or tough jeans and hand gloves for industrial workers.

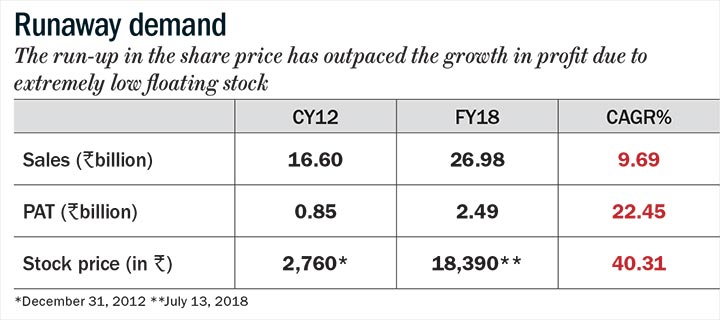

HAIL’s growth story has been a steady one. For FY18, it registered revenue of Rs.26.98 billion compared to Rs.16.60 billion in CY12. Stock price performance, however, has far outrun revenue and profit growth (see: Runaway demand). Its growth is the result of getting not just more business from its traditional oil and refining segment but spreading its wings beyond that. It is a strategy that has worked well and the company now is readying itself to make the most of government-led initiatives to connect India, where it believes it has a huge role to play.

Base building

Much as Gaikwad underplays HAIL as just being a technology company, it helps many a large customer facing a challenge and in need of some serious levels of expertise. “HAIL was present when India really needed automation. That started off in the late 80s and early 90s,” he says. After a two year stint with CMC, then government-owned and later acquired by the Tatas, Gaikwad, 48, moved to Tata Honeywell in 1992 and has been there through its change of name and many new businesses.

Apart from HAIL, Honeywell has other privately-held entities, prominent among them, Honeywell Process Solutions and Honeywell Building Technologies. The latter launched an air purifier last year, marking its foray into the B2C sphere. HAIL is a clear case of a B2B business and one that Gaikwad thinks will be its core for many years to come. The Honeywell group in India has 15,000 people on its rolls, with over 3,000 employed with HAIL. “As a group, we have around 3,000 products engineered in India,” says Gaikwad as he takes us on a tour of the HAIL factory in Phulgaon, an industrial area about an hour’s drive from Pune. Opened in 2014, this facility spread over 150,000 square feet after a recent expansion, manufactures a suite of products such as pressure and temperature transmitters, controllers and process safety systems, which are also exported to other parts of the world. This factory works very closely with the global engineering services division situated in Hadapsar, an extended suburb of Pune, to conceive, design and eventually manufacture products for the Indian market. “Working with the technology development centres that Honeywell owns in India puts us in a very strong position. There is a lot of equity that the parent already has here,” he reveals.

That sound global pedigree has worked well for HAIL. Take the case of Emami Paper Mills, a player in the newsprint and packaging board business. Right after acquiring a second hand paper Beloit (newsprint paper) machine in 2007, the company’s management at its Balasore plant in Odisha was figuring out the next step. MBS Nair, a key member of the team and now head (strategy & operations) for the company, recalls the decision to install a quality control system, which resulted in Honeywell coming aboard.

The machine, then acquired at a cost of $4.5 million, was geared to manufacture 1,100 metres of newsprint paper per minute. “The challenge was in ensuring uniform quality at high levels of production. That meant, we had to constantly get it right on the thickness of the paper,” says Nair. Through his network, he reached out to the likes of Siemens, ABB and Honeywell. This involved technical discussions with each of the companies. “Honeywell was a leader in the paper industry and Beloit in the US already had their system across factories,” he explains. Besides, Honeywell locally was already working with the likes of Ballarpur Industries and Gurugram-based Khanna Paper Mills.

Emami Paper’s largest customer was The Times of India and their demand for a thick paper necessitated buying the new machine. The basic quality parameters such as GSM (grams per square metre, an indication of paper quality) and moisture control were already being overseen by Emami. “The hardware is the most important component since it delivers uniform printability at high speeds. That’s where Honeywell came in,” says Nair. The initial investment made in the Honeywell system was to the tune of Rs.50 million-60 million. The big benefit, according to him, has been in reducing the wastage (Gaikwad estimates that is 4% overall for folks in the industry who work with Honeywell), with rejection rates being at almost nil. On the overall investment made in the quality control system, around 15% is what Emami spends on running costs each year. Comparable machines from ABB and Valmet, too, cost as much with respect to capex and running costs. “The difference is the quality, which is where Honeywell scores. Therefore, for the same price, Honeywell delivers more,” says Nair.

Oil and gas it is

The thrust on oil and gas formed the early phase of HAIL’s India journey. It was in line with high demand for automation in that sector, with the company quick to capitalise on that, starting the mid to late 90s. A key breakthrough moment was Manthan, Indian Oil’s IT re-engineering project involving an enterprise resource planning solution through SAP. Indian Oil’s challenge on hand in the late 1990s was to integrate its key functions such as procurement, refining and marketing, with all of them working in silos. “It was not a very efficient way of doing business and we realised this would get difficult in an environment, that was already getting competitive. The need of the hour was to have an integrated supply chain model,” says S Ramasamy, former executive director (Information Systems), Indian Oil.

The company brought in Honeywell in 1999 to not just correct this but suggest ways to increase productivity levels across the organisation. According to Ramasamy, the situation was no different from a linear programming model with constraints and objectives. Indian Oil had challenges in the supply chain to integrate, view and make decisions based on 80 crudes sourced from South America to South East Asia, 10 refineries and five detailed models, along with a large network of 200 depots, 40 terminals, 17 pipelines and six transportation modes. Honeywell first designed the refining and petrochemicals modelling system (RPMS), which could predict the demand for crude based on the time of the year. “Earlier, all this was done without any automation and decision making was based on what had taken place in the past,” says Ramasamy. The next part was the supply and distribution model (SAND), which clearly outlined how much of the finished product would go to which distributor/s or a specified petrol pump. “It was now mapped and centralised at many levels. Access to key information such as inventory levels at a particular outlet of a remote location was now a reality.”

According to Gaikwad, the experience of working on Manthan, followed by other projects in oil and gas, led to creating products specifically for the Indian market. “It is not about getting a product from the US or Western Europe to India. Innovating a product or solution focusing on India is critical for success here,” he says firmly.

Again, it was refining that showed the way. About a dozen years ago, there was a requirement from HPCL. It was fairly straightforward – they were looking for an automated way to dispense fuel at their terminals, at a time when the entire process was done manually by HPCL’s own staff. “There was no precedent globally and we had to create the software from scratch, which took about a year,” explains Gaikwad.

This formed the basis for the terminal automation solution, which would essentially facilitate the smooth movement of the truck from the point of entry to then replenishing it with the right kind of fuel (premium petrol or different kinds of diesel) and then make its way out. HAIL’s software had the driver being given a RFID chip, which was necessary to gain entry, followed by the presence of robots, which is where the hardware part came in, directing him to the right bay. “There was no hose pipe involved and the robots would take over,” he says. Once that was done, the truck would proceed towards the exit, where a printed invoice was generated, which would validate the weight and the nature of fuel. This comprehensive offering increased truck flow at the terminals by over 50%. “Automation here had to be safe and reliable, since we were dealing with something that was highly inflammable,” he says on the key challenge involved. Eventually, the success of the project with HPCL led to HAIL undertaking it for BPCL and Indian Oil. “Adapting it for another refinery becomes easier once the model is cracked the first time. What changes is only the specific requirement.”

Projects such as this have formed the core of HAIL’s East 4 East strategy, which tries to optimise the “cost to serve”. Gaikwad elaborates that in a competitive market like India, affordability has to be kept in mind without losing the functionality of the product. “We could use different materials or labour arbitrage or even use software instead of hardware. East 4 East is for countries where competitiveness and price points are different,” he says. It could then become a case of “made for India” and then similar economies in Africa, Middle East, Europe and parts of South-East Asia. It then becomes an export for India,” points out Gaikwad. Today, the terminal automation solution for the oil and gas industry is being implemented in markets such as Ghana and Nigeria.

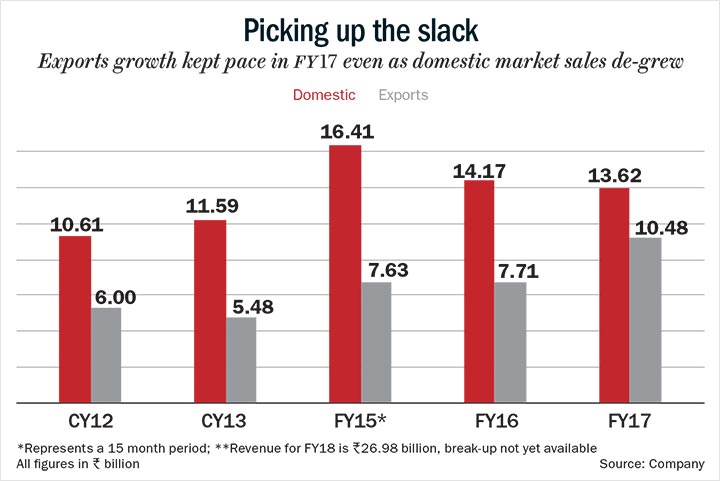

In the process, exports have increased significantly from 19% of HAIL’s revenue in 2005 to almost 45% today (see: Picking up the slack). “Though there is a lot of growth in the domestic market, we would like to hedge our bets. My board is constantly asking me what new ideas can be generated, which can be executed in India and then taken global,” he says. According to him, the global engineering centre in Hadapsar, looks at ways to implement projects outside India. “The export strategy is not by accident but well-planned. Over time, it has evolved and we will continue to be at it.”

Analysts tracking the company say it has been in a sweet spot for a while. Dhirendra Tiwari, head (research), Antique Stock Broking says HAIL derives a lot of technological inputs from its parent, which enables it to offer solutions ahead of competition. “While the company has global competitors, it continues to enjoy market leadership in many areas of its expertise,” he adds.

Project next

A key feature of HAIL has been its ability to move with the times. Gaikwad says starting from the 1990s, the company was quick to identify the trend at each phase of its growth cycle. “At that point, we saw a big demand for automation in industry to increase productivity. In the early phase of the 2000s, there was a need for quality engineering and we created our strength here,” he recalls. In his mind, the company’s strength lies not in starting a mega trend but in detecting it and as he adds, “then latching on to it and doing the best from our portfolio.”

The hitch till about seven to eight years ago was the high level of dependence on oil and gas. Soon, the company moved to cover newer business opportunities such as utilities, cyber security, water, bulk and fine chemicals. “We were doing very little work for the paper industry and power. Oil and gas can be cyclical and we wanted to grow irrespective of crude oil prices,” he says. The earlier relationship with the Tata group has helped in executing work for companies like Tata Power, Tata Steel and Tata Chemicals. “Refining continues to be a huge business for us but growth comes from other segments too. The dominance of oil and gas earlier was simply because the level of automation required there was significant,” states Gaikwad.

Today, HAIL is seeing a big story in the Digital India initiative, where there are opportunities to increase productivity. However, the one that Gaikwad is visibly kicked about is the Smart Cities Mission, that the government launched in 2015. The outlay is a large Rs. 980 billion for the development of 100 smart cities over the next five years apart from the rejuvenation of 500 others. HAIL has won the smart city project for Aurangabad, Bhopal and Bhubaneswar. This means the company will contribute in areas such as surveillance management, traffic and parking management or even work with fire prevention and police departments. “The definition of a smart city is evolving and it was important for us to showcase our capability,” thinks Gaikwad.

The options are manifold and a lot will depend on how innovative HAIL can be. According to Vineel Krishna, CEO, Bhubaneswar Smart City SPV, it will be another six to eight months before pace picks up on the project. “Initially, we will be looking at traffic management, transit and surveillance management. These are long-gestation projects,” he says, before adding that Honeywell’s experience in these areas in larger markets was what convinced the government. Tiwari says smart cities is a new concept in India, where technology is expected to make life easier involving a high degree of automation.“In true smart cities a lot of utilities, healthcare, mobility, education, surveillance are connected. India might take a slightly different route for its smart cities, where access to each of the above utilities could be provided, however all of them may not be connected seamlessly,” he adds.

From HAIL’s point of view, it is keenly looking at some of the opportunities such as metro projects and distribution of utilities, which will include power, gas and water. Gaikwad points towards automation required for both overground and underground transport. “We could end up playing a bigger role in underground since it calls for a high level of technical understanding,” he says. In the case of utilities distribution, smart cities will need smart meters, which Gaikwad estimates to be to the tune of 250 million units. HAIL will manufacture this locally with the technical expertise of its parent. “Smart meters can be used for both domestic and industrial consumption, which will also lead to less emission. Our role here will also involve ensuring the quality of gas at the right pressure,” he says. Water is also another avenue for HAIL, where it can not only manufacture the meters but as he adds, “work on analytics to reduce wastage.”

The prototyping on the smart electric meters is underway. Though the smart meter is something that the parent makes globally, issues related to tampering are somewhat unique to India. “Our product will be tamper-proof. If a customer has not paid his dues, the company can remotely switch off the connection,” says Gaikwad.

The optimism about the future is hard to miss and he makes it a point to emphasise that. The next decade will have industrial internet of things or IIoT (various sets of hardware such as sensors, devices and machines that work together to enhance both manufacturing and industrial processes) at the crux of the story. “As a part of IIoT, the connected plant is a big one for us and the idea is to bring together process, equipment and people,” he shares. HAIL has worked for Reliance Industries’ Jamnagar plant on this, where the challenge was the emission of toxic and combustible gases. The requirement was fire and gas detection and CCTV systems. HAIL installed gas sensing technologies with fire alarm panels. “The connected plant strategy is to have multiple sensors, which monitors the health of the process and predicts a potential hazardous situation much early so as to allow operators to take early action,” he adds.

There is apprehension around the IIoT hype, which Gaikwad thinks the company needs to be careful about. “The current phase will be very different from what the company did between 2005-17. Our approach to IIoT is to get to the bottom of the problem and making customers aware of what IIOT is actually solving,” outlines Gaikwad.

The growth assumption rides heavily on industrial capex. “Unfortunately, there is little private sector capex taking place and that is largely limited to improving operational efficiency, which does involve automation. The larger investment today is being led by the public sector in hydrocarbons and mobility. The extended period of low industry capex will hurt several industrial companies including Honeywell. Hopefully investment cycle will revive soon, thereby enabling industrial companies to accelerate growth,” says Tiwari.

The ace up HAIL’s sleeve is its large product portfolio coupled with a sound understanding of technology. This portfolio comprises a commoditised category like transmitters, where HAIL looks for ways to cut costs and a premium offering like connected plants, which revolves greatly around AI and analytics. “We want the volume from what is commoditised, which sits well with the premium bit. Mass gives us visibility and to that we add our East 4 East strategy,” says Gaikwad confidently. Looks like HAIL is set to execute and grow like never before.