Founded by scientist, philanthropist and entrepreneur, the late Dr K Anji Reddy, Dr Reddy’s Laboratories (DRL) has emerged as a leading global pharmaceutical company with a 30-year legacy that thrives on research and development (R&D). The company’s best-in-class research capability focuses on complex injectables, particularly long-acting ones. This enables it to commercialise difficult-to-manufacture complex drugs at a fraction of the cost of an innovator’s version.

It is also one of the few Indian promoter-driven companies to be run by a professional management. The new chief operating officer, Erez Israeli, is an accomplished leader and has held several leadership positions in his 23-year career at Teva Pharmaceutical Industries. His focus is on generating incremental shareholder value by delivering robust profitability.

The company has three target areas as it lays the foundation for the coming years: a) prioritise growth areas, that is, US generics, India, China, Russia and active pharmaceutical ingredients (API); b) streamline cost structure and make loss-making businesses self-sustaining; and c) create a leadership structure underpinned by outcomes. The company’s board members also come from diverse fields, thus, bringing a comprehensive outlook to steering the company towards its goals.

Good corporate governance, strong earnings growth and almost zero debt on its books demonstrate that DRL has all the right ingredients to succeed.

US Bonanza

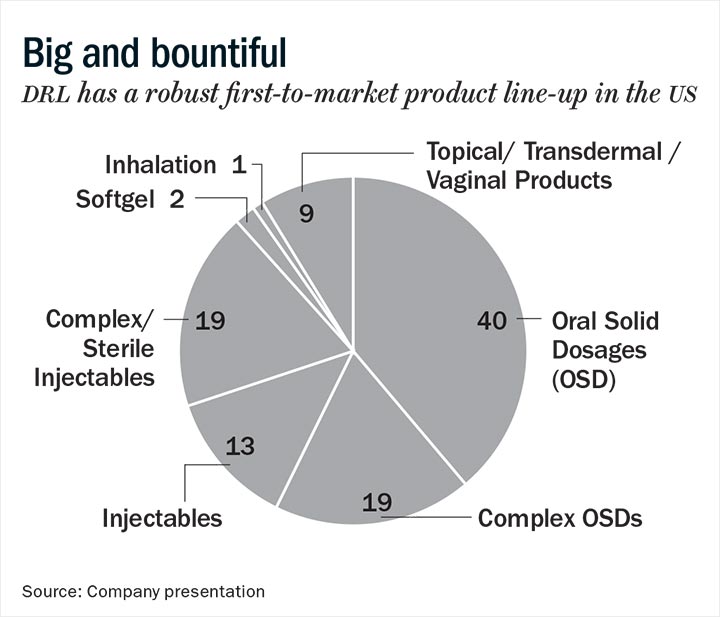

DRL focuses on complex generics, specialty and biosimilars. It mainly follows an organic strategy, relying on its R&D expertise. The company has a strong complex generic pipeline that entails the potential to double sales in the US in four years. It has 100 abbreviated new drug applications (ANDAs) awaiting approval from the US Food and Drug Administration (USFDA), which include almost 60 Para-IV filings, of which almost 30 are first-to-file. We expect the recent launch of Suboxone and Diprivan and key pipeline products Nuvaring, Copaxone and Revlimid to fuel US growth over the next four years. Approval for Nuvaring is likely to come in the first half of 2019.

The company also has three new drug applications (NDAs) filings awaiting the regulator’s approval. It recently received approval for Tosymra, its novel nasal sumatriptan formulation to treat acute migraine, and is working towards commercialising it in the first quarter of FY20. Also, the recent lifting of the USFDA warning letter at the Duvvada (Andhra Pradesh) formulations facility will now facilitate the approval of almost 20 oncology products, half of which are injectables. In biosimilars, as an early entrant, the company has established itself as one of the prominent emerging market players with five commercialised products and seven in the pipeline.

Best Among Peers

What makes a good pharma company is its strong R&D and DRL scores here as well. The company has four R&D centres in India, six technology development centres — four in India and two overseas, and 23 manufacturing facilities — 18 in India and five overseas. Dr Reddy’s has the highest R&D spend among peers — almost 12% of sales, having invested over $2 billion over the past four years. Of the total investment, $650 million was spent on asset addition.

For the second quarter of FY19, R&D spend was Rs.4.12 billion, which is largely at a similar level compared with both year-on-year and sequential quarters. However, as a percentage of sales, it was 10.8%, lower than the trend seen over the past quarters. The management, though, has indicated that the spend in the second half will increase and, overall, will be at a level seen in the preceding year.

The Way Ahead

Currently, biologic and proprietary product businesses incur annual losses of Rs.10 billion. The new management is working towards making these businesses self-sustaining over the next two-three years. While the US launch of Tosymra will help this, the management will not hesitate to exercise business rationalisation as an option. We are positive on these initiatives, which have started to bear fruit.

The USFDA has also lifted restrictions on the Andhra unit, which was slapped with Form 483 (with eight observations) in October 2018. The new onco-injectables plant, where the company manufactures Dacogon and Vidaza, contributes around $20-30 million to the company’s revenue. Importantly, around 20 products of the total 100 in the pipeline are from this facility, half of which are injectables and a few are niche. Based on DRL’s responses and corrective actions, the regulator has issued an establishment inspection report (EIR), changing the status to VAI, that is, voluntary action indicated. Thus, any launches from this plant will be incremental to what has already been baked into FY20-FY21 numbers. The company also recently received 11 observations, mainly related to procedures and quality control for its formulations manufacturing unit at Bachupally (Telangana). This plant accounts for around 45% of US sales and around 15 of the 100 pipeline products. Four of these 11 observations were repeat observations. Hence, we believe these observations are procedural in nature and addressable.

After the US, India generics is a key focus area for DRL where it operates as the 15th largest pharmaceutical company, and it aims to become a Top 10 player. DRL is also the largest non-Chinese pharmaceutical player in China and is well positioned to benefit from an expanding pharma market, thanks to the China Food & Drug Administration easing its norms. The new rules now enable Indian drug makers to file drugs, already approved by the USFDA, in China and commercialise them with a local partner. The $100 billion-plus Chinese market has, thus far, been dominated by local drug makers and multinationals. DRL, which has a joint venture with local partner Kunshan Rotam, has clocked $100 million revenues in China in FY18. The management expects to launch around 60 products in the Asian country over the next eight years, with a focus on oncology.

Rare Value

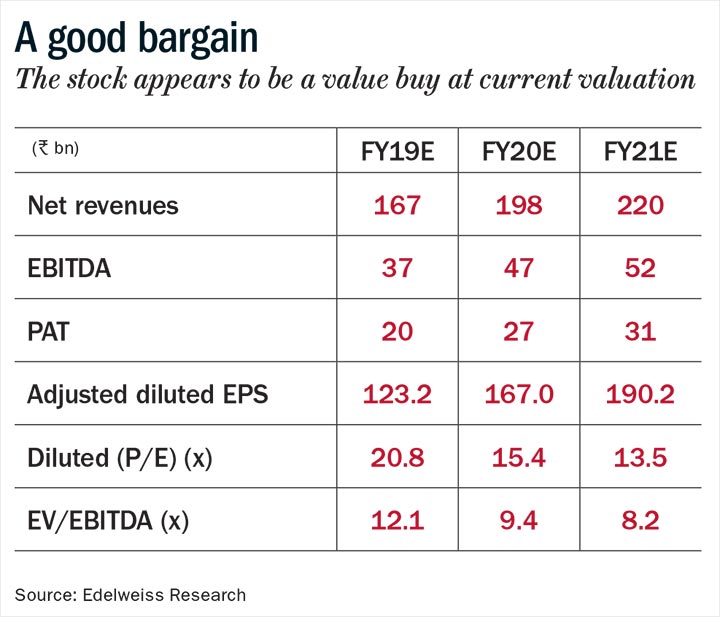

A promising complex generics pipeline, strong earnings revival and compelling valuation of around 14x estimated FY21 earnings render the stock as a prime re-rating candidate. The management has delivered on cost-control initiatives over the past three quarters and is on track to turn around the loss-making businesses. The multiple earnings levers and a favourable valuation make Dr Reddy’s a stock to watch out for.

The brokerage has a buy call on the stock, but the writer does not own the stock in his personal capacity