Venkatesh Rajagopal joined the civil services as an IPS officer in 1979. After 10 years of service he finally couldn’t ignore his inner calling to be an entrepreneur. He resigned in 1988 to start his own export-manufacturing outfit called Celebrity Fashions. “Start-ups were nowhere in the picture those days but being an entrepreneur was definitely a thrill for me,” says the chairman and managing director of Indian Terrain. As an exporter, client visits often took Rajagopal overseas. “I could see the huge difference between products in international markets and domestic markets. There was a definite gap waiting to be filled, which I knew we could. Plus manufacturing for exports is an anonymous business. Once the product is on the ship, it is no longer yours. But I wanted to experience the complete product cycle for manufacturing to owning a brand and it was also becoming clear that consumption was going to take off in India. So we decided to launch Indian Terrain in 2000,” he says.

Indian Terrain was launched as a premium work-wear and smart casual clothing brand for men. At that time, it was a division of the Madras based Celebrity Fashions, which was into manufacturing, and exporting of apparels to leading international brands such as Timberland, Diesel, Tommy Hilfiger, LL Bean and Nautica. “Indian Terrain was just a cold start but the confidence to take on the big boys came from the fact that we had tremendous understanding and expertise of sportswear manufacturing, supplying to these global brands over the years. We knew we could manufacture a world-class product,” says Rajagopal. His company is known for its trademark khakis and offers a range of garments including shirts, trousers, T-shirts, shorts, sweaters, jackets, and denims.

The company began with two company-owned outlets in Madras and Bangalore and slowly began to widen its franchisee network in the South. They got their first big break with Shoppers Stop in 2003, which gave the company the much needed shelf space across outlets, kicking off their distribution, nation wide. “It was a bet I took on the entrepreneur. We didn’t know much about the brand back then but Venky seemed like a good entrepreneur to back,” says BS Nagesh, Founder, TRRAIN (Trust for the Retailers and Retail Associates of India) and non-executive vice-chairman, Shoppers Stop.

Now that the distribution was falling in place, the company realised it had to step up its marketing and brand building efforts. In 2005, Bennett Coleman & Co picked up a 3.6% stake in Indian Terrain in exchange for ad space and brand building initiatives across their properties for their next two-three years. “A lot of people questioned us on whether the branding efforts were worth giving up a part of the company. But there was no other way. We didn’t have a lot of capital and at that time it was important to create that brand recall. It was one of the best things that ever happened to Indian Terrain because it gave that much needed visibility and brand recall across the country,” says Rajagopal.

Network effect

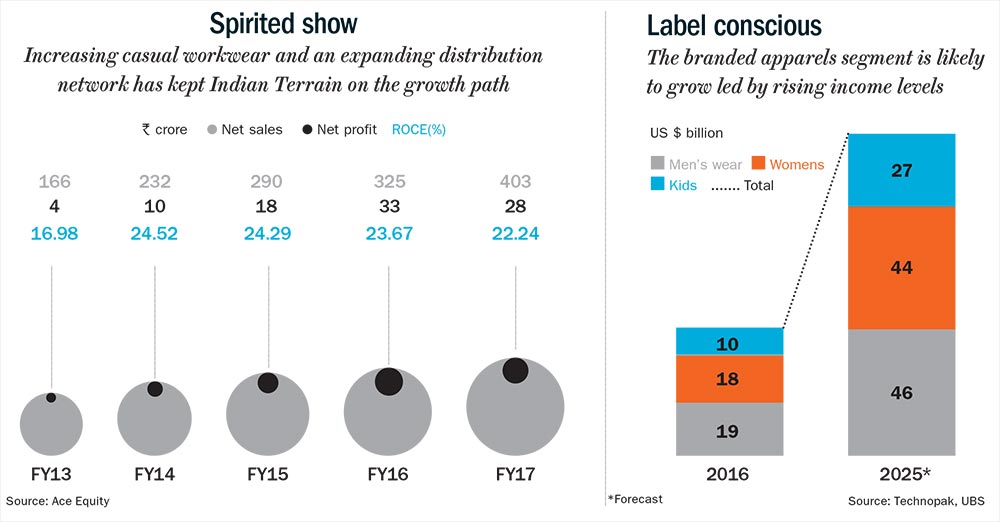

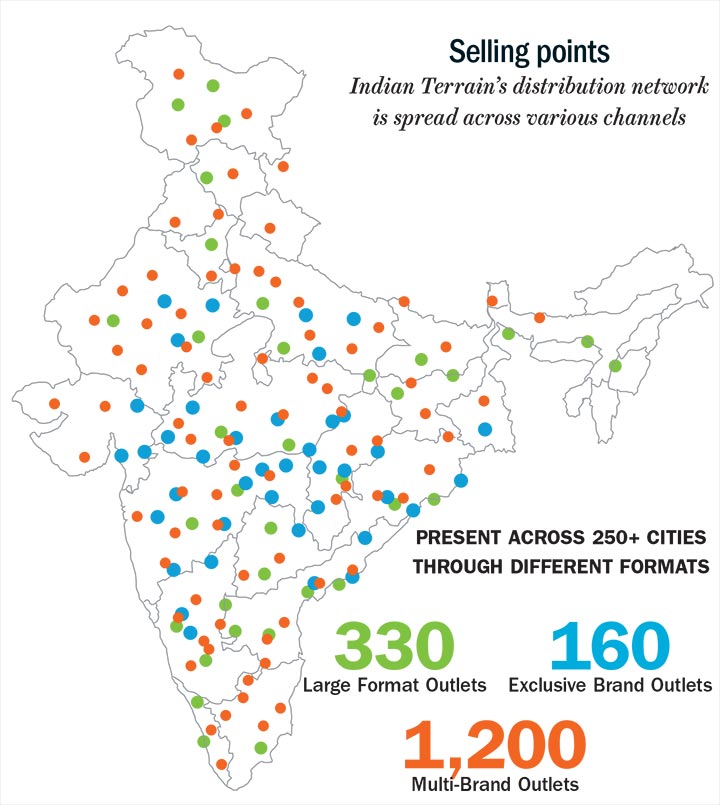

Initially, Celebrity Fashions helped the brand meet a lot of their supply requirements but today that has reduced to less than 5% of revenue, as they have built a robust pipeline of vendors who have grown with the company. The company’s expansion of stores has largely been led by franchisees. Today Indian Terrain retails across the country through more than 1,200 multi-brand outlets (MBOs), 330 large format stores (such as Lifestyle, Shoppers Stop, Reliance Trends and Central), 160 exclusive brand outlets (EBOs), and key e-commerce platforms as well. After establishing itself and to unlock the value of the brand, Celebrity Fashions decided to hive off Indian Terrain into a separate company in 2010. Shareholders in Celebrity Fashions got two shares of Indian Terrain for every seven shares held. Following the demerger, the company got listed in 2011. At that time Indian Terrain raked in about Rs.120 crore. Over the past five years, the company’s revenue has compounded at 21% and profit at 47% respectively.

Having tripled its revenue since listing, the company is now looking to grow by 20-22% over the next two-three years, riding on the growth in the men’s apparel segment. “Indian Terrain identified the opportunity in the casuals segment and focused on creating good quality products, which has helped them to stand out among international brands. Their success coincided with offices adapting a more casual dress code and they smartly identified that niche,” says J Suresh, managing director, Arvind Lifestyle Brands.

According to an UBS Securities research report and estimates by various industry sources, the men’s apparel segment is likely to grow from its current size of $18 billion-20 billion to $45 billion-47 billion by 2025. The report says the top 10-12 players make up only about 20% of the overall revenue with unorganised players bringing in the balance. Companies like Indian Terrain are hoping to make the most from the gradual shift from the unorganised sector (un-branded clothing) to the organised sector as income levels increase. “India is becoming a younger country and casual wear is becoming the de facto style of dressing which works to our advantage since we have built a strong presence here, which will clearly drive growth,” says Charath Narasimhan, CEO, Indian Terrain.

Narasimhan says, apart from increasing the number of outlets in metros, a growing presence in smaller cities and towns is helping them sustain the growth momentum. “Given our premium positioning, there was always this lingering question on whether there would be takers for the product outside the large 10-12 cities but we have been seeing good demand from smaller towns,” says Narasimhan. For instance, in Andhra Pradesh, after establishing its presence in Hyderabad, Vizag and Vijayawada, the company has found takers for its brand in smaller towns like Ongole, Khammam, Kakinada etc. “Typically we enter the markets through large regional retail chains and once we find there is enough demand for our products we open up an independent store there,” he says. According to him there are several regional retail chains in the South that help discover newer markets. For instance there is a retailer in Tamil Nadu who has a 40,000 sq feet store set up in places such as Thanjavur and Ramanathapuram. “We would have never guessed there could be so much demand in places like Ramanathapuram,” he adds

Seeing this increasing demand from smaller towns, Indian Terrain is looking to expand its network of 150 stores to around 250 stores in the next 4-5 years. It has been adding 20-25 stores every year over the past three-four years and that will continue. A large part of its network is in the South but now with the product being accepted, it is looking at a larger presence in the North as well. “Indian Terrain did well to develop long-term relationships with large retailers by focusing on quality and timely delivery and their network across the retail chains has played a large part in the brand’s growth,” says Vasanth Kumar, managing director, Lifestyle International. Last year, the company tied up with Reliance Trends, which gave them space in 100 outlets. “Reliance Trends now makes up one-third of our presence in large format stores. They now want us to expand to all the 450 stores they have,” says Rajagopal.

About, 40% of its revenue comes from the South, 20% each from the North and West and the balance from East and online sales. E-commerce currently makes up 5% of overall revenue and over the past year, the company has worked on redefining its relationships with e-commerce players. For instance, with Myntra, they have worked out a model where Indian Terrain will hold the inventory and ship the product once the order comes through and about 20% of the merchandise will be sold at full price while the balance, the last season’s inventory, will be sold at a discount of 30-35%. “We want to use data and analytics generated by the e-commerce platforms to understand what merchandise sells better. While e-commerce definitely will be a growth area for us in the coming years, we don’t want to be seen primarily as a discounting brand,” says Narasimhan.

Men II Boyz

In a bid to expand its presence across segments, Indian Terrain forayed into boys’ clothing in 2015. The merchandise, targeted at boys from the age of 6-16 years, is currently being sold only in 25 of their stores. Apart from having a larger presence across its stores, the company will also retail the boys’ line through all the major retail chains such as Lifestyle, Shoppers Stop and Central. As a result, the business, which now brings in about Rs.35 crore, is expected to rake in 100 crore in the next four years.

While its performance over the past five years helped Indian Terrain make the fastest-growing companies list, Nagesh thinks it hasn’t been aggressive enough to leverage the growth opportunities, choosing to stick to its core area of sportswear and casual wear. “Despite having a presence for more than a decade, Indian Terrain missed the window of opportunity to scale up the business aggressively before the advent of the international brands. However, their product is aligned to today’s youth and they can build on it,” feels Nagesh.

Rajagopal agrees with that observation. “We have been focused on sportswear because I have been passionate about the design philosophy of sportswear. When you are a building a good brand, you should know which opportunity to pursue and which one you should walk away from. If we foray into a segment that doesn’t lend itself naturally to our expertise, then we will be undoing all the good work done in the last decade or so,” says Rajagopal. He learnt that lesson the hard way when the company forayed into women’s wear in 2008-09 but made little headway and two years later pulled the plug. “We went at it hammer and tongs but I have it to give to my team who identified early on that it just didn’t play to our strengths and there was no point pursuing something where we couldn’t leverage any of our strengths.”

Having decided to stick to one brand, the company will have to look at ways to stay relevant across seasons while sticking to their core strength of manufacturing casual menswear or sportswear. “The challenge of being in a single segment is that there is very little room for error and any misstep can prove to be costly for the brand. Since they (Celebrity Fashions) continue to manufacture for top international brands, there is a lot they can learn with respect to fashion trends,” says Suresh. That’s why Arvind had taken a multi-brand approach opting for a portfolio of both home-grown and licensed brands. While the portfolio is skewed in favour of casual wear, these brands are positioned across various price points and styles targeting different demographic segments. The brands rake in about Rs.2,350 crore for Arvind of which US Polo, Indian Terrain’s largest competitor, brings in nearly Rs.1,000 crore. “I could launch another brand to rake in another Rs.20 crore-30 crore because there are always consumers on the fringe who are looking to try a new brand. But it takes a lot to create and scale up a brand and when you are a small company, you don’t always have the bandwidth to manage multiple brands and it ends up taking our attention from the core business which can be disastrous.” says Rajagopal.

Closet wars

Indeed, the garments business is execution intensive and the company is looking to ensure both the supply chain and the distribution network is in place to ensure there are no stock outs. In fact, the company has doubled its central warehousing capacity in Chennai to ensure timely supplies. “Not discounting is not an option because that is the way the industry functions. But what we can do to improve our overall profitability is to increase in-season sales by a few basis points. So in order to do that, you need to react to the store sale trend in real-time and depending on the product that is selling, we can dispatch more of it early into the season,” explains Narasimhan.

Increasing competition will not allow the company much leeway to increase prices and with an increase in retail and marketing costs, only higher volume can bring some scale benefits in sourcing and amortising costs. Given the increasing working population and income levels, almost all the leading international brands such as GAP, Tommy Hilfiger, H&M, US Polo. and Zara have a presence in India either with partners or independently. And with FDI being allowed in single brand retail, a lot more large and mid-rung brands are looking to come to India such as Japan’s Uniqlo, Asia largest retailer; Turkish brands such Mavi Jeans, AVVA; Chinese brand Meters/bonwe and French ready-to-wear brand Kiabi. “Clothing is an attractive business opportunity in India given the size of the population. There is still a lot of juice left in the can and we believe, with our niche focus, we can continue to grow at 20%,” says a confident Rajagopal. The company has followed an asset-light model so far, outsourcing its manufacturing to vendors. Even its store expansion is predominantly franchisee-led with over 100 stores in its current network belonging to them and according to the company, the bulk of the exclusive stores will continue to be with the franchisees. As a result, the company’s margin at 11.5% is significantly higher than that of brand business of Arvind (7.2%) and ABRL (7.0%) according to the UBS research report. While Arvind and ABRL have a large branded apparel portfolio, both companies are still investing a lot on marketing and distribution initiatives on their newer brands, which is dragging down the overall margin of the branded business.

Indian Terrain raised Rs.75 crore through a QIP in 2015 to fund its expansion. The company moved from GAAP to Ind-AS in April 2017. Under the new accounting standard, discounts that were added earlier to the costs will now be directly deducted from revenue. For the nine-months ended December 2017, revenue increased by 24% while profit growth was tepid at 17% as margins came under pressure due to higher costs.

In FY18, analysts estimate revenue growth to remain at 20-22% and net profit, which saw a decline of 16% in FY17 due to a significant increase in tax provision, is likely to grow 10-12% due to increased marketing spend and personnel costs. However, with increased distribution, the company’s revenue over the next two years (FY19-20) is expected to see an average growth of 21% and margin is likely to improve to 13% due to higher sourcing gains, leading to profit growth of around 28%. As the brand has been able to create a niche for itself, revenue and earnings growth could stay on track.