Dare. Learn. Inspire. Shape. Listen. To some, these may simply be words. But imagine a workplace that had them engraved in boldfaced Helvetica into the steps of the entrance stairway. These are values that Tata’s subsidiary Titan cherishes, and the designers of its spanking new office in Electronic City knew how to get that message through.

Not just that — the jewellery and watchmaker’s chief Bhaskar Bhat, along with his team, knew that they had to make their latest HQ nature-friendly and efficient. Its cafeteria uses ceramic cups and steel utensils instead of disposable cutlery; the building’s design allows for plenty of air circulation and natural light. “We wanted to ensure that it was a green office. That’s why you see so many elements of natural light, breeze and ambient temperature,” says Bhat.

Titan is one company that has made a fortune moving with the times — be it about going green or venturing into businesses that are likely to be trendsetters. Bhat explains, “One thing we are not driven by is market cap. It is the outcome and not the objective. Growth, on the other hand, is something we pursue relentlessly.”

The second, and equally important reason, is recognising the growth potential in its core market, India. “This market is extraordinary for three reasons — one, the sheer size of the population and the scale that you can hope to achieve; the other two are an underserved and underpenetrated population catered to by unorganised players. Those are the three Us: Unorganised, Underserved, and Underpenetrated,” says Bhat.

This isn’t a new strategy. In fact, the three Us are at the heart of Titan’s business strategy, on which, Titan has built three prominent verticals — watches and accessories, jewellery brand Tanishq and eyewear brand Eye+. Bhat says, “In every category we entered, these are prevalent at varying levels.”

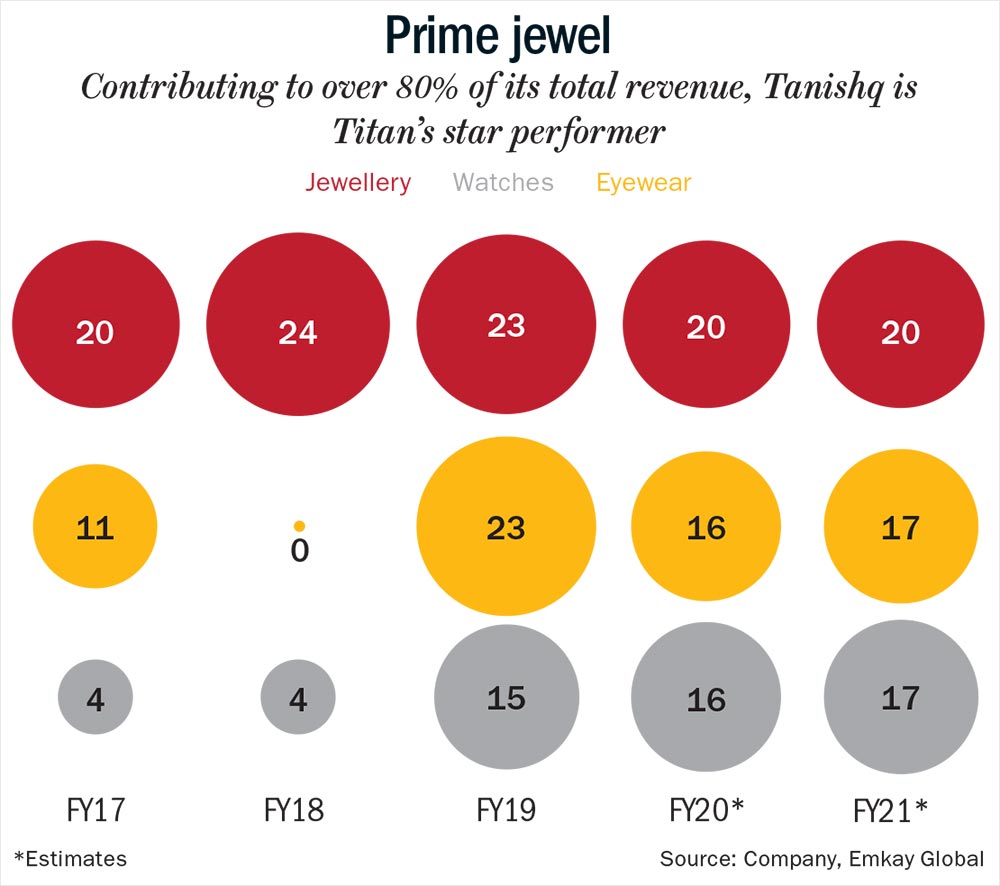

The jewellery business, accounting for over 80% of Titan’s revenue, has been compounding at 14% CAGR over the past five years. While the watch business continues to grow at a more modest 11% CAGR, the eyewear segment, which contributes 2.52% to revenue, continues to grow at a decent pace (See: Prime jewel). Having tasted success with its three Us mantra, Titan continues to hunt for new business segments with similar characteristics, the most recent being the traditional Indian womenwear, saree.

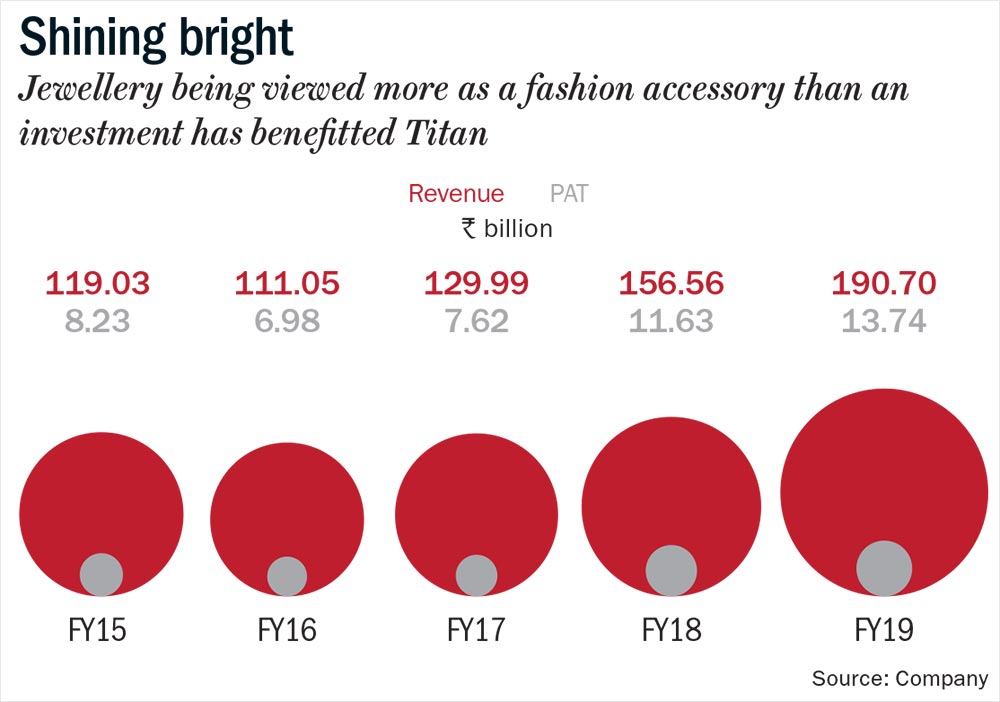

Looking into the future, can Titan make it big in any of these verticals to be able to turn in disproportionate return over the coming years? Over the past five years, Titan has seen sales and profit compounding at 12.5% and 13.7%, with the stock price rising 31% each year (See: Shining bright). Till FY23, Titan is targeting a growth of over 20%. As for the long haul, here is Bhat’s take: “If you listen, you forget. If you read (or watch nowadays), you remember. But if you do, you learn,” Bhat elucidates, “I think our category expertise is improving by the day. Our ability to make better watches or jewellery, lenses and frames, comes from our ability to create and brand products for every segment. We are not a retailer or an aggregator. Category expertise comes from deep knowledge — and that’s our edge.”

Here is a lowdown on how Titan’s various businesses stack up and where they are headed.

Time is a constant

It all started with watches in 1987. It was an unorganised business — technology was dated, there was no organised retail and unprofessional practices were rampant. There was a lot of smuggling since the market was underserved. Capacity in India was not enough. That’s when Titan seized the opportunity.

The brand effectively leveraged the situation to bring order to chaos. “We brought a sense of value to the consumer, and, thereby, the company. When you deal with unorganised sectors, some of the practices are unethical. When you deliver quality and transparency, combined with great design, brand and buying experience, you create a new market.”

Bhat elaborates how all this work would amount to little without one ingredient: every Indian’s aspiration to rise higher. “Indians want better, and that’s been happening for a while, thanks to the television, the internet, and the ease of communication and travel,” he says. According to Bhat, the two — changing aspirations of the consumer and Titan’s strategy — synchronised perfectly. It went about segmenting and marketing its watches methodically. To cater to four distinct segments, it built four different products — Fastrack, Sonata, Raga, and Xylys, and marketed them smartly. The decision to rope in a rockstar such as MS Dhoni for Sonata made the brand relatable as a budget offering. Similar is the case with Rani Mukerji and, more recently, Kriti Sanon, for the Raga line-up.

As aspirations and affordability grew, Titan also kept pace with newer and highly priced products. It pushed the envelope on pricing by introducing expensive watch brands Nebula, the pure-gold range; Xylys, its own take on the Swiss watch; and Edge, among the slimmest watches in the world, covering a wide spectrum of price points, some stretching the half-a-million bucks mark. Not all went flying from the shelves, but some did, like the Raga collection, designed to the Indian sensibilities. It has no competition there. “That’s where design plays a role in differentiation,” Bhat says.

Titan also made some tricky choices. It entered the luxury watch segment by acquiring Swiss watchmaker Favre-Leuba back in 2011. The acquisition was significant because it marked the legendary brand’s re-entry into India after over 40 years. But the reason Titan bought into it was for something fundamental. Would you buy a Rs.500,000 watch from an Indian brand, or would you rather get yourself a Rolex, a Breguet La Marine, a Tag or a Rado? “Yes, the Swiss lineage plays an important role as you move higher up the price point. That’s a perception that you cannot swim against,” says Bhat. “But then, this doesn’t stop you from introducing products that are truly differentiated at higher price points,” adds Bhat. Though the company has taken an impairment of Rs.1.45 billion over the acquisition, it has ruled out a further write-down since it expects to leverage the brand in India.

The larger trend, however, is discomforting. For one, when was the last time you looked at your watch to check time? The watch no longer remains a time-keeper. Your smartphone does everything, including keeping time.

There was a time when one would experience pride in strapping on a Titan watch. But the totems are changing. Youngsters do not relate to it and the older lot has so much to choose from, be it Seiko, Timex, or Skagen, with higher brag-value. At the top end, luxury watches may still retain their aspirational value and stickiness, but that’s a smaller play for Titan.

So far, Titan has still been able to maintain reasonable growth. Last year, it sold 16.8 million units, clocking revenue growth of 12%. But the question remains: How much longer would the brand be able to sustain this growth?

One silver lining is the $19-billion-worth global smart-watch category, which is growing at a scorching 80%. Titan is cognisant of this trend and is having its research and development team work on it, according to Bhat. Arnab Mitra, consumer analyst at Credit Suisse, feels the growth in watches will get slower over time and, eventually, plateau. In fact, he goes on to point how tech companies — Fitbit, Apple, Samsung and so on — will take the lead in smart watches.

Going forward, the watch segment may not see the good ol’ times replay, but that’s probably a lesser worry as the segment contributes much less to the overall revenue compared to the past – Titan, now, is all about Tanishq.

All that glitters

Getting into the jewellery business was nothing short of a masterstroke. Tanishq’s super success came again with a differentiated strategy in a cluttered marketplace. Titan enthused people to adorn themselves with jewellery and feel good about it rather than look at jewellery as an investment or store of value. They did that by building an exceptional brand with designs that caught the eye.

Today, Tanishq brings in Rs.160.30 billion in revenue with an operating margin of 12.2%. And jewellery demand still seems to be rising, with plenty of room to grow. “Increasing demand for diamond-studded jewellery and preference for light-weight jewellery, instead of traditional bulky ones will be growth drivers for Tanishq,” says Amnish Aggarwal, head of research, Prabhudas Lilladher.

The beauty of Tanishq is not just that it was a well-timed marketing sensation that has kept up its game, but also that its business model has been carefully crafted in a way that it is not too vulnerable to gold price volatility — a key factor that determines the fortune of jewellery makers.

Mitra mentions that Titan is completely hedged when it comes to its gold inventory. “The brand was clear it didn’t want to predict gold prices. They lease gold at a fixed rate of interest over a repayment cycle, 180 days in Titan’s case. This way, the company remains unaffected during price fluctuation,” he says.

Gold prices could affect demand too, but Mitra says this happens only if there is a drastic change. “Historically, gradual movements in gold prices don’t affect jewellery purchases. However, any sharp rise or fall in gold prices may cause demand fluctuations. This variation in demand may even be reflected in the company’s quarterly results. But, say over a span of a year, the kinks get ironed out,” he says.

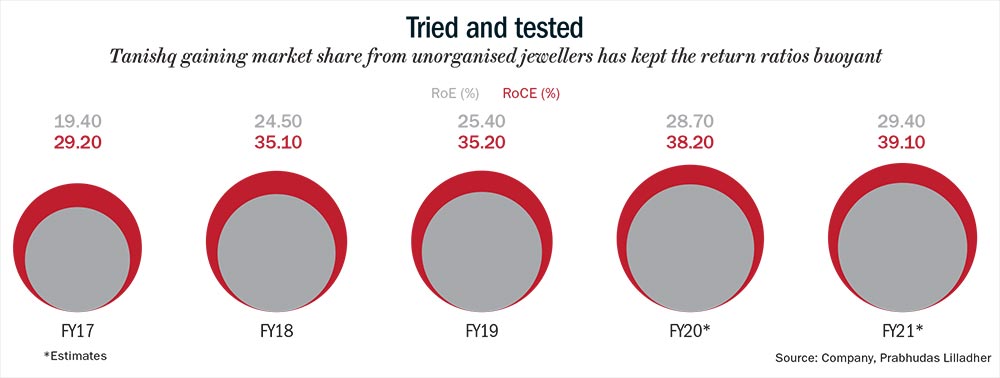

Past couple of years, Tanishq has clocked solid revenue growth — bulk of it driven by existing stores. Same-store sales over the past three years contributed 60% to overall revenue growth (See: Tried and tested). That growth had a good reason — GST. “Smaller, unorganised jewellers were crushed by GST. Earlier, they could get away with low making charges, but that is no longer possible. If Titan charges say, 20%, and the local player charges 12-13% (earlier, it was around ~8%), buyers would rather buy from a branded place for a small premium,” points out Mitra. On the flip side, some analysts have another worry — the hallmarking regulation that will apply to all jewellers. “If they become mandatory, regional players will step up their game. They may then eat into Tanishq’s share,” says Naveen Kulkarni, head of research, Reliance Securities.

But Bhat is unfazed. Titan has also tried the same segmenting trick that worked exceedingly well with watches in the jewellery business with brands such as Mia, Caratlane and Zoya. The sales targets for the different segments are ambitious for FY20. With the light-weight work wear Mia, they are going for 54% increase over last year’s sales and with Caratlane, the target is 45% growth over the same period. After opening the first boutique for premium brand Zoya in Delhi, they plan to open five more this fiscal, targeting Rs.1.5 billion in sales. On top of that bullishness, Titan is also confident about its eyewear vertical Eye+, launched in 2007.

Next big thing?

Eye+ is now the largest eyewear chain in the country with over 600 stores. This is despite the presence of established brands such as Lawrence & Mayo and GKB Opticals, which have shown little hunger to grow. While that put Eye+ on a strong wicket all these years, the playing field is changing now.

Online players such as Delhi-based Lenskart and Specsmakers of Chennai are upping the ante. “This is the next frontier in the online eyewear market,” points out Bhat. This is especially true with technologies such as virtual frame trials, precision lens-cutting and unique marketing strategies. Titan, too, has been pushing its online business hard with strong offers to acquire customers. Be it the ‘first-frame-free’ offer or ‘trial at home’, where a sales representative gets a few pairs of your choice to your doorstep, or ‘free eye-check-ups,’ which are also arranged as per the customer’s location of choice, Titan is working on drawing customers in this segment. Channel notwithstanding, Eye+ aims to reach 10 million customers per year by 2023 even as it ended last year with 3.6 million customers, up from 2.4 million in FY18. But the growth came on the back of an advertising blitzkrieg, aimed at building the Titan Eye+ Chain and Titan Eyewear brands.

In a change of strategy, the company has also redefined its price-value equation by introducing a whole new set of products at lower price points. Even as it eyes volume growth to ensure that margins don’t get impacted, Titan has also started in-house manufacturing of frames, besides increasing the number of lens labs. “Keeping a balance between advertising and in-house manufacturing of both lenses and frames is not easily predictable, but the idea is to keep the gross contribution,” mentions Bhat, adding that the idea was to have 12-15% kind of margin.

This year, the company has identified 50 catchment areas where it will aggressively push the brand through big and small stores, and open 50 premium stores to focus on high-end offerings. The brand will aim to increase its sales in value terms by 20% to Rs.1 billion, as they increase volume by 26%. “Growth is finally the agenda and everything we are doing is to achieve it,” Bhat adds. In FY20, the management hopes the eyewear division, which incurred a Rs.20 million loss in FY19, will turn profitable.

Lined up next in the growth wagon is Skinn, Titan’s fragrance brand which was launched in 2013. The logic behind the brand is simple. Once again, fragrances in India is an underpenetrated category, and the folks at Titan believe that there’s enough room for expansion. Why? “India is a hot, dusty country. We’re not a fragrance-heavy society yet. Once again, it’s a highly unorganised space,” Bhat says. Skinn saw sales of Rs.1.2 billion in FY19 and is targeting Rs.5 billion by FY23, and is expected to increase its market share from 9% to 20% over the same period.

As with its watches, Skinn is priced in the Rs.400-2,500 range. That makes it the ideal upgrade for those spending Rs.200-250 on say, a Jovan Musk or Axe, while someone looking for a more premium product has something to choose too, without burning a hole in the pocket. But then, analysts say this segment may not be too big for Titan since there is still competition from various quarters including store brands of big retailers that offer a similar value proposition.

If Skinn seems like an ambitious play in a crowded market, even more ambitious is Taneira, Titan’s latest baby, which saw the light of day in February 2017. With this venture, Titan is sort of completing the whole package of a person’s attire — from eyewear to jewellery, to clothing now. The first store was launched at Indiranagar in Bengaluru. The state capital has two stores, and so does New Delhi, and there is one store in Hyderabad. With this saree brand, the company is taking tiny steps, aiming for Rs.3 million to Rs.7 million per month per store. It is looking to generate revenue of Rs.450 million by December 2019. The management plans to increase its retail presence across seven cities this year with 15 additional stores. The stores will focus on giving an immersive experience and bring all the weaves of India under one roof. The company has a long-term vision for this, targeting Rs.8-10 billion in sales over the next seven to eight years.

Again, the idea here is to bring order in silk and handloom saree space, this time with the urban woman in mind. Yes, brands such as Nalli, Sabyasachi, Ritu Kumar and Manish Malhotra have been around, but in Bhat’s opinion, none have a pan-India presence that Titan plans to bring to the table. Given the company’s success streak, who’d be surprised at the Rs.5-billion-per-year target that Taneira has set for itself by 2023?

Krishnan Sambamoorthy, analyst at Motilal Oswal Securities, says there may be room for more than one player in this segment, but we should wait and watch how this plays out. “Taneira wants to do what Titan did to the watch space, but this time with pure-silk sarees. The sarees range from Rs.2,500 to Rs.250,000. The aim is to leverage the ‘Tata’ trust.” He says that, though it is a small vertical now, it’s likely to become big 10 years down the line.

Old game, new play

Titan is also pushing its marketing prowess to make itself edgy. “Three years ago, we invested in a digital function which has become all-pervasive. Today, we are moving towards analytics using artificial intelligence — it’s about using information gathered in each category to become more efficient in marketing, retailing, pricing, and even product inventories,” Bhat adds. Product-related research continues, of course. For instance, they are working on hardening gold as a material so they can stud better.

Overall, the brand is unlikely to step off the pedal anytime soon. The key driver here will be the young brands with their aggressive growth targets. Aggarwal and Kulkarni point out that jewellery will continue to be bread and butter for the company, but other segments such as watches, sarees, fragrances, and eyewear will drive growth. As a result, the two analysts predict nearly 20% CAGR for multiple years. Kulkarni states, “Non-flagship and sub-brands of jewellery divisions are expected to make higher revenue contribution, along with watches and eyewear.” He expects Caratlane to be profitable soon and believes watches will ride on the premiumisation trend.

Sambamoorthy says that accessories aren’t Titan’s forte, but it will help extend the company’s profit. “In terms of retail, the overhead costs (lease, rent) are high and the end goal is to maximise profit per square feet. The accessories will be sold via existing Titan stores and won’t have dedicated brick-and-mortar touch points. As long as they add to the bill-per-customer, it will boost Titan’s revenue.”

With major investments in eyewear branding and distribution, Kulkarni forecasts better bottomline growth there. Skinn and Taneira are also expected to mature by FY23, according to the management. He elaborates, “The company has followed aggressive and consistent store expansion. With modest capex requirement (Rs.25 billion), the company is expected to generate over Rs.34.5 billion free cash-flow over the next two years, adding to Rs.10.9 billion of cash equivalents in FY19.”

Overall, Titan has chosen the right field to play — it seeks to tap the big domestic opportunity of 47% young population (under 25 years) aspiring for premium products. Its vision is to reach 50 million customers with a revenue target of Rs.500 billion by FY23. Kulkarni extrapolates those numbers. “This will mean a topline growth of over 25% for the years to come, making it the next big Tata brand in value terms.”

The shining growth figures have only helped the stock rally and Titan figures among the top five Nifty gainers during the past year. It has gained nearly 45% against 8.7% for the Nifty. At its current market price, the stock trades at 49x estimated FY21 earnings, which discounts the ambitious double-digit revenue growth. “In the past three months, the stock has rallied from Rs.1,075 to over Rs.1,300. Its 52-week low stands at Rs.732. The present market price may not yield a strong upside unless profit grows at a better pace,” says Kulkarni.

But why has there been such a strong run-up lately? Aggarwal explains, “Brand strength alone has not led to the rise in Titan’s stock price. The auto sector is in jeopardy, NBFCs are under tremendous pressure, and the number of good stocks is dwindling. In such a scenario, if there is a brand with good visibility, investors tend to flock to it.”

Bhat feels the brand strength is an outcome of what has been built over the years. The veteran, who has spearheaded the brand for 17 long years will soon hang up his boots. “Titan’s growth story has been carved one day at a time, through daily grind. Good business is all about converting strategy into executable components, which you execute with excellence. That’s how you get a great product,” reminisces Bhat. But surely, there must be something that stood out. “If you ask me, we had our ear to the ground and the ability to respond quickly,” adds Bhat. That one thing should be enough to keep Titan’s Midas touch.