When explaining the core business of Syngene International, its CEO, Jonathan Hunt, offers an interesting analogy. “Think of it as a lock and key. We first spend time understanding the lock (i.e. the disease), and then design the key (i.e. medicine). This is really the first step to building a new medicine and the journey can take about ten years,” he says. With its strong capabilities in discovery and development, Syngene offers its clients a time-saving and cost-efficient way for conducting their research and development (R&D).

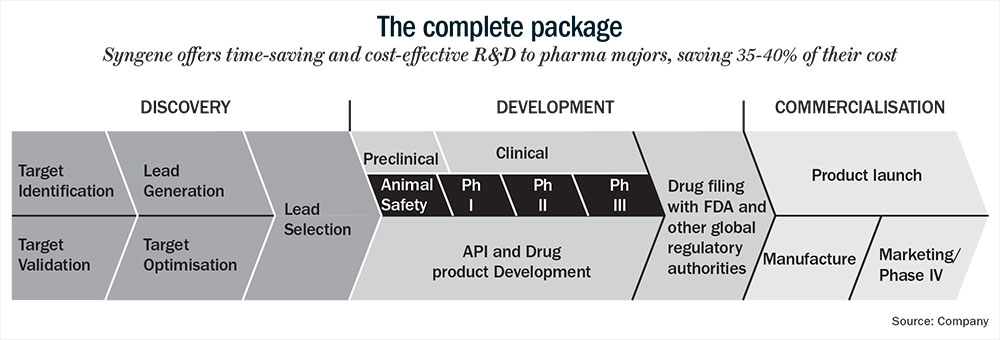

The Bengaluru-based company was incorporated in 1993 as a subsidiary of Biocon and started off as a contract research organisation (CRO) with services in chemistry and biology. Over the past 25 years, it has expanded into a leading CRO, which offers R&D programmes ranging from lead generation to clinical supplies (see: The complete package). The company has about 4,000 scientists operating out of their 1,300,000 sq ft CRO facility in India, serving about 331 clients globally. Its prestigious client list — comprising but not restricted to pharmaceuticals, biopharmaceuticals, nutraceuticals, animal health and agrochemicals -— includes leading global firms such as Bristol-Myers Squibb (BMS), Zoetis, GlaxoSmithKline (GSK), Abbott, Baxter International, Herbalife Nutrition and Amgen.

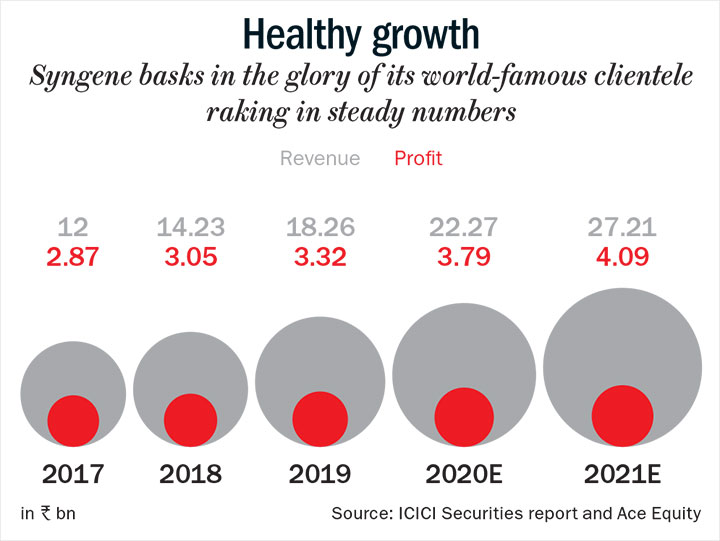

“Our clients judge us by the company we keep and the ‘company’ we keep are of world leaders in their field,” says Hunt. Over the past five years, the company sales has grown at a CAGR of 22% to Rs.18.26 billion in FY19. In the same period, net profit grew at 20% to Rs.3.3 billion (see: Healthy growth).

The company derives about 95% of the revenue coming from international markets such as the US, Europe and Japan. From its closing price of Rs.310.40 on its listing date, August 11 in 2015, the stock price has grown by more than 93% to Rs.600.45 as on May 3 this year. In the same period, its market cap rose to Rs.120 billion from Rs.62 billion.

The strong growth has been aided by regular addition of new clients and scaled up revenue from existing clients led by integrated service offerings, high data integrity and continuous endeavour to move up the value chain, notes an ICICI Securities note released this year. In line with this, the company is setting up a new commercial-scale facility in Mangaluru to manufacture novel small molecules for innovator companies.

“It is like a value chain that mimics what the client would be looking to do in their own organisation and we can do it for them externally. This allows Syngene to become a full service provider (contract research and manufacturing services [CRAMS]) in the market,” says Hunt.

Joining The Dots

At the heart of Syngene’s success is the quality of service that it has been able to provide to clients, believes Hunt. More importantly, he points out, the company has always got its timing spot on. For instance, the company commenced operations around the same time that there was a structural change going on in the pharmaceutical and biotechnology industry.

“In mid-90s, we were seeing research teams in companies starting to consider outsourcing work either because it is more cost-efficient or because they were growing quickly and required solutions faster,” says Hunt. To capitalise on this, Syngene was launched with a focus on R&D service in chemistry.

Since then, the company has diversified its business and added services such as product development, formulation work and biology. “We have mirrored those core capabilities that our clients would have and replicated them in India to offer them back to clients as a service, often with the cost advantage,” says Hunt. Industry estimates peg the cost savings for clients at 35-40%.

The partnerships that companies such as Syngene strike with clients prove mutually beneficial. Analysts note that, globally, pharma players are facing structural issues from the impending patent cliff, a shrinking product pipeline, rising R&D costs and growing competition. To maintain the structural balance and improve profitability, they tend to outsource a substantial part of the R&D work. Similarly, innovative companies that are extensively working on new products and may not have the required capital or manpower also tend to outsource a substantial part of their R&D. There is reportedly an 8x increase in cost per novel molecular entity from $140 million in the mid-1970s to $1.2 billion in the early-2000s.

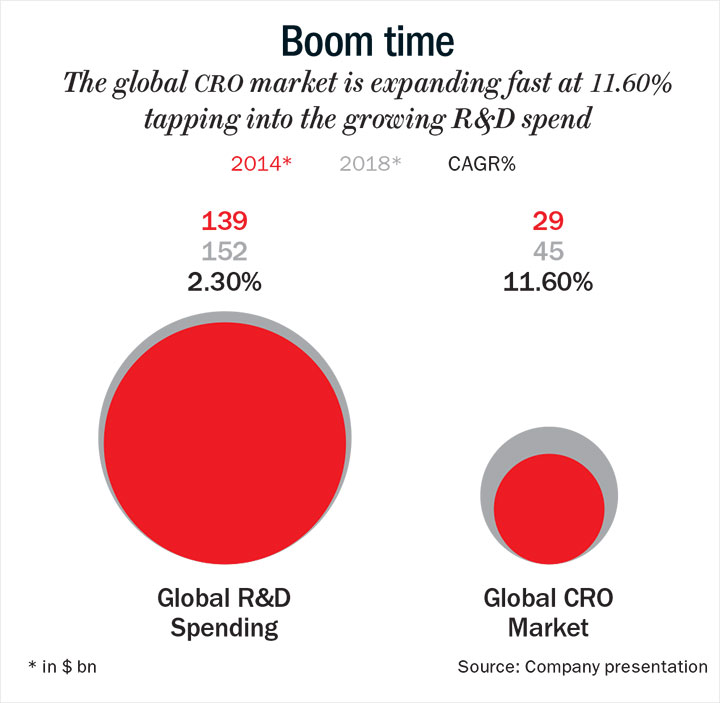

Rahul Guha, partner and managing director, Boston Consulting Group (BCG) – India, says, “I see the macro view for CRAMS as very positive. They are able to deliver quality services at a substantially lower cost offshore. The opportunity is akin to the early 2000s of the IT boom.” According to Syngene’s investor presentation, about 75% of the global R&D spend can be potentially outsourced (see: Boom time).

Currently, Syngene’s revenue pie is neatly distributed into three key verticals — Discovery Services, Dedicated Centres and Development Services, each contributing about a third of the revenue. “The synergies and advantages of having the research and development work going on in one location are tremendous,” says Hunt.

Discovery Services, which contributes 30% of Syngene’s revenue, can be viewed as the first stage in the R&D process. Under this, the company earns its revenue through billing based on number of scientists deployed. These contracts are typically renewable annually. It entails an in-depth understanding of discovery chemistry and discovery biology pertaining to small and large molecules. The molecule has to have a right balance of being effective in the disease the company wants to treat, but also minimise side effects.

“When you find a molecule that has the most chances of success, you can then take it into next stage, that is, development service,” says Hunt. This stage supports a molecule once it moves beyond in-vivo testing to preclinical studies and clinical development. Focus is on how it will be put into a form physically — gel, tablet, injection — and designing it accordingly. The company also manufactures molecules for clinical supplies and commercialisation. All this is a part of the development and manufacturing vertical, which constitutes 37% of the total revenue. “Contracts (under this vertical) are mostly short term in nature,” notes the ICICI Securities report.

The remaining 30% of the revenue come from the Dedicated Centres, housed within Syngene’s Bengaluru facility, with a contractual commitment of five years and more. These centres offer a dedicated, customised and ring-fenced infrastructure in line with client’s requirements. Calling it a key growth driver, Hunt says, “The Dedicated Centres demands sophisticated integration of all our services.”

This model started first with their client BMS in 2009, with about 400 scientists deployed exclusively. The duration of this collaboration has been extended till 2026. It marked the switch of the business model from purely transactional to a more evolved partnership. Hunt opines that this partnership, established in the late 90s, was the inflection point for the company as they worked together to build capabilities and started integrating them. “It took 10 years for it to become an overnight success,” he says. The company then went about establishing similar partnerships with companies including Baxter, Amgen and Herbalife.

“Syngene is a pedigreed and long-standing company with deep client relationships. Their client base includes the top players, which inspires a lot of confidence in other clients. This is a critical differentiating factor,” says Bhavesh Gandhi, analyst, Yes Securities.

Interestingly, while eight of the top 10 global pharma companies have been availing services for the past five years, Syngene also has strong partnerships in sectors such as diagnostics, petrochemical, electronics and cosmetics companies. For example, Syngene worked with India’s bestselling soap brand and helped the company change a little bit of chemistry to improve its shelf life and reduce their operating cost. “It is not Nobel Prize-winning science, but it did something useful for that client,” says Hunt. The company has been reducing its dependence on the top ten clients, whose contribution has moved down from 71% in FY15 to 66% in FY19.

Gandhi points out that such diversification is important because as you move away from reliance on top ten clients, it gives you breathing space and supports revenue growth, which is what is happening over the past few years at Syngene.

Besides a well-diversified, yet integrated business model, Syngene’s key strength is also the fact that it operates from India despite 95% revenue coming in from international markets. An analyst, requesting anonymity, states that this gives them a cost advantage as compared to cost of resources in the US. So while the company earns in dollars, it spends in rupees (The company has hedged its FY20 revenue at Rs.72 for every dollar. FY19 revenue was hedged at Rs.69). Secondly, it benefits from a huge pool of talented resource domestically and trains them to work as per global standards.

“I think the success of Syngene is driven by a combination of Indian energy and talent. There are a lot of young bright graduates studying tough sciences such as chemistry, biology. Plus they have good English language skills. So this, coupled with our global client base, makes it a lucrative opportunity in India,” says Hunt, who has worked with AstraZeneca and Bayer Schering Pharma before taking over as the CEO in 2016, after the retirement of Peter Bains.

Ask him what he had on his priority list after he took over and he says, “Being a new CEO in the business is to not try and change everything but to really build on what’s good and strong. And I think that is part of what we did.”

Branching Out

While the discovery and development verticals continue to register strong growth, the company has also turned its focus to ‘manufacturing’ of molecules to further leverage their existing relationships with clients. Of the $350 million, out of a $550 million capital expenditure plan, spent between 2016 to now, $50 million has been directed towards the establishment of a new commercial-scale facility in Mangaluru (SEZ). The facility is likely to commence operations by the end of FY20.

According to Siddhant Khandekar, analyst, ICICI Securities: “Scaling up of Syngene’s manufacturing is likely to gain momentum two to three years down the line.”

A step into manufacturing also means an increase in regulatory requirements. But Hunt isn’t worried, simply because they already operate to global standards. “We are already, in the earliest discovery stage work, compliant to regulators around the world. Credit goes to Kiran (Mazumdar-Shaw, MD, Syngene),” says Hunt.

This means not just sophisticated systems and processes in terms of infrastructure, but also thorough education for all employees on safety. “Performance appraisals, promotions, everything is linked back to how the person demonstrates the right safety behaviour. And we invest in the best preventive measures,” says Hunt.

The importance on safety and quality is also stressed by Guha, who adds that the main challenge for CROs will be that they maintain the same quality bar on their new accounts that they have on their old accounts. “My biggest worry is that one bad apple or bad incident could paint the entire industry with a brush,” he adds.

A Yes Securities report notes that investment in safety and compliance is likely to lead to slight compression in margin, which will reverse over time. Ebitda margin has remained under pressure over the past five years contracting from 32% in FY15 to 29.9% in FY19. The ICICI report too notes that on the margins front, the company is witnessing some pressure due to compliance, safety and quality-related expenses besides employee addition.

“Company margins are under pressure as they are investing a lot in capex. Once they get scalability, the margins are likely to improve. During FY19-21E, the margins are likely to remain somewhat muted as the company remains in investment mode (higher fixed costs, employee addition). So for the next two years, focus will be on volume and margins are likely to see a dent. But they will be able to maintain their revenue growth. We are expecting 22% growth in FY20E and FY21E,” says Khandekar. Over the same period, the margins are expected to remain at the same level, marginally contracting to 28.9%.

While margins may remain a challenge in the short term, the company is likely to witness a huge growth in the coming years once the Mangaluru facility is fully operational. Khandekar points out that no other company has this kind of margin profile which remains a key distinguishing aspect vis-à-vis global competitors. Also, unlike competitors, Syngene has a huge growth potential because of its smaller size. It competes with players such as Charles River Laboratories, ICON and Quest Diagnostics globally and players such as Sai Advantium, Divis Life Sciences and Dishman in India. Thirdly, most contract research players are mainly into development and not in discovery.

A proven track record on consistent quality and robust growth might provide a cushion for the company as it ventures into newer territories. But as their tagline says, it is about ‘putting science to work’. To sustain this growth momentum, Hunt already has his task cut out. Of the $550-million capex plan drawn in 2016, the remaining $200 million will be invested over the next two years. This will be evenly spread across key verticals, with a little bit of tilt towards manufacturing, biologics and smaller molecules ($75 million for Mangaluru, and $125 million for biologics facility expansion in Bengaluru and R&D centres at Bengaluru and Hyderabad).

Consequently, these investments will result in newer client additions as well as additional service requirements from existing clients. “The one area of course — not in the near term but in the long term — which will show more growth just because it is coming off a smaller base will be the fourth business vertical — the manufacturing service. We will try to ramp it up,” he says. The company’s revenue is expected to grow at a CAGR of 22.1% to Rs.27.21 billion by FY21 while net profit is expected to grow at a CAGR of 11.3% to Rs.4.09 billion in the same period. Ebitda is expected to grow at a CAGR of 21.1% to Rs.7.86 billion in FY21 from Rs.5.36 billion in FY19. “Overall, the company remains well poised to capture opportunities in the global CRO space,” notes the ICICI report.

And as Hunt highlights in the beginning, for Syngene, discovering and developing the key to unlock success doesn’t seem to be a difficult task.