Every year, around the Budget, Outlook Business reporters visit industrial clusters across the country with the objective of ascertaining business sentiment. As is now obvious, the report card for FY16 does not look pretty, and most clusters are praying for serious respite. This was not the case last year, when optimism was the clear theme after a long period of despondency. In early February, our reporters made their way to 11 industrial clusters — Khatauli and Kanpur in Uttar Pradesh, Jagatpur in Cuttack, Vijayawada, Hyderabad, Erode, Tiruppur and Karur, Butibori in Nagpur, Pune, Surat and Sanand.

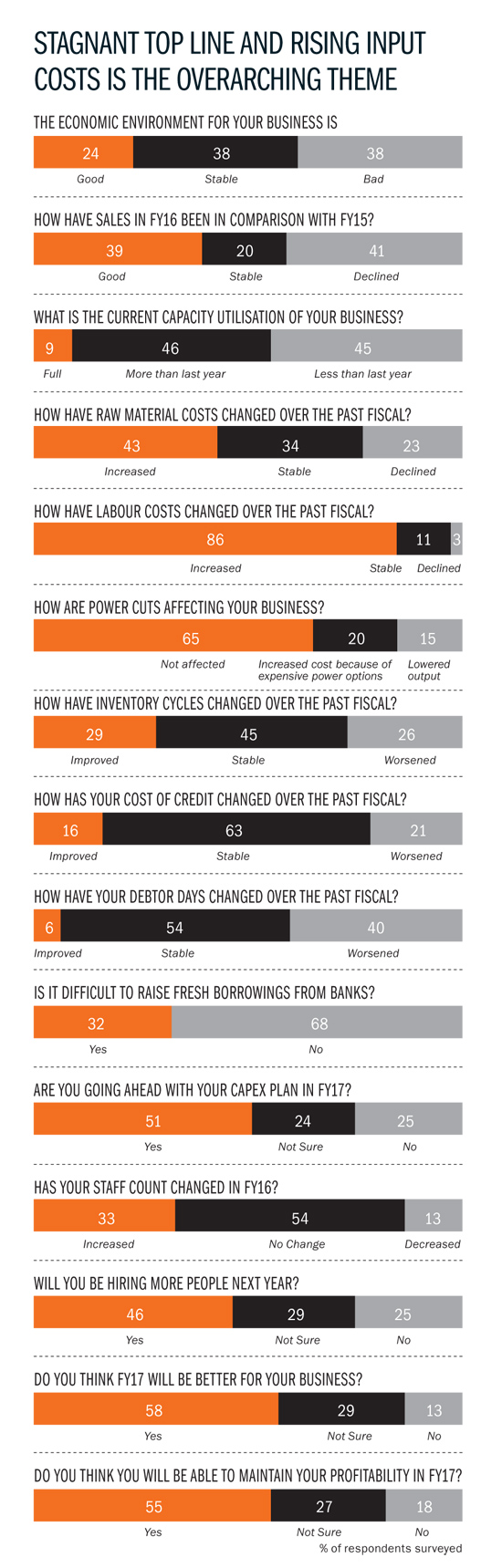

Of the 112 units surveyed, 39% said business was better than the year gone by, while 20% maintained it was stable. In all, 58% said FY17 would be better for business, with 55% sure they would maintain profitability. That said, there is a caveat which we shall come to at the end. Looking back, at the beginning of FY16, 70% of the respondents had felt sales would be better or stable. Of course, that optimism was powered by the results of the general election in May 2014.

Of the 112 units surveyed, 39% said business was better than the year gone by, while 20% maintained it was stable. In all, 58% said FY17 would be better for business, with 55% sure they would maintain profitability. That said, there is a caveat which we shall come to at the end. Looking back, at the beginning of FY16, 70% of the respondents had felt sales would be better or stable. Of course, that optimism was powered by the results of the general election in May 2014.

In the north, sugar mills in Khatauli and the leather cluster in Kanpur are battling tough times. The sugar industry is in dire straits, with farmers’ dues not being cleared by mill owners. The mismatch between the price of cane and sugar has caused much resentment among mill owners. Some companies have been in the red for over five years and are counting on policy correction to rectify the situation. In Kanpur, home to a leather cluster, exports are in a bind as prime markets like Europe and Russia aren’t buying enough. The entrepreneurs there are a harried lot, and rising raw material prices and environmental issues have added insult to injury. As many as 91% complain of declining sales, with capacity utilisation levels for 73% being less than last year. Moving east, you see the same despondent mood in Cuttack’s Jagatpur cluster: every respondent there has had a problem raising money from banks. While 75% said the environment for business was bad, 83% exhibited no confidence that profitability would be maintained. Be it power cuts, tax harassment or an ineffectual single-window clearance mechanism, Cuttack is battling all, but the real problem is a weak domestic economy.

Power down

A perverse benefit of the downturn is that most companies across clusters have stopped complaining about electricity — 65% of respondents said power cuts weren’t an issue. That’s clearly the result of a weak economic climate that has resulted in low capacity utilisation and reduced overall demand for power. As things stand, the global slump is causing much pain in India, thanks to Chinese dumping. Be it steel products or pharma, companies are in pain, as they are unable to withstand competition. Hyderabad, now the capital of Telangana, has seen over 100 bulk drug manufacturers shut shop as they lost orders to Chinese manufacturers. The industry has also been facing USFDA heat. Still, pharma is putting up a brave face, hiring people and working on a product pipeline. Thanks to new capital Amaravati, which is close by, businesses in Vijayawada sound a lot more cheerful. The task at hand is to bring in big-ticket investments and ensure basic infrastructure such as good roads and a large airport, so that this predominantly agri-focused region can transition to being an industrial hub. 64% of respondents there said they will hire more people in FY17.

Another vibrant spot is Tiruppur, the knitwear capital of India. The cluster is now clamouring for skilled labour as business is buoyant, a sharp contrast from two years ago, when business was at its lowest ebb. Competition from Bangladesh and Pakistan had folks here crying hoarse back then, but the moolah is now back. Here, 85% of businessmen say they will invest in more capex, and 100% of respondents believe profits will grow. The story in neighbouring Karur, a big base for home textiles, also borders on optimism, with expectations of steady growth. But rising labour costs continues to be a pain point.

Over the past few years, however, businessmen across the country have reconciled to higher costs, be it labour or raw materials. This year, 86% of respondents complained that labour costs have increased. Higher labour costs did not matter very much when business was doing well, as most of it would be absorbed. With the scenario now looking less favourable, companies are looking at different ways to tackle this issue. While Erode, with its multiple industries, is insulated, in Surat, India’s diamond capital, units have slashed salaries by about 30% instead of showing workers the door. Several other clusters are just chugging along, waiting for a turnaround.

Wishing, waiting

It already seems like a long wait. In Sanand, the much touted upcoming automobile hub, a worrying 75% of respondents confess to utilisation levels being less than last year, with the sector going through a very challenging period. Sales have declined for 62% of the respondents, with the same number, not surprisingly, being unsure about business or profit looking up in the next fiscal. Ditto for Butibori in Nagpur: its steel re-rolling industry has its back to the wall, with a host of problems to contend with; Chinese dumping and low demand are the prime problems. Plants have scaled down production or have shut shop. Inventory cycles have worsened and the overall economic environment is not looking up, companies say. In Pune, a fledging industry is food processing. It has its problems but entrepreneurs here are brimming with confidence and ideas to scale up, as the market for packaged foods is growing. Now, for the caveat, while 58% of the respondents surveyed feel that FY17 will be better for business, the skew there flows from the optimism in Tiruppur- Karur, Hyderabad and Vijayawada.