Praj Industries was among my career-best picks which I had recommended in 2002 at around Rs.5 when its face value was Rs.10. It was an undiscovered story then, which also caught the imagination of discerning investors, including Rakesh Jhunjhunwala and Vinod Khosla. I exited with 400x return when the company, after a trailblazing performance, entered a phase of maturity and consolidation. It did move up further and corrected. Still the-then Rs.4 crore market cap company is now worth Rs.1,400 crore. I am now revisiting the stock after a gap of nearly a decade as I believe the company is entering its next phase of growth. However, as a matter of abundant caution, do not expect a return anywhere close to what I had fetched earlier!

Praj is a process engineering and solutions provider for bio-ethanol, water and waste water treatment as well as brewery plants. Fuel ethanol is the main focus for the company in India and globally, as there is an ever-increasing mandate for ethanol blending to reduce greenhouse gas emissions. The ethanol business is largely driven by blending mandates in different countries and also gets a fillip when crude turns bullish.

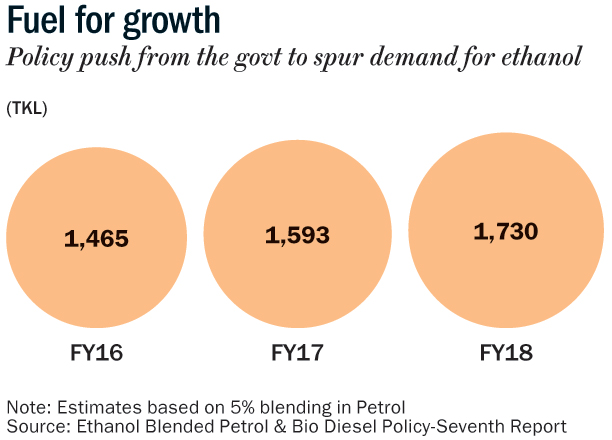

Policy push

Currently, the blend is below 5% in India but there is a concerted push from the government to achieve the mandated blend of 10% at the earliest. This would need 2.9 billion litres of ethanol at the current gasoline consumption level and Praj is by far the leader with 70% market share. Nitin Gadkari, the union transport minister, recently stated that the government would look at increasing the blending to 22.5% for petrol and 15% for diesel which would mean a multi-fold increase in capacity and resultant business for Praj. Currently, in India, ethanol is mainly produced using sugarcane molasses as a feedstock. This is going to undergo a major shift with second generation (2G) lignocellulosic ethanol plants equipped to work with multiple feedstocks, including crop residue and farm waste such corn cobs, rice or wheat straws and bagasse. The first-generation plants use sugary feedstock such as molasses or starchy feedstock such as grains.

With the national biofuels policy in place, the government has been nudging oil marketing companies (OMCs) to set up bio-ethanol projects with 2G plants. Each of these projects would have a capex of about Rs.500 crore and OMCs would take the lead in setting up the first 10 projects. Praj recently signed pacts with Indian Oil Corporation and BPCL for 2G bio-ethanol projects and this is just the beginning of a new chapter for the company. It is not just a technology and equipment selling contract but, Praj would also be partnering with the OMCs to build, operate and maintain the plants.

Further, the sugar sector, which is the biggest producer of fuel ethanol, is back on track after a gap of nearly six years and this bodes well for Praj, as fresh capex could be expected going ahead. The recent Opec output cut, which could result in a rally in oil prices in the new year, could be another catalyst for accelerated compliance of the blending mandate.

A recently passed Industries (Development and Regulation) Amendment Bill is positive for the sector as it facilitates inter-state transport of fuel ethanol eliminating state-specific duties and permissions, thus placing it as a central government subject. However, the demand from the Indian Sugar Mills Association is to put it in the exempt category under GST, as it helps reduce environment pollution, as well as reducing the import bill. If that is accepted for at least a lower slab, it would be a huge booster.

Looking beyond

Praj is not just an India-centric player but has a global presence with a significant share in South American, African and south-east Asian markets. A notable fact is that all the plants in Colombia have been installed by Praj. Overall, the company exports technology to 75 countries, including the UK and Belgium. In other words, Praj’s technology accounts for 7% of the total ethanol produced in the world.

Praj Matrix, the company’s top-notch R&D facility in Pune is engaged in research in the emerging areas of industrial biotechnology such as second-generation biofuels, advanced biochemicals, and health and wellness products. Praj has 16 patents now and about 79 patents are at various stages of approval.

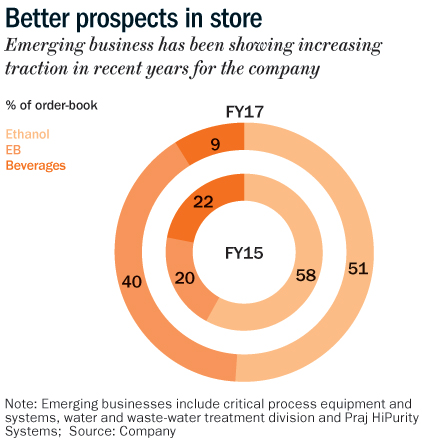

Again bio-ethanol is not the only sector of specialisation for Praj. Water and waste water treatment, too, is an emerging business opportunity. The company, which had taken over Neela Systems in 2012 and renamed it as Praj Hi-Purity Systems, is now the ‘emerging businesses’ division of the company. This division provides value-added solutions to food and beverages (F&B), biotechnology, cosmetics and healthcare sectors for their requirement of sterile process water generation. Stricter standards for pharma and F&B sector ensure ample business opportunity for Praj. They also have a prominent exposure to waste water treatment, where they have over three decades of experience. The Critical Process Equipment and Systems division designs and manufactures equipment such as heat exchangers for oil and gas, storage vessels, and related sectors.

Praj has successfully installed sustainable solutions across sectors. The stricter pollution norms for coal-fired thermal power plants and industrial effluent plants for utilities, chemicals, F&B should have a positive impact on Praj’s business. This division has been clocking a CAGR of 24% over the past four years and forms about 40% of its pending order-book. Praj forayed into brewery plants business in the ’90s and has more than 100 successful installations till date. But this business now accounts for a smaller share of its topline at 11% and 9% of the order backlog.

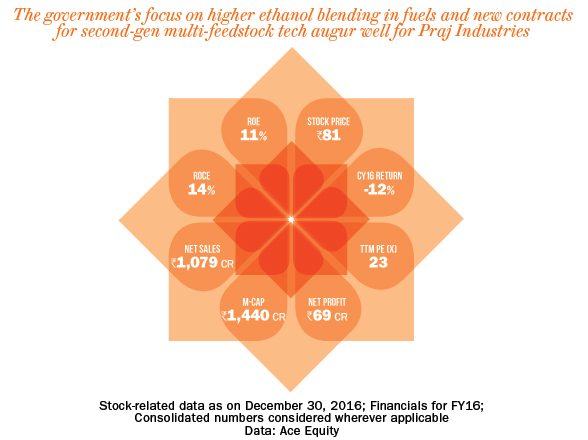

I believe Praj, with its proven technological skills and growing global environmental conciousness, should witness an era of high growth in the years to come. At Rs.81, the stock is available at 15 times estimated FY17 earnings of Rs.5.10 and 12 times estimated FY18 earnings of Rs.6.80, thus offering a decent upside for those who have a long-term investment horizon.

The author has an interest in the stock and has recommended the stock to his clients