Satyabrata Mohanty, 44, didn’t exactly start out to become the star fund manager he is today. After completing his CA in 1997, Mohanty joined the Aditya Birla Group as a management trainee in 1998. His first job as an executive assistant to Debu Bhattacharya, the managing director of Hindalco, involved coordinating between the MD and the various business heads, analysing the business and giving inputs to the MD.

As a management trainee at Aditya Birla Group, Mohanty was to do a stint across all group companies. By 2000-end, Mohanty was moved to the asset management business. When Mohanty joined Birla Sun Life as a credit analyst, he decided to stay on with the AMC. From being a credit analyst to managing funds in the fixed income team and then becoming co-head of fixed income funds in 2003, Mohanty’s responsibilities at Birla Sun Life grew at a rapid pace. He started managing equities in 2009 and has since never looked back.

He first got curious about equity investing when he was doing his CA. His friends would give him regular updates about their stock market exploits. Mohanty even read George Soros’ theory of reflexivity during this time. In 2000, he made his first investment in Blue Dart around Rs.100. His first investment went on to teach him the importance of picking a quality stock with good management and more importantly, the power of compounding. Though he modestly admits that it was a stock he just got lucky with.

Spotting winners

Mohanty started managing equities for hybrid funds in 2009 and by then Blue Dart was trading around Rs.700. Armed with his first lesson that it pays to find quality companies and stick with them, Mohanty was set to repeat his success with hybrid funds.

He prefers to invest in companies with a steady growth profile and ones that can compound at 20% over a long period of time. “Somebody with high expectation may overlook these companies,” he says. It is not that he has a perennial distaste for cyclical stocks, but he prefers the slow and steady stories.

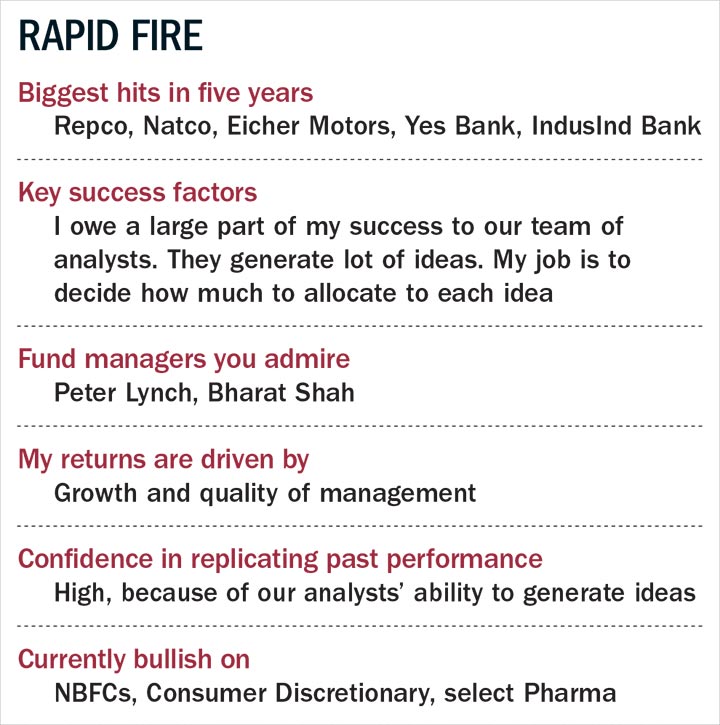

Banking and financial services have been his favourite hunting ground to find these slow and steady stories. According to data from Value Research, seven of the top 10 stocks that have done well for Mohanty over the past five years, belong to the BFSI space. Yes Bank sits on top of that list. In September, 2013, when the Birla Sun Life Advantage Fund bought Yes Bank, it wasn’t exactly a market favourite. While there were no NPA issues in its corporate loan book, investors still had some concerns about its quality. However, what caught Mohanty’s eye was the fact that the bank was working on increasing its retail assets, which was a stable business. It was a call that worked well and the stock has since raked in a profit of Rs.100 crore for the fund.

In the banking space, he prefers retail-oriented banks over and corporate asset-focused private sector and PSU banks. “Market share has been shifting steadily from PSU banks to private banks and that trend is likely to continue. So we try to identify banks that have low NPAs, that are more retail-oriented and can grow their bottom-line at 20-25% on a consistent basis,” he says. For Mohanty, his investments in IndusInd Bank and HDFC Bank have reaped good returns as well. He first invested in IndusInd Bank in May 2012 and the stock has gained more than 4x. Similarly, HDFC Bank where he first invested in September, 2014 has gained 54% in value.

In the Advantage Fund, Mohanty is betting on private and select PSU banks such as State Bank of India, Bank of Baroda and ICICI Bank which are looking to recover from asset quality issues.“There has been a growing sense in the banking industry that the stress in the system is about to end. We also feel that could be the case. But, one cannot say it with certainty yet. That is why we wanted to be in large liquid names, so that we can exit if the problems persist,” he points out. He is also betting on housing and consumer finance companies as he believes the consumption boom in India is here to stay. “There is a lot of disposable income coming in and this disposable income would create demand across two-wheelers, four-wheelers and consumer durables,” he adds. Bajaj Finance, one of the consumer finance companies he invested in through Advantage Fund has done well for him.

In the Advantage Fund, Mohanty is betting on private and select PSU banks such as State Bank of India, Bank of Baroda and ICICI Bank which are looking to recover from asset quality issues.“There has been a growing sense in the banking industry that the stress in the system is about to end. We also feel that could be the case. But, one cannot say it with certainty yet. That is why we wanted to be in large liquid names, so that we can exit if the problems persist,” he points out. He is also betting on housing and consumer finance companies as he believes the consumption boom in India is here to stay. “There is a lot of disposable income coming in and this disposable income would create demand across two-wheelers, four-wheelers and consumer durables,” he adds. Bajaj Finance, one of the consumer finance companies he invested in through Advantage Fund has done well for him.

Mohanty is betting on the consumption theme in more ways than one. “I have been trying to play the consumption story through consumer discretionary such as autos, consumer durables, retail-oriented banks and through cement to some extent,” he says. Mohanty first invested in the New-Delhi based cement player Dalmia Bharat in June 2014, when the price was somewhere around Rs.458. Today the stock is sitting pretty at Rs.1,910 and has generated a profit of nearly Rs.87 crore for the fund. “Getting into stocks at an attractive valuation and then riding the improvement in operational performance has helped us generate better returns,” he says.

His investment in the Kochi-based consumer electronics company, V-Guard in 2014 was also a bet on the consumption theme, only it took some time for the idea to play out. When he first invested in the stock at around Rs.82, the company was working on expanding its presence in the rest of the country. Mohanty was convinced about its growth story, but for a year the stock went nowhere. But Mohanty wasn’t too hassled since the company’s numbers were in line with his expectations and he knew it was only a matter of time before the stock performed. And surely enough it did. The stock currently trades around Rs.212.

His investment in the Kochi-based consumer electronics company, V-Guard in 2014 was also a bet on the consumption theme, only it took some time for the idea to play out. When he first invested in the stock at around Rs.82, the company was working on expanding its presence in the rest of the country. Mohanty was convinced about its growth story, but for a year the stock went nowhere. But Mohanty wasn’t too hassled since the company’s numbers were in line with his expectations and he knew it was only a matter of time before the stock performed. And surely enough it did. The stock currently trades around Rs.212.

While some of his investments have been slow starters, some of them have generated returns way beyond his expectations. Take the case of Eicher Motors for instance which he bought for the Advantage Fund in June, 2013 at an average price of Rs.3,510. The stock currently trades at Rs.24,718, a more than 7x increase. When Mohanty bought the stock, he expected it to yield 25-30% kind of return but as the company kept delivering better-than-expected numbers quarter after quarter, he held onto his investment and kept adding to his position. The company not only had a virtual monopoly in the segment it was operating in but also the consumption theme that he was betting on was starting to unfold.

For Mohanty, steep valuation is not a problem as long as growth justifies the valuation. “Some of our investments have exceeded our estimates. We have held onto them and have even added to our positions. As long as the company is delivering numbers as per our expectations, we are okay to hold on. If the company has a premium positioning, it gives us that extra comfort to hold on to the position,” he says. IndusInd Bank and Yes Bank are some of the investments that continue to be part of Mohanty’s funds even after they have delivered better than his expectations.

He believes that housing finance companies will also join the long list of outperformers. “HFCs that are focusing on small-ticket housing finance should do well. As India becomes more industrialised, you will see a lot more people migrating from rural to urban areas. This should create long-term demand for low-cost housing and small-ticket housing loans. So we remain positive on the long-term prospects of housing finance sector.”

He believes that housing finance companies will also join the long list of outperformers. “HFCs that are focusing on small-ticket housing finance should do well. As India becomes more industrialised, you will see a lot more people migrating from rural to urban areas. This should create long-term demand for low-cost housing and small-ticket housing loans. So we remain positive on the long-term prospects of housing finance sector.”

Mohanty first invested in the Chennai-based Repco Home Finance in May 2013 at an average price of Rs.198. The housing finance company’s average ticket size is around Rs.18 lakh but more impressive is the processes and risk controls that it has put in place that has ensured that asset quality doesn’t suffer. As a result, the stock currently trades more than 3x his average purchase price.

Getting it right

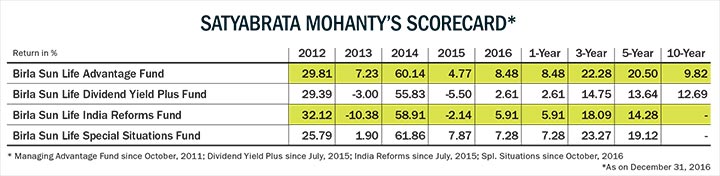

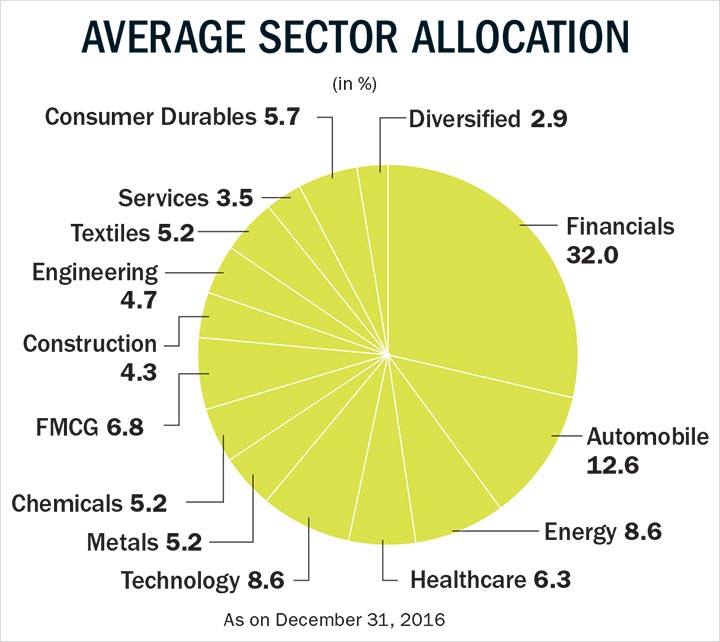

Mohanty’s starting role as a credit analyst has stood him in good stead as an equity manager. “My job as a credit analyst was to analyse the economy, interest rates and gauge the direction that the monetary policy was taking. It entailed focusing on cash flows as you cannot repay debt if you don’t have good cash flows. That is why when I started managing equity funds, I started with a top-down approach. I feel identifying the right sector is critical. After identifying sectors, one can identify the companies,” he says. “That is why in my portfolio you will see a large allocation to three-four sectors.” For instance, Birla Advantage has 30% weight towards the banking and financial services space, followed by 11.26% in auto.”

Markets often have a way of teaching investors valuable lessons along the way and Mohanty surely has had his share of learning. Take the 2008 crisis where everyone had something to learn from. It taught Mohanty to be more careful when it comes to investing in high beta stocks. “I don’t believe high beta stocks generate returns over long periods of time. Typically, low beta stocks outperform over a business cycle. Earlier, one would look for opportunities which can double in a year. We have seen that if you try to make money fast, you don’t. However, if you have reasonable expectations and find a good management, it is then that you find the outliers.”

Mohanty also feels that sometimes it is better to wait for something to change at the margin and wait for signs of revival on the ground before turning bullish on a particular sector. For instance, his funds went overweight on capital goods about three years ago on expectations that private capex will happen following the decisive victory of the Modi-led government. However, things didn’t play out as expected. Capital goods companies continue to see sluggish order book and muted earnings.

Mohanty also feels that sometimes it is better to wait for something to change at the margin and wait for signs of revival on the ground before turning bullish on a particular sector. For instance, his funds went overweight on capital goods about three years ago on expectations that private capex will happen following the decisive victory of the Modi-led government. However, things didn’t play out as expected. Capital goods companies continue to see sluggish order book and muted earnings.

While Mohanty has been learning from his colleagues and other money managers, Peter Lynch’s advice on keeping things simple and investing in simple businesses has gone a long way in helping him in stock picking. Working with Bharat Shah, before he quit Birla Sun Life, also influenced Mohanty’s style a great deal. “His ability to see the potential growth of a company over longer periods of time and the focus on balance sheet and cash flows have helped me in my calls,” says Mohanty. From A Balasubramanian, who is the current CEO of Birla Sun Life AMC, Mohanty has learnt that one must not have any ideological biases. “He taught me that one shouldn’t get attached to a stock or an investment theme and that you must stay open-minded,” he says.

The thrill now, according to Mohanty, is in finding the next ‘20-something’ compounding machine and given his track record, he should have no trouble bagging one.