How diverse businesses could fetch non-linear profit from similar capital has always intrigued Vinay Paharia, who grew up watching his own relatives dabble in varied businesses — albeit on a much smaller scale — right from trading to chemicals to software. “It all seemed very fascinating to me,” he says. But instead of trying his hand at the family business, Paharia chose to complete his MBA and CFA to pursue a career in finance. “Until my graduation, I never knew that a formal career in equities was possible,” smiles the 36-year-old, who today manages Rs.600 crore in cumulative assets across Religare’s Mid N Small Cap funds, besides co-managing the Business Leaders and Tax schemes with Vetri Subramaniam, who is also the chief investment officer of the company. During his MBA, microeconomics was what caught Paharia’s fancy, as it dealt with businesses and the markets. But once he got a chance to read Peter Lynch’s One Up On Wall Street, Paharia knew his calling lay in investing. Back then, the most important takeaway from Lynch’s lucid tome for him was that stocks were slaves of earnings. “The fact that, irrespective of economic booms and crashes, stocks — over a period of time — always followed earnings was so insightful,” says Paharia, who got his first break with First Global after completing his CFA and later went on to work with KR Choksey and DBS Cholamandalam AMC.

From each of his bosses — including Subramaniam — Paharia says he learnt some unique lessons. If Devina Mehra introduced him to the rigours of analysis, Kisan Ratilal Choksey taught him how a passion for long-term investing can be transformed into good investment ideas, while Pradip Pathak at Cholamandalam trained him to have a process-driven mindset and a dispassionate approach to stocks. “If the facts change, your view, too, has to change,” says Paharia, who holds close to 50 stocks in his portfolio. Following are the parameters that he keeps in mind while picking stocks: first, the business should generate a RoC higher than 15% per annum on a sustainable basis, although it could have lower RoC in the interim. “Internally, we use 15% as the cost of equity and, hence, would want the company to generate a positive economic spread to create value. For us, that is the definition of a good business,” says Paharia.

The second parameter is good management, which the fund house believes is evident from how prudent the capital allocation record of the management is, especially in mid caps. “There are only two ways to allocate: one is that you plough the money back into the business and the other is that you return it back to shareholders. That track record itself will speak volumes about the quality of the management,” says Paharia. The third aspect that the fund looks at is the execution track record. “The biggest clues about the management come from its past history. You can never judge the top management just by meeting the board members, as you will end up getting sold on their ideas. As investors, we place far more emphasis on what has happened than what will happen. Hence, the 10-year track record of the company is more important than what the management hopes will play out over the next five years,” he says.

When it comes to valuations, Paharia believes that in the current context, investors should be cognisant of not extrapolating the current outlook into the long term. “If the business has momentum, I shouldn’t extrapolate lifetime high profit margins in my long-term forecasts. The same rule applies if a business is suffering in the short term. The only way one can arrive at a reasonable value is by normalising the numbers,” says Paharia. Talking about how his team ascertains the reasonable value and margin of safety, he explains, “The value of any asset is the sum total of all future cash flows it can yield, but there might be huge variations in the final value depending on the way you compute cash flows. After all, this is not a precise number but an approximation. Our objective is that, over a period of time, the market prices converge with the underlying value so that we get the benefit of both the discount rate [15% every year] and the value gap closing in.” All the stocks that the team screens have to make it through the above-mentioned filters and seven additional parameters, the first three of which are related to growth. This includes a parameter that deals with companies whose growth is relatively higher than the companies under coverage and others in the industry. Internally, the fund house calls them ‘stars’.

Seeing stars

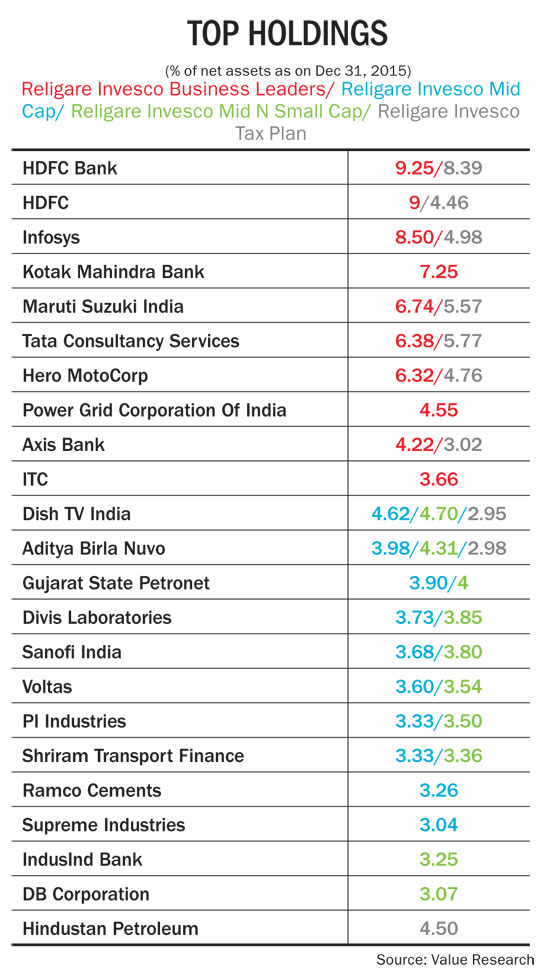

“High-growth companies have the inherent ability to expand their profitability once operating leverage kicks in,” explains Paharia. If one was to take a look at the company’s portfolio, an investee that falls under this category appears to be Aditya Birla Fashion (formerly, Pantaloons Fashion & Retail). The company is India’s largest pure-play fashion and lifestyle player, comprising the brands and retail businesses of Madura and Pantaloons. While Madura has four leading brands under its fold (Louis Philippe, Van Heusen, Allen Solly and Peter England) and a network of 1,735 stores across the country, Pantaloons is one of India’s largest affordable fashion retailers, with a presence in 49 cities and 134 stores and a strong portfolio of exclusive private brands (which form nearly 52% of its revenue). Given that Madura is looking at incremental store additions through company owned franchisee operated (COFO) or franchises owned franchises operated (FOFO)formats, wherein the capex responsibility lies with the franchisee, RoE is expected to trend higher in the coming years. The stock accounts for 1.45% of the mid-cap fund’s assets. Going by the same yardstick, Dish TV, at close to 5% of assets in the mid-cap fund, falls in the high-growth bracket as well. The company is India’s largest DTH player, both in terms of subscriber base and revenue. It is also among the first-listed pure-play DTH companies in the country to report a profit after tax in FY15, as opposed to the operating profits reported by some of the other Goliaths, for whom DTH services is just another small business segment. More importantly, its average revenue per user (ARPU), too, has trended higher — from Rs.138 in FY10 to Rs.172 as on date — and its revenue has gone up threefold over the same period to over Rs.2,500 crore.

The second growth parameter relates to companies that are leaders in their business not just by market share but also in terms of return metrics. And that is evident in the Tax and Business Leaders' scheme, where SBI is conspicuous by its absence and HDFC Bank has the highest combined weightage in the portfolios at over 16% of assets, thanks to its high RoA of over 1.8% and RoE of over 18%. The third parameter covers companies that are growing faster than the market leader. Very clearly, the fund has opted for Axis Bank, which has been growing its retail book at a fast rate. “Companies that are growing at a fast rate and taking away market share are categorised as ‘warriors’,” reveals Paharia, who holds Axis Bank across both the Tax and Business Leaders funds. Similarly, given that DB Corp has been aggressively gaining market share in each of the seven states that it has entered, the stock accounts for close to 8% of assets in all four of its schemes. Analysts expect the company to derive significant operating leverage from higher ad yields and lower newsprint cost in the near term.

The second growth parameter relates to companies that are leaders in their business not just by market share but also in terms of return metrics. And that is evident in the Tax and Business Leaders' scheme, where SBI is conspicuous by its absence and HDFC Bank has the highest combined weightage in the portfolios at over 16% of assets, thanks to its high RoA of over 1.8% and RoE of over 18%. The third parameter covers companies that are growing faster than the market leader. Very clearly, the fund has opted for Axis Bank, which has been growing its retail book at a fast rate. “Companies that are growing at a fast rate and taking away market share are categorised as ‘warriors’,” reveals Paharia, who holds Axis Bank across both the Tax and Business Leaders funds. Similarly, given that DB Corp has been aggressively gaining market share in each of the seven states that it has entered, the stock accounts for close to 8% of assets in all four of its schemes. Analysts expect the company to derive significant operating leverage from higher ad yields and lower newsprint cost in the near term.

The remaining four parameters that the fund house looks at before buying stocks are more value-oriented. “Simply put, this means buying cheap assets or cheap earnings,” explains Paharia. Which is probably why he has bought into Gujarat State Petronet, a gas transmission utility that has its current core network in Gujarat and which now accounts for 8% of assets in the mid-cap and small-cap funds. This is because the company, which generates RoCE upwards of 12% and RoE of 15%, is trading at a discount to fair value at the current level. Also, given that consensus on the Street values Redington India at 10x one-year forward earnings, Paharia, too, seems to have taken a liking to the stock, which accounts for over 4% of assets across three of his schemes. Paharia had also purchased GE Shipping in the past as it was trading at a discount to net asset value, but sold it once the valuation discount narrowed. Some other parameters that could prompt Paharia to buy a stock are the company being in the middle of a turnaround or some other special situation. The fund scrutinises companies that have near-term catalysts such as demergers or spinoffs on the horizon or if the investee is actually a holding company that is going to list a subsidiary that enjoys a higher valuation.

If one was to consider the turnaround criteria, then VIP Industries seems to fit the bill. The luggage company, which went through a lean patch, has, of late, been aggressively building its brands — Skybags, Carlton and Caprese, resulting in the company’s market share rising to 45%. Given that the Street expects VIP to grow sales at 15% CAGR and operating profit at 18% over FY15-FY18, it’s not surprising to see Paharia holding the stock [4% of assets] across three schemes. Similarly, in the case of Aditya Birla Nuvo, which accounts for nearly 8% of assets across the two schemes managed by Paharia, it’s clear that the fund house, just like most analysts, is looking at unlocking value. The commodities space is another target that makes the cut for Paharia. “But the company needs to be well placed in the cyclical business,” he adds. Which is why he has picked up Ramco Cements. The Chennai-based company, a victim of oversupply, is best placed in the pack, given that it has plants closer to the market and a strong brand, and has worked on its cost structure, resulting in better profitability per tonne. Paharia owns the stock across two of his schemes, accounting for 7% of assets.

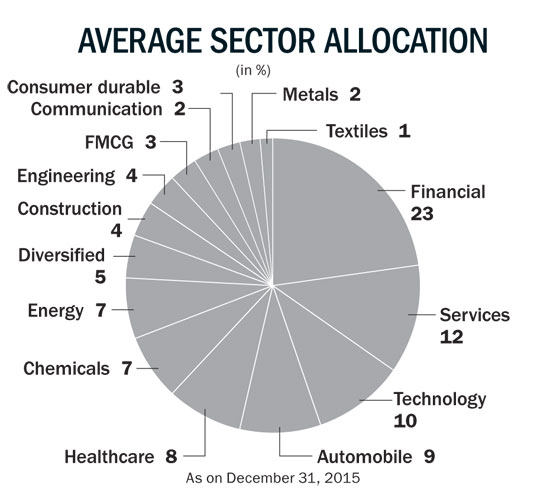

With the market now cooling off from the highs, Paharia believes that based on 12-month trailing earnings, the market is closer to its long term average after having traded at 20% premium about a year back. From a top-down perspective, sectors where the underlying valuations are reasonable and the underlying earnings are suppressed is where the fund house is sensing an opportunity. “Our sectoral views get reflected in our large cap fund, where we are overweight on consumer discretionary and financials and underweight on staples where we see valuation concerns, besides materials and industrials,” says Paharia.

In the mid-cap space, given that the mid-cap index has outperformed large caps by 40% over the past two years, there is a distinct possibility that the next leg of correction would be seen in mid-caps. “Though mid-caps comprise a very wide bouquet of stocks, you can’t paint all of them with the same brush. But there could be some catch-up. Either the large-caps catch up with mid-caps or vice versa. In short, there will be a reversion to the mean,” feels Paharia.

Given that the past five years have been a rollercoaster for investors, Paharia is guarded in his prediction. “Given that equity is a non-linear asset class, it is safe to assume that returns will be in line with earnings growth and will outperform both fixed income and inflation.”

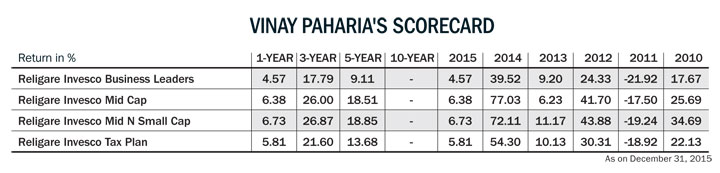

As far as the schemes he has been managing since 2008 is concerned, Paharia points out that in the past five years, the entire alpha in the Religare Invesco Mid N Small Cap Fund — which has over Rs.474 crore in assets — came on the back of stock selection. “Our bottom-up approach and decision to adhere strictly to our investment process — both in letter and spirit — have made all the difference,” he concludes.