Why does Joe Six-pack from the USA who drinks beer all day make $50,000 a year, and humble and hardworking Ram Bharose struggle to make Rs.50,000 annually? That’s what struck Manish Sabharwal, co-founder, TeamLease, when he touched down in the land of the free and the home of the brave for an MBA from The Wharton School. Seriously, why is India poor?

Ashok Reddy, Sabharwal’s partner at TeamLease, adds perspective: “In a regulated regime (where labour laws are adhered to), 5-15% of the workforce is outsourced but 100% of labour is employed in the formal space. In India, because of the multiplicity of labour laws and poor compliance, we are at 40% outsourced with barely 1.5% of labour in the formal sector.”

These stats are precisely what Reddy and Sabharwal want to change with TeamLease Services. The Bengaluru-based company is one of India’s strongest growing recruitment and staffing companies. The duo wants to put India to work, a mission that began 24 years ago.

Bitten By The Bug

Reddy and Sabharwal have been friends since their stint at the Shri Ram College of Commerce (batch of 1990). The two parted ways to pursue their careers and eventually MBAs, with Reddy going to IIM Bangalore. Around 1995, both found themselves in Mumbai and that was when the entrepreneurial bug bit.

“That is how India Life, a payroll and pension administration company, was born. At that point, that service didn’t exist in India and globally, it was a big market,” says Reddy.

Provident fund, super-annuity, gratuity schemes and all other aspects of payroll administration are run as trusts by corporates. The two began advising companies on where to invest their provident funds. Within three years, the company was working with 450-500 corporates. In 2002, when Hewitt Associates was looking for a strong India platform, it acquired the Indian firm for an undisclosed amount.

Reddy explains, “We still wanted to rule over our own kingdoms. When we evaluated what to do, the concept of staffing came about. Globally, it was a $140 billion industry (presently $200 billion, according to Reddy) but in India it didn’t exist as an organised entity.” The two saw an opportunity, founded TeamLease in 2002 and today spearhead a Rs.40 billion company that has staffed 20,000 people till date. According to Sabharwal, they are just getting started.

Luck By Chance

Reddy and Sabharwal bring two very different flavours to the table. They are similar to prose and poetry, respectively, both necessary in equal measure. They are voracious readers, but while Reddy carries himself with clinical precision, Sabharwal lavishly quotes from his favourite books, which you will find stacked in his library-like cabin.

They concur on one thing though. “TeamLease got lucky in getting into business when companies came to realise that productivity matters and that they cannot fix the supply chain of workers themselves,” says Sabharwal.

“We hit the ground running because we had clients who knew us from before. During 2002-07, the economy was opening up, many industries were being created and privatisation was picking pace,” Reddy adds.

He jokes about hanging a signage outside their offices saying, “Trespassers will be recruited.” There was a booming demand. “The sectors we were catering to at the time were telecom, retail, insurance and BFSI (banking, financial services and insurance),” he says.

And then, the 2008 market crash happened. “That was the first downturn. No one knew how to cope with it, and there were knee-jerk reactions by corporates such as cutting headcount,” he says. The regulatory environment was particularly bad for the sectors they were catering to.

“We were at 80,000 employees (for clients), but we had to scale down to 45,000. We realised we were only working on one vertical, staffing, and that we had to diversify the range of product offerings. We had to become more pan-industry, pan-India,” says Reddy. It was when they decided to step into training and employability.

The E’s of Business

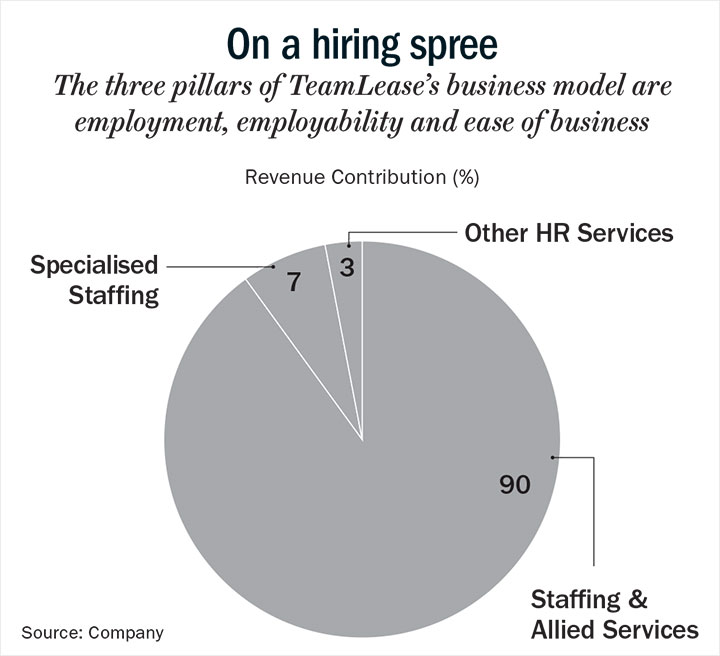

There are three pillars to TeamLease’s business model — employment, employability and ease of business, all complementary to each other. Of these, the employment vertical contributes to 97% of revenue, the balance coming from the employability business (See: On a hiring spree). The ‘ease of doing business’ vertical is at a start-up stage. At a profit before tax level, the employment cluster, volume staffing contributes about 70%, specialised staffing about 20% and employability about 10%.

Their staffing business, which offers temporary and permanent placements, has over 150,000 people on board. The company doesn’t focus on any specific sector, but their highest hires go to BFSI (17%), followed by manufacturing (15%), consumer durables (12%), e-commerce (12%) and retail (10%).

TeamLease also has a job portal for freshers — freshersworld.com. It acquired 30% of the web-portal from founder Joby Joseph in June 2017. As with monster.com and naukri.com, candidates create their profiles on the portal and TeamLease matches them with industrial requirements. “We use the database (registered candidates on the site) for our requirements, but also sell the data to corporates.”

Before the global meltdown in 2008, TeamLease handed a job to an applicant every five minutes, or as the founders claim, filled 10,000 open positions on a daily basis. “The candidates had qualifications. However, our education system is broken because of rote-learning. For candidates getting rejected, we did not have interventional measures to get them employed. That’s when (in 2009) we thought of getting into the employability aspect,” says Reddy. This was also the only time the company raised venture capital money, Rs.750 million from Gaja Capital and ICICI Venture. The second time they raised capital was in February 2016, when the company came out with their initial public offer. It was primarily to let investors realise their returns, and also let employees cash in their employee stock ownership plans (ESOPs).

The employability cluster, an on-site classroom, handles 150,000 students a year (independent of the 150,000 people employed by TeamLease for their clients) spread across various locations. Reddy says, “We have 200+ centres for the on-site vertical. The best and cheapest way to reach a wide audience is online. But effectiveness of this is lower. So, through universities, we reach out to students.” The classes use a combination of the traditional teacher-led model and TeamLease’s e-learning platform. The programmes are largely funded by the government (up to 97%) and TeamLease’s clients.

Next, ease of doing business. These are technology platforms that TeamLease gives out to enterprises to help them scale up operations. For instance with payroll outsourcing or compliance outsourcing, which are non-core functions in a corporate. Last fiscal, payroll and compliance outsourcing brought in revenues to the tune of Rs.150 million for Reddy and team.

Now TeamLease has begun building software as a service (SaaS) technology platforms for firms that do not want to outsource a workforce. Reddy, Sabharwal and team are also putting together what they call digital workforce solutions, to help corporates manage attendance, sales, asset tracking, reimbursement and so on.

Three Roles

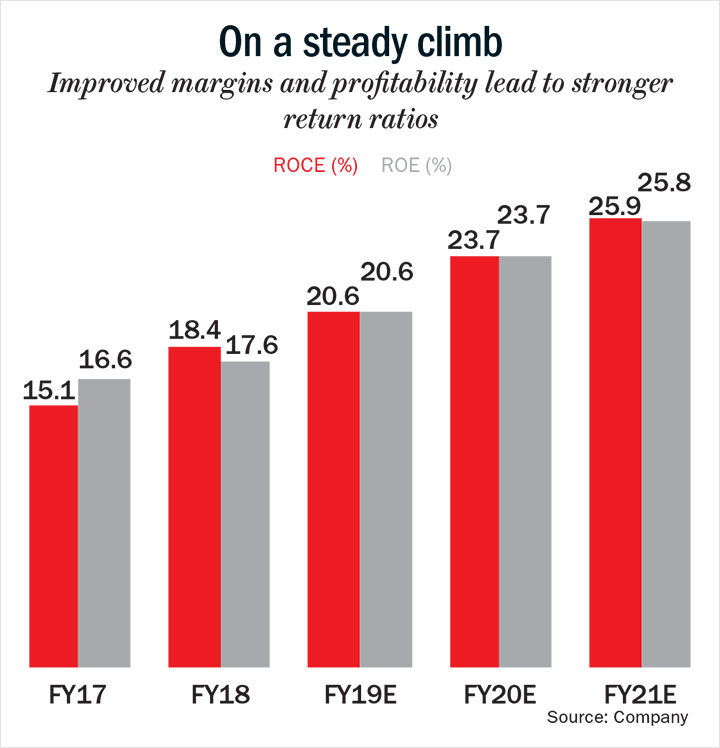

The company has posted a consistent 20-25% YoY since 2014, says Sabharwal. “We want to be consistent, we don’t want to go outside India or diversify our customer base. It’s also frugality of capital. I don’t care about revenue or growth. I care about return on equity, because that’s what you are measured on as a company,” he says (see: On a steady climb).

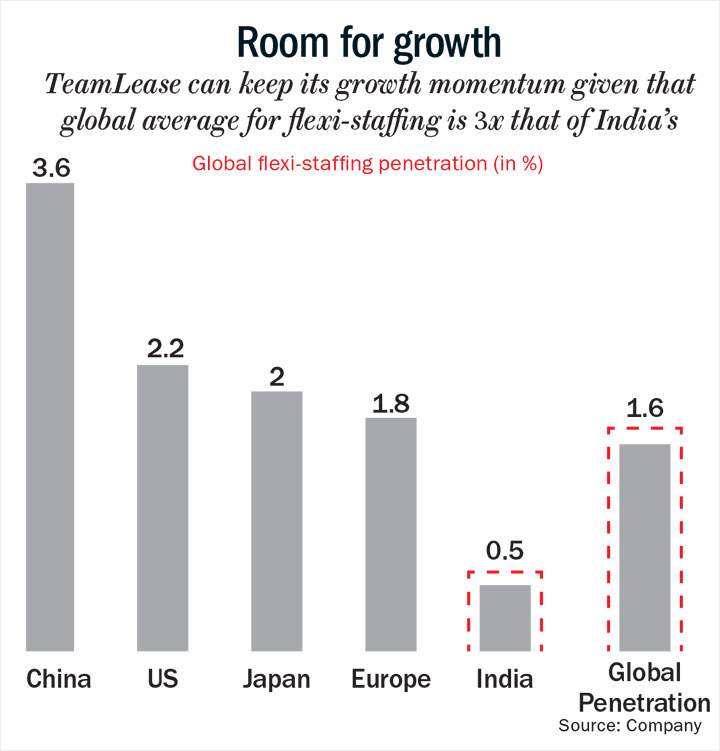

In contrast, its competitor Quess Corp, also Bengaluru based, a flexi-hiring company known for its strong revenues and relatively higher margins, has a heady acquisition rate of 23 buys so far. At present, Sabharwal and Reddy’s company has a 6% market share in the formal flexi-staffing space.

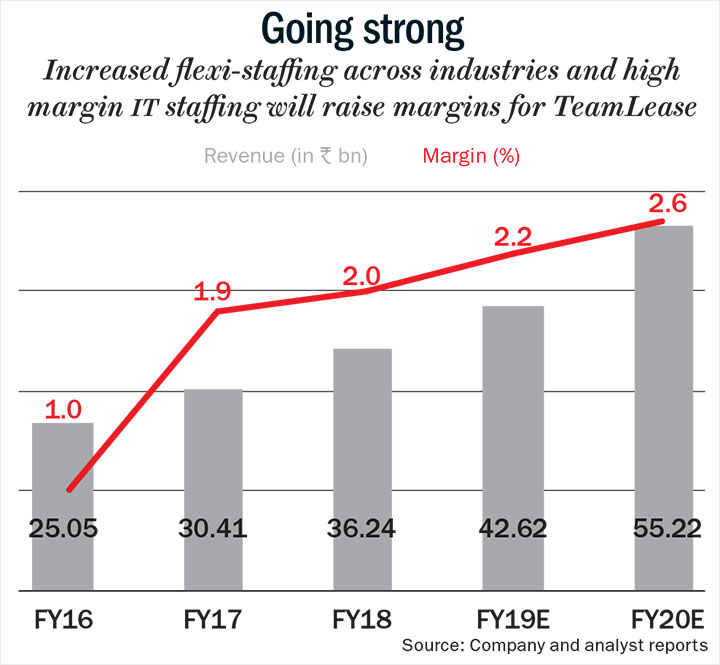

It’s worth noting that flexi-staff businesses work on low margins. That’s because the alternative, informal labour, comes at no additional cost. Despite that, TeamLease has steadily increased its margins from 1% to 2.2% over the past four years, largely down to their scale and growth. In comparison, Quess Corp’s margins range between 4.8-5.5% for the same period.

It’s worth noting that these two firms have kept international players such as Randstad and ManpowerGroup from capturing the market. Lohit Bhatia, CEO (Staffing), IKYA Human Capital Solutions - a division of Quess Corp, states succinctly, “Indian and Chinese flexi-staffing companies are disrupting USA’s models. We are quick to adapt to technology and trends such as the gig economy. For instance, we at Quess Corp keep track of crests and troughs in demand in every industry. Based on the predicted seasonal trends (high during festive period, leaner otherwise), we keep our labour force ready.”

The chief growth drivers for TeamLease, says Reddy, have been growth in existing industries and the shift towards formalising labour. He adds that ridding employment space of informality will require a thousand stabs. The goods and services tax (GST) regime is one such, but it is not a magic pill.

Thorn In The Flesh

Globally, in a more organised industry and regulatory environment, it’s easier to run a business (See: Room for growth). In India, depending on the industry, state or city, your compliance varies. There’s no ready-made technology to rely on, and TeamLease had to build its platforms from scratch.

There were expensive mistakes made. For example, the team’s first shot at skilling (employability) back in 2006 was by having its own training centres across 50 locations. “It is not something I would repeat,” says Reddy. Now, they run their projects through variable-cost, franchisee centres that are funded either by the government or the corporate client.

This is true for the TeamLease Skills University (the brand’s classroom programme started in 2009) or the National Employability through Apprenticeship Program (NETAP). The latter is a public private partnership between TeamLease Skills University, Confederation of Indian Industry (CII) and National Skill Development Corporation (NSDC). A total of 55,000 students have taken these upskilling programmes.

Working with the bureaucracy is not easy. Sabharwal says, “Labour laws are a problem, civil servants are a problem.” There is also the responsibility of planning the future of a hugely successful business. “In India Life, we had a one-year-plan, which we would run ten times over. At TeamLease, we’ve had a 20-year-plan from the beginning. It’s more laborious.”

Future Outlook

Gig-economy may be the trending hashtag in the human resource and hiring space. However, this is not the first time a new wave of employment opportunities has flooded the job market. Sabharwal explains how before the Swiggys and Dunzos took over our lives, telecom and finance were employment drivers.

It’s therefore important for TeamLease to not be focused on one industry, one geographical area or one form. Therefore, top ten customers contribute less than 20% of their revenue.

Amit Chandra, assistant vice-president at HDFC Securities, also cites TeamLease’s portfolio diversity as one of its key strengths. He says “Hereon, a 20%-plus CAGR is not difficult since TeamLease has over 1,600 clients across various verticals.”

Sabharwal has grand plans for his firm. “I think, in five years, we will generate Rs.150 billion in revenue. We would like to hit half a million people,” he says.

The analysts are optimistic. In their report, Soumitra Chatterjee and Omprakash Kavadi from Spark Capital Advisors project TeamLease’s revenue to increase from Rs.36.24 billion in FY18 to Rs.55.22 billion in FY20. The margins too are expected to see an upward trend — from 2.2% in FY19 to 2.6% in FY20 and 2.7% in FY21. According to the report, this growth will be driven by high-margin IT staffing, consolidation in the industry due to the onset of GST and increased flexi-staffing penetration across industries (see: Going strong).

Sumit Pokharna, vice-president of Kotak Securities, is also betting big on the flexi-staff space and consequently companies such as TeamLease. He says, “Despite having to pay marginally higher, companies are moving towards outsourcing their workforce… It’s especially suitable for start-ups wherein the firm doesn’t want the burden of a fixed-income member on board.”

That said, Pokharna says the industry is in its nascent stages. “Today, flexi-hiring has just hit metro cities. Tier-II cities promise plenty of scope since that is where a good chunk of our workforce comes from,” he says.

Reddy and Sabharwal sound self-assured. Sabharwal says, “We’re racing with ourselves here, if we mess this up, it would be no one else’s fault. Capital isn’t a binding constraint, India isn’t a binding constraint, who else do we have to blame besides ourselves?”

As for trusty Ram Bharose, no one can solve his troubles by throwing money from helicopters. The portly, dhoti-and-banyan-clad stalwart will have to be made part of a lean, mean, more productive workforce.