The Indian market is obsessed with earnings growth and beating expectations,” says Anoop Bhaskar, head of equity, IDFC Mutual Fund. Indeed, in India, there is always a premium attached to speed. Growing up, each of us invariably has been encouraged to compete against that kid who eats or finishes homework the fastest. It is only later that we came to appreciate the inherent value – measured by nutrition and understanding of concepts – of these pursuits. Companies, too, are put through this.

Investors have always attached higher premium to growth stocks. While a year or two of good revenue and earnings growth never fails to catch investors’ fancy, a sustained outperformance over a longer period and a superior quality of growth are what leads to the long-term re-rating of a stock.

To figure out where the action was, Outlook Business began the exercise of finding India’s fastest growing companies in 2012. Barring 2015 and 2017, this special edition has been mirroring the roller coaster ride that India Inc has been. Here’s how the exercise began.

Initially, we stuck to our universe of 586 companies, obtained by combining the BSE and NSE 500 stocks. Banks and financial companies were excluded. So were companies that had debt twice their equity since that impairs their ability to invest and grow. We looked at the companies’ sales and earnings growth over a five-year period and those that had incurred a loss in any of the years under consideration were also left out. Over the years, we have expanded our horizons to include the listed companies with a market cap of over Rs.1 billion.

The growth filters too had to change and threshold limits were lowered to expand our universe and that was a clear indication that growth had been hard to come by in the past two years. This edition, the companies that made the cut had to have a minimum turnover of Rs.1 billion, a sales and profit CAGR of 15% over the past five years (FY14 to FY19), and 15% return on capital employed (ROCE) every year over the same period.

Harendra Kumar, MD-institutional equities of Elara Capital, confirms that we have been on the right track thus far. “Sales is an outcome of a good balance sheet. Sales cannot be seen in isolation and has to be seen in conjunction with return ratios,” he says.

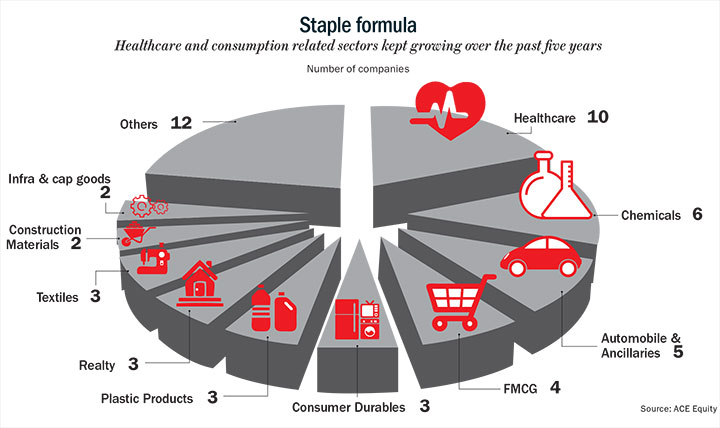

The objective part done, we did get a bit subjective. Of the 55 companies, we knocked off two companies for management issues. And what we have as part of our final list is an eclectic mix from sectors as diverse as auto ancillaries, healthcare and chemicals to infra and retail. Pharma and healthcare companies formed nearly 18.86% of the list followed by auto and ancillary companies, which made up 9.43% of the list (see: Staple formula).

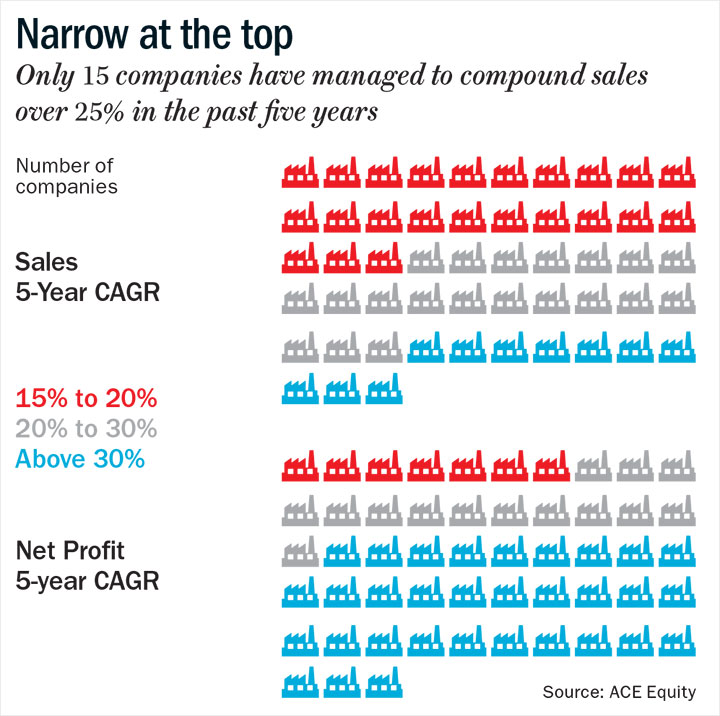

Of the 53 companies, only 10 managed to clock more than 30% topline growth over the past five years, while 20 managed to increase their sales at more than 20% (see: Narrow at the top). Earnings growth was slightly stronger as companies gained from lower inputs costs and an improved revenue mix, better pricing owing to lower global capacity (chemicals) and (in the case of some pharma companies) exclusive product launches. About 32 companies posted more than 30% growth in earnings and 14 companies clocked 20%.

But things are getting tougher. In FY19 (we have considered the trailing twelve months revenue as of December 2018, for companies yet to finalise their annual numbers) only seven companies clocked more than 20% growth in revenue and about 23 companies are either seeing their sales dwindle to single-digit growth figures or recording an actual decline in growth. While there are about 14 companies that managed to post 20% earnings growth, the decline in earnings is much more significant in the 24 companies that have either posted single-digit growth or are seeing a fall in profits. More indication that things may not be as rosy in the coming year as well.

Apart from shifting through their annual numbers, we also wanted to dig deeper to see if there is value in a few companies that have had a good track record but, due to near-term issues, aren’t getting the same love from the markets as they used to. In a growth-obsessed market, the fall from favour is often the hardest for the companies which fail to meet expectations. While the decline, for some, may be triggered owing to structural shifts — changing their growth trajectory forever — for others, the fall may be temporary a blip allowing investors an opportunity to buy into the stock. Last but not the least, we wanted to see what was common between companies that outperform their peers across business cycles. Here’s what we found out.

Ace Advantage

In an emerging market such as India, it is only fair that focus remains fairly and squarely on growth, and companies that can leverage opportunities in the domestic economy or, in some industries, in the global markets too. So, for many years, traditional value-investing that goes by dividend yield or low P/E or low P/B hasn’t been part of mainstream investing.

Value has always been relatively defined either in terms of valuation, which could lower the market average or the company’s five-year average, or in terms of their future earnings growth potential. “If you define value as low P/E, low P/B, typical cigar-butt-type of investing, then you always run the danger in your portfolio construction of falling into a value trap in terms of business fundamentals and then time works against you. But if you go for a franchise that is well recognised, the stock may look expensive but they compound well if you don’t pay too high a price and hold a portfolio together in stressful times,” says Chetan Parikh, co-promoter, Jeetay Investments, and Jasmine India Fund.

So, naturally, the premium for these quality growth stocks has only increased in the past couple of years. Classic growth companies have pricing power, which is what gives them the ability to earn more than the cost of capital, and the pricing power may be due to valued brands or IP.

Take the case of Page Industries, an eternal investor favourite, thanks to its ability to leverage its brand strength really well. The company has been able to maintain and build on its leadership through an extensive distribution network and introduction of new products, and consistently generate high return on capital. The company, which is the exclusive licensee of Jockey International to sell and manufacture the American brand in India, Nepal, Bangladesh, Sri Lanka and UAE till 2040, has a retail network of nearly 54,000 point of sales and 470 exclusive brand outlets across 1,800 cities and towns. “Jockey is a much stronger brand in India than it is globally. So, the local management has achieved something that globally the company has not been able to,” says KN Sivasubramanian, former CIO of Franklin Templeton India.

“India was ripe for such brand consolidation because the market for innerwear was completely fragmented and they had a superior product, and that was important because you cannot build a brand without a superior product,” he says. Over the past five years, the company’s sales has grown at 23.84% and its net profit has grown higher at 25.26%, which also indicate that the company has been able to improve on its margins during this period.

Nilesh Shah, MD of Kotak Mahindra Asset Management, says that there are three things that companies that consistently outperform their peers have in common. “These companies ensure there is good corporate governance in place, have a good management that has the ability to take the right strategic calls on future investments and almost always generate a return on equity higher than cost of capital.” Page Industries certainly ticks all the three boxes. The company scores well on capital efficiency with return on equity (ROE) averaging 52% over the past five years and the return on capital employed (ROCE) even more impressive at 67% during the same period.

Another company that can credit its good management for its impressive performance is Avenue Supermarts. The company that operates its retail chain under the DMart brand works on the principle of everyday low cost and everyday low price, through which it is able to offer its customers a discount on MRP, thanks to its significant scale in sourcing. “Retail is a very difficult business in India and (Avenue Supermarts’) promoter has understood the business well and built the business up step by step. The decision to buy property early helped them rein in costs during expansion and the focus on offering limited SKUs (stock keeping units) as opposed to someone who offers everything,” says Sivasubramanian. According to him, one of the biggest drivers for Avenue Supermarkets’ success is that the company has found its niche and built a successful business model.

“To his credit, Radhakishan Damani (promoter of Avenue Supermarts) has succeeded in whatever he has done so far, unlike Future Retail, that is yet to find a business model that works despite trying out various formats and being in business for longer,” says Sivasubramanian. According to a report by Morgan Stanley, Avenue Supermarts is one of the most efficient retailers globally with its DMart stores generating revenue per square foot of $530 compared to Walmart’s $450 in 2019. Morgan Stanley pegs the throughput for DMart at 3.7x of Walmart since unit costs in India are about one-third of the developed markets.

Bitter Pill

While retail companies are trying to find the model that works, Indian pharma is going through some soul searching of its own. While they still formed the majority of the fastest growing list, there is more to it than meets the eye. Some of the companies have taken a knock due to regulatory issues; the landscape has also become intensely competitive with more companies eyeing the same pie, leading to diminishing pricing power.

Manish Bhandari, founder of Vallum Capital, which manages close to Rs.5 billion in assets under management (AUM), predicts that the near-term outlook looks muddled for some of these companies. “Few pharma companies such as Natco have done well on the back of product launches but, now that the pipeline has dried up, the growth in the next few years will not be as in the past few years,” he says.

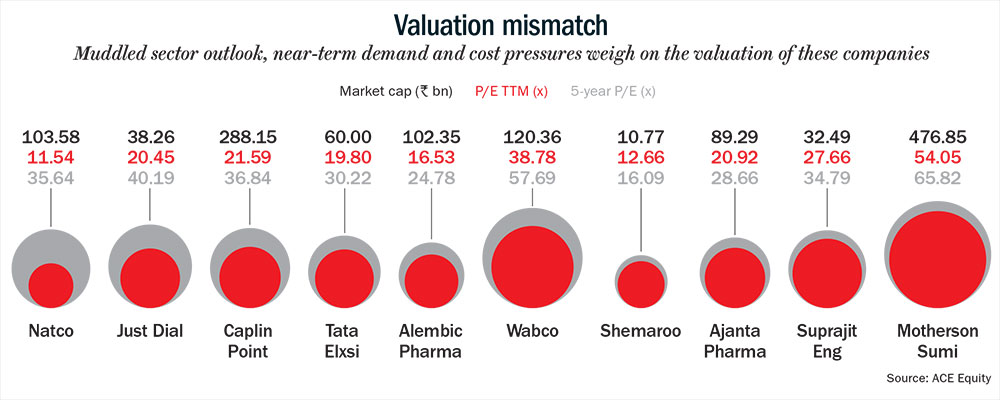

Natco, for instance, clocked strong growth especially during FY16-17 led by the launch of Tamiflu, a drug used to treat influenza, in the US. But with Copaxone (drug used to treat multiple sclerosis) ramp-up not as fast as expected, analysts expect the growth in the US business to be muted until the second half of FY21, when new launches including a trio of cancer drugs - Nexavar, Everolimus and Revlimid are expected to revive growth. The company is also working on doubling its non-US business over FY20-23. However, the key investor concern appears to be the company’s investment in agrochemicals. The company has allocated Rs.1 bn for a plant to manufacture insecticides. While the company’s management maintains that R&D skills remain the same for both businesses and it is just augmenting its manufacturing capabilities, the investment rationale remains unclear. The stock meanwhile has taken a significant beating and trades at 67% discount to its five-year P/E average and 53% discount to its ten-year P/E average (see: Valuation mismatch).

Natco Pharma is, probably, one of the classic examples of the risks involved when one buys into growth. “The danger with growth or buying franchises is that the moat becomes weaker, as the growth tapers off much faster than what you thought. The terminal rate that you thought would come up in year five, starts happening from year three, then all your calculations go for a toss. In this entire thing, it is important not to lose sight of margin of safety. One of the best ways of building that margin is to have a certain quality in terms of management, business, earnings and capital structure. You also have to be careful that you don’t overpay,” points out Parikh.

The pharma sector itself has seen a de-rating because of the changing competitive landscape and regulatory hassles throwing all growth projections out of whack. “Pharma has been the worst-performing sector twice in the past three years. Their weightage in the BSE 200 has declined from 14% to 9%, and this tells you about the price erosion in the sector. Pharma will continue to be stock-specific where earnings growth is led by product launches and a strong pipeline of products,” says Bhaskar.

Inflection Point

The recent five years have not treated auto and ancillary stocks badly. But, now they now stare at an uncertain future. “As the auto industry moves towards more automation and driverless cars, many of the products manufactured by ancillary manufacturers will no longer be required, so they have to reinvent themselves,” says Sivasubramanian. He puts the auto ancillary manufacturers into three buckets – first are the ones whose products are commoditised such as fasteners, second are those such as Wabco India that work with OEMs to develop some IP, which gives them not only pricing power but also establishes a long-term relationship with OEMs and, the third, manufacturers with products such as batteries and tyres that have a replacement market that reduces the dependence on OEMs.

While the first set of manufacturers will find the way ahead a lot more challenging, manufacturers with IP and a replacement market are likely to fare better. But the market is still uncertain about the value it should assign to these ancillary manufacturers. “You have to estimate the disruption that is going to happen such as when will electric vehicles gain critical mass, and there is a lot of variance depending on what kind of estimates you put in there. So there is high possibility of calculations going wrong,” says Parikh.

But such uncertainties could also present some investment opportunities. For instance, Wabco India, which apart from serving as a global manufacturing hub for its parent company, supplies to OEMs such as Daimler, Volvo, Scania, Tata Motors and Ashok Leyland. The company, which is a market leader in air-brake systems, has a road map for electrical vehicles and autonomous driving including emergency braking systems, fleet management solutions and connectivity road mapping solutions. Over the past five years, the company’s revenue and profit have grown at an average of 22% and 16% every year. The stock trades at 33% discount to its five-year average (see: Valuation mismatch).

Similarly, Motherson Sumi, which is one of the largest manufacturers of wiring harness, rear view mirrors and polymer body parts, is also trading at 18% discount to its five-year P/E. The company’s acquisition strategy has not only helped it sustain its market share but also increase supplying more content per car. Over the past five years, the company’s revenue and profit have increased 17% and 33% on average every year. While rising cost pressures kept the company’s performance subdued over the past three to four quarters, analysts predict a brighter FY20 with 21% revenue growth and 30% earnings growth.

However, the outlook for the auto industry does seem muted for the near term. “Thus far growth has been coming from rural areas for the past few years, but the price hike and fuel volatility have dampened sentiment. We have seen in the past the same peak-to-trough cycles playing out. This time it is no different. You will see a further correction of 10-15%,” warns Kumar. But that is unlikely to affect players such as Motherson Sumi, which gets a healthy share of its revenue from the global markets thanks to its long list of acquisitions.

There is a mixed view on where value is in the markets today. Even as small and mid-caps seemed to have recovered from the bludgeoning of last year, there aren’t a lot of stocks that offer deep value. But buying stocks just because they are cheap on relative terms, either to the market or to their long-term averages, is not always a winning strategy. “If the company doesn’t have the ability to unlock value then there is nothing you can do about it,” says Kotak’s Shah.

With the election results around the corner, the market is riding high on expectations that the current government will come back to power. But the new government is not inheriting an economy that is in a good place. Fundamentals are on shaky ground since the demand outlook for consumption-led sectors such as FMCG and auto remain weak. The weak consumption that started with housing a few years ago has percolated to auto and now to consumer staples, and this is not a very comforting sign. GDP forecasts are already being lowered for FY20 to 6.6%-6.8%, and slower than expected growth in earnings this year will lead to significant correction in valuations.

Maybe then there will be better value in the market. “When we speak of fastest-growing, you cannot expect more than 15% growth. There are hardly a handful of companies who are really growing above that,” warns Bhandari. While we have picked out five interesting companies that stand out from the rest, as the oft-quoted disclaimer goes, past performance is no guarantee for the future.