In 1997, Jayesh Choksi, the present chairman and managing director of Gufic Biosciences made a declaration, “Give me 10 years and I will be back.” Choksi had just sold his branded business which included his most popular brands — Mox (antibiotic) and Zole (antifungal) — to Ranbaxy for Rs.80 crore.

Choksi was exiting the pharma business as India’s move to TRIPS (Trade-Related Aspects of Intellectual Property Rights) signaled the arrival of the patent regime and threatened the survival of small and mid-sized pharma companies. MNCs which had hitherto held back investments due to prevalence of process patents were now expected to take the fight to Indian players in a product patent regime.

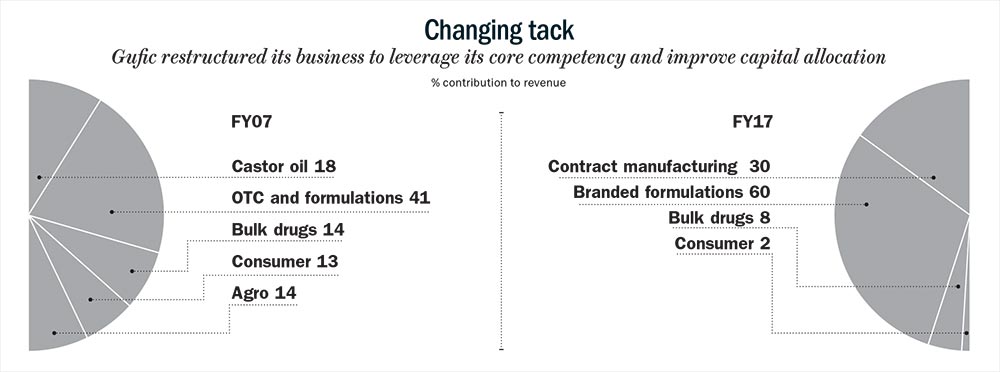

In 2000, Choksi set up Gufic Biosciences to regain his foothold in the Indian pharma industry. Focusing on herbal and consumer products, Gufic launched over-the-counter (OTC) brands such as Roll-On, Stretch Nil, Onergy (nutritional supplement) and Shapers (sanitary pads). The company had also ventured into hybrid seeds and tissue culture. However, despite these forays, the company’s FY07 topline of Rs.50 crore and net profit of Rs.70 lakh was nothing to boast about.

Choksi clearly was not kicked at the progress his new venture was making as his profit was less than the rental income on his real estate investments. When he sold the earlier business in 1997, it had a topline of Rs.85 crore and a net profit of Rs.5 crore. Ten years hence, Choksi’s attempt at making a comeback was not going anywhere.

It was in 2006, when Choksi called on his son Pranav who was in the United States. Pranav had completed his Masters in biotechnology from John Hopkins University and had just started working in the R&D team of a US pharma company. The idea of moving back to India overnight was not something that enticed Pranav as his career in the US pharma industry had just begun. Finally, after spending a year at the US pharma company, Pranav returned to join Gufic Biosciences in 2007.

Taking charge

When he assumed control, Pranav found that Gufic’s operations were spread across businesses, irrespective of its competency. “At that time, close to half of our topline came from herbal products where we had some competency, while the rest came from tissue culture and seeds for which we heavily relied on a set of professionals and a technical team whom we had hired. The business and the technology could come and go with these people. We didn’t have much control on this business,” recalls Pranav.

For a company that was doing too many things, Gufic needed to find its niche. Pranav went back to the company’s roots. In the 1970s, Gufic under its founder Pannalal Choksi (Pranav’s grandfather) was the first Indian company to import a lyophilizer. Gufic’s founder used it to make oxytetracycline injectables (anti-bacterial used to cure chest and mouth infections) which became a popular product and broke Pfizer’s monopoly in oxytetracycline in India.

In 1997, when Gufic sold its brands to Ranbaxy, the R&D work had continued in Gufic’s Navsari plant which had the lyophilizers. Between 1998 and 2007, the Navsari plant had developed 34 products in lyophilized injectables segment, but it had not marketed them as it didn’t have the required field force. The existing field force was anyway busy pushing other products. Lyophilization is considered the most stable way of making certain life-saving injections and Pranav felt that this is where Gufic should be channeling most of its energies.

However, expanding the sales team overnight to market its own products would have required huge capital and it would have also been difficult to attract good talent because of the company’s small size. Pranav realised that if Gufic was to survive it needed to scale up its topline so that the overhead costs could be absorbed. To begin with, contract manufacturing of lyophilized injectables was identified as a key focus area for the company.

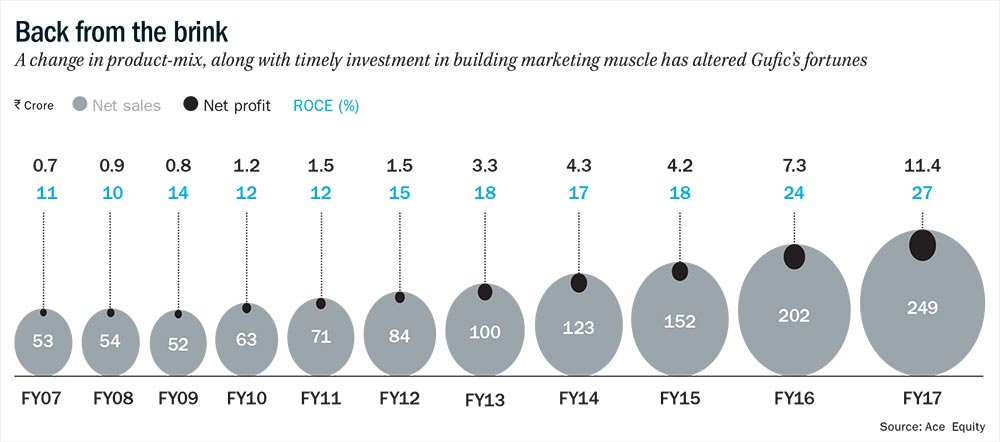

“From the capacity to manufacture 50,000 vials per month in 2007, it was ramped up to 1.2 million vials per month in 2012. From 1-2 clients, our client base increased to 36,” says Pranav. From net sales of Rs.53 crore in FY07, topline compounded at 9.4% to Rs.83 crore in FY12. At the beginning of FY07, Gufic had two lyophilizers. Between FY07 and FY12, it bought three more lyophilizers for Rs.4 crore which was funded through term loans.

By FY14, the company was clocking sales in excess of Rs.100 crore. Sensing that it was the right time to market its own products, the sales force was gradually increased from 260 in FY14 to 1,030 in FY17. However, it was not just about increasing headcount, but also getting the right mix of people. Gufic hired people from leading pharma companies such as Alkem, Lupin and Abbott for its field force. Between FY14 and FY17, employee costs grew at CAGR of 51% from Rs.12 crore to Rs.41 crore.

New look

However, to make sure that the marketing team’s energies were aligned with the company’s core competency, Pranav had to make some changes. First off, he stopped selling via the OTC route. Another reason behind realigning the businesses was to steer clear from allocating capital to segments where Gufic would have to compete against established players, typically MNCs or larger pharma players, with huge marketing and promotion budgets.

Products such as Stretch Nil were moved to the pharma division (created in FY14). Roll-On was made part of the herbal division. These products would be pushed through doctors’ prescription and not as OTC products. “OTC is more glamorous and in your face. But the problem with OTC is that once it is out of sight, it is also out of mind. In the prescription-route, once the doctor is convinced by your product, it will have an endorsement value that will stay much longer,” says Pranav.

This is how Gufic’s business divisions look post restructuring. The herbal division, (recently re-branded as healthcare) offers pain management and nutraceutical products. The rebranding has been done on feedback from Gufic’s sales team which found that doctors’ receptivity to products with herbal tag was low. Within herbal, Sallaki is Gufic’s largest brand with sales of Rs.26 crore. Sallaki is an ointment that is used by rheumatoid arthritis and osteoarthritis patients to treat inflammation and pain. The newly-created pharma division has special focus on pregnancy and pediatric products. The infertility division has products formulated to help women conceive and also treat male infertility.

The critical care division has 18 products. These are largely lyophilized life-saving injectables that are given to ICU patients. Within the critical care division, another sub-division ‘critical care life’ has been created which offers products that have molecules which have not been introduced in India yet or products that have better grades.

While the pharma division’s sales team has gone up by 80 post the ramp-up, most of the additional field force has gone to the critical care division which was set up in FY14. The critical care division is the largest contributor to Gufic’s branded business with 50% share. Besides pharma (12%) and critical care, infertility (6-8%) is another division that has been set up more recently in FY17. Besides these new divisions, herbal (30%), as things stand, is the oldest division at Gufic.

Industry insider Nirav Mehta, director of Ahmedabad-based Corona Remedies whose company uses Gufic’s contract manufacturing for its infertility range, says, “Pranav has infused aggressiveness and much-needed vibrancy into Gufic’s marketing team. He regularly sits with his sales team and motivates them.”

Eyeing growth

Of the new divisons, only critical care has turned profitable, while pharma and infertility are yet to do so. While Pranav says any new division does take three years to break-even, in the case of pharma, profit is still elusive after three years. He believes Gufic needs to rework it approach in the pharma business. “Initially, we launched a lot of branded generics in the pharma division. However, we have realised that we need innovative or differentiated molecules to convince doctors,” he says.

While Gufic has set up various divisions to drive its branded business, it is also trying to capture growth opportunities in the contract manufacturing business which accounts for 30% of its topline.

In FY12, after seeing good traction for its contract manufacturing services, Pranav decided to set up a new plant that could supply to regulated markets like the EU. Partly funded through internal accruals and remainder through debt, a new plant in Navsari was operational by FY15. Costing Rs.88 crore, this was a fully-automated plant which didn’t need any human intervention whether for a pre-production stage such as cleaning or the production process itself.

In 2016, the plant received EU-GMP approval. In Q3FY18, it exported for the first time to Germany. It was a small order of 40,000-50,000 vials per month of a simple molecule vancomycin (life-saving antibiotic). “As it was our first order to an EU nation, we wanted to avoid complex molecules. Now that we are more confident, we have filed for two products and will also file for a third product where Gufic would have the marketing rights,” says Pranav. However, the new EU-GMP-compliant Navsari plant will not be solely dedicated to EU nations as the demand from Germany is not as high. For example, monthly consumption for Tigecycline vials is 3,000 in Germany, while it is 55,000-60,000 vials in India.

Gufic has already filed patents for Tigecycline (lifesaving antibiotic) and Anidulafungin (life-saving antifungal) in Europe, Russia and South Africa. Supplying to countries such as Europe is lucrative as margins are higher. The gross margin Gufic makes from contract manufacturing is between 20-25%, while it is 30% on the Germany order.

While margins are important, Gufic doesn’t file patents for products unless it can make a minimum of $1 million-$2 million in revenue from that product in two to three years. For instance, the addressable market for Gufic’s Rifabutin is $120 million in Russia but the product is at least three to four years away from launch as clinical trials is also required.

Next move

For Gufic from here on, it would be about sweating its assets in the most optimal way. “We are mostly done with capex. Now, it is about improving the efficiencies of the people and the assets,” explains Pranav.

The new Navsari plant has capacity of 1.5 million vials per month which can be extended to 2.8 million vials by adding just three automated machines. “Ramping up the capacity would cost us Rs.10 crore-Rs.12 crore which can be taken care of by internal accruals or debt if the latter is cheaper,” says Pranav. With the old plant at Navsari running at its full capacity of 1.2 million vials per month, the incremental growth would come from the new plant. With the combined installed capacity of 2.7 million vials per month, the capacity utilisation across the two plants stands at 82%.

Through a focused business strategy, Gufic has already done a good job of sweating its assets. Over the past five years (FY12-17), Gufic’s RoCE has gone up from 15% to 27%. Pranav’s plan for the future involves sticking with this strategy. “Our strength is in critical care and we expect this division to drive our growth. Right now, we are present in anti-bacterial and anti-fungal. We are planning to expand this to anesthetics and later to cardiac critical care,” he adds. According to an investor, whose fund has a substantial holding in Gufic Biosciences, the RoCE could inch up even further as the business only needs minimal working capital.

Industry players say that Pranav’s strategy to move into a segment like lyophilized injections was a master stroke as the segment has hardly any players in India and should ensure sustainable growth for Gufic. “Lyophilization is the only way to make certain injectables. It is not easy to build capacities in such a niche business and getting your facilities cleared by one of the most stringent audits,” says Viranchi Shah, director at Saga Laboratories.

The branded business in the domestic market makes gross margin of 55% which goes as high as 80% in export markets. Gufic wants to shore up its branded export business to at least 40% of the total topline which today just contributes 8%. Getting an EU-GMP-compliant plant is a step in that direction. Gufic, which has already been exporting to markets such as South East Asia and South America, has plans to follow-up its Germany foray with entry into other EU nations such as Belgium and Netherlands. Besides EU nations, Gufic is targeting the UK, South Africa and Australia.

As mentioned earlier, critical care division which largely comprises of lyophilized injectables is expected to drive profitability for Gufic. In the domestic market, the critical care business makes gross margin of 48%. In the export market, critical care products make margin of 75%. Pranav expects Gufic’s operating margin to go up to 18-20% over the next three years. For 9MFY18, Gufic’s Ebitda margin improved 395 basis points to 14%.

From being a company that was on the verge of shutting down, Gufic has scripted a successful turnaround. By getting into contract manufacturing in 2007 when CRM was still not widely acceptable, Gufic not only grew but also built strong relationships.

Satyen Manikani, VP (strategy, in-licensing and business development), Alkem Laboratories, vouches for Gufic’s capability as a contract manufacturing services provider. “We know if we have given a project to Gufic, then they will ensure timely delivery. We don’t need to do multiple follow-ups with them which is not the case with other business partners,” says Manikani.

According to the earlier mentioned investor, in the fragmented pharma industry, Gufic can leverage its relationships with the big pharma players to push its own products. “Gufic can launch its products with larger players who could have their labeling on the product, but when a doctor would notice on the packaging that the manufacturer is Gufic, it would help in building Gufic’s brand,” says the investor. The management expects 20-25% sustainable growth for at least the next three years. However, with a young 35-year old owner-CEO at the helm who has already passed the litmus test of a downcycle, Gufic 3.0 has all the triggers to sustain its growth momentum for several years. After 20 years, Choksi’s Gufic has found its way back and is here to stay.