We have been fortunate enough to buy many multi-baggers over the past two decades. I have talked about some in the past and this time I shall choose one which is more recent rather than the biggest one. KNR Constructions is a mid-sized EPC player based out of Andhra Pradesh (AP). A construction company from AP is enough to scare most people away, including myself. As they say, sirf naam hi kaafi hai. But this idea came up while we were invested in another EPC company in the private space. So to better understand how other companies are conducting their business, we were looking at listed peers.

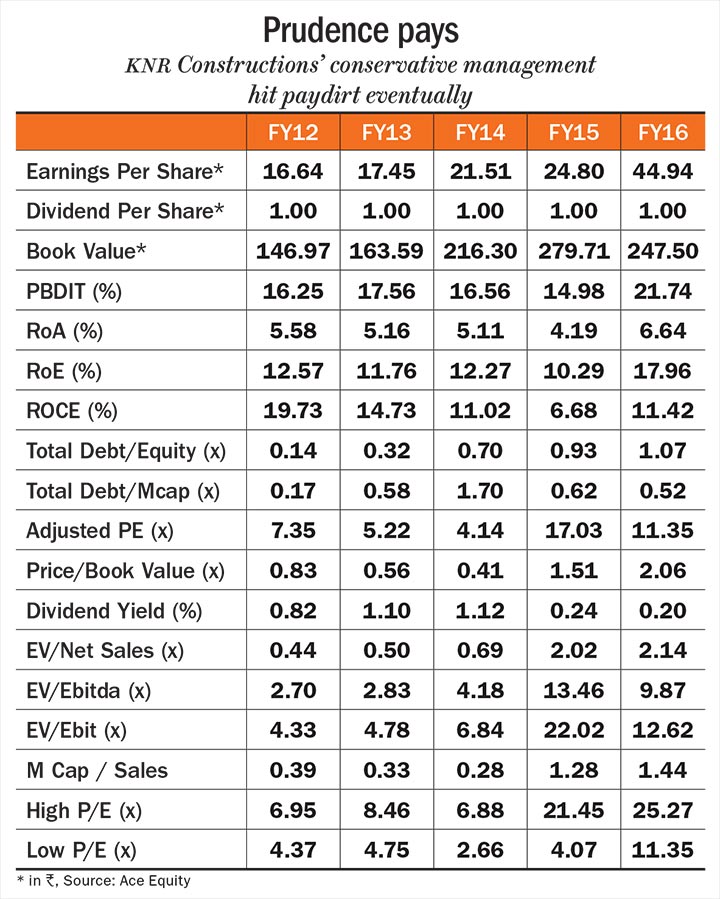

KNR IPO-ed in early 2008 at Rs.170 (pre-split). As is usually the case, any IPO comes when the sector is the talk of the town. The sector was buzzing with activity in light of new policy initiatives from the government and the banks liberally funding any infrastructure project. KNR is run by the founder along with his family in key positions including tendering/bidding and project management. The company focused on its core markets while expanding slowly into other geographies. Its focus was on growing profitably, or consciously waiting when the environment did not present opportunities. After doubling topline between 2008 and 2010, its topline remained more or less stagnant. Its accounting was also very conservative, and balance sheet relatively impeccable. It didn’t spread itself too thin nor did it bid for unviable projects. That was the time when the markets were focused on growth at any cost/risk/debt. There was scant regard for the durability of cash flows or balance sheet quality. Perhaps because of this reason, its stock price hardly moved.

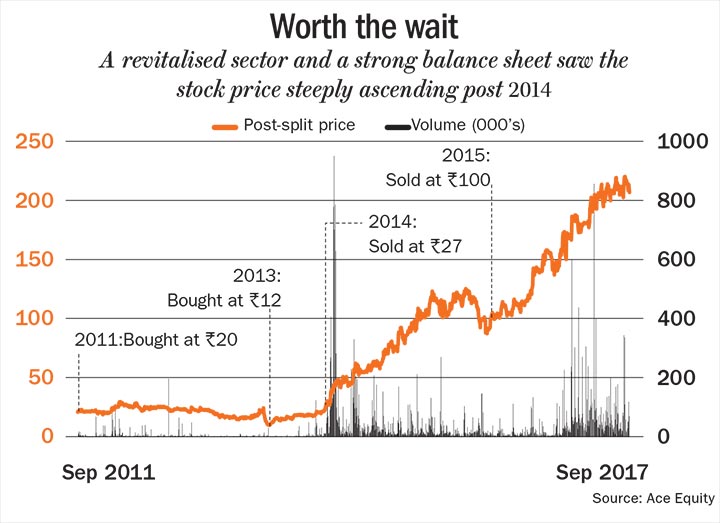

Between 2010 and 2014, the EPS went nowhere, and in the absence of growth, the market punished the stock for not growing its business, unlike its peers. In 2011, the stock crashed below its IPO price and kept falling. We initiated buying in May 2011 when the price was Rs.100 (pre-split). It was trading at a P/E of 5x and at a discount to its book value of Rs.135. The stock was very illiquid and we kept accumulating in the range of Rs.120-105 in early 2013. As we paused, the stock promptly went south since we were the only buyers. In August 2013, it hit Rs.80, a good 30% down from our average purchase price. We bought some more. It fell to Rs.70. We reluctantly bought more. It fell to Rs.60. At this price, it was down to almost half our initial buying price with nowhere to hide. We were numb, but still managed to buy some more. It went down to as low as Rs.46. We threw in the towel and didn’t have the gall to buy more. All told, it took us two to three years to buy 3-4% of the company.

Between 2012 to 2014, we were pushed to reassess our thesis given our sizeable holding. The sector is notorious for being a dirty business and for its questionable accounting. Andhraites running it didn’t provide much comfort since most other players in the same industry and from the same state had a superlative gross mis-governance record. Many other factors kept us on tenterhooks. They included the possibility of the management abandoning their sane stance to follow their peers and bidding for some risky or unviable project or leveraging their balance sheet and getting into BOT (Toll), government policy flip-flops or paralysis, lack of government clearances leading to inordinate delays and destroying already wafer-thin margins, the working capital cycle getting elongated due to payments stuck with government departments or even with customers, the business not turning out to be great in terms of return ratios and thereby the stock remaining cheap for an extended period of time, lack of exit options (stock being illiquid) and so on.

We were hoping for a recovery in the sector and the company’s fortunes in 2013, since by that time the sector had been in a lull for a few years already. But that never came. Thankfully, a new government came to power in 2014, and there was a renewed sense of urgency in the sector. From 2014 onwards, the company took advantage of the tailwind. Not many players were in the fray due to their balance sheet problems, and this is what the company (and me) were waiting for all these years. This made easy pickings for KNR. Earnings doubled.

In October 2013, the stock jumped back to Rs.20 (post-split) and we sold all the quantity we bought between Rs.12-16. We thought might as well use this opportunity to sell some stock and thereby reduce our average cost and also lighten our position in a highly illiquid stock. Between July 2014 and June 2015, the stock moved to Rs.100 and we kept selling all the way up (while promoters sold 15% of their holding), this time more out of elation on our thesis playing out and patience and conviction paying-off. We ended up selling half of what we bought. We would have sold less, but there were two factors which accentuated our selling. One was that the stock was no more dirt cheap (it was almost 10x P/E). Who is to say for such businesses what is a fair valuation adjusted for all the risks mentioned earlier? And more importantly, promoters sold almost 10% of the company. In hindsight, we should have relied on ourselves than the promoters for cues on price action because it was the stock and not the business that we are talking about. But hindsight is always 20/20.

As things stand today, there seems a nice NHAI runway ahead, and KNR is one of the few players which has the balance sheet to capture the opportunity. At its current price of Rs.208 (post-split), it trades at 15x FY18 expected earnings. That’s not exactly cheap for the stock, but there is comfort in holding a 10-bagger than buying at this price. Probably next year shall define how far the company can transition into its next growth phase, which in turn will determine how much longer we hold on to it. Only regret — we would have liked to be holding half the original quantity, but it’s hard to catch the top every time; and it’s not bad to get a 10-bagger in a bull market without forking out 50x P/E!

Some of our worst investing experiences have been errors of omission, i.e. selling out too early. Other sins include overpaying for great companies or getting entangled in bad or badly run businesses. In today’s scenario, it may be a faux pas to talk about the former. So I shall discuss the latter. And I won’t restrict it to a stock but a theme which has collectively given us prolonged grief.

So, this was a theme we had played before and made loads of money from: PSU banks. In the last cycle in early-2000, the banking sector was reeling under the NPA problem. Many of the smaller PSU banks were not even listed. Most of the listed ones were available at a fraction of their networth. We had bought bucketloads from the listed space as well as through IPOs. We anticipated history to repeat itself. So we went about cherry-picking once the sector was out of favour and the stocks had collapsed more than 50-60%. We did some rough cut calculations, made some further adjustments, did some other basic checks and pulled the trigger! Though we felt a little cocky, we were not sure which bank might turn out to be worse than the other in the absence of clarity on the quantum of the problem which remained undisclosed. Therefore, in true Grahamian spirit, we bought a bunch of them.

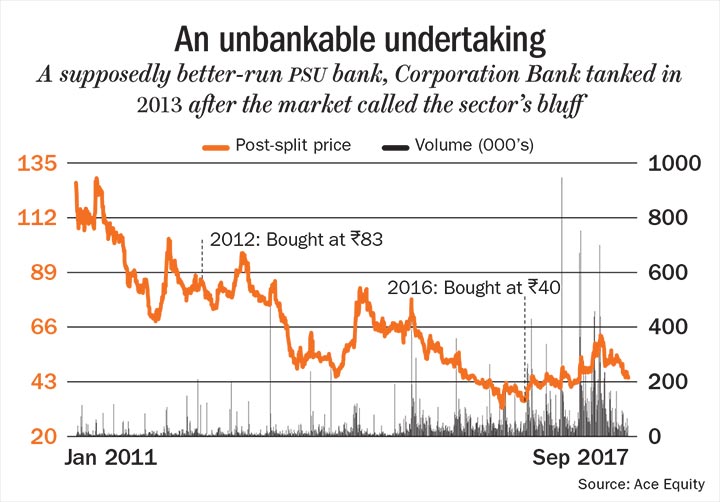

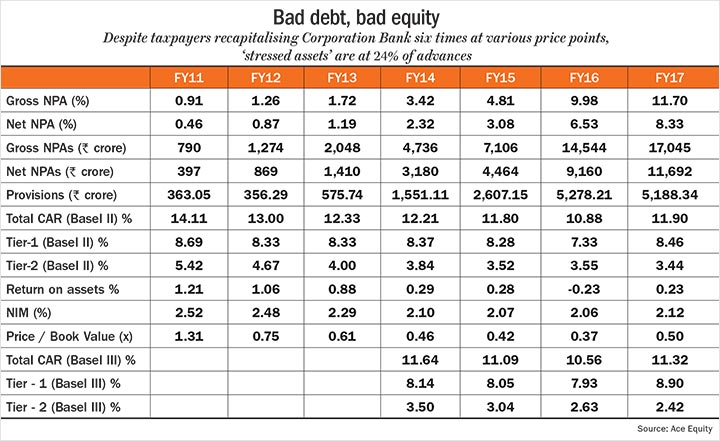

But I will single out Corporation Bank for discussion here. In 2011, it was supposedly a better-run PSU bank, with RoA of 1% despite low CASA (low cost deposits). Its GNPA (Gross Non Performing Asset) was also < 1% with PCR (Provision Coverage Ratio) > 60% and well-capitalised with CAR (Capital Adequacy Ratio) at 14%. In 2013, we were already a few years into the bad loan cycle (or so we believed), and the market (including us) suspected that the stressed asset disclosures were inadequate. The market called the bluff and the stock tanked. We nibbled as the P/B was now 1.2x compared with 1.9x at its peak. The government had already recapitalised at Rs.130 (adjusted for split) in FY11. When we bought at Rs.83, the GNPA had already doubled to almost 2%, PCR had shrunk to 30% and obviously RoA and CAR had dwindled. We anticipated that half the NPA disclosure had been made with the balance to be reflected in FY14. But that was not to be. They disclosed that about 6% of their advances were ‘restructured’ over and above the ones classified as NPA. That was a big number. The stock tanked to Rs.60 in FY15 and then Rs.40 recently. We bought both times.

Some of the stocks in this PSU bank basket were down 75-90% from their peak, and 45-60% off our purchase price! We were forced to re-examine the thesis ab initio, because we still weakly believe in the efficient market theory, we can’t ignore it outright like Warren Buffett (and that’s because our intellect and vision is not a patch on his).

What we figured out were some glaring differences from the previous cycle. One, we had relatively lower infrastructure lending previously. This included steel and textile sectors in the previous cycle but excluded construction, roads, real estate and power sector. The reason was that in the 1990s, most of these sectors were the domain of the government and there was hardly any private sector participation in these sectors except construction. And construction back then was such a dirty sector to fund, hardly any bank lent to it. Another difference was that whatever project lending happened to such sectors then was via the institutions created for that purpose (ICICI, IDBI and IFCI) so as to avoid straddling banks with asset-liability mismatches. The other difference was in concentration of the top defaulting borrowers. There were just two-three large groups across maybe 10-odd companies which accounted for a majority of the NPAs. In this cycle, the number of companies in the big default list was maybe closer to 30-40. Incidentally, there is only one large group which featured in this ‘distinguished’ list both times. Fourth, most new PSU bank IPOs hit the market after the government recapitalised them to plug the bad loan hole and were priced very attractively only because of the perception they had following the build-up of bad loans. Finally, and perhaps most importantly, at that time the recovery in the economic activity happened with a helping hand from the global economy. We were reminded of the quote modified as ‘History doesn’t repeat itself, but it rhymes’, and we seemed to have got the historic rhythm horribly wrong.

To quantify these anomalies, we then understood the difference between a bad cycle (which turns) and a trap. In a traditional cyclical recovery, interest rates go down, capacities get utilised leading to fresh capacity creation, working capital cycles improve, operating leverage kicks in leading to improved margins, and everyone lives happily ever after like in the movies. For the banks, it leads to net interest income (NII) growth, treasury gains on their bonds, and recoveries in already provided-for NPAs and providing less for fresh slippages. However in a trap, the pain remains so prolonged that the capital structure gets distorted to such an extent that the recovery doesn’t help. In such a situation, a business services its borrowings forever with nothing left for the stockholders, promoter included. The promoters then lose interest, leading to a host of unintended consequences. This situation gets further aggravated in case of banks, as they are highly leveraged businesses themselves. They become capital-starved, leading to low/no growth or de-growth in NII, even higher provisions for fresh slippages and no recoveries from past provisions either. You can survive a few days without eating, but may starve to death if you don’t eat for a month.

Between 2011 and now, taxpayers (and LIC policyholders) have recapitalised Corporation Bank six times at various price points, and despite that, the ‘stressed assets’ have risen to 24% of advances. At such stress levels, net worth means nothing. And from these levels, it’s almost impossible to recover. We are still under water licking our wounds. To rub in iodised salt, the market is at an all-time high, and to twist the knife further, all other sub-sets of financials have had an unprecedented run. The only saving grace is that this sector is not a big weight in our portfolio. We are still holding on to these duds though in the hope that even donkeys win once in a while in a bull market and because we can live with 2x P/B (ok 1.5x) and not the 10x P/B that some NBFCs command.