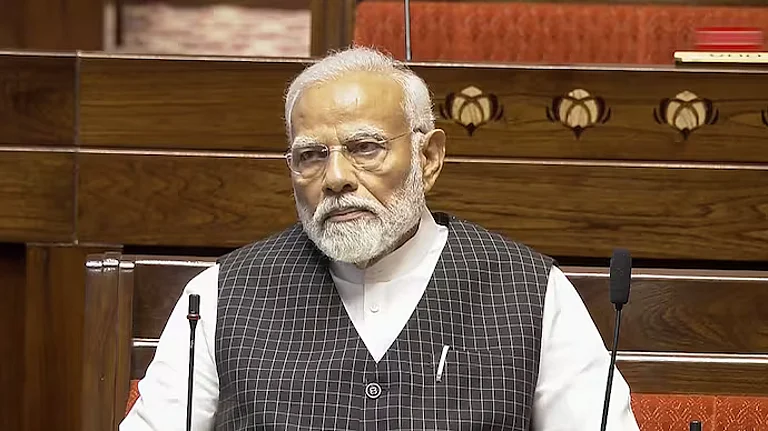

Prime Minister Narendra Modi on Thursday hailed GST 2.0 as a double dose of support and growth for the nation and asserted that the series of next-generation reforms to make India self-reliant will not stop.

In an interaction with the winners of the National Teachers Awards, Modi said he had promised "double dhamaka" of next-generation GST reforms before Diwali and Chhath from the ramparts of the Red Fort and the new simplified tax rates will come into effect from September 22, the first day of Navratri.

Chhath is one of the most important festivals of Bihar, which goes to polls later this year, while Diwali and Navratri are celebrated across the country.

Modi said that GST was one of the biggest economic reforms in independent India as it freed the country from a complex web of multiple taxes.

"Now, as India advances into the 21st century, this new phase of GST reform being referred to by some in the media as 'GST 2.0' is truly a double dose of support and growth," he said.

Modi's remarks came a day after the GST Council approved a complete overhaul of the tangled Goods and Services Tax (GST) regime with a two-tier rate structure of 5 per cent and 18 per cent.

He also slammed the previous Congress governments for levying high taxes on kitchen essentials and items related to farming and agriculture, or even medicines.

The prime minister said that before 2014, medical treatment remained out of reach for many, with the Congress government imposing a 16 per cent tax on diagnostic kits, which has now been reduced to just 5 per cent, making basic healthcare more accessible to the poor and middle class.

"Under the previous regime, building a home was a costly affair. Cement was taxed at 29 per cent, and appliances like ACs and TVs at 31 per cent. Our government has brought these rates down to 18 per cent, easing the cost of living for millions," Modi said.

"Had that regime continued, you would have been paying Rs 20-25 tax on every purchase worth Rs 100. But the aim of our government is to ensure maximum savings in the lives of common people, and to make people's lives better," the prime minister said.

He likened the GST reforms to adding 'Panch Ratna' (five gems) - simpler tax system, better quality of life for citizens, boost for consumption and growth, encouraging investments and job creation through ease of doing business and strengthening cooperative federalism for developed India - to the country's economy.

"Without timely changes, we cannot give our country its rightful place in today's global context. I had said from the Red Fort on 15 August this time that it is crucial to undertake next-generation reforms to make India self-reliant. I had also promised the countrymen that there would be a double blast of happiness before this Diwali and Chhath Puja," he added.

Modi said the "transformational" tax reforms undertaken by the NDA government have significantly lowered the financial burden on Indian households.

"The move is expected to provide substantial relief to the poor, neo-middle class, middle class, farmers, women, students, and youth. Young professionals starting new jobs will especially benefit from the reduction in vehicle tax. This decision will make it easier for families to manage household budgets and improve their quality of life," he said.

The prime minister said that sectors employing a large workforce such as textiles, handicrafts, and leather have been given significant relief through reduced GST rates.

These reforms will not only benefit workers and entrepreneurs in these industries but also lead to lower prices for essential goods like clothing and footwear, he said.

"For startups, MSMEs, and small traders, the government has combined tax reductions with streamlined procedures, ensuring ease of business and enhanced operational flexibility," Modi said.

Recognizing the growing focus on wellness, he said lower GST on services like gyms, salons, and yoga will encourage the youth to take up fitness activities.

The prime minister stressed that these reforms were part of the broader agenda to build a Viksit Bharat, where youth, enterprise, and health are key national priorities.

He said the government's guiding principle was "Nagarik Devo Bhava" (Citizen is God), and reaffirmed its commitment to the welfare of every Indian.

He highlighted that this year, tax relief has not only come through reductions in GST but also significant cuts in income tax.

"Income up to Rs 12 lakh is now tax-free, providing substantial relief to taxpayers," Modi said.

The prime minister said that inflation in India was currently at a very low and controlled level, reflecting true pro-people governance.

"As a result, India's growth rate has reached nearly 8 per cent, making it the fastest-growing major economy in the world. This remarkable achievement is a testament to the strength and determination of 140 crore Indians," he said.

He also made a strong pitch for the use of 'swadeshi' products and urged students and teachers to lead campaigns for 'vocal for local'.

Modi cited the example of India spending over Rs 1 lakh crore annually on edible oil imports, stressing that self-reliance is essential for national development.

According to the reforms approved by the GST Council on Wednesday, common use items from roti/paratha to hair oil, ice creams and TVs will cost less, while tax incidence on personal health and life insurance will be brought down to nil.

Almost all personal-use items and aspirational goods for the middle class, like AC, washing machines, will see rate cuts as the government looks to boost domestic spending and cushion the economic blow of the US tariffs.

Premium paid for individual life insurance and health insurance (including family floater) policies too have been exempted from GST. Earlier, such policies were subject to 18 per cent GST.