Chicago/ July 14, 2017

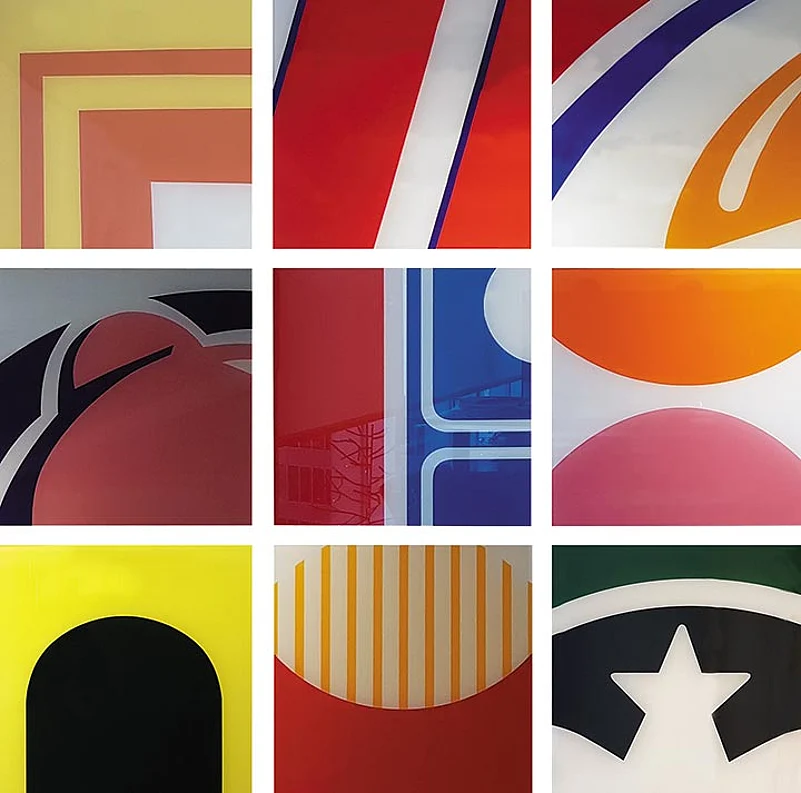

Bill Nygren’s 46th floor office on Chicago’s South Wacker Drive has its fair share of what seems like random modern art. At first sight, the piece installed right behind his desk looks like a ticker tape, perhaps, of his initial stock holdings. The sofa cushions, too, have a ticker print. On the wall facing him is a vibrant reverse-painted Plexiglas art work, seemingly with no particular theme. Or so we thought. Curiosity helps, be it in investing or journalism. And we discover that all of them are puzzles, which we could not have solved unaided. The paintings turn out to be logos of fast food chains, and the ticker has a profound message for investors. Nygren, who is the chief investment officer for US equities at Harris Associates, oversees about $27 billion through the Oakmark Select, Oakmark Fund and Oakmark Global Select and surely lives and breathes that ticker message as we realise during our meeting. Nygren is the rare value manager to have identified the potential in technology stocks early enough, buying into them soon after they met the ‘value’ criteria. He bought into Amazon before it became the sensation it is now and Alphabet, Oracle and Apple continue to be among his top holdings.

Your newsletter states that the valuation, right now at 20x earnings for the market, is about 20% more than the average for the past 20 years or so. If you were to peg where valuation stands today in the historical perspective — all variables considered — would you say it is cheap or expensive?

That’s never an easy answer, and we don’t think we’re market-timers. Take my answer with a pinch of salt. I always tell my analysts that I don’t like them calling anything cheap or expensive unless they can follow it up with relative to what. It’s fairly easy to say right now that stocks look expensive relative to their own history. What’s harder to say is if you don’t own stocks, what is the opportunity that will get you a higher rate of return. Typically, we think about stocks relevant to cash or bonds. Cash earns almost nothing today; bonds give you 2% or 3%. When it comes to yield on equities, it is a higher percentage of corporate bond yields than it was historically. If you think about stocks on a P/E basis, it looks a little expensive. But if you look at stocks on a dividend basis relative to the fixed income market, it looks a little cheap. So, we almost always advise our investors to not try to time the market, to set long-term asset allocation guidelines and every once in a while rebalance their portfolios in line with their long-term targets.

Compared to the time when you started managing funds at Oakmark 20 years ago, have the standard assumptions you would make — the benchmark growth and the discount rates that you would use on average — changed radically?

Oh, they have changed tremendously over the past 20 years. We set our discount rates based on the fixed income alternatives. Our discount rates are always set at a premium to what we can do on a seven-year treasury bond. The automatic tailwind of growth and just inflation was almost at a double-digit level during the early stages of my career, and has come to 2% today.

Twenty years ago, GDP growth was a much higher number than what it is today. It would be difficult to project the US GDP growing at more than 2% for an intermediate term, and corporate profits aren’t likely to grow faster than the GDP. But what some people who are coming to a more bearish conclusion forget is that if we’re only in a 2% inflation environment and we only have 2% growth, it means that companies are retaining too much of their income to support a 4% nominal growth rate. They will then be able to use cash to purchase other companies or purchase their own stocks. So we see earnings per share (EPS) growth significantly exceeding net income growth. When you adjust to that, our expectations for EPS growth and dividends are not that much different from what it has been for the past decade.

Relative to history, we have seen and will continue to see that the number of shares outstanding in the S&P 500 continues to decline. The number of public companies also continues to decline because other companies acquire them. The base growth of a company is supplemented by growth from reinvesting its excess cash. A typical company today would grow at 2% from inflation and 2% from real growth, but if it only pays 40% of its income, then the remaining 60% may be used to buy 3% of their shares. Some of the stocks in the financial sector are selling at 13x earnings. Even in a scenario where they don’t grow at all, they [the companies] retain 60% of their earnings, which is enough to buy back 5% of their shares or so. That way, they get a 6% EPS growth rate along with dividend yield in a no-growth environment. This is a much more negative outlook than we have either for that sector or the US economy.

If you assume that there is no imminent growth and that a dominant part of value creation is through buybacks, it doesn’t portray a glorious future. Would you not worry about an eventual derating in such a situation?

If you can have a company that pays a 3% yield and have the EPS grow 6% every year, what’s wrong in getting 3% in dividend and 6% annual growth as against buying their bond and earning 3% or 4%? I think the stock provides a far superior value to the bond.

Now, what can be worrying is having a lower growth in sales than we anticipate. It is therefore important to have a management that is focused on per share value creation, because the last thing we want is it [the management] trying to reinvest in an industry that isn’t going to grow. It’s like pushing on a string. No matter how many new plants they build, it’s not going to increase demand for their product. We spend a lot of our time identifying management teams that focus on per share value creation. They are just as happy to see growth from a shrinking denominator as they are from a growing numerator.

You see a lot of technology companies featuring in the portfolios of value investors over the past two-three years. What’s the deal with technology companies today? Are they looking sufficiently cheap for your comfort? Or is it that we have a number of companies that seem to have a lot more predictable cash flow than one could think about say 10 years ago? Or is it just that we are overcoming our anxiety about technology being too short-lived for any meaningful value creation?

I think it’s a little of all of these reasons. Some twenty or thirty years ago, these companies were at an emerging stage. There were stories of two high school kids in a garage working to make a current company obsolete. This is not going to happen to Intel or Texas Instruments, which have matured to a point where they are not going to be disrupted by a new venture capital-type investment. A group of us value investors who base our investments on what we expect the cash flow to be like in five to seven years, if not longer, from now, are comfortable forecasting that seven years from now Intel is still going to be one of the biggest semi-conductor companies. Apple will be one of the biggest, if not the biggest, smartphone companies. The predictability is just higher.

When you have an industrial company that is growing, that growth tends to be represented by building new factories, which is capital expenditure. It goes on the balance sheet and is expensed over the 30-year life of the company. On the other hand, when a company like Alphabet invests for growth, it is done through their income statement, which depresses its current earnings. When someone new looks at Alphabet and they see it trading at 35x earnings, they would say that it’s almost twice the market multiple and does not obviously look like value. If you look deeper, you may find they are losing $5 a share per year on some bets they are making. But when you consider what the Google search engine is worth, it’s not generating just the amount of reported earnings; it’s generating $5 a share more. These are VC-like investments made in the company that, if made through a VC firm, would be showing up on the balance sheet as an investment and not going through their income statement. We’re trying to look at it this way and focus on the worth of their autonomous driving division, then you look at what Intel is paying for Mobileye, talk to people about technology differences and assess their value.

All these assets grow by depressing the reported earnings, which, when scrutinised on a piece-by-piece basis, have tremendous value. For instance, we think there is significant value in YouTube, which is not producing much in current income. This is because they are building the infrastructure to allow this business to double hours viewed every two years. In such cases, the expense structure of a company will be much larger than the current revenue base. If you value Alphabet on a P/E basis, you’re effectively saying that YouTube is not worth much, their autonomous driving and AI is worth a negative number. You are also saying that hundred dollars per share of cash is worth nothing at all... But when evaluated piece-by-piece and with all these other assets subtracted, we conclude that we are not even paying the market multiple for the search engine.

You have this kind of a dynamic working in more and more of high-growth technology companies. An investor who tries to cut short the valuation approach by just focusing on P/E is sure to miss significant pieces of value. We saw that happen last year with LinkedIn. We owned that company; it was not a typical holding for a value investment firm. The reason they were not reporting profits was because they were spending in the adjacent markets wherein they were trying to grow. If you worked backwards to see just what the headhunter or career placement part of their business was, we weren’t paying much more than the market multiple for that while getting all those investments for free.

More and more of the opportunities in the market are going to involve more complex type of valuation work. Value is no longer just low P/E. There has to be something else tied to it that will be harder for a computer to figure out. The technology names today fall under that category.

How do you factor the technology risk into valuation? For example, you may take a positive view of the fact that Google is deploying its income from search into other technologies, but there is no certainty about their outcomes. Those technologies may or may not work. In hindsight, this management could have proved itself a great capital allocator. But it might have proved itself to be a disastrous capital allocator too. This would determine how well your stock would do in the next 10 years.

One of the reasons we didn’t buy Google early on was that we were not convinced that the search battle had been conquered. When we thought out five to seven years, we considered disruption risk. That battle is over now. Trying to estimate the value of Google is like trying to estimate the value of search as a business. We believe that their share is clearly going to be a high number. The range of outcomes about the other investments, on the other hand, is much wider. At the same time, just because there is a wide range of outcomes, doesn’t mean you have to penalise them. I think of them as lottery tickets, where not all the numbers have been scratched out yet. At some point when the numbers are scratched off, the ticket will turn out to be either very valuable or a worthless one.

When we started investing in Google, to us the money they were spending on autonomous vehicles was akin to lighting fire to dollar bills and throwing them outside the window. It sounded futuristic, with a low probability that there would be significant value. We did not value it as highly as the capital that was going into it. But the more we learned about Google’s venture capital investing, the more confident we grew about them thinking very economically about it. In fact, venture capital firms view what Alphabet is doing today as being state of the art for venture capital investing. Some of their early-stage investments have progressed to such a point, that we see similar companies under acquisitions get a value placed upon them. Perhaps we should up the multiple a little bit for these reasons, or use the transactions as a benchmark for the value. With something like autonomous vehicles, we’re at that point already.

How do you view Amazon, now that there is tremendous predictability in its cash flow and a huge runway of growth ahead, considering the possibilities it could explore? Is it just valuation that keeps Amazon out of your portfolio at this point?

Amazon was in our portfolio two years ago. When the stock was under 300, we wondered about adjusting their sales number for the third-party sellers. If Amazon owns the inventory and sells it to you for a dollar, that’s a dollar of sales. But if I own the inventory and am on Amazon’s site, when you purchase it from me, Amazon gets about a 15% commission on that. So the 15 cents are all that show up in their sales numbers. The profitability is not very different whether it’s a first- or third-party sale. When comparing it to other retailers, we need to gross up the third-party sales to get the gross market value. When we did that, Amazon was trading in the market at 80% price-to-sales ratio of the brick-and-mortar companies it was slowly putting out of business. We thought that was an attractive place to enter the company. The only bet was if the company was doing the right thing deciding to suppress profits in order to maximise growth. So, while retail sales in the US were growing 2% a year, Amazon was growing at 20%. To get that 20% growth, they had to invest with the income statement, both to make the company bigger in scale to handle future growth, and to lower prices to maximise the current market share.

For us, the question was whether it was worth foregoing a year of profit to grow the company 20 percentage points faster than the industry. Making that economic call was easy. Most of Wall Street was worried about what would happen if and when Amazon decided to show profits. But we think they are making the right economic decision. Over the course of a year, Amazon stocks went from under 300 to over 600. With that happening, combined with all the brick-and-mortar companies falling in price, we could no longer make the argument that Amazon wasn’t selling at a premium to the brick-and-mortar companies. At that juncture, we felt you had to have a strong case in favour of the future growth of AWS, which again is an emerging industry and we are not comfortable projecting what that would look like seven years from now. You also had to be willing to forecast that this 20% growth beyond the industry would last an extended period of time.

As value investors, our crystal ball gets fuzzier faster than it does for other people. We felt that the unusual opportunity we had had of buying Amazon cheap had passed. It’s a company we still follow; you almost have to in any industry today. At its current prices, we’re not saying Amazon is overpriced, but it doesn’t have enough of a discount to a conservatively calculated value that we can be comfortable with.

Can you tell us business segments and companies that have pricing power that can be sustained for a reasonable period?

It is hard to come up with companies that have pricing power today because so much of the opportunity, and venture capital money, is in finding a way to get a product directly from the producer to the consumer. This is much more efficient than the value chains of today, where you have a producer selling to a distributor, then to a retailer and then to the consumer. It is hard to see anyone in that chain having pricing power when the competition lies in the producer trying to get directly to the consumer. Look at the example of Gillette. Five years ago, you could say that it was as entrenched as a consumer brand could get. Media marketing to the consumer directly has turned that industry upside down.

The pricing power is probably with those companies that are earning almost no money because they are massively growing scale to become the dominant player and only then worry about monetising. YouTube is monetising numbers by charging like 4 cents per hour watched, whereas typical cable is charging 20 cents. It has pricing power, but it’s not a separate company selling at a low P/E and having pricing power. It is a company that is reinvesting heavily to dominate its business. Amazon is probably one company that has pricing power. Today, pricing power is in a different place than it was 20 years ago. Back then, you would have said that the cable networks or consumer brands had pricing power.

If you were to pick one theme or business segment that would throw up maximum value creators over the next 10 years, what would that be?

Foremost is the current valuation of a company, and the second most important is a management team that is focused solely on maximising per share value. Some of the best opportunities today are in very large financial companies selling at low book value, selling below P/Es with managements that have learnt that growth through shrinking shares outstanding can be just as valuable as topline growth. The last thing I want to invest in today is a financial services company, where the management is trying to grow by growing their loan book 10% a year. Companies that maximise per share value, no matter if that means they don’t grow or even if they shrink, will be great bets.

You describe your approach as that of a private equity (PE) firm in public market investing. Can you elaborate on that?

What you see today in most public market investors is a momentum focus on stock price and earnings. Most investors are trying to outguess each other about what a company is going to earn in the next quarter, or for those who call themselves long term, in the next year. What we do is quite different; we look at a company and try to project what it will look like five to seven years from now. We also think about how the balance sheet is likely to change, and how each division of the company might be different from what it is doing today. Some of those divisions might need money, some might be revitalised in ways that can get them a reasonable return or, in case that doesn’t happen, get them sold. We try to estimate how public investors might look at this company differently five to seven years in the future. When you think about it, this is not very different from what a PE investor does: trying to find a company that in the market today is worth significantly more than what investors are paying for it.

Certainly, there are important differences here. We don’t want to invest in a company unless we think the right management is in place to maximise that value seven years from now. A PE firm will often begin by removing the existing management and putting its own people. We don’t do that. Liquidity is obviously very different, you make a private equity investment and you can make a guess as to how the value has changed. But there is no liquidity unless the company is sold or it goes public. You rely on the estimates of the value. Compare that to our fund, where everyday you can see the price of that is based on what each of the securities are trading at in the marketplace.

The fees, too, are different. A typical PE firm is charging 2% of assets and 20% of profits, whereas our fees are just below average. For the mutual fund industry, it is less than 1% of assets or a fraction of 1% and 0% of profits. We provide liquidity, better disclosure of holdings and lower fees, but the thought process is similar to that of a PE firm.

Tell us your experience as an investor — the biggest mistakes and lessons you’ve learnt.

When people talk about their biggest mistakes, what always comes to mind is the investment that you made where you were too optimistic and the stock price went down significantly. Were you to ask me our bigger mistakes, they would be not getting over the hump to make the investment in companies that went up by multiples of the price when there was an opportunity to invest in them. For us, that is Google when it became public, or Apple when we bought it in Oakmark Fund but weren’t quite confident to buy it in Oakmark Select, and then you watch it go up seven-fold or more than that right now. Those are the big mistakes — the things that you should have invested in that went up by multiples and met your criteria, but you paused and decided against making that investment.

How has your evolution been as a value investor? What does and doesn’t work according to you?

As a value investor, you always have to be doing something that most investors aren’t doing. When I started in the business, even a simple screen of ranking an industry on P/E basis on forward earnings produced interesting results. A lot of people weren’t doing this. You could see that some of those companies were 15x earnings, while some were at 8x earnings. In some cases, the few that were at 8x didn’t look very different from the ones at 15x. During my early years, very simple quantitative screens created value and produced interesting output. Today that screening is so easy to do that everybody is doing it, which is why the outcomes aren’t very interesting. You have ETFs where the computers are programmed to just buy the lowest P/E companies.

The definition of value always has had to be somewhat fluid to be more advanced than what other people are doing. For us today, it’s less about saying this company is at 10x earnings in an industry that is at 15x, more about saying this company does not look cheap on a P/E basis but if you think about the following adjustments, it would be cheap.

Who are your role models in investing? You’ve previously talked about Michael Steinhardt as your role model, but isn’t he at the other end of the spectrum?

That is right. But I’ve always found it interesting that most value investors like to read only about other value investors. If you ask any value investor about their investment hero, Warren Buffett will be on the top of their list. He is on top of our list too, but once you’ve read seven books on Buffett, is the eight one going to add more value? Would not reading about somebody else, who did things very differently from you but who also succeeded tremendously, be more valuable? I find that I learnt a lot by reading about some of the hedge fund managers such as Michael Steinhardt, Paul Tudor Jones and George Soros, all of whose approach was very different from what ours is. Perhaps you may find one thing from their approach that is consistent with your own philosophy.

One of the things that Michael Steinhardt famously relied on was variant perception. On every company he had a position in, he knew what the bulls and bears thought, and why his point of view was different. Sometimes, as value investors, we don’t spend enough time doing that. We assume that if a company has a low P/E, or a low price to book, that’s enough to conclude it’s cheap. But we’ve learnt by studying Steinhardt that we can add value in our process even in a stock that looks statistically cheap by stating our different and distinct point of view. Anybody at Oakmark will be able to tell you what our variant perception is of a stock that we own.

There is a famous picture of Paul Tudor Jones with a piece of paper on his bulletin board that says ‘Losers average losers’. As value investors, we always want to believe that the stock is overreacting to bad news. A typical analyst report goes: This is a disappointing quarter but my value estimate fell only 5% while the stock fell 15%, so it’s a lot cheaper than what it was yesterday. This led us to do a lot of research into our own ideas. When the fundamentals start deviating from what our analysts had projected, averaging down on those names tend to not work. It made us alter how we thought a little bit more, which for us is certainly more valuable than learning what Warren Buffett eats for breakfast. What Warren does — buying great businesses that are run by good people, buying and holding, thinking about long term — is still the core of our investment approach. Nothing pleases me more than when somebody says that what we do at Oakmark is very similar to Buffett. At the same time, that doesn’t mean we can’t learn from people who do things very differently from what we do.