It’s a cautionary tale of how no company should be managed, let alone one that employs over 170,000 people. For the first time ever, loss-making Bharat Sanchar Nigam (BSNL), along with MTNL, couldn’t pay salaries to its employees. In a last ditch effort, the government decided to merge the two ailing companies hoping to keep them afloat, maybe for a little while longer, as they play catch-up with private telecom players, including disruptor Reliance Jio. And if you thought this is where the woes of PSUs end, you’d be mighty wrong. It’s just the tip of the iceberg. After a tepid market debut last year, defence PSU HAL had to borrow Rs.10 billion in January to pay its employees, one-third of whom went on an indefinite strike over wage revision in October. Then, we all know the tale of our humble Maharaja, Air India, which isn’t even attracting private buyers and its survival continues to hang in balance. “Excessive dividends and huge mismanagement have resulted in a situation where investors are not willing to re-rate the stocks and businesses are deteriorating on fundamental parameters,” says Pankaj Bobade, head of fundamental research, Axis Securities.

Once touted as the crown jewels and a relic of India’s socialist past, the fall of PSUs has been stark. Their bottom lines also don’t make for a pretty picture. Bobade states, “They have been growing at a meagre 2% CAGR over FY12-18.” Naturally, weak performance over the years has depressed their valuation. Currently, SBI is the only PSU among the top ten companies in market capitalisation. BSE PSU Index has also been a laggard, giving 4.78% CAGR return since 2014 as compared to Sensex’s 14%. This year alone, 61 PSUs have lost an average of 22% of their market cap, with five companies losing more than half their share value.

Clearly, PSUs are saddled with structural flaws that are likely to be never rectified. Hence, the growing clamour for privatisation among India Inc veterans. But take a step back and think about what comes to mind when someone says healthy cash levels, cheap valuation, high dividend yield and a virtual monopoly. The answer is most likely to be PSU companies. Over the same period of abysmal profit growth, these companies have given dividend yield of 9% CAGR, and many analysts believe government’s divestment plans could be quite beneficial. The stock price of BPCL is already on an upward trajectory on reports of private players picking up stake. So, is there a case to look for long-term value bets in this beaten down space?

Sunil Tirumalai, head of research and strategist, Emkay Global Financial Services believes there is, but one has to cherry pick. He adds, “One must look for companies in sectors where the entry of private players is not easy.” This shields them against free-market competition.

But besides trading at reasonable valuation and having a secure monopoly, a PSU also needs to have a strong brand value, well-built network and earnings visibility. Here are some companies with the potential to become stars in the future.

Indraprastha Gas

The city gas distributor is a PSU that enjoys an almost monopolistic presence in the Delhi-NCR region, and has healthy pricing power. Since compressed natural gas (CNG) costs much less than fuels such as petrol or diesel, the company sporadically takes price hikes if necessary. While a kilogram of CNG in the capital costs about Rs.45, petrol is priced above Rs.72 for a litre. Similarly, piped natural gas (PNG) is 10% cheaper than liquefied petroleum gas (LPG) cylinders.

As pollution levels in the NCR region continue to rise, natural gas consumption in India’s capital is expected to rise dramatically. Domestic and industrial customers could shift to PNG and, according to a Supreme Court order, all public transport vehicles have to run on CNG in Delhi. The Delhi government is also set to roll out 2,000 CNG buses during the odd-even days. These put IGL in a sweet spot. Meanwhile, the distribution company is foraying into new areas such as Gurugram, Karnal and Rewari, which will drive volume growth.

“Clean-up of industrial fuels and policy thrust for gas-run public transportation will drive over 9% annual volume growth for IGL over the next decade. Favourable taxation, regulations and better price competitiveness favouring gas will also support growth,” state analysts at Ambit Capital.

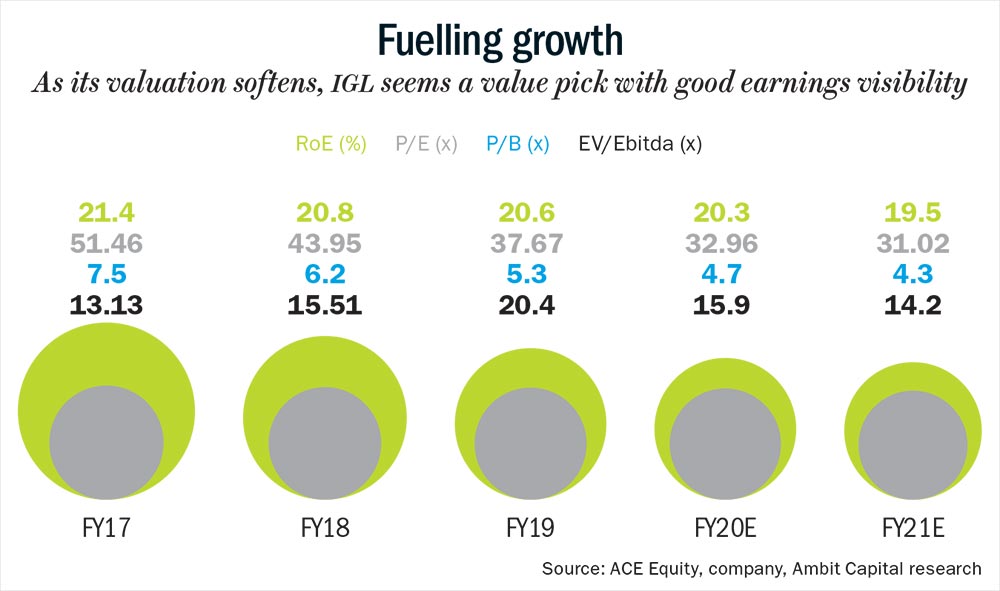

IGL posted robust Q2FY20 profit, which doubled from last year, due to rise in sales and tax reduction. Naturally, it has become one of the favourite PSUs among investors. Strong financial performance and earnings visibility are driving its high valuation and analysts continue to bet on the stock that’s trading at 31x FY21 estimated earnings (See: Fuelling growth).

Petronet LNG

Another gas sector company that’s been in favour is Petronet LNG (PLNG), a company that will see steady growth in demand and has strong pricing power. “Petronet LNG and IGL are good stocks to own over a long period of time because of good demand and pricing environment,” says Nitin Bhasin, head of research, institutional equities at Ambit Capital.

The country’s biggest importer of LNG, which also set up India’s first receiving and regasification terminal in Dahej, Gujarat, will benefit from switch towards natural gas indirectly. India has not been able to meet the rising demand for natural gas, forcing fertiliser companies to move towards regasified liquefied natural gas (RLNG). Analysts expect this trend to continue for a while.

PLNG follows a unique business model and processes cost-effective LNG. Its Dahej facility has a capacity of 17.5 MMTPA and is the lowest production cost terminal in India. Experts believe this is a technical advantage that the company’s peers don’t have, and they would find it time-consuming to set up such a facility.

Bhasin states that it can easily withstand competition, adding that expansion of city gas distribution network will lead to steady volume growth. Analysts at Ambit Capital remain sanguine about the company’s prospects, noting in a report, “PLNG is competitively positioned given that it has the cheapest LNG capacity (40-50% lower capital cost). Thus, concerns over a market share loss to competing terminals are unfounded.” Besides, the company’s take-or-pay agreement with its suppliers has shielded it against risks such as currency fluctuation, gas price volatility and drop in capacity utilisation. With the agreement being beneficial to both PLNG and its supplier, it’s able to procure gas at a lower price.

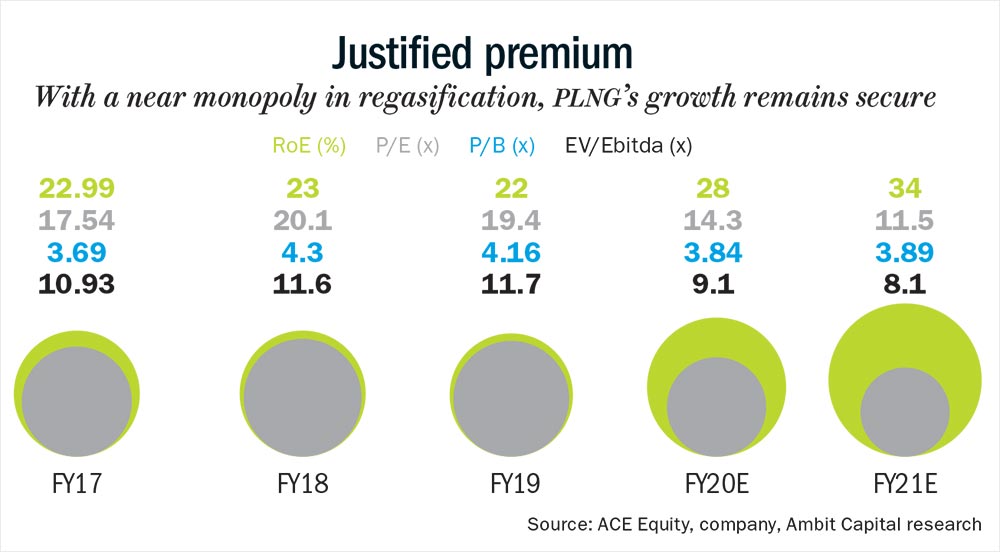

Revenue and capacity utilisation are also likely to improve further. With the Kochi-Mangaluru pipeline almost complete, the terminal will ramp up 2 MT volume this financial year in addition to 17.5 MT of Dahej terminal. The latter already has a capacity utilisation of 107.61%. Despite steady volume, earnings growth and 24% rise in stock price this year, PLNG continues to trade at 11.5x FY21 estimated earnings (See: Justified premium).

State Bank of India

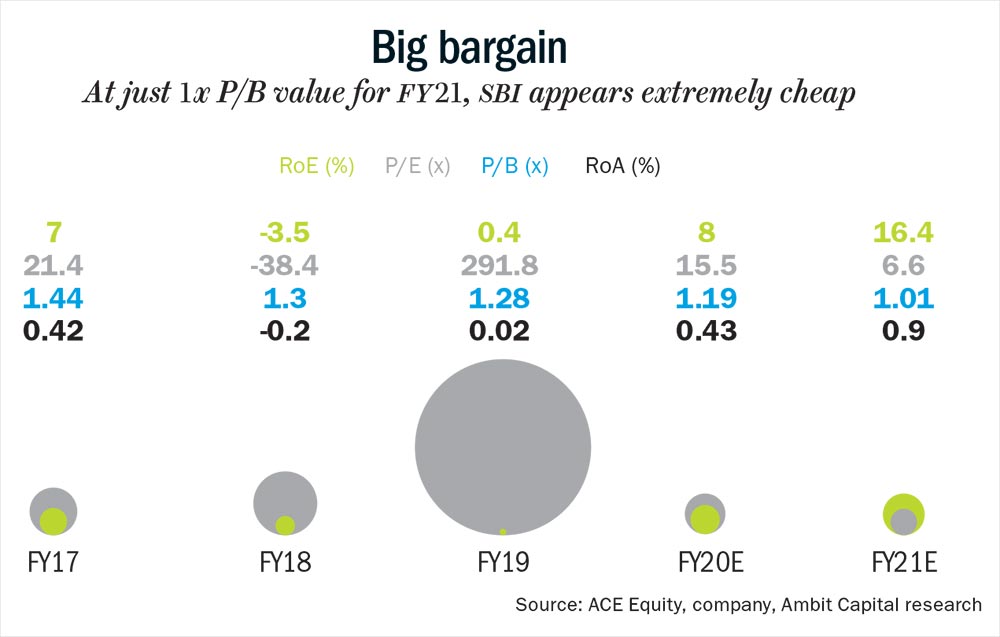

India’s largest lender has seen its fair share of ups and downs since its inception. But over the past few years, there have been more setbacks than positives. From falling to as low as Rs.150 in 2016 to hitting Rs.370 in July 2019, State Bank of India’s (SBI) stock has seen a wild ride. Even currently, the PSB is facing near-term challenges including the possibility of a rise in non-performing assets (NPAs) due to the bank’s Rs.100 billion exposure to debt-laden DHFL and the overall economic slowdown. These concerns have pushed its valuation down, and the stock currently trades at 1x P/B value for FY21 (See: Big bargain).

But even as the risk of bad loans persists, SBI is a bank with strong brand and an expansive network. “They recently invested in building a technology platform and are trying to create a credit card portfolio in the urban market. In addition to that, SBI has an extremely good brand of insurance business and asset management,” says Bhasin.

Recently, the bank’s management outlined a strategy to leverage synergies by cross-selling products. Post that presentation, analysts at JM Financial wrote, “SBI has a huge opportunity to leverage its huge existing base of 438 million customers to cross-sell its retail assets products, especially in life and card where only 3.6 million and 3.3 million respectively are SBI customers.”

The bank is treading on a conservative path in regards to providing cover for its bad loans. The provisioning coverage stands at 81.23% as of Q2FY20, up from 70.74% a year ago in the same quarter. The management also made it clear that credit cost is expected to fall and net interest margin will improve, leading to 1% return on assets by FY21. Analysts believe the prevailing uncertainty provides an opportunity given its cheap valuation and strong network.

NTPC

Like SBI, National Thermal Power Corporation (NTPC) has also had a rough year. The stock of India’s largest power utility company has plunged by 17% since July. Strike in Coal India’s mines, and coal supply disruption due to heavy monsoon have led to a drop in plant availability factor (PAF). This unit measures how productive a plant has been over a period of time; the higher it is, the better. In Q2FY20, the PAF dropped to 85% from 91% in the previous quarter.

There’s another cloud hanging over the company. The government is reportedly planning to divest its stake in Shimla Sutlej Jal Vidyut Nigam (SJVN). If the Centre directs NTPC to buyout hydropower producer SJVN, like it had asked ONGC to purchase HPCL, then thermal power manufacturers’ cash reserve could deplete. Currently, NTPC has a cash and bank balance of Rs.27.82 billion, whereas SJVN has a market cap of more than Rs.95 billion.

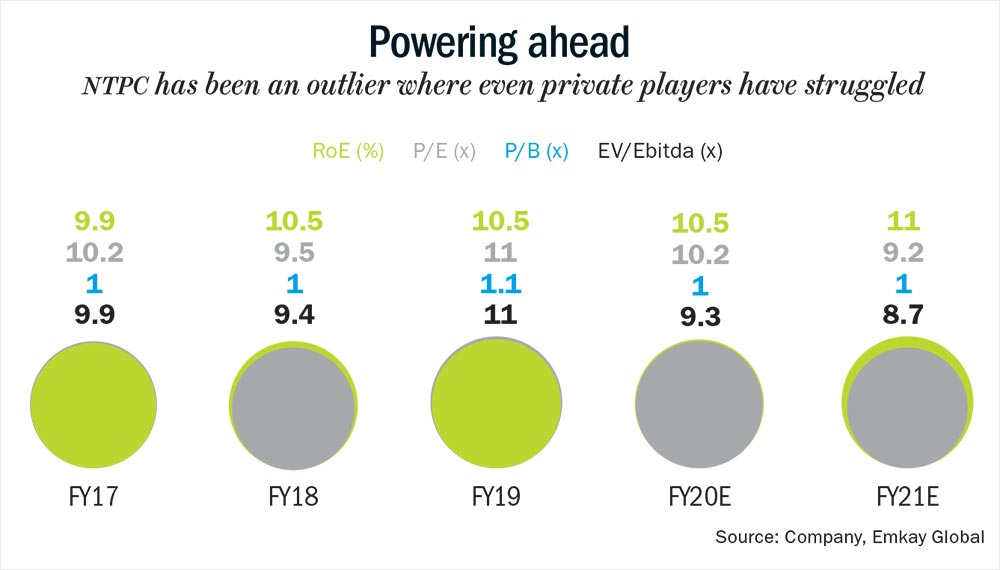

Analysts are asking investors to look beyond the short-term challenges as NTPC has a fixed revenue model. “They build a power plant and the government buys electricity at a regulated price. So they have good revenue visibility and it isn’t going to change,” says Tirumalai. He adds that since investors can predict earnings of NTPC, it can be seen as a stable ship in times when the economy is going through a turbulent period.

NTPC also provides power to suppliers by signing a long-term power purchase agreement with them, which offers protection from price volatility. In a sector where even private players have struggled to reap profit, NTPC has been an outlier. With valuation at a historical low of 1x P/B value for FY21 (See: Powering ahead), the stock could bounce back.