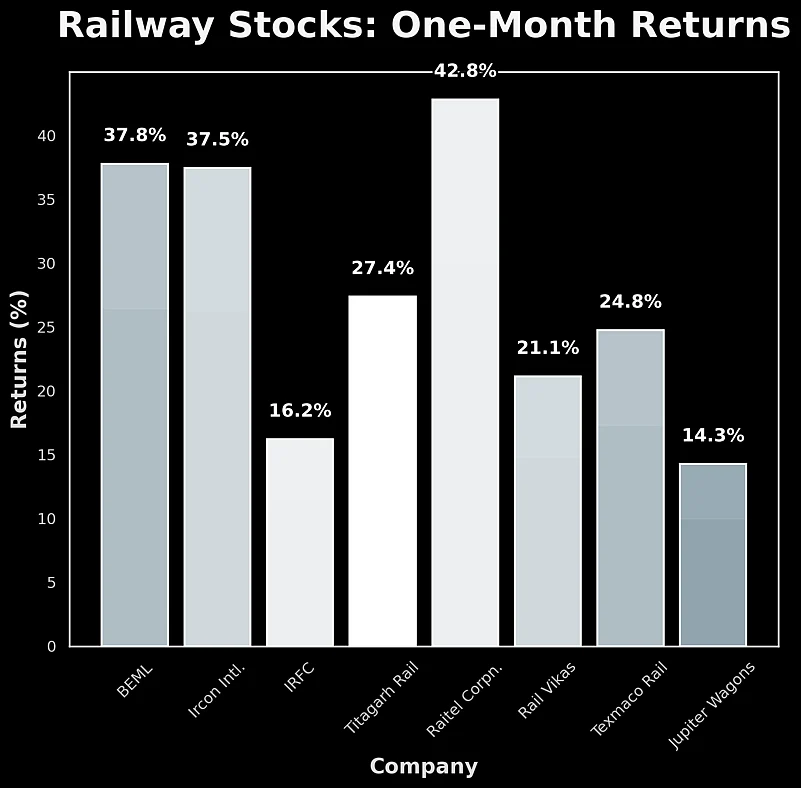

The hype-driven rally that first seeped into defence counters in the last three months has stretched its arms to lap up railway stocks. Major players like BEML, Ircon International, IRFC, Titagarh Rail, Railtel, and Jupiter Wagons have seen a flurry of incessant buying in the past month, surging as much as 43% during the period.

The surge in sectors like defence and railways have brought back fears of narrative carrying investor sentiment rather than actual fundamentals. Taking this further, Kotak Institutional Equities warn that the steep increase in prices of railway stocks and their hot valuations stand in sharp contrast with the flat capex of Indian Railways in FY26 and their modest medium-term growth prospects.

To that effect, the brokerage ascribes the run-up in railway stocks to euphoria in small and mid-cap space and positive rub-off effect from other narratives. “The market is clearly not making any distinction across sectors and stocks, as long as they fit into some prevailing narrative (defense, electrification, manufacturing, railways),” Sanjeev Prasad, Co-Head of Institutional Equities at KIE wrote.

A major trigger behind such narrative driven euphoric moves that market experts have often pointed is the high share of retail shareholders in these counters. Since many of the ‘narrative’ stocks are largely owned by retail shareholders, these are often more prone to extreme bouts of volatility, driven more by hype than fundamentals.

Growth Outlook Remains Tepid

The central government’s budgeted capital expenditure for railways has stood broadly flat over FY24-26. Prasad highlights that the bulk of the capex of the railway sector is actually captured in the central government budget, with only a portion of capex , related to metro projects, comes under a different head of government spending.

In that context, Prasad feels that the medium-term growth prospects for railway players look dim, more so because any meaningful pickup in government capex for the sectors remains unlikely. To justify his stance, Prasad names some factors. First being that it looks like the government has largely maximized the capacity of its extant railway network with large investments in rolling stock and track over the past 10 years. Second, the lack of visibility when it comes to more new projects, like the high-speed railway network on the lines of dedicated freight corridors or the upcoming Ahmedabad-Mumbai high-speed line, makes Prasad bearish over the railway sector.

Fundamentals Lag Behind

Even though medium-term growth prospects remain dull, railway stocks have soared to sky-high valuations, yet again. With this, there has come a large disconnect between the fundamentals and valuations of the railway companies.

“PSU railway stocks trade at several times book value (net worth) and at very rich P/E multiples. The valuations are very hard to reconcile with the financials and growth prospects of the companies,” KIE flagged.

The firm also pointed towards the price agnostic behaviour among investors that gives off a sense of déjà vu. “The nonchalant attitude perhaps reflects the market’s confidence in retail investors sustaining their hitherto price-agnostic purchase of stocks through mutual funds and FPIs staying positive on Indian equities based on a ‘narrative’ of a lack of alternatives in emerging markets,” KIE said.