Crude oil price: Trump’s oil bargain is turning out to be pricier than expected for Indian OMCs, which are already stuck in a storm. From delays in expansion projects to higher capex outlay resulting in weaker cash flow, problems continue to mount for domestic oil companies. This is quite evident in the trajectory of oil stocks as well. The NSE Nifty oil and gas index has plummeted over 27% in the last 6 months, with majority of the stocks trading below their 50-DMA.

And the recent call to shift focus from Russia to the US for oil imports to meet Trump's 'reciprocal' demand over trade practices and stabilise the widening trade deficit between the two countries, has only made things worse.

Not only is US crude more expensive than Russian crude, but its quality is also less suitable for Indian refineries. Some domestic oil companies have said they can only process a limited share of US crude in their refineries. Besides, the earnings season has already signalled sustained weakness in margins, with profits continuing the declining spree.

Does this mean more pain is left for Indian OMCs? Market analysts believe so. Even as oil prices remain at moderate levels, domestic refineries might have to spend more bucks on buying the commodity due to the rupee depreciation effect.

Crude Reality

Earlier this year, Brent crude surpassed the $80 price level before easing back and trading around the $75 per barrel mark. Lower oil prices mean lower gross margins for Indian OMCs as majority of the demand is met via imports. Despite multiple production cuts by OPEC+ nations, that kept oil prices in check, lower overall demand has impacted the cost levels adversely.

Meanwhile, EIA (Energy Information Administration) is expecting more downward pressure on the prices ahead. "We forecast benchmark Brent crude oil prices will fall from an average of $81 per barrel in 2024 to $74 per barrel in 2025 and $66 per barrel in 2026, as strong global growth in production of petroleum and other liquids and slower demand growth put downward pressure on prices," the US-based agency said.

Softening crude prices can also hit inventory gains wherein domestic oil companies profit when the crude they purchased at lower rates rises in value before refining.

In the past few quarters, Indian refineries were losing out on discounts made on the purchase of Russian crude. From $7-$8 per barrel discounts to just $3 to $3.4 per barrel, domestic refiners were losing big time on cost advantage which in-turn made their operations more expensive alongside already declining profits. While the surge in overall production from non-OPEC producers might provide supply flexibility to India, higher US production could also result in lower global oil prices, which is exactly what is being witnessed now. This will eventually impact the margins of upstream companies like ONGC and Oil India.

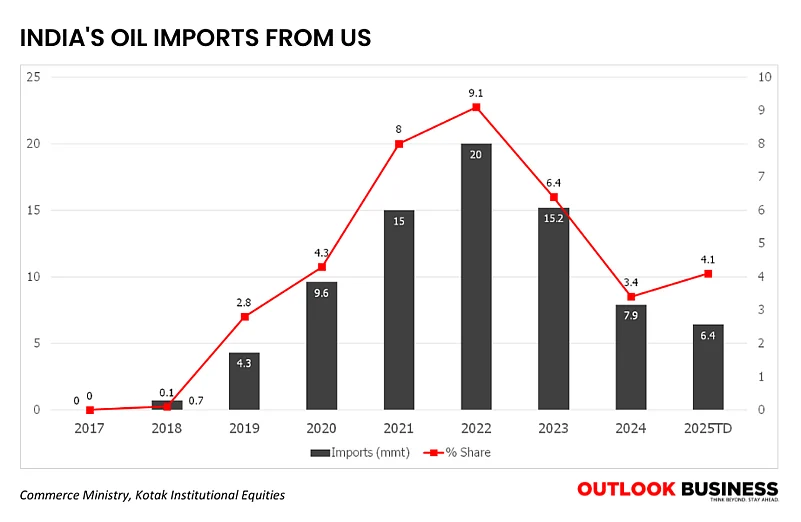

What’s worse is that India is likely to ramp up US crude imports, even though it is not well-suited for Indian refineries. "With relatively sweeter, lighter and longer voyages, US crudes are typically not preferred by Indian refiners. Our recent interactions with HPCL (Hindustan Petroleum Corp.) and IOC (Indian Oil Corp.) suggest that they cannot use more than 8-10% of US crude in their refineries," Kotak Institutional Equities stated in a report. The share of US oil imports rose by around 9% in FY22 but dropped to 3.4% in FY24. However, it is expected to increase again, as per analysts.

Will OMC Shares Feel the Heat?

Market analysts believe oil prices will inevitably take a hit if Trump’s oil deals drive global crude lower. Since OMCs profit from the gap between crude costs and retail marketing price, any drop in global oil prices would directly hurt domestic companies' refining margins, and eventually their stock price. The other pain point is the declining value of Rupee against the Dollar.

"Since India is a major oil importer, the weakening rupee against the dollar would make imported crude more expensive, eventually impacting the profitability of OMCs. Indian OMC stocks might face downward pressure in the short term until the uncertainty surrounding Trump's actions and market reactions subsides," said Prashanth Tapse, senior VP research analyst at Mehta Equities.

For domestic OMCs, the challenge lies not just in crude price fluctuations but also in securing cheaper oil imports, which had previously helped manage costs. With India importing 85-90% of its crude requirements, any disruption in global supply dynamics could impact margins, said Shruti Jain, chief strategy officer at Arihant Capital Markets.

The Nifty Oil & Gas index is already trading in bear category, down by over 30% from its 52-week-high.

Analysts believe that increased fluctuations in the price of the commodity will be a major hurdle for OMC stocks ahead. Based on fundamentals and valuations, our top picks are HPCL, BPCL, Mahanagar Gas, GAIL and ONGC, as per Yes Securities. While Trump's demand over oil imports to India alone may not significantly impact the bottom line, volatility in oil prices coupled with already strained margins could weigh on the trajectory of OMC stocks ahead.