From being the company to introduce laminated tubes in India for the first time in 1980’s to becoming the largest player in the oral care segment with 36% global market share; Essel Propack has definitely come a long way. Riding on product innovation, the company is looking to repeat its success in the non-oral category (3.5% market share), that is nearly 3x the size of oral care. Part of the $2.4 billion Essel Group, the company sells more than 6.5 billion tubes a year. Essel Propack caters to around 400 customers including the likes of Colgate, Johnson & Johnson, L’Oreal, Nestle, P&G, Unilever, Cadbury, among others. Currently, international revenue accounts for 64% of sales with Europe and Americas making up for 18% and 20%. Emerging markets, including India (37% of overall topline), account for a chunk at 40%.

Post the acquisition of Propack in 2000, the company became the largest player in the oral care segment with a global market share of 33%. While being a market leader is a matter of pride for any company, it also became a cause for concern. “We were at cross-roads. How do we grow from here? “Some said let’s take our market share in oral care to 50%. However, that would have meant incurring significant capital investment and compromising margins. That strategy didn’t seem sound,” says Ashok Goel, managing director, Essel Propack.

The right choice

In 2004, Essel Propack acquired a plastic tube-making company in the UK catering to the non-oral care segment. “The oral care market size was 14 billion tubes. When we explored the potential of non-oral care market, the beauty and cosmetics space offered a 12 billion tubes opportunity and another 10 billion aluminium tubes in pharma and food could be replaced with laminated tubes. So suddenly, our market size nearly tripled,” says Goel. Besides, the machines required for non-oral care would be the same machines that Essel Propack was using to cater to its oral care customers.

The realisation were also higher as the products are relatively less price-sensitive compared with oral care products. As Goel puts it, “If the price of a tube in oral care space is 1x, the price in pharma is 2x and in beauty and cosmetics, it is 3x-4x.” The non-oral care customers also need highly customised products, which also leads to higher margins in this space.

But the foray came with its own set of initial challenges. “In oral care, you’d typically have long-term contracts with fixed volume. Due to the stickiness of these orders, our marketing didn’t really have to put in much effort. However, non-oral care was a completely different ball-game. The order sizes tend to be small – 50,000 to 100,000 tubes and the contracts were for a shorter tenure. This meant the back-end team needed to reset the machines at regular intervals leading to higher scrap levels. The marketing team also needed to deepen their engagement with customers in the non-oral care segment,” Goel reveals.

As the company tried to adapt to the changes required in the non-oral business, profit growth got chequered, while revenue grew at a tepid 4% during FY08-12. Deciding to get the house in order, Essel Propack sought the help of consultants who helped the company’s manufacturing units across the world reset their processes and respond faster to the changing trends in the marketplace.

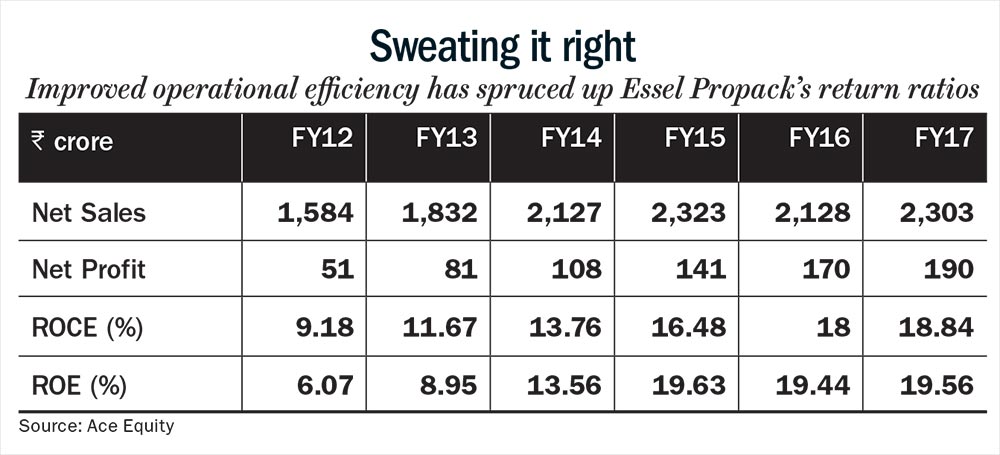

The changes worked and over the next five years (FY12-17), Essel Propack’s revenue growth almost doubled at 7% CAGR from Rs.1,583 crore to Rs.2,302 crore, while profit clocked an impressive 30% CAGR from Rs.51 crore to Rs.190 crore, driven by better operating efficiency (See: Sweating it right). Operating margin was up 217 basis points to 19% during the same period. In sync, revenue contribution from non-oral care tubes business has gone up from 34% in FY12 to 40% in FY17. Now, the plan is to take the contribution to 50% by FY19.

Essel Propack has chalked out different growth plans for developed and emerging markets. In developed markets, Essel Propack is focusing on beauty and cosmetics, while in the emerging markets; it is more focused on pharmaceuticals. “The developed markets have higher consumption of beauty and cosmetics products. It makes sense to convince customers in these geographies to switch to laminated tubes. These customers have presence across geographies, so we can increase our overall volumes. In the emerging markets, we are focusing on OTC and prescribed formulations. These geographies not only consume a good deal of pharmaceutical products, but also export huge quantities to other emerging countries which are not seeing too many regulatory headwinds. We want to ride this growth in EMs,” says Goel.

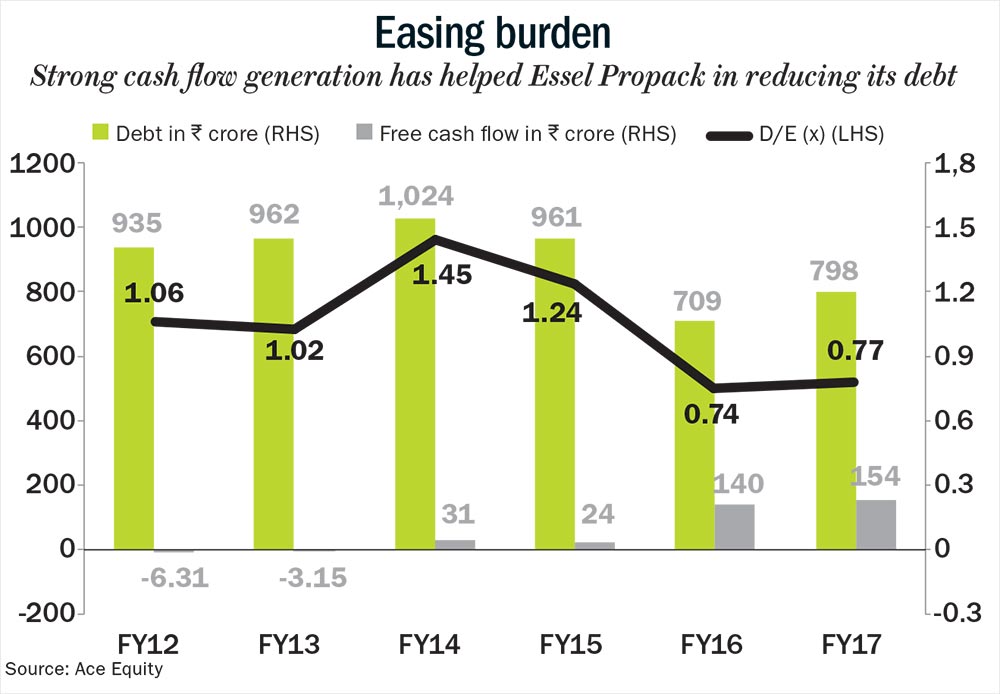

After improving its operational performance, the management at Essel Propack set itself another challenge in FY14. Essel Propack launched its 20:20:20 mission with a 5-year horizon. The target was that the Ebitda margin, ROCE and ROE needed to be 20% by the end of FY19. While the average revenue growth target was set at 15%, profit needed to grow at 20% CAGR. To improve efficiency and reduce costs, operations on the shop floor was benchmarked to global standards and the finance team was told to bring down interest costs. Between FY14 and FY17, the company brought down its debt from Rs. 1,024 crore to Rs.798 crore (See: Easing burden) . It also improved its free cash flow from Rs.31 crore to Rs.154 crore; a growth of 70% CAGR while profit increased at 20% CAGR from Rs.111 crore to Rs.194 crore during the same period.

Shiny future

Over the past three years (FY14-17), the company’s European operations have grown at 12% but it has not all been smooth sailing. In October 2016, Essel Propack bought its partner in its joint venture Essel Deutschland Germany (EDG). The German unit, which accounts for 40% of Europe’s topline saw its revenue drop by 10% for the nine months ended December 2017. “The company was not realistic about the actual conversions of orders and couldn’t meet requirements on time,” admits Goel. As a result, some customers moved to more reliable suppliers. Analysts reckon the company should be able to turnaround EDG operations soon. “In 6-8 months, the EDG business should breakeven. That should give a fillip to overall Europe operations,” says Ankit Gor, analyst, Systematix.

Sanjay Manyal, analyst, ICICI Securities, says that the turnaround at EDG will offer Essel Propack better cross-selling opportunities, sourcing flexibility and ensure higher capacity utilisation at all its European plants. Over FY17-20 he expects revenue to grow at 14% compounded for the Europe business. While 59% of the European revenue is driven by non-oral care market, Americas’ revenue share from non-oral care business stands at less than half of Europe at 21%. However, analysts expect revenue from Americas to grow at 8% CAGR over FY17-20 driven by non-oral care business and improved sales from Colombia.

Though the India business has seen some disruption due to the implementation of GST, analysts expect the business to clock an average growth rate of 9% during FY17-20 driven by higher demand from non-oral clients. This is almost double the growth rate seen in the previous five years. Essel Propack is combining three of its plants – Silvassa, Murbad, Chakan into one unit in Bhilad (Vapi) to improve its cost structure. “Combining three domestic units into one will bring down the overall operating costs. This, along with demand recovery in India and, improved capacity utilisation in Europe would help in sustaining the consolidated Ebitda margins,” says Payal Pandya, analyst at Centrum Broking. The India business drives the overall margins for Essel Propack clocking Ebit margins of 21%, compared with Europe’s 6% and 15% for Americas.

From a volume-driven company, Essel Propack has made a successful transition to a product development-driven company. This gives it negotiating power with its price-sensitive clients. Over FY17-20, analysts estimate the company’s revenue to grow at 10% and profit to grow at 13% every year. “We expect a strong growth in non-oral revenue riding on conversions in US and Europe and growth in cosmetics, foods and pharma in China & India. The oral care business is expected to log stable revenue growth. Earlier, losses in Americas and Europe had impacted Essel’s performance,” says Nihal Jham, analyst, Edelweiss.

Given its execution track record, analysts say the company’s valuation is attractive compared with its peers. “The company is presently trading at 8.6x one-year forward EV/Ebitda which is a 15-20% discount to global peers such as Aptar and Bemis. None of the global peers’ return ratios are at par with Essel Propack. So the company should get a premium valuation as it expands its business,” observes Jham. The stock that has gained 20% in the past one year is currently trading at 16x FY19 estimated earnings. Given its growing presence in the lucrative non-oral segment and product innovation capabilities, Essel Propack looks well placed to ride the growth in non-oral care.