Avenue Supermarts Shares: The shares of the hyperlocal retail chain remained in the red territory for the better part of 2024. While investors were already counting-in a rough Q3, the results have painted an even bleaker image. This eventually pushed many D-street analysts to cut the share target price.

As the pressure factors continue to mount, the company’s performance is majorly feeling the heat from two main challenges: heavy discounting driven by growing competition in quick commerce and the resulting strain this has put on its margins.

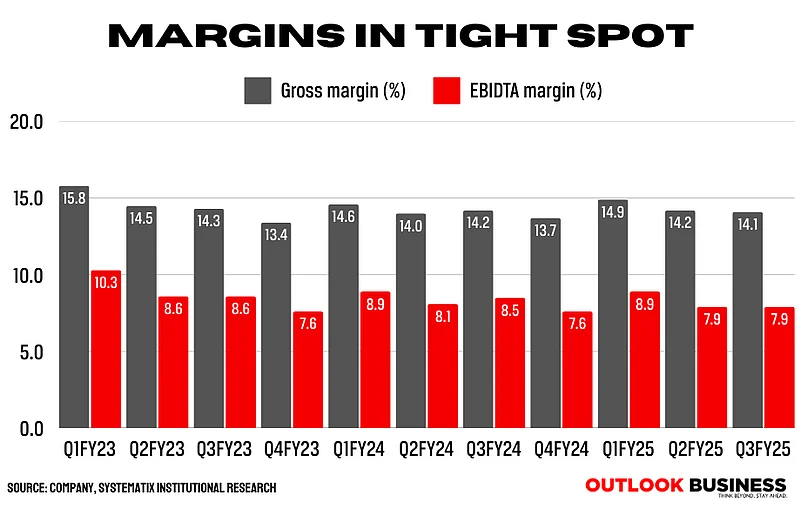

However, heavy discounting was not the only culprit behind the gross margin squeeze. Other expenses, such as rising employee costs, spending on service upgrades and future investments also added to the strain. This pulled down the gross margins by 14 basis points year-on-year (YoY), to 14.1%. Plus, a large part of this decline came from the increased share of the low-margin foods business. Similarly, Ebitda margins also took a hit, declining by 53 basis points to 7.9% compared to the same period last year.

Not everything painted a dull picture, though. For instance, revenue grew by around 17.5% YoY, and PAT saw a 6.5% increase. However, PAT margin did dip by 52 basis points YoY in the recent quarter.

What's working and what's Not?

While the performance was largely subdued, DMart’s Q3 picture remained steady at several points. For instance, the metric used to gauge sales growth from existing stores (like-for-like growth) hit 8.3%, marking a surge from 5.5% recorded in the previous quarter. Bill cuts also jumped by around 17% and revenue per store went surged by 3%. But again, the rapid rise of quick commerce in big metro cities is still a concern.

To tackle this, Avenue Supermarts' online service, DMart Ready, is already witnessing robust growth. It had a solid 21.5% YoY revenue growth in the first 9 months of FY25. Still, it’s not growing as fast as quick commerce, even though it’s a smaller operation, as per analysts.

Category-wise, the food segment, which is the biggest revenue driver, witnessed the fastest growth pace at 20%. This was followed by non-foods with a 13% increase and general merchandise & apparel growing by 15% YoY.

However, inflationary pressures continue to take a toll on overall sales, as even the festive season failed to uplift the figure.

"This time the festive season sales were lower than expected in Non-FMCG. Within FMCG, agri-staples (ex-edible oil) are going through significantly high inflation," said Neville Noronha, CEO and MD of Avenue Supermarts.

Besides this, the company is keeping its working capital game strong. DMart is aiming for 33-35 days of inventory and a net working capital cycle of 23-24 days, as per Systematix institutional equities. For FY24, the company spent more on capital expenditures (Rs 26 billion), likely due to land purchases for expansion.

"We expect a pick-up instore opening trajectory in 4QFY25E (had opened 24 stores in 4QFY24), building in 45 stores over FY25E which would lead to a gradual increase in capex. By FY27, DMart expects to achieve a return on equity (RoE) of 15.3% and a return on capital employed (RoCE) of 20%," the report said.

For D-street analysts, the margin play continues to be one of the most concerning factors. This alongside the recent shift in top-management has brought-in uncertainty in the minds of investors in the short-to-medium term outlook.

D-street's word of caution

"We believe DMart’s margins would continue to be under pressure amid the high competition and management’s focus on market share followed by margins. We are trimming revenue/PAT estimates for FY25 and FY26 by 0.5%/11% and 2.1%/17.4%, respectively, on account of lower margins," Nuvama said in its report alongside revising the target price to Rs 4,212 and maintaining its Hold recommendation.

Last year, Avenue Supermarts' shares struggled to remain in the green territory and have been down by over 35% from its 52-week-high level mark of Rs 5,484.85. Since the advent of this month, the shares have followed the same trajectory, declining by nearly 3% on the bourses.

ICICI Securities has lowered its target price by 10% to Rs 3,300 and maintained a 'Reduce' rating citing that slower-than-expected retail expansion could have an impact on the overall bottom line.

Motilal Oswal, on the other hand, has maintained its Buy rating, albeit with a revised target price of Rs 4,450.