Camlin Fine Sciences’ (CFS) topline received a mighty blow when it announced its entry into the antioxidants blends business. Its biggest client, US-based Kemin Industries was unhappy with its entry as a direct competitor and annulled its contract with the firm in August 2017, when it announced its foray into the US market. Kemin Industries accounted for 20% of CFS’ topline at Rs.1 billion. CFS was also facing headwind from the Chinese market around the same time, in the form of pricing pressure and low demand. The resultant capital crunch put the brakes on its expansion plans. But this definitely is not the endgame for CFS which was formed after the demerger of the fine chemical division of Kokuyo Camlin in 2006. The firm is a global player with manufacturing and research presence across five countries, through a host of its subsidiaries. The firm started off as a manufacturer of intermediate antioxidant products and due to an enterprising management, quickly became a global leader in the market.

Marching forward

It is now amidst a structural shift as its portfolio is transitioning from competitive shelf life offerings towards high margin antioxidant blends, alongside increasing penetration in vanillin (the synthetic version of vanilla) and performance chemicals. The gross margin for antioxidant blends is in the range of 40-70% in comparison to the 30-35% level for the more commoditised tertiary Butylhydroquinone (TBHQ)/ Butylated hydroxyanisole (BHA) offerings, both of which are food additives used for animal as well as human consumption.

CFS is already a global leader in less-specialised antioxidants, such as TBHQ and BHA, commanding more than 50% market share. But the opportunity in these markets is limited from here on ($100 million) and there has also been a steady rise in competition. The move towards antioxidant blends will not only extend its customer profile, but will also enhance its potential for cross-selling. The shift has enhanced its exposure to four end markets — human food, animal feed, pet food and biodiesel. For instance, the addressable market for the firm will expand from the current $54 million to $500 million in food and beverage segment and to $200 million in animal feed segment. Nikhil Mathur, associate vice-president, Ambit Capital, says “While initial overhead costs are fairly high in the blends business, the high entry barriers should reduce the risks for the firm as it scales in this segment.”

If complexity and scale are external drivers, there is more going for the company thanks to its past track record. Surya Patra, vice-president, healthcare research, PhillipCapital says “We are positive about CFS’ entry into blends because the firm has demonstrated the ability to successfully carve a niche for itself in new businesses in a short period of time.” Patra cites its success in the food ingredients business, where the firm began from scratch but achieved global leadership in less than six years. Normally, it is difficult for a new firm to break into food intermediate products, but CFS has. Patra adds, “Even though it will face competition when it ventures into the new segment, because of its Indian positioning and its integration spanning across the entire chain, it will be a cost competitive player globally.”

Thanks to that optimism, CFS raised Rs.1.5 billion through a Qualified Institutional Placement (QIP) in December 2017 to complete its greenfield manufacturing plant at Dahej, Gujarat, which is expected to be the lowest-cost manufacturer of downstream products and of vanillin globally. The plant is expected to commence operations in FY19. Mathur states that the plant will reduce CFS’ import dependence on key raw materials considerably and propel its presence in downstream segments. The inventory levels are also expected to reduce and will potentially lower the working capital cycle.

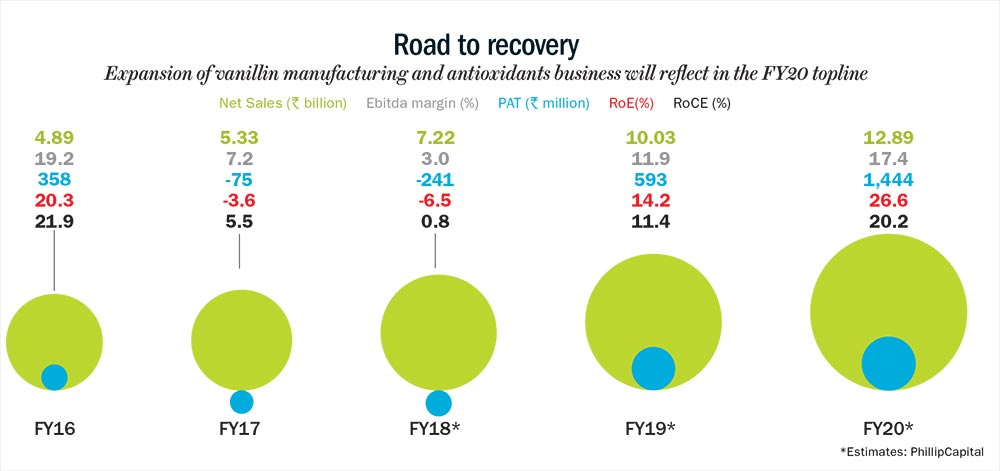

Patra believes that the stock is set to re-rate as its past investments are set to bear fruit going forward. “CFS has already tied up its investments towards forward-integration and that should boost its earning efficiency in the near future. The losses, which we have seen over the past few quarters, should subside and we will gradually see a ramp-up in the blends business. FY17 was the year of pain, when the key customer exited and the process of forward integration began. FY18 was the transition period, from making losses towards turning around the business, and in the meanwhile it also increased its footprint in the vanillin manufacturing business. Moving forward into this fiscal, we should see smart recovery in earning efficiency, with FY20 being the year when its expansion efforts will be more meaningfully manifested in its topline,” (see: Road to recovery).

Acquired benefits

The firm’s track record on the acquisition front is equally impressive. Its acquisitions and in-house initiatives have ensured that it has a presence across the globe and have enabled it to migrate towards high-margin products. Apart from manufacturing and distribution presence in Brazil, Mexico and Europe, CFS has a contract manufacturing presence in the US. According to Mathur, local presence is a key factor which gives them confidence in the firm’s ability to replicate its past performance. “Close proximity to customers will enable CFS to cater to their requirements better and to reduce its service turnaround time, a key performance metric for antioxidants blends.”

Through its Mexican subsidiary, CFS acquired a 65% stake in Dresen Quimica in May 2016 to fortify its position in the antioxidants blends market. Dresen has operations in five countries which include Mexico, Guatemala, Peru, Colombia and Dominican Republic. “Besides leveraging their distribution network in North, Central and South America to cross-sell CFS’ products, acquiring Dresen has expanded its footprint to service multinationals globally. The acquisition has saved it two to three years of gestation period to make inroads in the market and gain customers” says Mathur.

That’s nothing new for CFS though. The promoters have taken calculated bets that have paid off in the past too. The acquisition of chemical major Borregaard’s Italian subsidiary in 2011 is a fine example. Borregaard was one of the five global producers of Hydroquinone (HQ), a key intermediate compound used for producing TBHQ and BHA. CFS decided to acquire this firm in order to combat the issue of volatility in prices and the availability of HQ. The management successfully turned around the loss-making entity by focusing on improving process efficiencies. It increased its capacity by 50% to 12,000 MTPA, from the 8,000 MTPA it had acquired. CFS achieved this by focusing on debottlenecking and incurring incremental capex to improve operational performance. Today, thanks to the acquisition, it is among the five global producers of HQ and colour inducing organic compound Catechol (CAT).

Post the commencement of Dahej operations, CFS will become world’s lowest-cost producer of HQ and CAT. The management is expecting HQ and CAT production costs to reduce by 25%, which hypothetically translates into savings of Rs.500 million. While globally CAT is an over-supplied commodity, the management reckons that its local manufacturing at the Dahej plant will give it cost competitiveness in comparison to global players like Solvay which has a relatively high cost structure. According to Mathur, the working capital cycle is expected to improve by 30 days-40 days over FY17-20, after Dahej plant, as a large part of HQ and CAT requirement, which was imported before, will be met indigenously.

In July 2017, CFS along with its European subsidiary acquired a 51% stake in Ningbo Wanglong Flavors and Fragrances. Post the acquisition, CFS is the third largest producer of vanillin in the world. The market size for vanillin is expected to touch $423 million by CY20, as per Ambit Capital estimates. CFS offers vanillin and ethyl vanillin, which are both flavouring agents for food and beverages, but the latter is costlier due to its intensity.

According to Mathur, “While vanillin and ethyl vanillin are already preferred because natural vanilla is expensive as well as inadequate in supply, CFS deploys a unique process to manufacture vanillin from a naturally organic compound — guaiacol which is more environment friendly. Since sourcing of raw materials from China is becoming tougher owing to environmental issues, CFS’ in-house access to such raw materials gives it a key competitive edge.”

The firm has also entered into a supply agreement with the US-based Lockheed Martin Advanced Energy Storage, a subsidiary of the global security and aerospace company. As per the contract, CFS will have the exclusive right to supply 80% of its requirement for energy storage solutions. CFS will be offering specialty chemicals, which are a key ingredient in the manufacture of flow battery systems. Flow battery is made of non-toxic materials and is more efficient and inexpensive compared to the currently used lithium ion battery. The exclusive agreement highlights CFS’ process capabilities and quality assurance. Commercial delivery for this is expected to begin by September 2018. This offers a revenue potential of $35 million, with a 18-20% Ebidta margin.

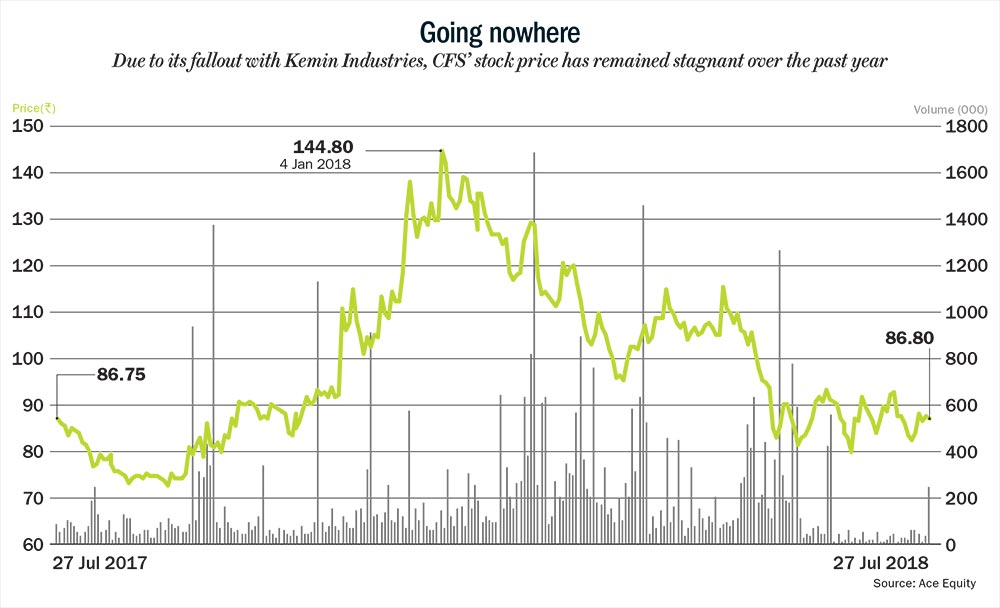

Overall, the management’s consistently smart choices have helped the firm. This has also emboldened institutional investors to increase their stake from 12.25% in March 2017 to 23.42% in June 2018. Due to its fallout with Kemin, the stock price has been stagnant during the past year (see: Going nowhere) and now trades at 8.6x its FY20 estimated earnings.