The pharmaceutical industry is currently in a state of flux amid structural changes in international as well as the domestic markets. In the US, the largest pharmaceutical market in the world, pricing pressures owing to increasing competition and consolidation of the distribution channels have significantly dented the profitability of players. Closer to home, the push to increase the use of generics, increased price controls and the impact of GST took some sheen away from the lucrative Indian market. Lupin, which gets 70% of its revenue from India and the US, has been bearing the brunt of it over the past couple of quarters.

Lupin is the sixth-largest pharmaceutical company in India with a market share of 3.3% and is among the top five companies in terms of prescriptions in the US. While the exclusivity around the launch of its generic diabetic drugs, Glumetza and Fortamet, helped Lupin’s US revenue increase significantly in FY17, the loss of exclusivity leading to steeper price erosion saw the US sales dip by 27% over the past two quarters. Revenue from India in Q1FY18 declined by around 2% for the first time in 12 quarters, thanks to the GST impact. Over the past one year, the stock lost more than one-third of its value compared with a 22% gain by the benchmark Sensex owing to the muted performance. Lupin believes that the worst is over as far as both its key markets are involved. It is betting on the US markets to start recovering in the second half of FY18 and the Indian business to grow by 15%, on an average, over the next three quarters. Can Lupin walk the talk and turnaround its performance in the coming quarters?

Under pressure

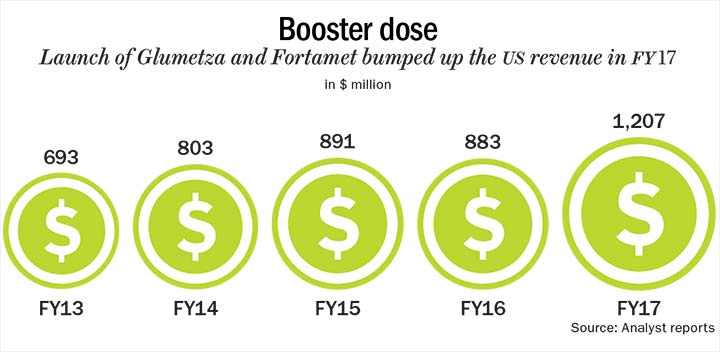

The US brings in almost half of Lupin’s revenue and, over the past five years, it has grown from $693 million to $1,207 million (See: Booster dose). But the generics portfolio has been bearing the brunt of falling prices. “FY18 is a very challenging year for the US pharma industry. Multiple pressures of channel consolidation, hyper-competition and strict price scrutiny are all coming together. In FY17, we had a record 37% growth in the US. We have a very stable base business in the US but it is very hard to continue to grow on last year’s base,” says Nilesh Gupta, managing director, Lupin. Lupin sees a low double-digit decline in the US in FY18, owing to more than anticipated competition in Glumetza and Fortamet. In the June 2017 quarter, Lupin’s base business grew 11% QoQ, excluding Glumetza and Fortamet. Both these products brought in $574 million for Lupin in FY17. But as more competitors entered the fray, revenue from both products has steadily declined.

Siddhant Khandekar, AVP (research), ICICI Securities breaks down the reasons for Lupin’s muted performance in the US. “First is the consolidation at the distributor’s level in the US. Earlier there would be eight large distributors, then this number came down to six and now just three,” he explains. “The distributors now have a better bargaining power which is taking a toll on realisation; second, the competition in generics is becoming stiffer by the day. Five years back if there were 4-5 players, now we have at least 8-10 players.”

Ramesh Swaminathan, CFO, Lupin feels increasing competition and price erosion will be the new normal for the pharma industry and that companies would accordingly need to realign their strategies. “Price erosion has been a concern in the past few years. In some ways we can compare this industry to a leaky bucket where the price is continuously eroding and the only way to actually grow is by replenishing the pipeline further,” he says. “That’s why a strong product pipeline as well a speedy launch in the market becomes important. You need to be among the first few players to gain critical mass, and market share because, this is one industry where there is a huge upside on launch and then there is a continuous downside.” Lupin has the fourth-largest pending Abbreviated New Drug Application (ANDA) pipeline in the US. The firm has 151 approvals pending with a market value of about $76 billion. Of this, 45 ANDAs are first-to-file (FTF) opportunities, including 23 exclusive launches, with a projected market size exceeding $13 billion. The company hopes to make up for some of the loss in revenue in FY18 by launching 30-35 products such as Ranexa, Renvela and Welchol in FY19 and an equal number in FY20.

To beef up its presence in its largest market, Lupin acquired the US-based Gavis Pharmaceuticals for $880 million in FY16 — the largest acquisition by a domestic pharma company so far. “The acquisition gave us our first manufacturing site in the US apart from skill sets of a different kind on the R&D front. It helped us foray into things we always wanted to — controlled substances, niche therapies, colonoscopy and other areas such as women’s health,” says Swaminathan. Lupin has leveraged its acquisitions to either expand its presence in new markets or augment its product portfolio. The company has acquired 13 companies in the past nine years across Japan, the US, Germany, South Africa and Australia.

However, the first year performance has been disappointing with Gavis reporting an annual revenue of $117 million against a guidance of $200 million in FY16. “The first year turned out to be less than satisfactory because we kind of underestimated the issues we were likely to face with Gavis. In terms of revenue, it’s just one year behind of where we should have been,” says Swaminathan. He goes on to explain that controlled substances are dependent on releases by government by way of quotas and there were some delays on the front. Secondly, it took some time to ramp up its manufacturing capacity. Gupta is confident that things will be on track in FY18. “The capacity expansion, higher quotas and new product launches will help us bridge the gap,” he says.

Making it special

To counter the price erosion in the generics business, the company is looking to build a portfolio of specialty drugs where the pricing power is better. In FY17, the business brought in 6%of the US revenue and Lupin expects it to increase to 25-30% over the next few years. “With channel consolidation and increased competition in the US, companies need to differentiate. We anticipated this five years ago and began investing in complex generics and specialty, where growth potential is strong. These are usually high-value products since they require specialised handling, unique developmental capabilities or expensive clinical trials,” mentions Gupta. By 2019, Lupin expects to have a strong portfolio, also comprising complex generics, which will once again improve its growth trajectory. Kumar Saurabh, vice president (research), Motilal Oswal Financial Services says, “In the current scenario where your base business is declining by 10% on an average due to price cuts and the number of blockbuster products going off patent reducing, you need to secure your portfolio by launching specialty drugs and branded products to keep growing consistently. Lupin’s investments in the specialty business will definitely pay off, but the results will be visible only over the next 2-3 years.”

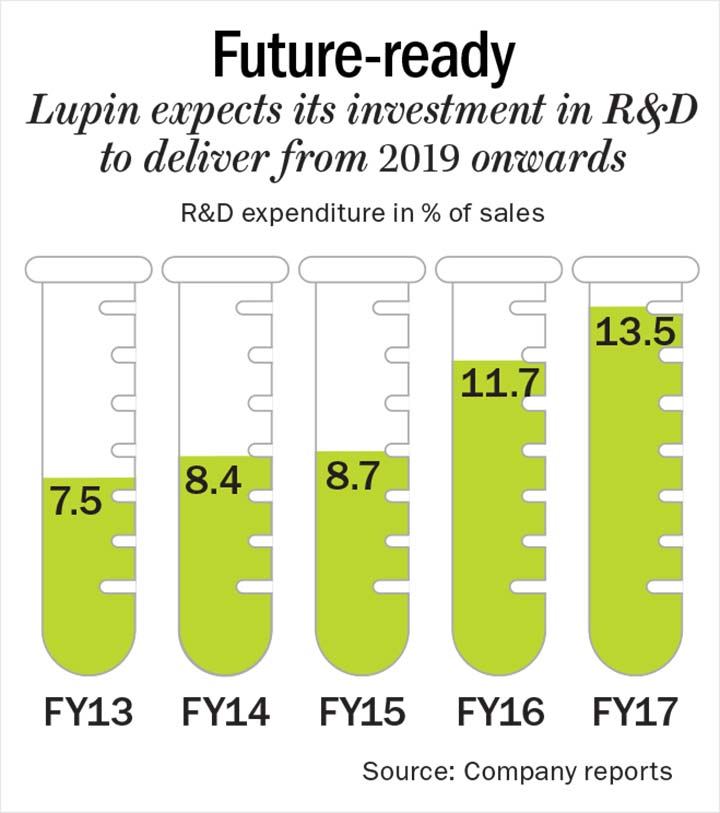

Lupin has been investing in building a pipeline of products across new chemical entities, biosimilars, complex generics among others. Its R&D expenditure, as a percentage of sales, has increased substantially in the past five years, from 7.5% in FY13 to 13.5% in FY17 (See: Future-ready). Amey Chalke, lead analyst, HDFC Securities, adds, “Lupin has one of the largest R&D spend among the Indian players with filings and development work going on in inhalers, biosimilars, injectables, topicals and novel products. It is also focusing on building its capacities in alignment with its filings.” According to Chalke, 2020 will be the year when the company will unleash a substantial portion of pipeline, including its respiratory portfolio, derma products and complex injectables. This will not only drive its revenue but also ensure it enjoys reasonable margins due to the limited competition in these categories. Lupin will file for approval for its first biosimilar drug, Etanercept, which has a global sale of over $5 billion, in Europe and Japan this year and in the US next year.

Different strokes

What also works in Lupin’s favour is the fact that it has a strong presence in Japan, the second-largest pharmaceutical market and India, one of the fastest growing markets in the world. Japan is a difficult one to crack with very few Indian companies making headway there. But being the sixth-largest player in Japan, the country contributes about 10% to Lupin’s revenue. While the Japanese government’s decision to reduce the price of generics on an annual basis instead of the earlier biennial basis will further impact margins, the erosion is not as high as it is in the US. Here again, the company is looking to increase its presence in the branded segment. In FY17, Lupin acquired Japan-based Shionogi’s branded portfolio (21 products with annual sales of US $90 million) for JPY15.4 billion. “It is very difficult for generic products to penetrate the Japanese market as its consumers prefer branded products. The acquisition of this branded portfolio will provide the distribution channel to Lupin for marketing its generic products,” says Chalke. Despite the pricing pressures, revenue from Japan grew by around 23%, on an average, over the past two quarters, helping to counter the volatility in other markets to some extent.

India contributes nearly 22% of Lupin’s revenue and the company has grown the domestic formulation business by 15%, on average, over the past five years. Apart from getting more than 55% of its revenue from the high-margin chronic segments, Lupin is the market leader in anti-tuberculosis drugs. In FY18, the company expects to grow nearly 25-30%, higher than the market, driven by new product launches through in-licensing and increasing its presence in the chronic segments.

Taking a breather

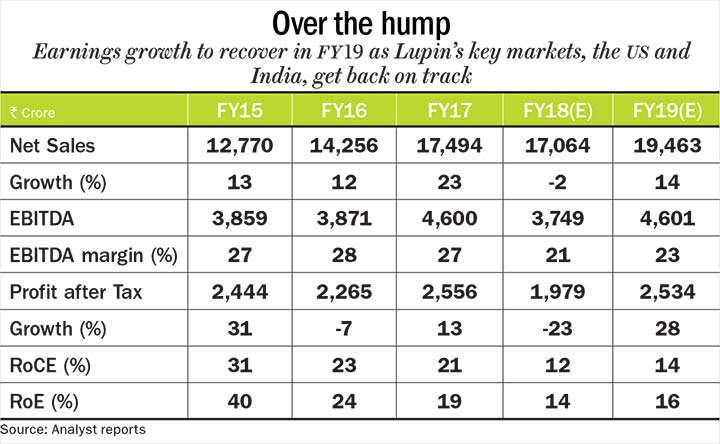

While Lupin’s revenue has grown 20%, on an average, between FY12 and FY17, its revenue growth is expected to see a flat-to-marginal decline in FY18. The management also revised its EBITDA margin guidance down to 21-23% from 24-26%. As a result, profit growth which grew 24%, on an average, will see a dip of 23% before recovering in FY19. Thanks to its acquisitions, its return on equity (RoE) and return on capital employed (RoCE) also witnessed a decline. The RoE has dropped from 40% in FY15 to 19% in FY17, while RoCE fell from 31% in FY15 to 21% in FY17. The company hopes to see an improvement in its ratios once the revenue momentum picks up in the US.

Lupin’s management believes its efforts in R&D will start delivering 2019 onwards. It is also looking to build the specialty branded business across the US, Europe and Japan through acquisitions. While the USFDA did raise concerns on its plants in Pithampur, Goa and Aurangabad, Lupin believes there is no cause for concern and sees no impact on the product launches.

According to analysts’ FY19 estimates, the company’s revenue and profit growth will get back on track with a 14% and 28% increase, respectively. Much of the concerns are already priced into the stock, which is currently trading at 19.4x its FY19 estimated earnings. Given its rich product pipeline and investments in R&D likely to pay off in a couple of years, Lupin will be healthy addition to an investor’s portfolio.