If you had asked anyone a decade ago, “Where do you want to spend your vacation?” the answer would be “Paris” more often than not. It was a time when everyone — from new couples and families to young men and women — wanted to visit the ‘City of Lights, Love and Romance’. Today, there are way too many options for anyone with wanderlust. You can take your family of four for a week-long trip to Phuket, Budapest or Istanbul without burning a hole in your pocket. And just the way tourists are getting picky, Indian pharma companies are too, when it comes to their Paris — the US market — a destination that has been a mainstay for our drug companies for a very long time. But as competition intensifies, the market gets crowded, players consolidate, prices erode and the USFDA gets tough, drug makers are not looking at the US with the same zeal anymore.

So, when Natco Pharma’s CEO Rajeev Nannapaneni was asked about the US market in June 2018, he said that the market is extremely competitive and one needs to have unique generic products to make money. It sounds like just another pharma company coming to terms with reality in the US, but Nannapaneni was among the first to accept that Natco, like its peers, has over-relied on the US. The country contributes nearly 40% to its revenue. “You have to do the US, but you should not overdo it like all have done, including myself. I am not saying that I am somehow different from others, I have done the same thing too,” he said in an earnings call in 2018. Post that, the company has been charting a new path — trying to strike a balance between the US, India and the rest of the world. But will it be successful?

Same, but different

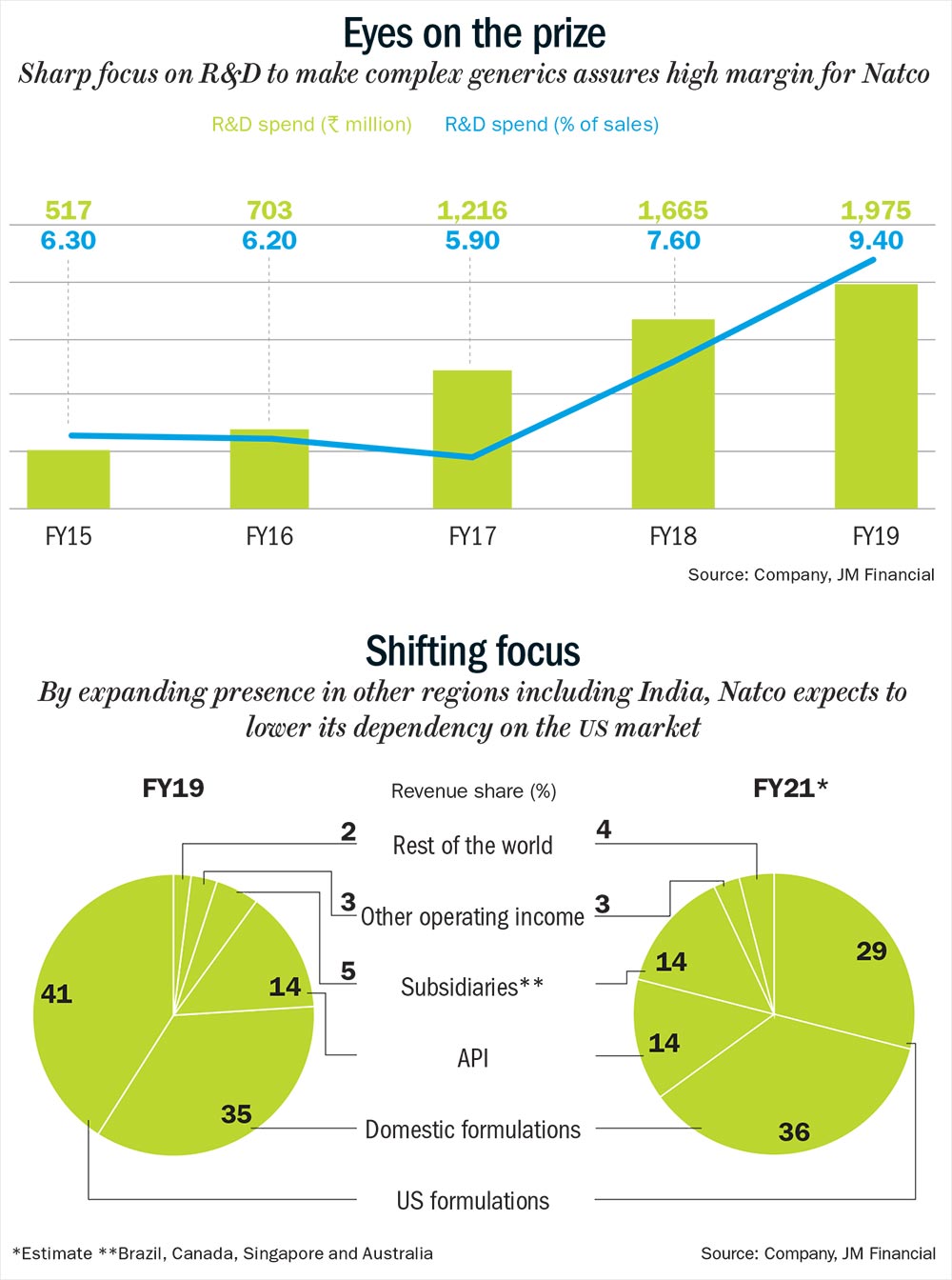

By breaking down its financials, one can see that the Hyderabad-based company has seen strong earnings growth over the past five years — sales and net profit compounded at 25% and 45%, respectively. It reported revenue of Rs.20.94 billion and profit of Rs.6.42 billion in FY19. Analysts attribute this growth to a well-defined strategy and sharp focus on R&D to make complex high-margin generic products (See: Eyes on the prize).

With an upper hand in R&D, the company could build a differentiated product portfolio of first-to-market generic launches such as gTamiflu (used to treat flu virus) and gCopaxone (for multiple sclerosis), stealing a march on its competitors — Sandoz and Dr Reddy’s. In fact, Mylan-Natco’s market share in 40 mg/ml of gCopaxone has risen to 28% in the US since August 2018, after the company slashed its prices. Meanwhile, a key player in this space, Teva, is gradually losing ground. “Natco is not a ‘me too’ Indian pharma firm and has adopted a differentiated path by focusing on limited competition segments,” says Anmol Ganjoo, pharma analyst, JM Financial Institutional Equities.

This gave the company freedom to monetise its high-margin products well. Both gCopaxone (40 mg/ml) and gTamiflu provide a margin of 70% to the company. “Natco makes high-value and common generic drugs. They also have limited number of filings of around 50, which reduces the cost and aids profitability,” says Sriraam Rathi, VP, ICICI Securities.

What Natco has also got right is its decision to tie up with global generic players such as Alvogen (for gTamiflu) and Mylan (for gCopaxone) to launch new products in the US. Hence, the company does not have to be concerned with distribution and marketing, leading to Ebitda margin of 37.95% in FY19, up from 25.85% in FY15. “The reason behind the tie-ups in the US is to reduce risk — the responsibility of litigation and marketing of products falls on the partners,” explains Nimish Mehta, founder, Research Delta Advisors.

With a strong strategy and fundamentals in place, Natco is already on track to lower its dependence on the US market and increase presence in India, Brazil and Canada (See: Shifting focus). The company will leverage its facilities and brands to increase its presence in Canada. Its current product portfolio in Canada consists of 16 drugs, and according to the management.

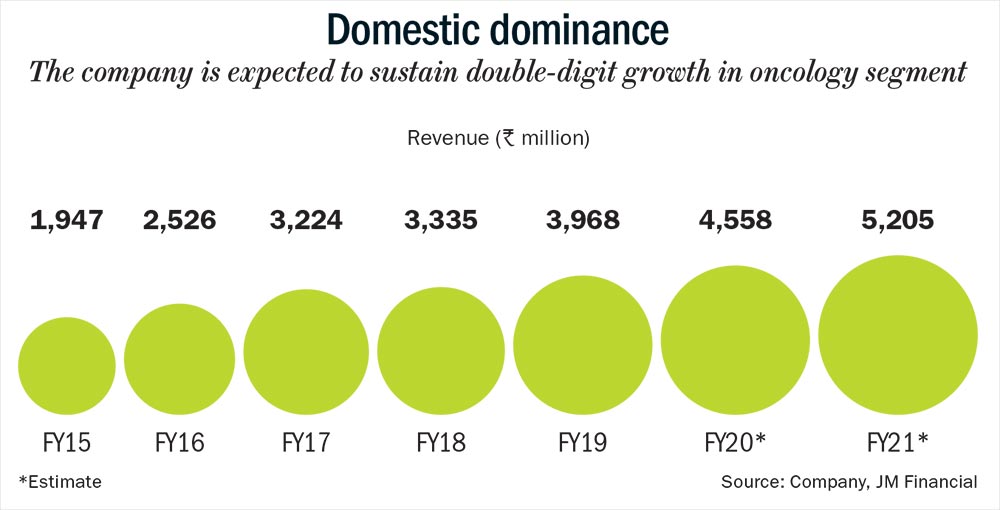

It has adopted a similar strategy of focusing on oncology products in Brazil as well, along with establishing first-to-market generic drugs. In FY18, Natco became the first generic player to introduce Everolimus, which curbs organ rejection following liver or kidney transplant. And in FY19, it received regulatory approval to launch Letrozole, a breast cancer drug. Analysts are confident of Natco’s oncology play in these regions since it is already a market leader in India with 29 products. Out of these, six brands including Bortenat, Erlonat and others have annual sales worth more than Rs.100 million (See: Domestic dominance). “Oncology is one of the fastest growing and lucrative therapeutic areas in the Indian pharma market due to limited competition, high manufacturing complexity and very high margin,” says Ganjoo. This market is estimated to continue its double-digit growth of 13-15% over the next three years and currently offers a gross margin of about 90%. Plus, the company also has a specialised sales force and a strong distribution network. Mehta believes that there will be an opportunity in the oncology segment “as long as Natco continues to launch new products”.

“They have decent opportunities in Brazil and Canada. Over the next three years, there is major scope for improvement as a lot of niche products will get launched,” says Rathi. Pointing to the company’s track record in India and the US, Rathi says that Natco Pharma should be able to replicate its success in these markets.

Risky business

While its strategy may be working, everything is not in the pink of health for the company. Even though it has a robust Hepatitis C (liver infection) business in India, with brands such as Natdac, Hepcinat LP and Velpanat, the segment is facing price erosion. “This has turned into a hyper competitive space, leading to price erosion over the past two to three years,” says Rathi. Just like Indian pharma companies disrupted the US generics market a few years ago, US-based Gilead Sciences tied up with 11 Indian companies to produce and market the Hepatitis C drug, which led to intense competition and subsequently erosion of drug prices in this segment.

But analysts believe if the company is able to come up with first-to-market products in cardio and diabetology segments, those can provide a buffer against price erosion. Rathi adds that the company could also in-license them from innovators in cardio and diabetology segments. “If they can make it happen, then it will be a sizable business in the next three years,” opines Rathi.

In the latest conference call, the management exuded confidence about the oncology business. Highlighting that Natco has won the case to launch a cardio product Brilinta called Ticagrelor, Nannapaneni said, “I am very bullish about the domestic business and I think we have a good pipeline and we should do well.” They couldn’t launch the drug last year as planned, because of an injunction filed by the innovator, AstraZeneca. While the other high value cardio product, Valsac, is still stuck in a separate litigation, a positive outcome in Ticagrelor case will help boost margin. The company has experience in fighting legal battles and has won several cases before — an injunction against Teva to export generic Copaxone to the US; making cheaper version of Bayer’s kidney cancer drug Nexavar; and Novartis’ blood cancer drug Glivec.

While the company is willing to take risks, it remains careful about not neglecting its biggest market — the US. And a lot rides on Revlimid, a drug used to treat bone marrow cancer and anaemia, for which Natco has won the licence to manufacture and sell from 2022 after settling the litigation with Celgene in 2015. The $6 billion product is expected to increase the company’s profit and provide much-needed relief to Natco in the US market. Rathi believes this drug will be extremely beneficial since it is complex and not easy to replicate. Although Dr Reddy’s may also enter the market eventually if it settles with Celgene, for now, Natco remains in the lead position.

Besides going all in to retain its leadership in existing markets, the company is also not afraid of venturing into unchartered territory. Just like Bayer, Natco is foraying into the field of crop sciences and has invested Rs.1 billion in its Nellore facility. With this, it is targeting molecules that will go off-patent in the next three years. Analysts note that the chemistry skills needed to develop drug formulations can be leveraged to make agriculture-related products and will give Natco one more market to play with.

The right pill

With the right formula for growth, analysts believe it is an apt time to look into the stock. A mix of attractive valuation, strong balance sheet and decision to re-arrange its portfolio make Natco Pharma a compelling bet. They state that the negatives have been factored into the stock as it trades at 19x FY21 earnings, which is near its 10-year average. Compared to the 52-week high of Rs.801 in November last year, the stock has dropped by 30%. Price erosion along with general pessimism surrounding the pharma sector has kept investors jittery. But the pessimism might be overdone, feel analysts.

Highlighting that Natco is gearing up to make deeper inroads in India and emerging markets, analysts state that the company’s strong balance sheet gives it the firepower to invest and grow.

JM Financial’s Ganjoo believes that the current valuation does not factor in base earnings (which exclude profit share from niche US launches), the existing product portfolio in the US and products in the pipeline. “Given Natco’s track record of identifying and exploiting niche opportunities, we believe that the current market price offers an attractive entry point,” he asserts.

The US market may recover from the structural change or not — that’s a billion dollar question. But without waiting for that to happen, an agile pharma player like Natco has already decided to switch tactics. The company has diagnosed the problems and is well on its way to find a cure through a combination of niche product line and change in geography. As it does all that, investors can take advantage of the cheap valuation, to later profit from the recovery.