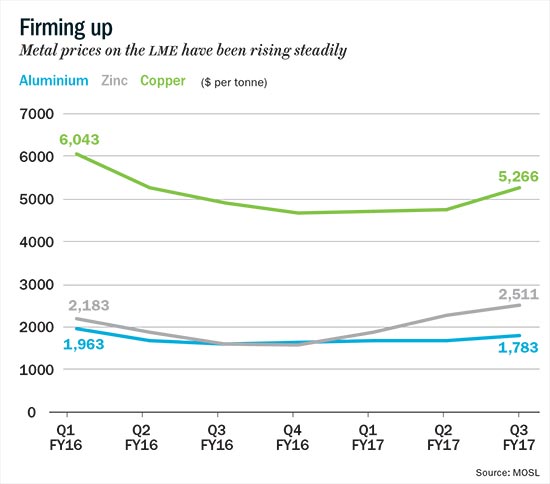

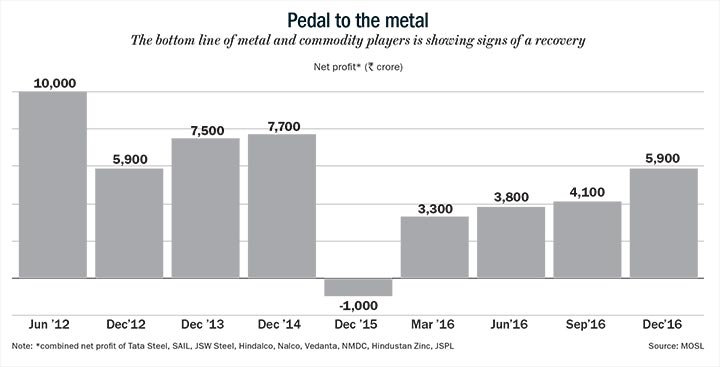

Investors who made a contrarian bet on metals must be a happy lot as their bets have paid off rather handsomely. The NSE Metal Index has gained about 71%, compared with the Nifty’s 22% in the past one year. The Nifty Metal Index is trading at an EV/EBIDTA of 6.8x, compared with its 10-year average of 6.2x. However, Neelesh Surana, fund manager, Mirae Asset says, “Valuations are reasonable. While last year, there was a lot of scope to make some easy money in the metals space, there is still enough money on the table considering that the companies are expected to benefit from the current pricing environment and increased volume growth providing some operating leverage.” According to him, FY18 will be the first year of normalised earnings since the downturn and valuations are still reasonable, given the earnings growth expected. FY16 was a tumultuous year for the industry with most companies reporting huge losses as a result of a significant drop in LME metal prices and lower demand in the domestic market, coupled with the impact of Chinese imports. While the recovery began in the second half of FY17, the impact in metal prices and volume gains of these companies can only be seen in FY18. According to estimates by Motilal Oswal Securities, the top nine listed metal companies are expected to record an average annual earnings growth of 40% during 2017-19. In FY18, the companies are expected to post a 58% growth in earnings, followed by 24% in FY19.

In Q3FY17, the top nine major metal companies made a cumulative profit of around Rs.5,900 crore as against a loss of Rs.1,000 crore during the same period a year ago. It is still half the profit they made in June quarter of 2012 (when HRC steel prices peaked at Rs.39,000 per tonne) and Rs.8,900 crore in March 2013. Currently, steel prices have moved up to Rs.37,000 a tonne from Rs.34,000 a tonne at the end of December 2016, indicating that the next couple of quarters will continue to be good for steel companies.

Investors are also counting on financial and operating leverage to kick in with higher volumes. For instance, JSW, which was operating at 76% capacity utilisation in FY16, has now improved its utilisation rates to 85%. Thanks to higher realisations and better capacity utilisation, JSW Steel will be making an operating profit of close to Rs.11,600 crore, a 90% increase over last year. A higher capacity utilisation helps companies absorb fixed costs, leading to higher profit for every unit that is produced.

Companies like Tata Steel whose balance sheet is highly leveraged has seen its overall realisation move up from Rs.45,000 a tonne in 2016 to around Rs.50,000 in the current fiscal. Analysts estimate that this 11% increase in realisation will lead to a 560 basis points improvement in operating margins with EBITDA moving up from Rs.2,950 a tonne in FY16 to Rs.5,300 a tonne this fiscal. In FY16, the company posted an operating profit of Rs.7,585 crore which was mostly consumed by its interest cost of Rs.4,100 crore. This year, it will see its operating profit swell to Rs.12,000 crore as against an interest cost of Rs.5,000 crore leading to a significant improvement in its bottom-line.

“Tata Steel is well positioned to generate an EBITDA/tonne of Rs.11,000-12,000 on average over the next couple of years from domestic operations due to stable spreads, ramping up at its Kalinganagar operations and increased ferro-alloy production from its recently commissioned Gopalpur project,” says Amit Dixit who tracks the company at Edelweiss Securities. The Kalinganagar plant, which was commissioned in February last year, has seen ramp up in production to more than two million tonne annually from a million tonne five months ago. Also, the benefits of restructuring its European operations and closing down some of the loss-making facilities in the past have started accruing. “If we combine all the factors, we expect Tata Steel’s operating profit to grow at an average of 36% every year over 2016-19. Against this backdrop at 6.1x, FY19 EBITDA, Tata Steel is actually trading in the lower quartile of its 10-year trading band,” points out Dixit.

Similarly in the non-ferrous space, Hindalco was barely profitable last year. But thanks to the recovery in LME copper and aluminium prices, Hindalco will be making close to Rs.12,000 crore EBIDTA, which will more than cover its interest cost of Rs.5,000 crore leading to a spurt in profit to about Rs.3,000 crore. Hindalco has gained hugely with higher LME aluminium prices. Compared to last January, LME aluminium prices are up 28%, at Rs.124,300 a tonne. That apart, Hindalco, has been able to bring down its cost by 20-25% over the last four quarters because of the new smelter, leading to improved margins.

Hindalco has also reduced its debt by Rs.1,030 crore in the first three quarters of the current fiscal. With the improvement in profitability and cash flows, particularly in the case of Novelis, it further intends to bring down its debt by Rs.2,000 crore. By the end of this fiscal year, the company is expected to reduce its debt to Rs.65,000 crore as against Rs.67,000 crore in the last fiscal, leading to a interest cost saving of Rs.166 crore.

Apart from the recovery in prices, falling input prices have also helped the profitability of companies. Raw material expense make up 45-60% of the overall costs for companies in the metals space. The global spread between steel prices and the cost of production is quite healthy at $200 a tonne post the correction in international coal prices from a high of $308 a tonne in November 2016 to $155 a tonne currently. “Falling coking coal prices is good news for domestic steel companies who are more dependent on imported coking coal. As a number of mines have been reopened in Australia, Canada, the US and Mozambique, there has been an increased availability of coking coal, which in turn, has led to the fall in prices in China. Considering that there is no major demand push or supply constraint, prices are likely to stay at the current levels,” says Jatin Damania, an analyst, who tracks the sector at Kotak Securities.

Steeling up

Post the commodity market meltdown in February last year, the Indian steel sector went through one of its worst slowdowns as cheap Chinese imports flooded the market and the price of steel also fell globally. To safeguard the industry, the government imposed an anti-dumping duty. As a result, steel imports fell by 37.4% — 5.5 million tonne from April to December 2016 compared to a year ago. “The anti-dumping on steel products has been levied for a period of five years, which is good enough to protect the domestic steel industry from any imports coming from China, Japan, Russia, Brazil, Indonesia and South Korea, among others,” says Damania.

The production volume has also increased. During April ’16 to January ’17, Indian steel production grew at 10.7% to 82.9 million tonne. More importantly, the top six steel companies accounted for about 56% of the total volume and their overall production grew 18.4%, which is a clear indication of marginal players going out of business. Due to huge leverage on their books, many smaller players have either shut down or reduced their production, leading a better market share for larger players. For instance, JSW Steel produced 11 million tonne in the first three quarters of FY17 as compared to 9 million tonnes in the corresponding period last year. With the recovery in prices and volumes, the company is expected to post a profit of around Rs.3,000 crore this year as against a loss of Rs.850 crore in FY16. “We believe that the market share gains by large producers would continue, as smaller producers are still reeling under the effect of demonetisation. They basically produce steel used in construction and the demand for them has been badly hit due to the slump in the real estate sector. The huge capacity built up by larger players like SAIL and Tata Steel means the cost of production is relatively cheaper, making them more competitive,” says Tarang Bhanushali, an analyst at IIFL.

In the non-ferrous space, a strong recovery in the LME prices have led to an improved earnings outlook. LME zinc prices has appreciated by 83%, followed by the 30% appreciation in copper prices in 2016. Because of the higher non-ferrous metal prices, Vedanta, a diversified player, which gets 20% of its revenues from aluminium and 23% from zinc reported an 81% increase in operating profit and a 348% jump in net profit to Rs.1,866 crore in December 2016. On a nine-months basis, despite a modest 2.5% growth in revenue, profit increased by 55% to Rs.3,733 crore largely led by margin expansion due to cost savings, better realisations and volume growth. The next year looks even better with the estimated increase in production volume of aluminium, zinc and iron ore. Analysts expect the company’s earnings per share to move from Rs.7 in FY16 to Rs.21 in FY17 to Rs.32 in FY18.

Macro gains

Analysts believe that domestic demand will pick up with the capex cycle turning around. Despite the impact of demonetisation, India’s GDP grew at 7% in the December 2016 quarter. The economy is expected to be in better shape in the next year, thanks to the remonetisation efforts, stability in external trade, a low interest rate scenario and increased government spending on infrastructure. Analysts expect this to push demand higher, leading to a possible recovery in capex cycle, albeit gradually, given the existing excess capacity in sectors like metals, engineering and others. The IIP which tracks industrial production activity saw a 2.7% growth in January 2017 as against a contraction of 0.4% in December 2016. This is good news for metal manufacturers as it means higher demand for their goods.

Globally as well, industrial production has recovered. The IIP number in the US has shown a recovery from a negative 2.8% in December 2015 to 0.3% in December 2016. Things have been getting better in UK and Japan as well with the numbers recovering from a negative 0.1% to 5% and a 4% contraction turning into a 4% growth respectively.

The macro recovery in both the domestic and the global markets will ensure that demand momentum sustains the next year. With FY18 being the first year of normalised earnings after the downturn, it looks like metal stocks will continue their dream run at least for the next couple of quarters.