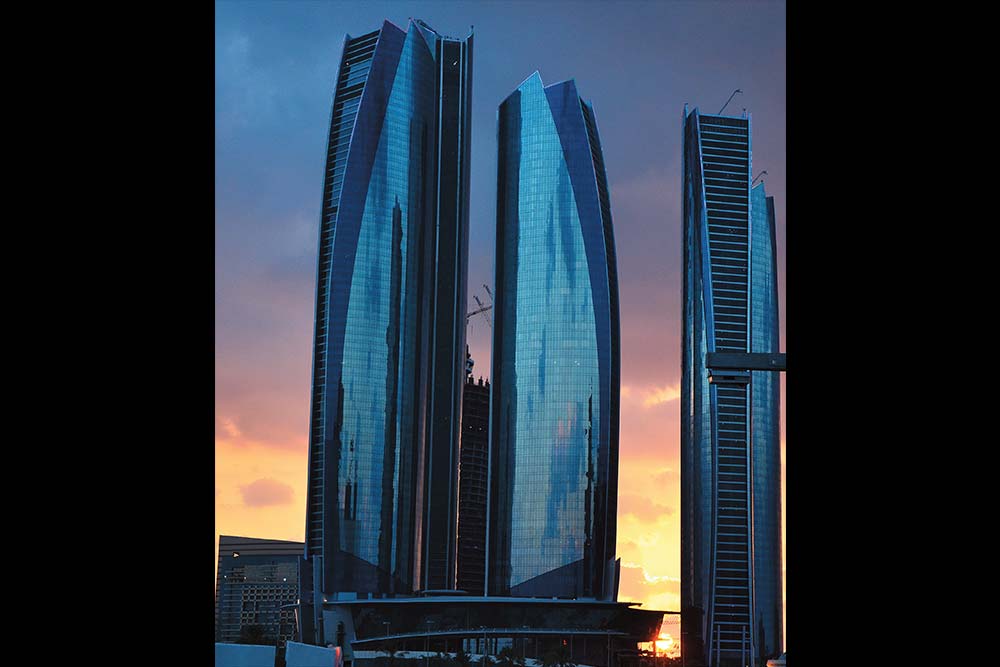

I think we’re getting used to winning!,” proclaimed an elated Shaukat Ali Mir, executive vice-president and COO of Voltas, on bagging the MEP Contractor of the Year, 2011, award in Dubai for the iconic new Etihad Towers in Abu Dhabi. It was the second consecutive win for the Tata group company; it had bagged the title in 2010, as well, for the Ferrari World project. Voltas seems to have found its El Dorado in West Asia; it has a string of landmark projects in the region to its credit, including the Burj Khalifa at Dubai, the F1 track and Ferrari World at Abu Dhabi, Wafi Hotel and Mall, a pyramid-shaped 240-room hotel in Dubai, Mall of the Emirates and the Etihad Towers.

But look at the company’s performance in the markets and you realise that the recent awards and accomplishments are more like a mirage. After a painful 67% drubbing on the bourse last year, the stock’s dismal streak has continued well into the New Year; after the Q3 results in early February, it tanked 33% to the current level of ₹108. So, what’s happening at Voltas? To understand that, you need to know what constitutes Voltas’ operations and what is giving the market the goose bumps.

West Asia blues

To begin with, Voltas’ business is spread across three verticals. Electro-mechanical projects and services (MEP), which primarily comprises heating, ventilation and air conditioning (HVAC) solutions for large enterprises, accounts for 70% of the company’s revenues. Unitary cooling products (UPC), which consists of air conditioners (ACs) and commercial refrigeration solutions, and the engineering products and services division, comprising textile machinery, mining and construction equipment and materials handling equipment, account for the balance.

In India, only 20% of contracting market is currently integrated in MEP format compared with over 75% in developed countries. So, Voltas has consciously pursued its strategy of growth in West Asia, a region which is looking to ramp up its infrastructure spend after the lull brought on by the 2008 credit crisis. Though the situation has markedly improved since then, order flows have been erratic on account of increasing macro uncertainty because of the Euro crisis and regional political unrest. According to Citigroup, the value of construction projects scrapped or on hold in the UAE soared to $958 billion in the 12 months to October 2011.

Besides, the slowdown in the domestic capex cycle has only accentuated the pain for the company. As a result, topline growth has been sluggish for the past several quarters, while rising inputs costs have kept margins under pressure. Says Vinay Khattar, head of research (wealth advisory and investment services) at Edelweiss Capital, “The slowing capex cycle has lead to poor order flows. Besides, the competitive business environment, domestically and overseas, has dented margins in Voltas’ key business segments.”

To top it all, cost overruns have cost the company dearly. For the third quarter of FY12, the company posted a loss of ₹115 crore following cost overruns in the ₹1,000-crore Sidra Hospital project. Although Voltas’ management refused to participate in this story, in a results concall, CFO Anil George told analysts that since the project is sponsored by the royal family of Qatar and their vision is that by December 12, 2012, the hospital has to be ready, there is tremendous pressure to complete the project at any cost. But for the one-time charge of ₹277 crore for the Sidra project, the company stated that the profitability of the MEP segment was higher at ₹60 crore in Q3 FY12 compared with ₹44 crore a year ago, while revenues were higher at ₹824 crore against ₹693 crore in the corresponding quarter last year.

Though Voltas’ overall order-book stands at ₹5,094 crore, it is evident that order flow is far from robust: the figure for the year-ago quarter was ₹4,697 crore, which means a year-on-year increase of less than ₹400 crore. Worse, the order backlog of ₹3,145 crore accounts for a chunk of the seemingly bulging order- book. However, George points out there will be a lot of infra investments happening in the region ahead of Fifa World Cup 2022 in Qatar. “Although it sounds quite distant, infrastructure projects take a long time for planning, execution, etc. So, there is a lot of promise that is held out to us,” George said in the analyst call.

But what is bothering analysts is that the company is ready to bid for orders on very low margins. “Bidding margins have not been at the historical 7-8% that we were used to. So, we have slipped in the margins,” George had mentioned. Though the management points out that planned sourcing of materials and resource optimisation can eventually ensure higher operating margins, analysts are not buying that argument. Kashyap Pujara of Enam Securities has lowered overall operating margin estimates to 6% for FY13, considering that MEP orders could be booked at 3-5% operating margin.

Cold comfort

While the outlook for the core MEP segment remains challenging, what is not helping matters is the bleak prospects in the unitary cooling segment, which fetches Voltas 20% of its revenues. Demand for ACs during the current fiscal hasn’t been good, following extended cold conditions in key regions. Not surprisingly, Voltas saw a 21% decline in volumes for the nine months till December 2011. Moreover, fierce competition with the entry of Japan’s Hitachi and Daikin is expected to erode market share and revenues. “The Japanese are coming in a significant way and are spending a lot of money much ahead of us and other competition in terms of advertising. But we do not want to cut ad spends as that will affect the long term prospects of the business,” George said.

While segmental profits have fallen 25% in the third quarter to ₹14 crore, analysts expect a further squeeze in margins and volume growth as competition intensifies. Besides, excess inventory has been piling up, forcing companies to offer price discounts.

Raising the red flag over margins, George said. “Over a period of time, margins cannot stay at 9-10% because cost of Chinese imports, too, has gone up.” Not surprisingly, Pujara of Enam has cut FY13 revenue estimates for the segment by 10% to ₹1,000 crore. And Khattar of Edelweiss, too, agrees that the outlook is grim. “While Voltas did hike prices of some products during the quarter, sustainability remains a big challenge,” he says.

What’s the call?

Since 68% and 16% of Voltas’ profitability comes from the MEP and unitary cooling segments, a combination of weak order flows and falling margins do not offer any comfort. Though George believes the situation won’t last for long, he is cautious in his outlook. “There is no way business can really survive at 3% margins. So, business will again consolidate to a situation where project managers and clients will come back to reasonable margins. It will work back to 7-8%, but not to 15% seen during the 2008-09 Middle East boom.”

Not surprising that analysts are bearish on the stock. “Unless order awarding improves substantially, the situation in FY13 may remain grim,” warns Khattar of Edelweiss. From a valuation perspective, the stock at 13 times estimated FY13 earnings is trading below its 5-year average of 16 times. But given the uncertainty around the company’s core businesses, investors can look at buying the stock on dips.