On May 15 at 10:20 am, early trends of the Karnataka Assembly elections showed that the BJP was leading in a Congress-ruled state. Subsequently, the Sensex rose 350 points, and Nifty breached the 10,900 mark for the first time since February 2. With the BJP all set to make inroads in a southern state, investors interpreted this as a sign of a majority government returning to power at the centre in 2019.

However, as the BJP struggled to reach the halfway mark of 112 seats and uncertainty loomed, the market turned volatile and entered into negative territory. While the Sensex fell 451 points from the day’s high of 35,993, the Nifty plunged 128 points from an intra-day high of 10,929.

Ahead of the 2019 General Elections, Rajasthan, Madhya Pradesh, Chhattisgarh and Mizoram will go to polls later this year. Analysts believe that political uncertainty will chart the market’s course over the next one year. “Political risks are adding to the already heightened macro risk environment. To that end, a loss in incumbent states such as MP and Rajasthan will add to the market uncertainty,” says Ravi Sundar Muthukrishnan, head – institutional equity research, Elara Capital.

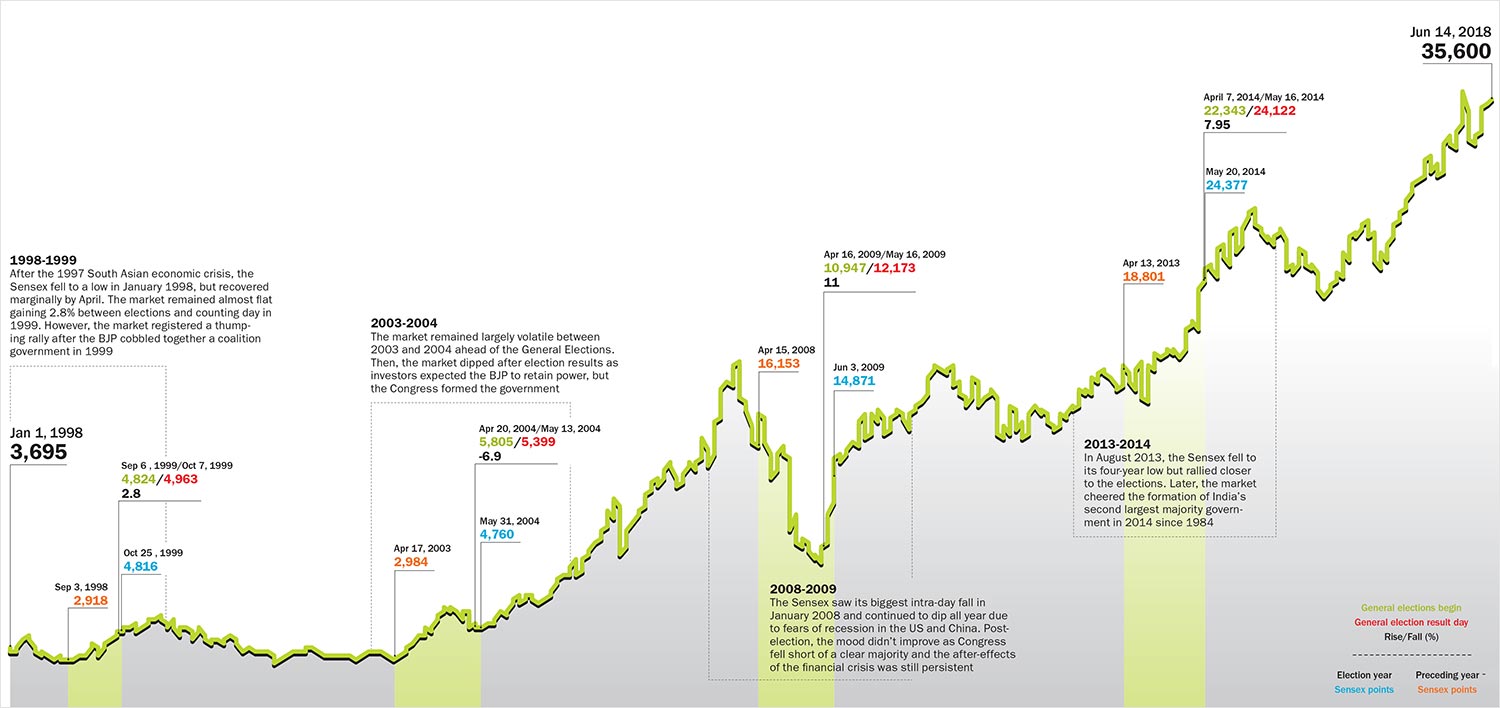

Historical data reveals that the market is extremely volatile in the year before the General Elections. However, after the polls, the market generally stabilises and scales new heights. As a united Opposition continues to catch up with the BJP, foreign brokerages and research houses expect political uncertainty to fuel market volatility this year. In its report on how investors must manage political risk, Morgan Stanley Research warns, “the market enters the 2019 polls with a majority government already at the helm. So, it has to deal with the prospects of a weaker government at the centre.”

It is not just elections, rising crude prices and higher interest rates are also expected to act as a headwind for the Indian equity market. In the second week of May, Brent crude was at $80 for the first time in four years, stoking inflation fears. As concerns of inflation rise, central banks across the world are expected to roll back their dovish stance.

“While the political outlook is an important factor for the market, our view is that the direction of the market is influenced by multiple factors such as global and domestic growth, commodity prices and technology trends,” says Manish Gunwani, CIO – equity, Reliance Mutual Fund.

He expects volatility to be high over the next few quarters not only due to politics but also because the market has witnessed exceptionally low fluctuation between March 2016 and January 2018. “Due to the tendency of reversion to mean, there is a likelihood of volatility being high,” says Gunwani.

Beating instability

Mutual fund managers, brokerages and analysts are banking on rural and IT stocks to provide a cushion against the rising tide of uncertainty. Improved spending environment in the US and depreciating rupee are expected to help Indian IT firms improve their margins. The rupee has weakened by around 4% since the beginning of the year. “Due to benefit of currency depreciation, the growth prospects of IT companies are better compared to last year. Some of the IT players’ commentary is also extremely positive. IT is one hiding place during volatile times,” says Pankaj Tibrewal, senior VP and fund manager (equity), Kotak Mahindra AMC.

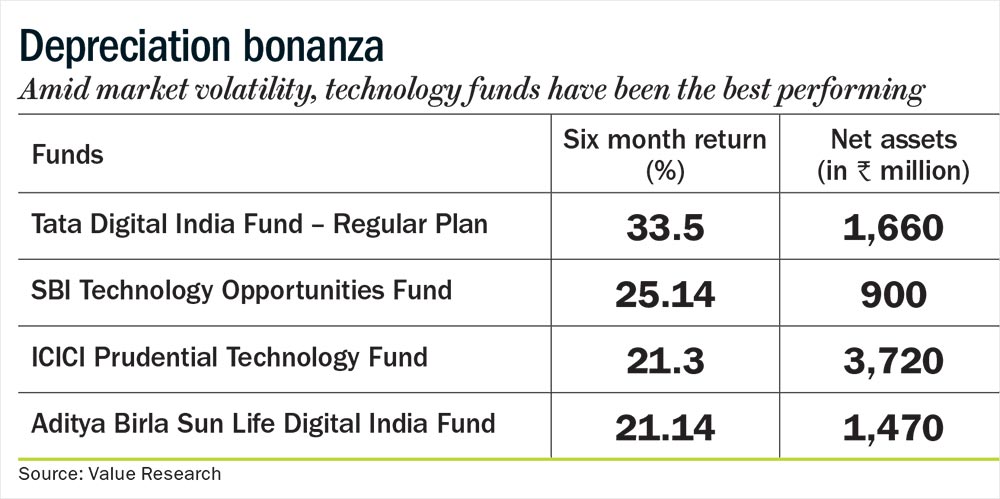

Currently, IT funds are one of the best performing in the market. Tata Digital India Fund, Aditya Birla Sun Life Digital India Fund, SBI Technology Opportunities Fund and ICICI Prudential Technology Fund have all delivered a six month return upward of 20%, as of June 4. [See: Depreciation bonanza]

Morgan Stanley is also banking on IT stocks to tide over a worst case scenario post the 2019 General Elections. It describes the worst case scenario as a government cobbled together with a lead party supporting from outside.

“Such support from the outside leaves the government vulnerable,” its report says. For such a scenario, the research house recommends investors to be overweight on IT, consumer staples, healthcare, telecom and utilities.

Growth booster

Fertiliser producers, automakers and consumer companies caught investor fancy after the Budget in February as the Modi government announced its plan to sharpen the focus on rural areas ahead of the 2019 elections. In the Budget, finance minister Arun Jaitley allocated Rs.14.34 trillion for rural infrastructure.

After the narrow win in Prime Minister Modi’s home state and successive defeats in bypolls elections, the BJP-led government is further expected to take measures to boost farm incomes and upgrade infrastructure. Morgan Stanley believes if indicators such as two-wheeler sales, tractor sales, rural wage growth, consumer price inflation, minimum support prices and jobs growth is in good shape in the coming months, that would enhance the prospects of re-election of the BJP-led NDA.

With the 2019 Election drawing closer, even the BJP’s state governments have intensified their rural thrust. After announcing farm loan waivers in Maharashtra and Uttar Pradesh last year, the BJP’s Rajasthan government launched a loan waiver scheme this June. It reportedly plans to waive off farm loans worth Rs.84 billion.

“We have been positive on the rural consumption space for some time now as we believe that government impetus towards rural recovery could increase rural consumption and demand in the sector,” says S Naren, ED and CIO, ICICI Prudential AMC.

Boosted by relatively good monsoon last year, MSP hikes, farm loan waivers and an increase in government spending on infrastructure, rural consumption outpaced urban spending in the previous financial year. According to a report by Nielsen, rural consumption increased by 9.7% in FY18, compared with the 8.6% growth in urban spending.

As the rural economy continues to grow, mutual fund managers are hoping that the government’s focus on rural areas will help their portfolio to flourish further. “We are witnessing early signs of traction in the rural economy. As we enter an election year, we believe a lot of freebies could be given to the rural population. Hence, consumer staples, consumer discretionary which are more related to rural areas are expected to do better or be resilient against this volatility,” says Kotak’s Tibrewal.

Jinesh Gopani, head – equities, Axis Mutual Fund says he finds excellent opportunities in the rural housing, infrastructure and finance space which are likely to be direct beneficiaries of rural consumption growth. “The consumption space continues to remain attractive, and the recent fall has been a good buying opportunity in select mid and large-cap names. The consumption space offers opportunities in companies with stable cash flows and steady growth metrics.”

Several rural-themed stocks have caught investor attention in the past few months. Kaveri Seeds rose by 14% in six days after US-based investor Mohnish Pabrai’s Pabrai Investment Fund II LP bought 780,000 shares on May 23. Kaveri Seeds, which manufactures enhanced quality seeds for crops, could be one of the major beneficiaries of farm output growth. In October last year, Motilal Oswal Securities (MOS) had put out a “buy” on the stock, saying that the company’s cotton seeds volume has witnessed growth of 28% in FY18, with an increased market share in Gujarat, Maharashtra and Karnataka.

In its report published in November last year on rural-themed stocks, MOS chose Hindustan Unilever, Dabur, Mahindra and Mahindra, M&M Financial Services, Repco Home Finance and the now-downbeat Manpasand Beverages as top picks. The report asserted that after three years of subdued rural consumption, there are now increasing signs of a pickup. “This year rural-themed stocks should do well because of several factors such as government’s decision to increase MSP rates. During an election year, the expenditure on rural areas increases. Also, we might have a third consecutive good monsoon. These factors make us bullish on rural consumption and stocks,” says Siddharth Bothra, senior vice-president at Motilal Oswal AMC.

Fund favourites

Mutual funds have started increasing their holdings in rural-themed stocks. Mahindra and Mahindra Financial Services, which has a solid presence in rural areas is seeing a lot of buying from mutual funds. Fund holding in the company has risen to 11.15% in the March 2018 quarter compared with 8.12% in December 2017.

Similarly, mutual fund holding in Dabur rose 1.31% QoQ and 3.18% YoY. Analysts also believe worries on the wholesale channel due to GST implementation and rural sales are receding faster than expected. Then, 30 mutual funds hold a cumulative 9.67% in Mahindra and Mahindra, a market leader in tractors. Sales for May 2018 stood at 29,330 units against 25,749 units in May 2017. The company is hoping that record production estimates for food grains and horticulture crops will drive sentiment and boost tractor demand. Despite overall sluggish growth, Jain Irrigation, which could directly benefit from the rural economy’s revival, has been another favourite. The domestic fund holding has doubled to 5.65% in FY18 from 2.84% in FY17.

Asset mix

The approach adopted by mutual funds apart, there are other methods which can also be adopted to curb risk. Investors can park their money in dynamic equity funds as they provide a healthy mix of equity and debt. Based on the prevailing market conditions, dynamic asset allocation funds invest in a mix of stocks, arbitrage and debt instruments. These portfolios are rebalanced regularly according to in-house parameters. “The concept revolves around the need to incorporate a degree of diversification across multiple asset classes in order to build a long-term sustainable portfolio that marries investor’s risk appetite and risk-adjusted return,” explains Gopani of Axis Mutual Fund.

Annualised return over the past five years has been exceptional and has led to high valuations. So, will the volatility this year provide an opportunity to buy stocks at lower valuation? “Uncertainty is what creates attractive valuations, and market corrections have typically provided better entry points in the long run. It is prudent to follow a rule-based allocation system wherein equity allocation goes up as the market falls,” says Reliance Mutual Funds’ Gunwani. As the outlook for the Indian stock market continues to remain uncertain ahead of 2019 elections, volatility is here to stay. While there will be opportunities for investment through the volatile phases of the market, Naren warns that one has to be prudent in his or her investment approach.