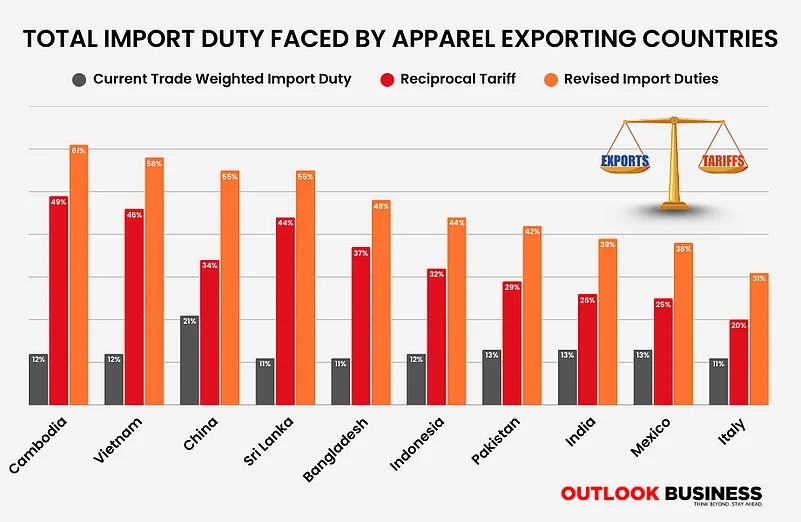

President Trump announced sweeping reciprocal tariffs on all countries on April 2. According to various economists, a 10% incremental tariff on any country will reduce its exports to the US by 10%. Applying the USTR methodology to US apparel imports, we can attempt to estimate (imprecisely) the impact on apparel exports by various countries to the US.

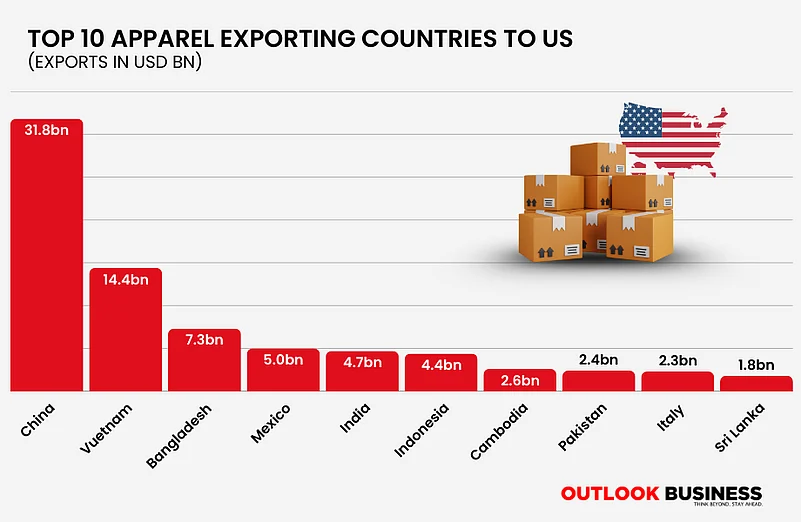

In 2023, the US imported apparel worth $95 billion. The first-order estimated reduction in apparel exports will be the largest for China (~USD 14 Bn accounting for new tariffs in Jan 2025 as well), followed by Vietnam (~USD 7 Bn) and Bangladesh (~USD 3 Bn), totalling $24 billion of lost exports, as these countries had high exports to the US to start with and have been levied with (relatively) higher tariffs. Some of this will be lost to all other exporters as well given higher retail prices will reduce the domestic US demand for apparel and consequently the freed-up manufacturing capacity of the three countries may be directed to other large export markets.

Some portion of the lost US exports will be recaptured by these very countries as they re-engineer their costs and/or their governments shield the industry with subsidies. However, a meaningful portion is expected to flow to countries like India, Mexico, and Indonesia as they face relatively lower tariffs and are well-positioned to supply to the US. How much of this overflow will be captured by each country will be based on their manufacturing capacity (how quickly it can be ramped up) and cost competitiveness (assuming the tariffs are here to stay and unit costs remain constant for the former players). And herein, India has a real opportunity to come out ahead.

The reciprocal tariffs already provide India with favourable market access to the US. If, in addition, India can improve its manufacturing competitiveness to be at par with China, Bangladesh, and Vietnam on cost, productivity, and lead times, it will act as a tremendous force multiplier. More importantly, improving competitiveness is the only thing India can control directly. Relying on tariffs to provide India with a permanent trade advantage puts us on weak and uncertain footing.

So, what does India need to do to improve its manufacturing competitiveness? The two major drivers contributing to lack of competitiveness of Indian apparel are raw material and labor. On raw material, India’s traditional advantage in cotton production and cotton textile value chain has been negated by poor and declining cotton yields, import duty on cotton fibre, lack of factor cost competitiveness (power, water, capital) coupled with high regulatory burden (effluent treatment).

Similarly, tariff and non-tariff barriers in the upstream synthetic value chain have made Indian Man-Made Fabric (MMF) fabric uncompetitive on cost. Lack of scale in this specific value chain also affects lead time competitiveness. On the labour front, India’s regulations around work hours, overtime, and lack of flexibility in adjusting workforce capacity with demand ensure India’s labour productivity stays low and per unit labor cost remains high and uncompetitive.

The way ahead is to liberalize India’s trade and labour regulations – eliminate import duty on cotton, remove QCOs on polyester and viscose fibre and yarn, reduce import duty on MMF fabric, implement work hour averaging, increase allowable overtime hours, and reduce overtime wage premium. This will immediately unshackle Indian garment manufacturing. As a start, these changes can be initiated in PM MITRA ‘regions'. These regions would comprise the currently envisaged PM MITRA parks acting as hubs with smaller apparel parks in the areas around them.

Coupled with PLI initiatives (properly tweaked to include all MMF fabric and garmenting), we can unleash our apparel exports. Lastly, all efforts must be made to conclude the India – US Bilateral Trade Agreement (BTA) at the earliest to reduce the Indian tariff rate even further. For the first time in two and a half decades, we don’t have any excuse to hide behind. If we get our act right, we can double our apparel exports, in a relatively short period of time, from the USD 15-17 Bn figure it has stagnated at for the past 10 years. The time for decisive action is upon us. We must not let this opportunity go by.