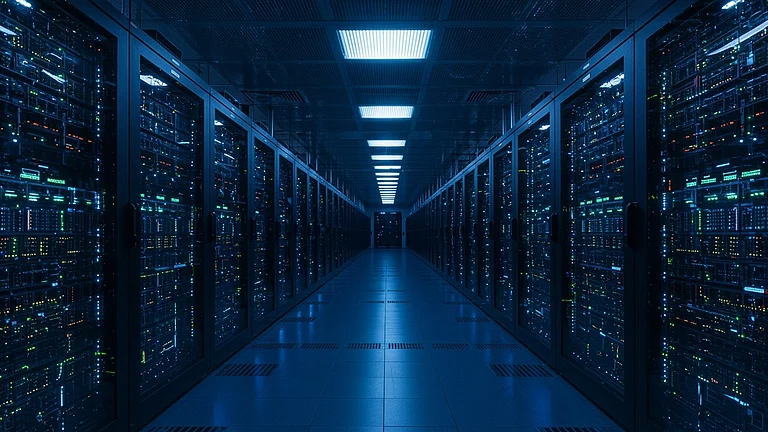

India’s data centre industry is on the brink of exponential growth, with total capacity expected to reach 3 GW by 2030, according to a report.

The sector is also seeing a surge in annual investments, currently at USD 1-1.5 billion (around ₹12,870 crore), and this figure is expected to double in the coming years, according to the report A Multi-Year Growth Proxy on India’s Data Explosion and Localisation Wave by Avendus Capital.

The data centre capacity of the country was estimated at 1.1 GW in 2024.

Rising data consumption, AI and cloud adoption, and policy initiatives focused on data localisation are the main drivers of data centre demand, the report stated. The demand is expected to reach around 6 GW by 2033, but the supply is expected to be only 4.5 GW, leaving a gap of 1.5 GW.

Much of the demand is expected to be met through large-format, hyperscale-ready infrastructure in core markets, alongside edge-ready capacity in Tier 2 and Tier 3 cities for latency-sensitive workloads, the report said, projecting a 25-30% compound annual growth rate (CAGR) for the sector.

The report further said that subsidised land banks and electricity duty exemptions by various state governments are emerging as key enablers for accelerating data centre capacity expansion across India.

While established leaders such as STT GDC and Sify continue to anchor the market, new entrants are gearing up to meet the rising enterprise demand.

Delhi-NCR-based infrastructure and real estate player Anant Raj has planned capital expenditure of USD 2.1 billion (around ₹18,000 crore) to achieve an operational capacity of 307 MW by 2031-2032, up from 28 MW of IT Load in 2025-26.

“With the advantage of pre-zoned sites, strong government policies, robust power access, and connectivity, we are well-positioned to meet the rising enterprise and hyperscaler, cloud-infrastructure as a service demand from both public and private sector clients,” Anant Raj Ltd Managing Director Amit Sarin said