One of the most notable shifts has been in the smartphone segment, where India has drastically reduced its dependence on imports. Currently, 99 percent of smartphones sold in the country are manufactured domestically. In FY24 alone, India produced approximately 33 crore mobile phones, with over 75 per cent of the models being 5G-enabled. This shift has been facilitated by government initiatives such as Make in India and Digital India, alongside improvements in infrastructure, ease of doing business, and incentive-driven policies.

Despite these advancements, India’s electronics market accounts for just 4 percent of the global market.

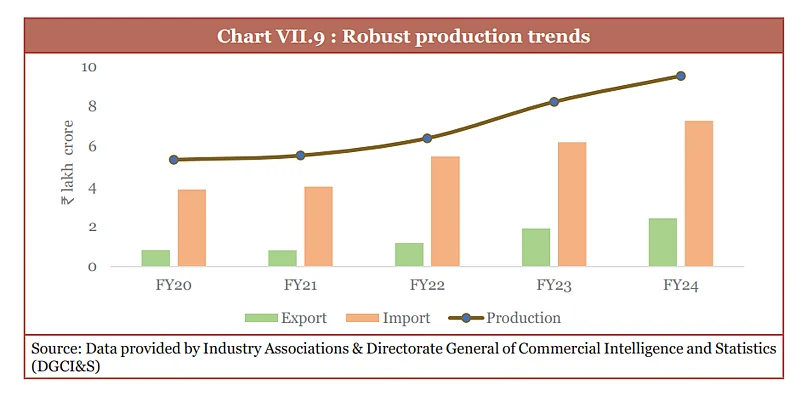

India’s electronics sector has witnessed notable trends in production, imports, and exports over the past five fiscal years, reflecting the country's growing manufacturing capabilities and shifting trade dynamics. In FY20, imports were significantly higher than exports, while production remained steady at around ₹5 lakh crore. FY21 saw a slight increase in exports, with imports remaining at similar levels, while production began to rise gradually. By FY22, production surpassed ₹6 lakh crore, continuing its upward trajectory, while exports showed moderate growth and imports remained dominant. In FY23, production and exports saw a notable increase, while imports remained high but stable. Finally, in FY24, production reached its highest level, nearing ₹9.52 lakh crore, with exports rising visibly, though imports, despite remaining significant, did not grow at the same pace as production.

PLI Scheme Strengthens Domestic Capabilities

A major catalyst in India’s electronics growth has been the Production-Linked Incentive (PLI) scheme, which covers 14 key sectors, including electronics. Unlike a one-size-fits-all approach, the scheme is tailored to specific industry needs. In the electronics sector, it aims to scale up assembly processes while fostering a robust domestic manufacturing ecosystem.

The impact has been evident. In FY15, mobile phone imports accounted for 78 per cent of the market in value terms, a figure that plummeted to just 4 per cent by FY23. In volume terms, imports fell to a mere 0.8 per cent. On the export front, India recorded zero mobile phone exports in FY16, but by FY23, the sector had achieved exports worth ₹88,726 crore.

The white goods segment is witnessing a similar transformation, with the PLI scheme targeting an increase in domestic value addition from 15-20 per cent to 75-80 per cent. These efforts reflect a broader push towards self-reliance and reducing India’s dependence on global supply chains.

As the government continues to refine its industrial policies, the focus now shifts to strengthening component manufacturing, semiconductor production, and design capabilities; critical areas that will determine India’s long-term position in the global electronics ecosystem.